While most metrics hit new all-time highs mid-way through the quarter, when the broader crypto market turned, many decentralized finance (DEFI) protocols saw activity decrease.

Despite being negatively impacted by depressed market sentiment and downfall in price, the DeFi sector, witnessing a lot of competitive action, grew and developed in multiple ways, according to Messari’s revizuiască of this year’s second quarter.

DEX volumes grow

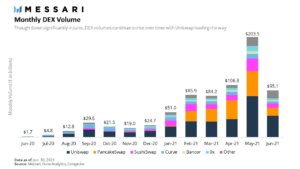

According to the crypto data and research platform’s review, decentralized exchange (DEX)

volumes continued their rapid growth in the second quarter of the year and reached $405 billion, while witnessing an 83% increase since the previous quarter.

Volume halved since May, which marked the high peak of the market, reaching $203,5 billion but despite June volumes falling to $95 billion, the dialed-down month still proved to be the third highest all-time.

Messari’s data showed that DEX volumes as a percentage of schimb centralizat (CEX) volumes surpassed 10% for the first time since October 2020 and according to the review “the data continues to show DEXs eating their centralized counterparts as time passes.”

Dynamic competitive landscape

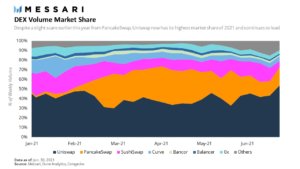

The review reflected on “a pretty dramatic shift” in swap de clătite’s standing as for a moment in April the competitor DEX that runs on Lanț inteligent Binance (BSC) flipped uniswap in volumes.

PancakeSwap market share has plummeted since Uniswap reclaimed the lead following the rise of its V3 protocol, which enabled liquidity providers (LPs) to create markets within customized price ranges.

By the end of June the automated liquidity protocol on the Ethereum (ETH) blockchain reached a 54% share of weekly volume, the highest since November 2020, and now accounts for more than 40% of all DEX volume.

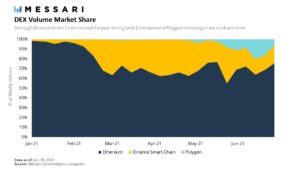

BSC ecosystem experienced the toughest pullback following May’s market crash as total value locked (TVL) fell more than 50% from its peak in just a few days, though the rise of Poligon, a protocol that transforms Ethereum into a full-fledged multi-chain system, played a crucial role in decreasing its share in volumes as well.

Unlike Ethereum’s TVL, which has plenty of stablecoins in the mix, its TVL was “heavily skewed towards the higher end of the risk spectrum making it extremely sensitive to market swings.”

In combination with a series of hacks and exploits on BSC, which led to substantial losses, the blockchain “saw speculation dry up dramatically in June leading to PancakeSwap volumes diving 69%.”

According to the review, “the activity provided a great glimpse into the developing liquidity wars between blockchains.”

obține o margine pe piața cripto-activelor

Accesați mai multe informații criptografice și context în fiecare articol în calitate de membru plătit al CryptoSlate Edge.

Analiza în lanț

Instantanee de preț

Mai mult context

Alăturați-vă acum pentru 19 USD / lună Explorează toate beneficiile

Ca ce vezi? Abonați-vă pentru actualizări.

- 2020

- Acțiune

- TOATE

- Aprilie

- articol

- Automata

- Miliard

- binance

- blockchain

- continuă

- Crash

- cripto

- date crypto

- Piața Crypto

- de date

- descentralizată

- Schimbul descentralizat

- Finanțe descentralizate

- DEFI

- Dex

- ecosistem

- ethereum

- schimb

- finanţa

- First

- prima dată

- mare

- Creștere

- hacks

- Înalt

- HTTPS

- Crește

- perspective

- IT

- alătura

- conduce

- conducere

- Led

- Lichiditate

- furnizori de lichiditate

- LP-uri

- Efectuarea

- Piață

- pieţe

- Metrici

- mulțime

- preţ

- cercetare

- revizuiască

- Risc

- sentiment

- serie

- Distribuie

- inteligent

- Stablecoins

- sistem

- timp

- uniswap

- actualizări

- valoare

- volum

- săptămânal

- în

- an