The crypto market is still shocked by the sharp drop over the week. ETH lost about 45% of its value in ten days. There are no strong buyers in the market yet, and the bears are entirely in control.

Analiza Tehnica

By cenușiu

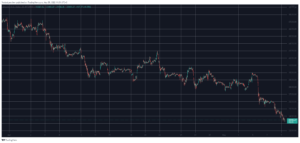

Graficul zilnic

On the daily timeframe, ETH continues to move downward within a descending channel (in yellow). The last time the bottom of the channel touched was in the fall of May last year. Currently, the price is approaching the bottom of the channel.

In the bearish scenario, if the sellers push the price below, the potential demand zone can be considered in the range of $700-$900(in green). If this area is touched, ETH might enter the accumulation phase after.

In the bullish scenario, the price will likely move towards static resistance at $1,700 (in red). Breaking this resistance depends on the strength of the buyers. Given that the current macroeconomic situation has made investors look at high-risk assets with doubt, this scenario doesn’t seem much likely.

All eyes are on the Federal Reserve’s policies to tame inflation.

Niveluri cheie de asistență: 1000 $ și 900 $

Niveluri cheie de rezistență: 1300 $ și 1500 $ și 1700 $

Medii mobile:

MA20: 1624 USD

MA50: 2002 USD

MA100: 2521 USD

MA200: 2907 USD

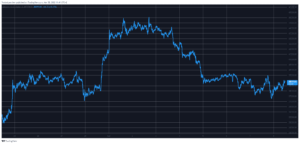

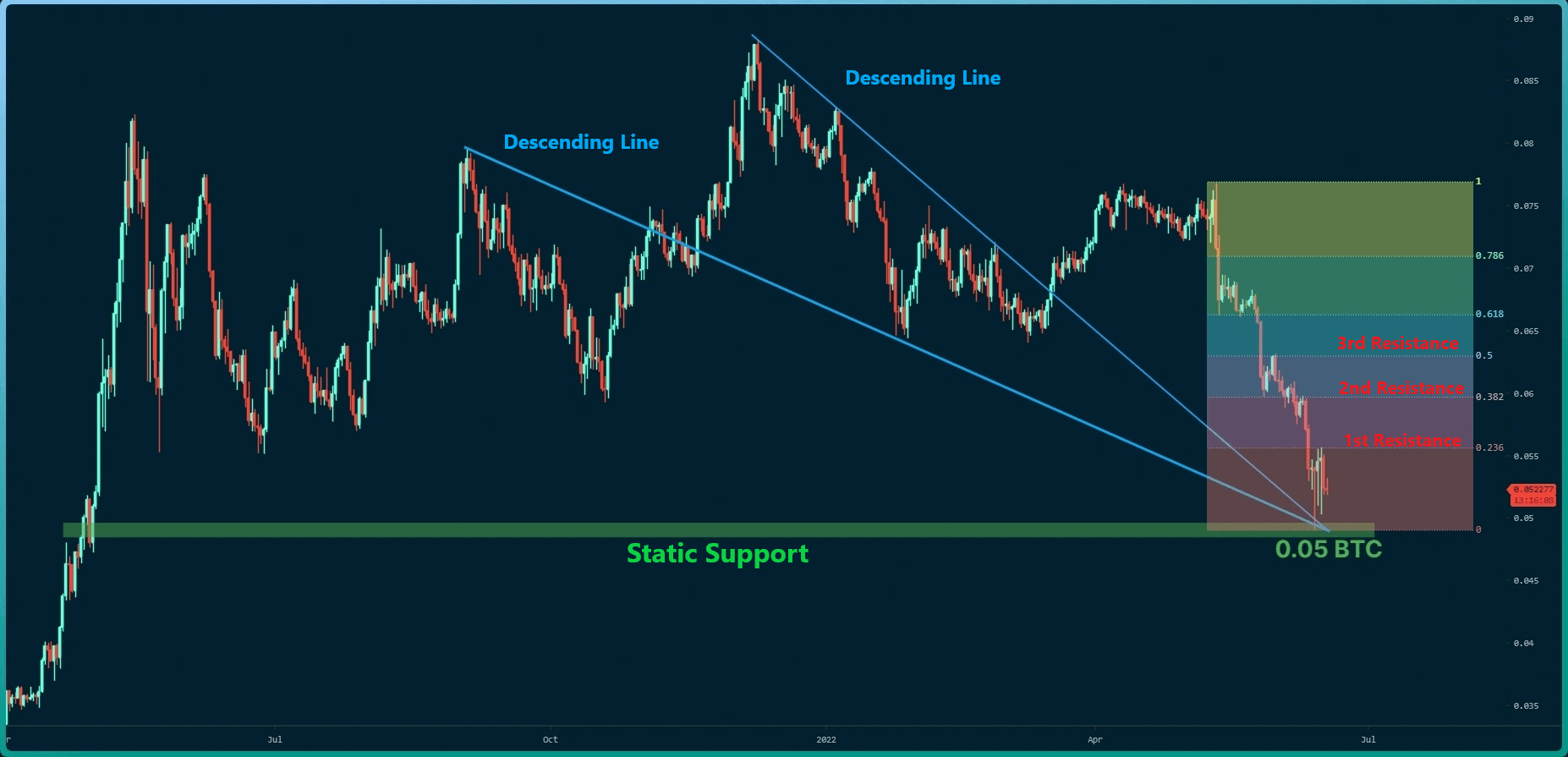

Graficul ETH/BTC

Against Bitcoin, the intersection of dynamic (in blue) and static (in green) supports at 0.05 BTC has prevented further price drops. The price is currently experiencing high volatility below the first resistance at 0.055 BTC. If the bulls can defend this support, the price of ETH against BTC might increase in the short term. In this case, it can move towards the resistance of 0.055, 0.06, and 0.063 BTC, respectively, which are Fibonacci Retracement levels of 0.236, 0.382, and 0.5.

Niveluri cheie de asistență: 0.050 BTC și 0.0.045 BTC

Niveluri cheie de rezistență: 0.055 BTC și 0.06 BTC

Analiza în lanț

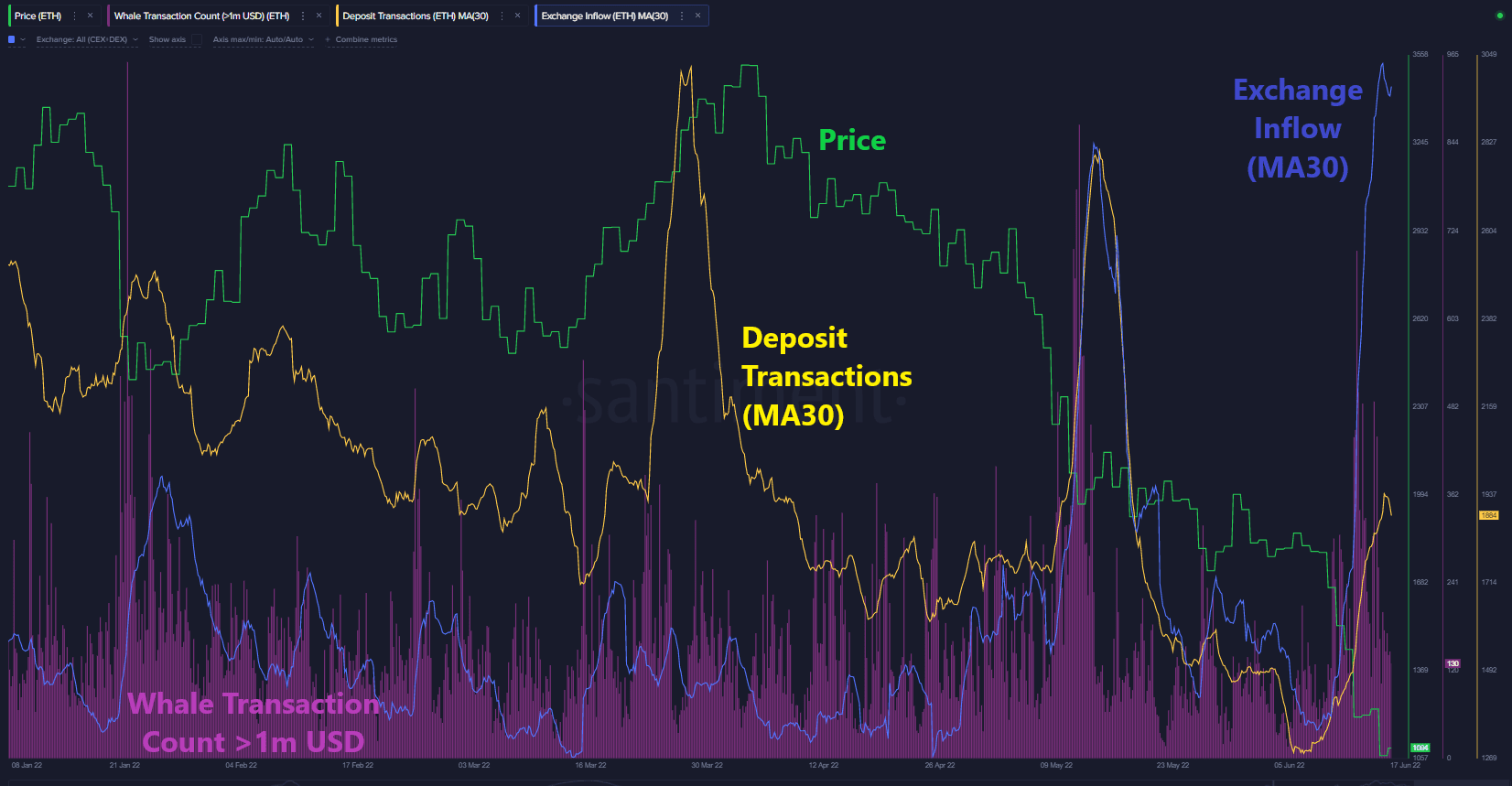

Whale Transaction Count > 1m USD (in purple)

Deposit Transactions (MA30) (in yellow)

Exchange Inflow (MA30) ( in blue)

The on-chain data chart shows that the number of deposit transactions to the exchange and exchange inflow is still high. Although, in recent days its amount has decreased slightly. The number of whale transactions above $1 million is also dropping. It is not yet possible to confirm whether the selling pressure has been significantly adsorbed or not.

- Coinsmart. Cel mai bun schimb de Bitcoin și Crypto din Europa.

- Platoblockchain. Web3 Metaverse Intelligence. Cunoștințe amplificate. ACCES LIBER.

- CryptoHawk. Radar Altcoin. Încercare gratuită.

- Source: https://cryptopotato.com/ethereum-price-analysis-eth-is-still-in-danger-amid-the-1k-critical-level/

- &

- $1000

- a

- Despre Noi

- împotriva

- Cu toate ca

- În mijlocul

- sumă

- analiză

- se apropie

- ZONĂ

- Bunuri

- de urs

- Urșii

- de mai jos

- Bitcoin

- BTC

- Bullish

- Bulls

- cumpărători

- caz

- continuă

- Control

- critic

- cripto

- Piața Crypto

- Curent

- În prezent

- zilnic

- de date

- Cerere

- depinde de

- Picătură

- dinamic

- Intrați

- ETH

- ethereum

- Preț Ethereum

- Analiza prețurilor la ethereum

- schimb

- confruntă

- federal

- First

- mai mult

- Verde

- Înalt

- Risc ridicat

- HTTPS

- Crește

- inflaţiei

- intersecție

- Investitori

- IT

- Nivel

- nivelurile de

- Probabil

- Uite

- făcut

- Piață

- ar putea

- milion

- muta

- număr

- În lanț

- fază

- Politicile

- posibil

- potenţial

- presiune

- preţ

- Analiza prețurilor

- gamă

- recent

- Vanzatorii

- De vânzare

- șocat

- Pantaloni scurți

- situație

- Încă

- rezistenţă

- puternic

- a sustine

- Sprijină

- timp

- interval de timp

- față de

- tranzacție

- Tranzacții

- USD

- valoare

- Volatilitate

- săptămână

- dacă

- în

- an