Former Coinbase Global product manager Ishan Wahi pleaded not guilty to two counts of wire fraud conspiracy and two counts of wire fraud in a Manhattan federal court on Wednesday, Reuters raportate. Wahi has been accused by United States law enforcement and the Securities and Exchange Commission (SEC) of insider trading while at Coinbase. He was arrested in May as he attempted to board a flight to India and was charged in July.

Specifically, Wahi has been accused of passing confidential information to his brother Nikhil and friend Sameer Ramani regarding cryptocurrencies Coinbase intended to list for trading. This allegedly allowed them to make a profit of at least $1.5 million between June 2021 and April 2022 by acquiring and trading the assets in advance of their Coinbase listings. It was possibly the first insider trading case involving cryptocurrency. Nikhil Wahi has also been arrested, but Ramani remained at large as of late July.

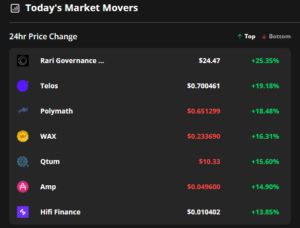

The SEC is pursuing a parallel civil case against Ishan Wahi based on its determination that nine of the 25 cryptocurrencies Wahi and his accomplice traded in — Powerledger (POWR), Kromatika (KROM), DFX Finance (DFX), Amp (AMP), Rally (RLY), Rari Governance Token (RGT), DerivaDAO (DDX), LCX, and XYO — were securities. The SEC’s move proved to be controversial, as it led to questions about the status of exchanges, funds, and investors who hold the assets.

Related: Investigația Coinbase SEC ar putea avea efecte „grave și înfricoșătoare”: avocat

The U.S. Department of Justice did not include securities fraud among its charges in the case, and Coinbase forcefully negat that it deals with securities in a blog post published after charges were filed against Wahi, with chief legal officer Paul Grewal writing:

„În loc să elaboreze reguli personalizate într-un mod incluziv și transparent, SEC se bazează pe aceste tipuri de acțiuni unice de aplicare pentru a încerca să aducă toate activele digitale în jurisdicția sa, chiar și acele active care nu sunt valori mobiliare.”

Caroline Pham, commissioner at the Commodity Futures Trading Commission, also joined in fray, calling the SEC case “a striking example of ‘regulation by enforcement.’”

The SEC is reportedly also looking at insider trading in crypto exchanges in an investigation unrelated to this case.

- Bitcoin

- blockchain

- respectarea blockchain-ului

- conferință blockchain

- coinbase

- coingenius

- Cointelegraph

- Consens

- conferință cripto

- cripto miniere

- cryptocurrency

- descentralizată

- DEFI

- Active digitale

- ethereum

- masina de învățare

- jeton non-fungibil

- Plato

- platoul ai

- Informații despre date Platon

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- dovada mizei

- Trading

- W3

- zephyrnet