Morgan Stanley increased its BTC exposure by purchasing another 58,000 GBTC shares as the company continues to accumulate BTC through its trust according to the latest SEC filing so let’s read more in our ultimele noutăți despre Bitcoin.

Morgan Stanley is the global financial services giant which continues to increase its exposure to BTC via the Grayscale BTC trust. Morgan Stanley increased its bitcoin exposure as the financial services company held 928,051 shares of Grayscale’s Bitcoin trust. The recent filing with the US SEC showed that it purchased another 58,116 shares of GBTC on July 31st.

The data shows that at the time, the shares were worth around $34.5 per piece which means that the company is more or less even with the latest investment. It is also worth noting that this came a day after Dennis Lynch who is the head of Counterpoint Global at Morgan Stanley’s Investment Management said that bitcoin is not fragile. The official believes that the asset can resist the market disorders and could propel further when others fail. He even drew a comparison between BTC and a TV character from South Park-Kenny:

PUBLICITATE

“I like to say that Bitcoin is kind of like Kenny from South Park, you know, the guy dies every episode and he’s back again. Owing a little bit of something where things can go right, but also knowing that there are some things that can go wrong is not unreasonable when you have a world that has such disruption occurring, and where these upside scenarios wind up being so large.”

As recently reported, The SEC files show that over 30 Morgan Stanley funds hold huge amounts of GBTC shares and the biggest one seems to be Morgan Stanley’s Insight Fund with more than 928,051 worth around $36 million or over 700 BTC. Morgan Stanley Institutional Fund, the institutional trust, the Variable Insurance Fund, and others seem to have bigger amounts as well. Back on June 28th, 2021, when BTC was still trading in the low $30,000s as Morgan Stanley disclosed a huge position on the GBTC via the Europe Opportunity Fund.

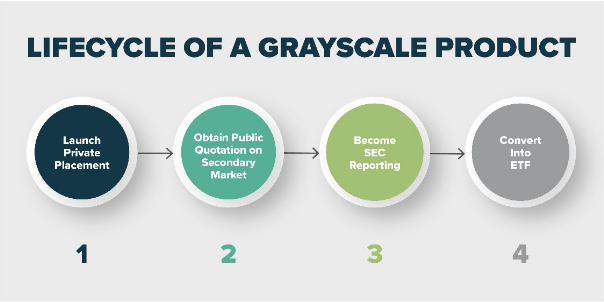

A few months before, the banking giant became teh first US-based financial institution to offer the clients exposition to the BTC funds and with over $4 trillion in assets under management, the bank doubled down on the industry as it seems right now. In addition to the Alb-negru Bitcoin Trust’s huge position, Morgan Stanley was investing in crypto-based companies as it added more BTC exposition via the 12 investment vehicles.

PUBLICITATE

- 000

- 116

- în jurul

- activ

- Bunuri

- Bancă

- Bancar

- Cea mai mare

- Pic

- Bitcoin

- Bitcoin ETF

- Știri Bitcoin

- Bitfinex

- BTC

- Cumpărare

- Companii

- companie

- continuă

- contrapunct

- cripto

- cripto News

- de date

- zi

- Ruptură

- Editorial

- ETF

- Europa

- financiar

- Servicii financiare

- First

- Gratuit

- fond

- Fondurile

- TCGA

- Caritate

- Alb-negru

- cap

- deţine

- HTTPS

- mare

- Crește

- industrie

- Instituţie

- Instituţional

- asigurare

- investind

- investiţie

- IT

- iulie

- mare

- Ultimele

- administrare

- Piață

- milion

- luni

- Morgan Stanley

- ştiri

- oferi

- oficial

- Oportunitate

- Politicile

- preţ

- SEC

- Servicii

- set

- Acțiuni

- Pantaloni scurți

- So

- Sud

- standarde

- Stanley

- timp

- Trading

- Încredere

- tv

- us

- Vehicule

- website

- OMS

- vânt

- lume

- valoare