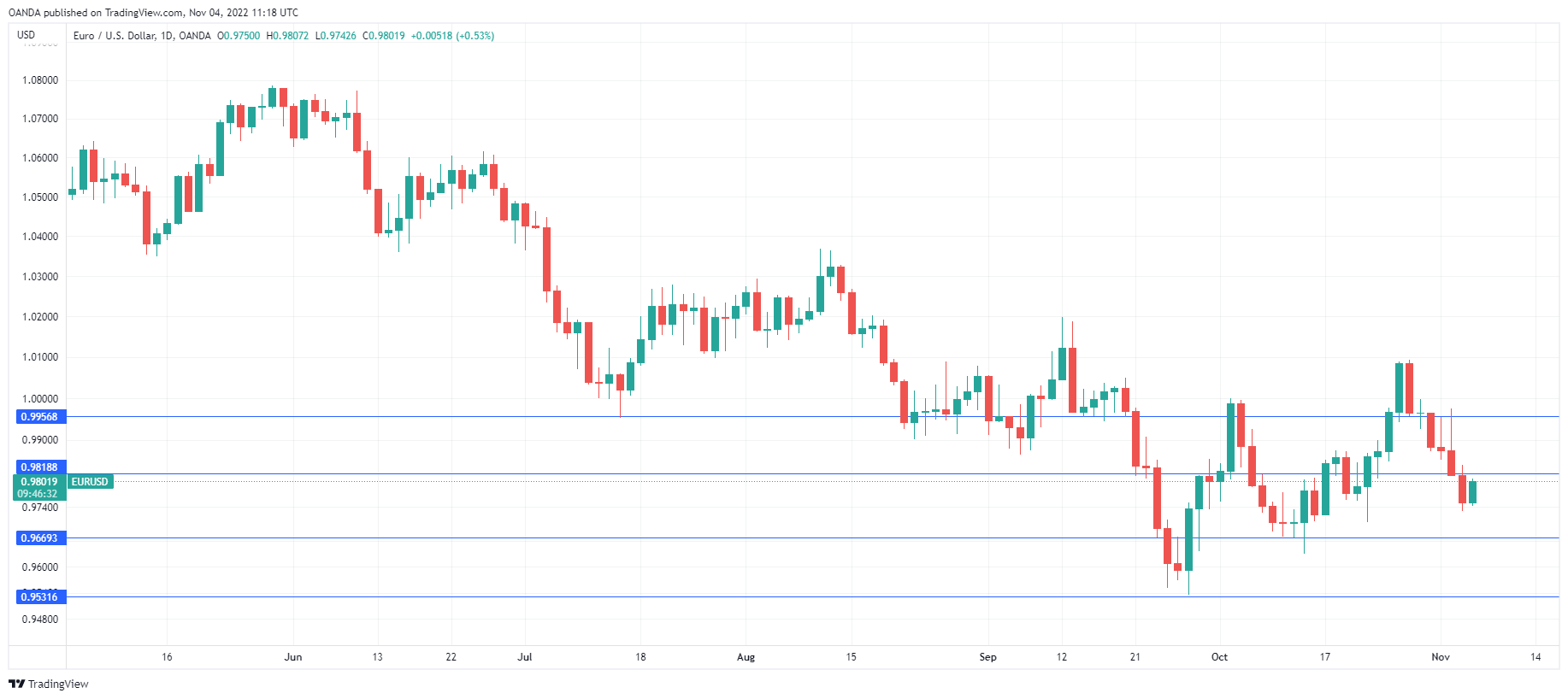

EUR/USD has rebounded and is in positive territory. In the European session, the euro is trading at 0.9794, up 0.45%. The upswing has ended a 3-day slide, in which the euro fell as much as 270 points.

German factory orders sink

The manufacturing sector in the eurozone continues to struggle. German and eurozone manufacturing PMIs are mired in contraction territory and German Factory Orders for September, published today, declined by a sharp 4.0%. A weak global economy has dampened manufacturing activity, and the war in Ukraine and the energy crisis in Western Europe will likely continue to take a toll on the eurozone economy.

The grim economic outlook is a major headache for ECB policymakers, who must maneuver delicately between soaring inflation and a weak eurozone economy. The ECB joined the rate-hiking dance late and finds itself well behind the inflation curve, as headline inflation in the eurozone jumped to a staggering 10.7% in October, up from 9.9% in September. The ECB has little choice but to deliver an oversize rate hike in order to tackle double-digit inflation, and ECB President Lagarde has said that she would use “all the tools” available to bring inflation back to the ECB’s 2% target.

All eyes are on today’s US nonfarm payroll report. The labour market has been resilient in the face of steep rate hikes, although we are seeing a jump in job cuts. The consensus for the October NFP stands at 200,000, lower than the September reading of 263,000. The release will be carefully watched by the Fed, as the strength of the labor market is an important factor in the December rate decision. The markets have priced in a 50/50 toss-up between a hike of 0.50% or 0.75%, which could translate into volatility for the US dollar in today’s North American session.

.

EUR / USD Tehnic

- EUR/USD is putting pressure on resistance at 0.9818. Next, there is resistance at 0.9956

- 0.9669 și 0.9531 oferă suport

Acest articol are doar scop informativ. Nu este sfat de investiții sau o soluție pentru a cumpăra sau vinde titluri de valoare. Opiniile sunt autorii; nu neapărat cea a OANDA Corporation sau a oricăreia dintre filialele, filialele, ofițerii sau directorii săi. Tranzacționarea cu levier este cu risc ridicat și nu este potrivită pentru toți. Ați putea pierde toate fondurile depuse.

- Bitcoin

- blockchain

- respectarea blockchain-ului

- conferință blockchain

- Băncilor Centrale

- coinbase

- coingenius

- Consens

- conferință cripto

- cripto miniere

- cryptocurrency

- descentralizată

- DEFI

- Active digitale

- BCE

- ethereum

- EURO

- EUR / USD

- Criza energetică europeană

- Inflația din zona euro

- PMI de producție în zona euro

- FX

- PMI german de producție

- Comenzi din fabrică din Germania

- masina de învățare

- MarketPulse

- Noutăți și evenimente

- newsfeed-

- jeton non-fungibil

- Salarii non-agricole

- Plato

- platoul ai

- Informații despre date Platon

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- dovada mizei

- Analiza Tehnica

- TradingView

- război din Ucraina

- Statele de plată din afara Statelor Unite

- USD

- W3

- zephyrnet