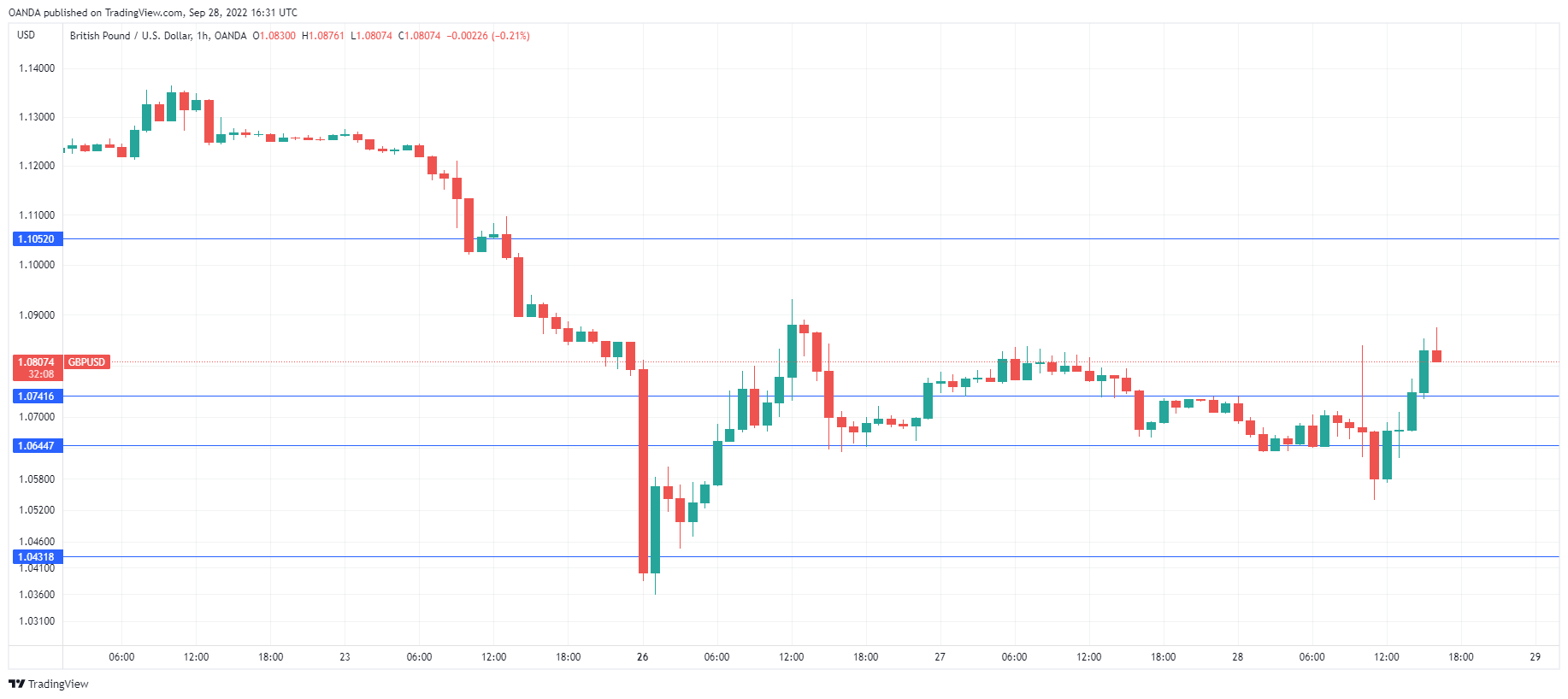

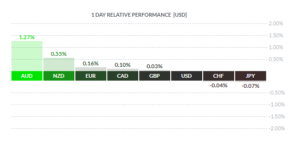

The pound started the day with losses but has reversed directions and soared in the North American session. GBP/USD is trading at 1.0838, up 0.98%.

Bank of England steps in to calm markets

The new Truss government has started off on the left foot, sending the pound to a record low in the process. The trouble began on Friday, as Chancellor Kwarteng’s mini-budget promised tax cuts, despite soaring inflation which is hovering around 10%. The mini-budget was widely panned and the pound sank like a stone on Friday, falling a stunning 3.6%. The pound lost another 1.5% on Monday and dropped to a record low of 1.0359.

The scathing criticism was not only domestic. The IMF has joined the chorus of boos and attacked the government’s fiscal plans, going as far as calling on the UK to “re-evaluate” its tax cuts. Moody’s warned that the plan could jeopardize the UK’s credit rating. With the new government’s credibility seriously undermined, it’s no surprise that the pound is taking it on the chin.

In a dramatic move, the Bank of England has stepped in order to avoid a possible crash in the bond market. There had been speculation that the BoE might deliver an emergency rate hike in order to prop up confidence and the ailing pound. Instead, the BoE said it would unlimited purchases of government bonds of 20 years or longer. This pushed 30-year bonds sharply lower after they had climbed to 24-year high.

In the US, ten-year Treasury yields pushed above 4.00% earlier today, for the first time since 2008. The markets are showing a healthy respect for Fed hawkishness, even after inflation weakened in the past two inflation reports. There is some optimism that the current rate-hike cycle is reaching its end, with Fed member Evans stating that it will be appropriate to slow the pace of tightening at some point. For now, the US dollar has momentum, driven by an aggressive Fed and weak risk appetite due to worrisome developments in the Ukraine war, including the sabotage of the Nord Stream pipelines and Russia’s plan to annex parts of Ukraine.

.

GBP / USD Tehnic

- GBP/USD testează rezistența la 1.0742, urmată de rezistența la 1.1052

- Există suport la 1.0644 și 1.0431

Acest articol are doar scop informativ. Nu este sfat de investiții sau o soluție pentru a cumpăra sau vinde titluri de valoare. Opiniile sunt autorii; nu neapărat cea a OANDA Corporation sau a oricăreia dintre filialele, filialele, ofițerii sau directorii săi. Tranzacționarea cu levier este cu risc ridicat și nu este potrivită pentru toți. Ați putea pierde toate fondurile depuse.

- Bitcoin

- blockchain

- respectarea blockchain-ului

- conferință blockchain

- Intervenția BoE

- Băncilor Centrale

- coinbase

- coingenius

- Consens

- conferință cripto

- cripto miniere

- cryptocurrency

- descentralizată

- DEFI

- Active digitale

- ethereum

- Membrul Fed Evans

- FX

- GBP / USD

- FMI

- masina de învățare

- MarketPulse

- Moody

- Noutăți și evenimente

- newsfeed-

- jeton non-fungibil

- Conducte Nord Stream

- Plato

- platoul ai

- Informații despre date Platon

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- dovada mizei

- Rusia

- Analiza Tehnica

- TradingView

- trezoreriile

- Mini buget al Marii Britanii

- Randamentele SUA pe 10 ani

- W3

- zephyrnet