Cryptocurrency market maker Cumberland has said that institutional investors are betting on the second-largest cryptocurrency by market capitalization, Ethereum ($ETH), at a time in which the cryptocurrency’s price has been surging to outperform the wider market.

According to a Twitter thread attributed to Cumberland’s head of trading Johan Van Bourg, despite a recent pullback seen in Ethereum’s price, the cryptocurrency’s uptrend remains intact. Per Cumberland, while ETH’s price action has been technical and highly macro-correlated in the recent past, its recent move has been “crypto-fundamental.”

The market maker pointed to the Sepolia testnet successful merging to Proof-of-Stake on July 6, which set the stage “for an early-autumn mainnet merge.” The Ethereum Merge describes the network’s current mainnet merging with the Beacon Chain’s PoS system, setting the stage for future scaling upgrades, including sharding. The move is expected to reduce Ethereum’s energy consumption by 99.95%.

Tim Beiko, an Ethereum protocol support engineer at the Ethereum Foundation, made a projection for the Merge to occur in September at a Apelează implementatorii PoS. Beiko a remarcat că cronologia Merge este foarte probabil să se schimbe în timp.

Cumberland added that barring any technical problems, the “emergence of a yield-bearing, deflationary, mega-cap asset is a very big deal” and noted that Ethereum’s move also “matters to the participants who care about climate change.”

Per the firm, portfolio allocations to Ethereum are “hardly oversubscribed” and it “doesn’t take much flow to move the needle.” That flow, it added, is being observed at its over-the-counter (OTC) trading desk, with buy/sell ratios tilting long.

The market maker added the shift reflects that it’s “always easier to buy a bounce than to catch the falling knife” and while volatility can “be off-putting” it’s “not without justification” as Ethereum is a world computer and global settlement layer “with tremendous potential.”

Cumberland’s comments come at a time in which Ethereum whales have started accumulating more of the cryptocurrency as its price surged over the past week, partly thanks to the projection for the date in which the blockchain will undergo the Merge.

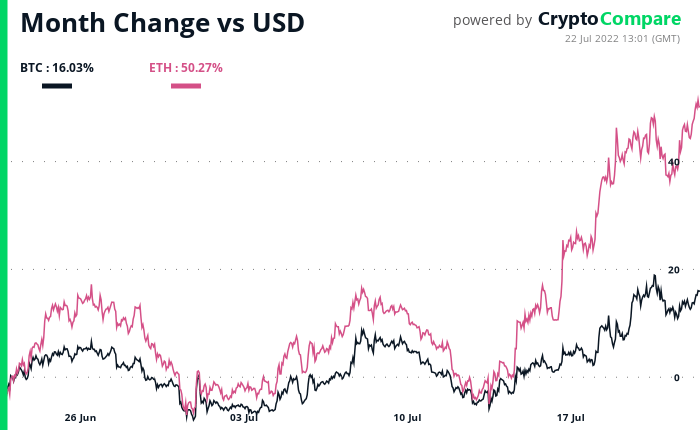

Ethereum’s price surged over 50% over the last 30 days to outperform the flagship cryptocurrency Bitcoin, which moved up around 16%, according to CryptoCompare de date.

Potrivit firmei de analiză în lanț IntoTheBlock, pe măsură ce prețul Ethereum a crescut de la aproximativ 1,050 USD la peste 1,600 USD la momentul scrierii, balenele ETH și-au accelerat ritmul de acumulare, pentru a deține acum peste 22.4% din oferta circulantă a criptomonedei.

În special, trecerea Ethereum la 1,500 USD a fost în conformitate cu o predicție făcută de veteranul comerciant de criptomonede și analist de piață Michaël van de Poppe, care a prezis la începutul acestei luni Ethereum ar putea vedea o „curgere semnificativă” dacă și-a spart rezistența la 1,140 USD.

Între timp, a panel format din 53 de experți fintech la Finder a dezvăluit previziuni de preț optimiste pentru viitorul criptomonedei, punând un preț țintă de 1,711 USD în medie pentru sfârșitul anului și prezicând o creștere la 5,739 USD până la sfârșitul anului 2025. Până la sfârșitul anului 2030, experții au prezis că Ethereum ar putea crește până la 14,412 USD.

Image Credit

Imagine recomandată prin Pixabay

- Altcoins

- Bitcoin

- blockchain

- respectarea blockchain-ului

- conferință blockchain

- coinbase

- coingenius

- Consens

- conferință cripto

- cripto miniere

- cryptocurrency

- CryptoGlobe

- descentralizată

- DEFI

- Active digitale

- ethereum

- masina de învățare

- jeton non-fungibil

- Plato

- platoul ai

- Informații despre date Platon

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- dovada mizei

- W3

- zephyrnet