On Monday, cryptocurrency exchange FTX.US won the bid to buy out Voyager Digital, a crypto investment firm that depusă for Chapter 11 bankruptcy in July.

Voyager has accepted the exchange’s $1.4 billion bid to be bought out, according to the announcement, bătăi afară Binance and Wave Financial in a race to buy the bankrupted firm.

“Voyager received multiple bids contemplating sale and reorganization alternatives, held an auction, and, based on the auction’s results, has determined that the sale transaction with FTX is the best alternative for Voyager stakeholders,” read the anunț.

decriptaţi reached out to FTX US for a statement but didn’t receive a response at the time of press.

To kick off the recovery process after its bankruptcy filing, Voyager deschis bidding for companies to buy out Voyager Digital, spunând on Twitter in early September that “multiple bids were submitted as part of the company’s restructuring process,” and an auction to acquire Voyager will soon follow.

Voyagers, vrem să vă anunțăm că au fost depuse mai multe oferte ca parte a procesului de restructurare al companiei. Drept urmare, o licitație este programată pentru 13 septembrie. (1/3)

- Voyager (@investvoyager) 7 Septembrie, 2022

The auction is only the latest in a long and winding road for the troubled crypto firm.

In July, user assets were first frozen, and trading was halted, with Voyager citând “market conditions” at that time. Then, in August, $270 million was eliberat for withdrawals as part of the firm’s bankruptcy filing.

Voyager stated, “The results of the auction do not change the Bar Date nor the need for customers to determine whether to file a claim” and that customers should still file to reclaim their crypto until October 3.

Voyager joins long list of troubled firms

Voyager Digital is not the only crypto firm facing liquidity issues amid the latest bear market.

Crypto lender Celsius, which has fielded zvonuri of insolvency since 2019, also depusă for Chapter 11 bankruptcy in July, claiming that the firm owed $5.5 billion to creditors and clients but was $1.2 billion too short.

Under allegations of “gross mismanagement,” United States Judge Martin Glenn has numit an independent examiner to further investigate Celsius and its financials.

Another crypto lender based in Singapore, Hodlnaut, also aplicat and was approved for judicial management to prevent total liquidation. The move also lets the firm organiza its restructuring plan, which had left customers unable to retrage their crypto.

Hodlnaut said that “these actions are taken in what we believe to be in the best interests of our users,” conform to an August announcement.

Fiți la curent cu știrile cripto, primiți actualizări zilnice în căsuța dvs. de e-mail.

- Bitcoin

- blockchain

- respectarea blockchain-ului

- conferință blockchain

- afaceri

- coinbase

- coingenius

- Consens

- conferință cripto

- cripto miniere

- cryptocurrency

- descentralizată

- decriptaţi

- DEFI

- Active digitale

- ethereum

- masina de învățare

- jeton non-fungibil

- Plato

- platoul ai

- Informații despre date Platon

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- dovada mizei

- W3

- zephyrnet

Mai mult de la decriptaţi

Web3 Social Startup Towns strânge 25.5 milioane USD condus de Andreessen Horowitz

Cum un copil de 12 ani a făcut peste 160,000 USD în Ethereum pe NFT într-o zi

Galaxy și Invesco se alătură cursei în creștere Ethereum ETF – Decrypt

La ce să vă așteptați la Coinbase și alte schimburi de criptomonede în timpul fuziunii Ethereum

WikiLeaks, Digital Artist Pak va lansa Ethereum NFT pentru a-l elibera pe Julian Assange

Senatul pe marginea adoptării proiectului de lege care amenință cripto. Iată ce se întâmplă în continuare

Crypto Watchdog Group a ieșit înșelat pentru binele dvs., susține

Departamentul de Justiție al SUA investighează hack-ul masiv FTX: Raport

Săptămâna aceasta în monede: Bitcoin, ICP și Solana conduc micul miting la nivelul pieței

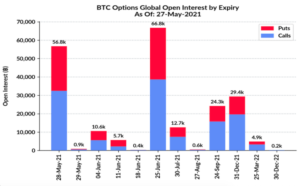

Aproximativ 2.1 miliarde de dolari în opțiuni Bitcoin au expirat astăzi

Ce este Loot? Phenonemonul de joc de rol NFT de la Ethereum