HodlX Guest Post Trimite-ți postarea

When Reddit users coordinated themselves to use their Robinhood accounts to buy GameStop shares en masse, the short squeeze they created sent shockwaves through Wall Street.

The 1,600% rally that was created turned retail investors and individuals who were new to trading wealthy overnight.

PUBLICITATE

The squeeze also caused a liquidity issue on Robinhood’s platform that saw the investment app restrânge the actions of its users killing GME’s early 2021 surge in its tracks and causing countless latecomers to the squeeze to lose out.

However, in the wake of the fiasco, the wider world of investing saw the benefits of what was a watershed moment in the growth of retail.

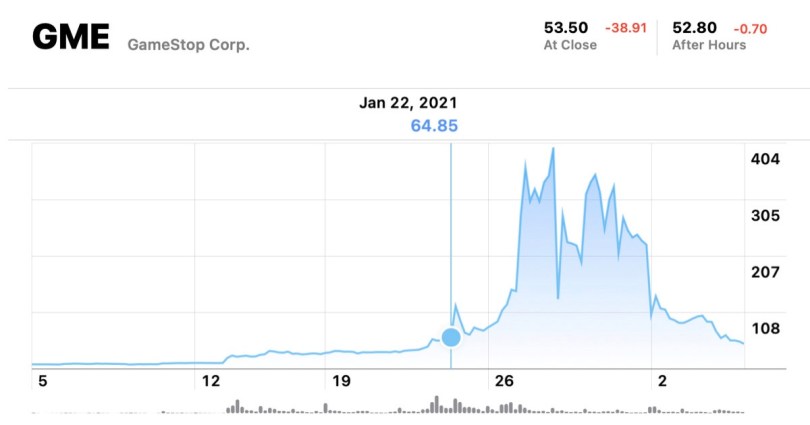

Sursa: Acostament

As we can see, GME’s 1,600% apare sent the company’s share price sprawling towards $400 in the final week of January 2021.

However, Robinhood sparked outrage among its community of retail investors when the company a anunțat on January 28, 2021, that “in light of recent volatility” it’s “restricting transactions for certain securities to position closing only, including $AMC, $BB, $BBBY, $EXPR, $GME, $KOSS, $NAKD and $NOK.”

Criticism of Robinhood’s movements crossed the political divide. Alexandria Ocasio-Cortez, democrat and member of the US House of Representatives, said on Twitter at the time,

“This is unacceptable. We now need to know more about @RobinhoodApp’s decision to block retail investors from purchasing stock while hedge funds are freely able to trade the stock as they see fit.”

Republican senator Ted Cruz responded “fully agree” to Ocasio-Cortez’s tweet.

While the timing of the restrictions led to complaints from retail investors over unfair treatment, Maxim Manturov, head of investment research at Freedom Finance Europe, notes that the problems Robinhood faced were purely operational.

“One of Robinhood’s major issues is the lack of liquidity against the large demand on GameStop (GME) stock. It was because of those limits that many investors were dissatisfied and filed complaints and claims against Robinhood. The company, however, denies any involvement in assisting third parties, as nobody outside the company influenced the decision on the limits.”

Although Robinhood’s restrictions led to a sharp fall in the price of GME in the wake of the short squeeze, we can see that further price rallies have punctuated 2021 for the stock along with similar boosts for AMC and cryptocurrencies like Dogecoin.

This indicates that, despite the fiasco of trading restrictions, we’re still seeing plenty of evidence that the retail market is bullish over investing and many individuals are taking their enthusiasm for GME further afield across the ecosystem.

PUBLICITATE

The rise of the retail investor

In 2020 alone, over 10 million new trading Conturile were estimated to have been created, according to JMP Securities.

This rise in accounts comes as platforms like Robinhood and zero-commission platforms have made options bets more accessible.

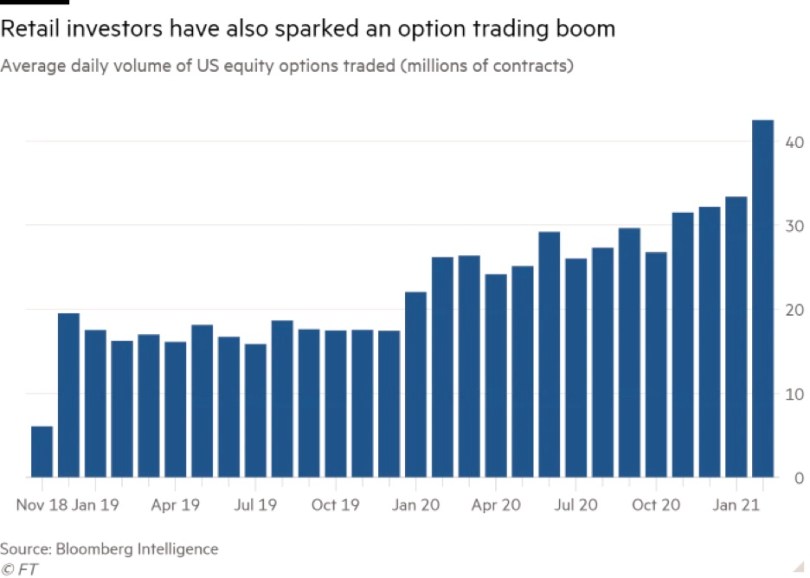

Sursa: Financial Times

As we can see from the data above, the average daily volume of US equity options traded topped 40 million in early 2021 levels that are more than double that of any month prior to 2020.

The implementation of zero-commission investing apps and the volume of government stimulus packages delivered during the Covid-19 pandemic appears to have created an ideal cocktail of conditions to draw new investors to the market.

The GameStop short squeeze, despite Robinhood’s high-profile limitations and restrictions, has acted as a catalyst for more users to discover and embrace these newly favorable market conditions.

Conform unui recent studiu by Wells Fargo, around 45% of teenagers said “the GameStop social media situation” had boosted their interest in investing, with 53% of boys and 40% of girls claiming increased interest ndicating that the event has inspired a whole new generation of investors to take their first steps into the stock market.

Driving investors towards cryptocurrencies

The same survey also explored the growing interest in cryptocurrency among younger investors, with 50% of parents admitting their teen knows more about Bitcoin than they do.

Likewise, around 58% of teen boys believe they know more about Bitcoin than their parents, while 33% of teen girls believe they are more knowledgeable.

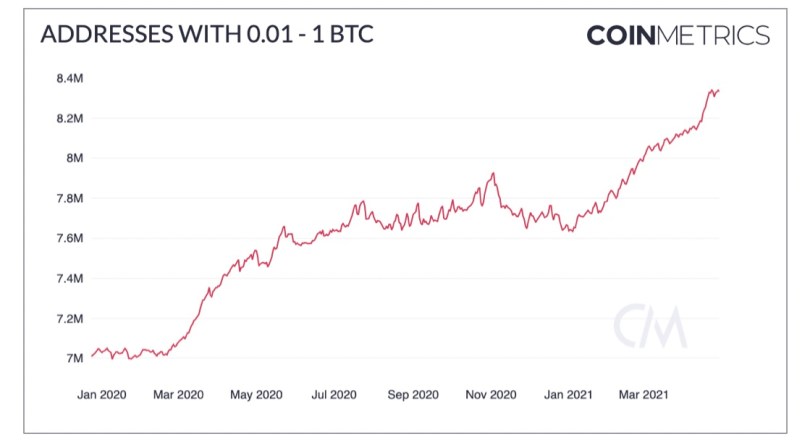

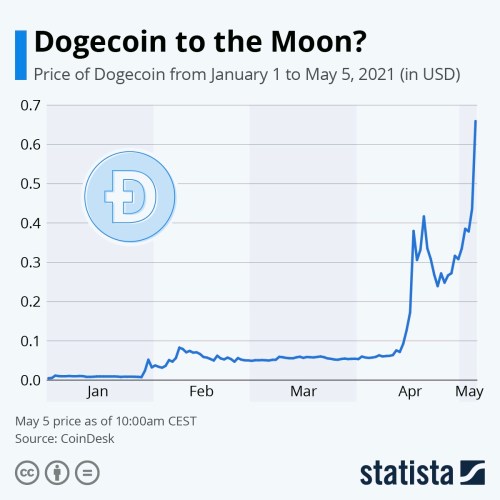

Sursa: Coindesk

Here, we can see that retail cryptocurrency trading also climbed around the beginning of the year, with wallet addresses possessing between 0.01 to 1 BTC. However, the biggest impact that the GameStop saga had on the wider world of investment could be found in Dogecoin, a meme-based cryptocurrency that won appeal among investitorii La inceputul anului 2021.

Sursa: Statista

In the wake of the GameStop short squeeze, we saw DOGE rise significantly, but as the year progressed, and investors became more cautious of Robinhood’s restrictions believing that there may be an unfair playing field in traditional investing the cryptocurrency pumped significantly in Q2 of 2021 before falling victim to the widespread crypto market pullbacks that spanned into the summer months.

PUBLICITATE

Although the perfect conditions for a widespread retail influx were already in place before the Robinhood fiasco with GameStop shares, the global news event acted as a catalyst for more individuals to incorporate more investment opportunities into their portfolios.

Whether we look to traditional investment markets or cryptocurrency, it seems as though the wider world of investing has benefited from the chaos of early January, with fresh blood on the market and greater retail awareness of crypto.

As these new arrivals learn the ropes and become more mature with their investments, we may soon see a healthier market for it.

Dmytro Spilka este un scriitor de tehnologie și finanțe cu sediul la Londra. Lucrările sale au fost publicate în Nasdaq, Kiplinger, Financial Express și The Diplomat.

Urmareste-ne pe Twitter Facebook Telegramă

Disclaimer: Opiniile exprimate la The Daily Hodl nu sunt sfaturi pentru investiții. Investitorii ar trebui să-și îndeplinească diligențele înainte de a efectua investiții cu risc ridicat în Bitcoin, criptomonede sau active digitale. Vă rugăm să vă informați că transferurile și tranzacțiile dvs. sunt pe propriul dvs. risc, iar orice pierdere pe care o puteți suferi este responsabilitatea dumneavoastră. Daily Hodl nu recomandă cumpărarea sau vânzarea de criptomonede sau active digitale și nici The Daily Hodl nu este un consilier în investiții. Vă rugăm să rețineți că The Daily Hodl participă la marketingul afiliat.

Nu ratați o bătaie - Mă abonez pentru a primi alerte prin e-mail cripto livrate direct în căsuța de e-mail

Urmareste-ne pe Twitter, Facebook și Telegramă

Surf Mixul zilnic Hodl

PUBLICITATE

Disclaimer: Opiniile exprimate la The Daily Hodl nu sunt sfaturi pentru investiții. Investitorii ar trebui să-și îndeplinească diligențele înainte de a efectua investiții cu risc ridicat în Bitcoin, criptomonede sau active digitale. Vă rugăm să vă informați că transferurile și tranzacțiile dvs. sunt pe propriul dvs. risc, iar orice pierdere pe care o puteți suferi este responsabilitatea dumneavoastră. Daily Hodl nu recomandă cumpărarea sau vânzarea de criptomonede sau active digitale și nici The Daily Hodl nu este un consilier în investiții. Vă rugăm să rețineți că The Daily Hodl participă la marketingul afiliat.

Imagine prezentată: Shutterstock / Tithi Luadthong

- 2020

- sfat

- consilier

- Parteneri

- afiliat de introducere pe piață

- printre

- aplicaţia

- recurs

- Apps

- în jurul

- Bunuri

- Auto

- Cea mai mare

- Bitcoin

- sânge

- amplificat

- BTC

- Bullish

- cumpăra

- Cumpărare

- cauzată

- creanțe

- CNBC

- Coindesk

- comunitate

- companie

- plângeri

- Covid-19

- Pandemie COVID-19

- cripto

- Piața Crypto

- cryptocurrencies

- cryptocurrency

- criptarea tranzacțiilor

- de date

- Cerere

- digital

- Active digitale

- diligență

- dogecoin

- Devreme

- ecosistem

- echitate

- Europa

- eveniment

- finanţa

- financiar

- First

- potrivi

- Libertate

- proaspăt

- Fondurile

- Caritate

- Guvern

- În creştere

- Creștere

- Oaspete

- cap

- Prima pagină

- Fonduri de investiții

- HODL

- casă

- camera Reprezentanților

- Cum

- HTTPS

- imagine

- Impactul

- Inclusiv

- industrie

- interes

- investind

- investiţie

- Investiții

- Investitori

- probleme de

- IT

- mare

- Ultimele

- Ultimele ştiri

- AFLAȚI

- Led

- ușoară

- Lichiditate

- Londra

- major

- Efectuarea

- Piață

- Marketing

- pieţe

- Mass-media

- milion

- luni

- Nasdaq

- ştiri

- Avize

- Oportunităţi

- Opţiuni

- pandemie

- părinţi

- platformă

- Platforme

- mulțime

- preţ

- raliu

- cercetare

- cu amănuntul

- Investitori de vânzare cu amănuntul

- Reuters

- Risc

- Robinhood

- Titluri de valoare

- Senator

- Distribuie

- Acțiuni

- Pantaloni scurți

- Social

- social media

- pătrat

- stimul

- stoc

- bursa de valori

- stradă

- de vară

- apare

- Sondaj de opinie

- tech

- Teen

- adolescenti

- terțe părți

- timp

- comerţului

- meserii

- Trading

- Tranzacții

- tratament

- stare de nervozitate

- us

- utilizatorii

- volum

- Wall Street

- Portofel

- săptămână

- Wells Fargo

- OMS

- Apartamente

- lume

- scriitor

- an