Last week, during an interview, Scott Minerd, Global Chief Investment Officer of Parteneri Guggenheim, the man who said last December that “Bitcoin should be worth about $400,000”, talked about silver, gold, and crypto.

Investiții Guggenheim este „divizia globală de gestionare a activelor și consultanță în investiții a Guggenheim Partners și are active totale de peste 233 de miliarde de dolari în strategii cu venit fix, acțiuni și alternative”. Se concentrează pe „nevoile de rentabilitate și de risc ale companiilor de asigurări, fondurilor corporative și publice de pensii, fondurilor suverane, fondurilor de dotare și fundațiilor, administratorilor de avere și investitorilor cu valoare netă ridicată”.

On 27 November 2020, according to a U.S. SEC post-effective amendment filing, it became known that one of Guggenheim Investments’ fixed income mutual funds (“Macro Opportunities”) was considering investing in Bitcoin. Per data by the Financial Times, this fund was launched on 30 November 2011, and its total net assets was $4.97 billion (as of 31 October 2020).

Depunerea SEC made on 27 November 2020 is known as an “SEC POS AM” (aka “post-effective amendment”) filing. This type of filing “allows a company registered with the SEC to update or amend its prospectus.”

This filing stated that the fund is considering getting some cryptocurrency exposure:

Cryptocurrencies (also referred to as ‘virtual currencies’ and ‘digital currencies’) are digital assets designed to act as a medium of exchange. The Guggenheim Macro Opportunities Fund may seek investment exposure to bitcoin indirectly through investing up to 10% of its net asset value in Grayscale Bitcoin Trust (“GBTC”), a privately offered investment vehicle that invests in bitcoin.Matei 22:21

Then, on 16 December 2020, after the Bitcoin price had finally broken through the $20,000 level on all crypto exchanges to set a new all-time high, Minerd, the Guggenheim CIO, talked about Bitcoin during an interviu la Bloomberg TV.

Interviul început de CIO Guggenheim fiind întrebat de Scartlet Fu, editorul senior al Bloomberg TV al Markets Desk, despre Guggenheim Macro Opportunities Fund și decizia managerilor săi de a investi „până la 10% din valoarea activului său net în Grayscale Bitcoin Trust. .” În special, a fost întrebat dacă Guggenheim a început să cumpere Bitcoin încă și cât de mult a fost această decizie „legată de politica extraordinară a Fed”.

Minerd a răspuns:

Pentru a răspunde la a doua întrebare, Scarlett, în mod clar Bitcoin și interesul nostru pentru Bitcoin este legat de politica Fed și de tipărirea de bani care se desfășoară. În ceea ce privește fondul nostru mutual, știți, nu suntem încă eficienți cu SEC. Deci, știi, încă așteptăm.

Desigur, am luat decizia de a începe alocarea pentru Bitcoin când Bitcoin era la 10,000 USD. Este puțin mai dificil cu prețul actual mai aproape de 20,000 USD. Uimitor, știți, într-o perioadă foarte scurtă de timp, cât de mare am avut-o, dar spunând asta, munca noastră fundamentală arată că Bitcoin ar trebui să aibă o valoare de aproximativ 400,000 USD. Deci, chiar dacă am avea capacitatea de a face asta astăzi, vom monitoriza piața și vom vedea cum decurge tranzacția, ce evaluare trebuie să o cumpărăm în cele din urmă.Matei 22:21

Apoi a explicat cum au venit cu evaluarea de 400 USD pentru Bitcoin:

Se bazează pe deficit și pe evaluarea relativă, cum ar fi aurul ca procent din PIB. Deci, știți, Bitcoin are de fapt o mulțime de atribute ale aurului și, în același timp, are o valoare neobișnuită în ceea ce privește tranzacțiile.

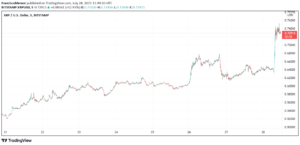

Then, on January 11, shortly after the Bitcoin price had corrected to as low as $32,475 on Coinbase, Minerd cautioned traders that Bitcoin might have gone up too much too fast and that perhaps it was time to take some profits.

On February 2, the Guggenheim CIO was interviewed by CNN anchor Julia Chatterley, who asked him what he thinks about Bitcoin.

Minerd a răspuns:

We’ve been looking at Bitcoin for almost 10 years and the size of the market just wasn’t big enough to justify institutional money. As the total market cap of Bitcoin got bigger, around $10,000, it started to look very interesting and my view is we get a lot of fundamental research and if you consider the supply of Bitcoin relative let’s say to the supply of gold in the world and what the total value of gold is, if Bitcoin were to go to those kinds of numbers, you’d be talking about four hundred to six hundred thousand dollars per Bitcoin.

Now, I’m not saying we’ll ultimately get there, but that’s an indication of what might be a measure of fair value. Tthat gives you a lot of room to run, but then when you consider that within a course of a month, we went from $20,000 to $40,000 on Bitcoin, that smacks of short-term speculation… now the air’s coming out of that speculative run, and so the money is migrating into other places…

I don’t really see the institutional support today, which is just coming online from the likes of people like BlackRock and Guggenheim and other large institutional investors being big enough to support the valuation at its current levels… Bitcoin has had a lot of times where it’s had setbacks of 50% from its highs. I wouldn’t be surprised to see that happen again…

I think that cryptocurrency has come into the realm of respectability and will continue to become more and more important in the global economy.

On April 7, Minerd was again interviewed by CNN’s Julia Chatterley, who wanted to know what would happen to the crypto space if there was a pullback in the price of Bitcoin.

Minerd a răspuns:

When I made the $400,000 statement, I’m looking at it over a period of time 10 to 20 year. Of course, the market took off. I first started looking at buying Bitcoin at $10,000. Today, I don’t know where we are anymore. It’s become so rich so fast, maybe around $50,000, but it clearly has gotten caught up in the speculative bubble that GameStop got into and a number of these other stocks.

I think when we get a risk-off moment, we could be seeing Bitcoin pullback to somewhere between $20,000 and $30,000, but I think for long-term investors that’ll be a great entry point.Matei 22:21

On May 19, however, Minerd appeared to be much more bearish on crypto in general.

Well, on May 25, the Guggenheim CIO was intervievați by CNBC’s “Worldwide Exchange“, where he shared his latest thoughts on Bitcoin, gold, and silver.

Potrivit unui raportează by Kitco News published on May 26, this is what he had to say:

As money leaves crypto and people are still looking for inflation hedges, gold and silver are going to be much better places to go.

Minerd expects gold to reach as high as $10K per ounce in the long term:

This is ultimately is in the cards. Silver traditionally lags. It is the poor man’s gold, and it’s the one that will have the largest move on a percentage basis. It is the high-beta version of gold.

As for his long-term outlook on crypto, although he thinks that Bitcoin and Ethereum will remain popular, he thinks the ultimate winner might be a crypto project that we have not seen yet:

AOL was the winner. Yahoo was the winner. Then Google and other players came along. We are going to find out that some new crypto comes long, which can overcome some of the issues we are facing right now with the cost of mining, all the carbon production. And it will be a superior form of crypto, and that will become the dominant crypto.

DECLARAȚIE DE RENUNȚARE

Opiniile și opiniile exprimate de autor sau de orice persoană menționată în acest articol au doar scop informativ și nu constituie sfaturi financiare, de investiții sau de altă natură. Investiția sau tranzacționarea criptocasurilor are un risc de pierdere financiară.

- 000

- 11

- 2020

- 7

- Anunţuri

- sfat

- consultativ

- TOATE

- Aprilie

- în jurul

- articol

- activ

- gestionarea activelor

- Bunuri

- Auto

- de urs

- Miliard

- Bitcoin

- Prețul Bitcoin

- BlackRock

- Bloomberg

- cumpăra

- Cumpărare

- carbon

- prins

- şef

- CIO

- mai aproape

- CNBC

- CNN

- coinbase

- venire

- Companii

- companie

- conţinut

- continua

- cripto

- Schimburi Crypto

- cryptocurrency

- Moneda

- Curent

- Cerere

- digital

- Active digitale

- de dolari

- economie

- editor

- Eficace

- echitate

- ethereum

- schimb

- Platforme de tranzacţionare

- se așteaptă

- cu care se confruntă

- echitabil

- FAST

- fed-

- În cele din urmă

- financiar

- First

- formă

- fond

- Fondurile

- PIB-ul

- General

- Caritate

- Economia globala

- Aur

- Alb-negru

- mare

- Înalt

- Cum

- HTTPS

- Venituri

- inflaţiei

- Instituţional

- investitori instituționali

- asigurare

- interes

- Interviu

- investind

- investiţie

- Investitori

- probleme de

- IT

- mare

- Ultimele

- Nivel

- Lung

- Macro

- om

- administrare

- Piață

- Capul pieței

- pieţe

- măsura

- mediu

- Minerit

- bani

- muta

- În apropiere

- net

- ştiri

- numere

- Ofiţer

- on-line

- Avize

- Altele

- Perspectivă

- pensie

- oameni

- Politica

- sărac

- Popular

- PoS

- preţ

- producere

- proiect

- public

- cercetare

- Risc

- Alerga

- SEC

- set

- obstacole

- comun

- Acțiuni

- Pantaloni scurți

- Silver

- SIX

- Mărimea

- So

- Spaţiu

- Începe

- început

- Declarație

- Stocuri

- livra

- a sustine

- vorbesc

- Ţintă

- Tehnic

- timp

- Comercianti

- Trading

- Tranzacții

- Încredere

- tv

- ne

- Actualizează

- Evaluare

- valoare

- vehicul

- Vizualizare

- vulnerabil

- Bogatie

- săptămână

- OMS

- în

- Apartamente

- lume

- valoare

- Yahoo

- an

- ani

- youtube