TL; Defalcare DR

- Goldman Sachs trade in Bitcoin futures

- How U.S bank BTC futures will boot crypto adoption

Goldman Sachs has become the first United States of America bank to trade in Bitcoin futures after entering the market in partnership with Mike Novogratz’s Galaxy Digital, Rapoarte CNBC.

It also marks the first time Goldman Sachs would use a digital asset firm as a counterparty since the investment bank set up its cryptocurrency desk last month.

This is another big feat for Bitcoin and the entire crypto industry as the move is one that gives other banks cover to begin doing so as well, said Vanderwilt, a former Goldman partner.

Goldman Sachs has said in a memo it will sign on more liquidity providers beyond Galaxy Digital to help expand its offering.

„Obiectivul nostru este de a dota clienții noștri cu prețuri de cea mai bună execuție și acces securizat la activele pe care doresc să le tranzacționeze”, a declarat într-un comunicat Max Minton, șeful activelor digitale pentru regiunea Asia-Pacific Goldman. „În 2021, aceasta include acum cripto și suntem încântați că am găsit un partener cu o gamă largă de locuri de lichiditate și capabilități derivate diferențiate care se întind pe ecosistemul criptomonedelor.”

Vanderwilt said that Goldman Sachs relies on Galaxy for access to crypto as banks can’t deal in Bitcoin directly due to high regulation.

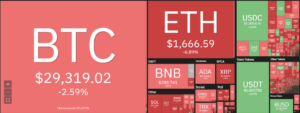

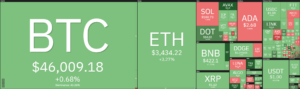

How Goldman Sachs Bitcoin futures trading will help crypto space

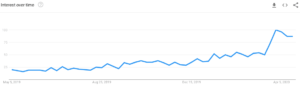

Support of banks for crypto is very crucial, especially for Bitcoin adoption, as it provides a trusted mechanism to invest and trade.

According to a former Goldman Sachs partner who joined Galaxy last year, Damien Vanderwilt, more and more institutional involvement will make Bitcoin less volatile and make it safer for retail investors.

The step by Goldman is expected to be followed by all other major banks as clients demand Bitcoin-based investment options more than ever.

It is safe to say that Bitcoin has now joined the list of assets being traded on wall street as more institutions like hedge funds, Venture capitalist firms can take a position on Bitcoin.

Source: https://www.cryptopolitan.com/goldman-sachs-trade-bitcoin-futures/

- acces

- Adoptare

- TOATE

- America

- activ

- Bunuri

- Bancă

- Băncile

- Bitcoin

- adoptarea bitcoin

- Bitcoin Futures

- BTC

- CNBC

- contraparte

- cripto

- Industria criptelor

- cryptocurrency

- afacere

- Cerere

- Instrumentele financiare derivate

- digital

- Active digitale

- Active digitale

- ecosistem

- Firmă

- First

- prima dată

- Fondurile

- Futures

- Galaxy Digital

- goldman

- Goldman Sachs

- cap

- Fonduri de investiții

- Înalt

- HTTPS

- industrie

- Instituţional

- instituții

- investiţie

- Investitori

- IT

- Lichiditate

- furnizori de lichiditate

- Listă

- major

- Piață

- muta

- Opţiuni

- Altele

- partener

- Asociere

- de stabilire a prețurilor

- gamă

- Regulament

- cu amănuntul

- Investitori de vânzare cu amănuntul

- sigur

- set

- So

- Declarație

- Statele

- stradă

- timp

- comerţului

- Trading

- Unit

- Statele Unite

- aventura

- Wall Street

- OMS

- an