Link-uri: PrimeXLabs, Portofoliul CoinFund

Rezumatul tezei de investiții

- Major opportunity as margin trading moves on-chain: On-chain interaction has overtaken that of centralized exchanges such as Binance and FTX. Margin trading for cryptocurrency has been primarily offered on-chain via perpetual futures contracts, rather than spot margin trading that leverages existing liquidity in AMMs.

- Novel mechanisms for assessing risk and credit: Using automated risk assessment models allows for leverage to be adjusted based on the risk profile of different assets.

- Cross-chain compatibility by default: By leveraging existing bridging solutions PrimeX unifies previously disjointed liquidity, improving the trading experience for users.

CoinFund is proud to have co-led PrimeXLab’s recent fundraise and we are specifically excited to see their novel technologies bring the leveraged on-chain trading experience to feature parity with that of centralized venues. Margin trading has been a major cornerstone of the cryptocurrency market for several years. However, margin trading volume has largely been confined to centralized exchanges such as Bitmex, Binance and FTX. These centralized venues have suffered a range of issues including poor compatibility for various ecosystems, less-than-perfect uptime among other issues. As DeFi has continued its rise in popularity since Summer 2020, it is a natural evolution to see margin trading move on-chain.

PrimeX, the exchange product being built by PrimeXLabs, is the next major innovation in on-chain margin trading. By settling trades directly on decentralized exchanges (DEXes), PrimeX can benefit from liquidity that is already present in Ethereum Virtual Machine-compatible blockchain ecosystems, while also enabling cross-margin trading, cross-DEX settlement, and cross-chain settlement.

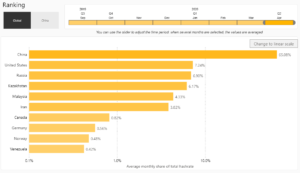

Since mid-2020, the volume mix of cryptocurrency trading activity has steadily shifted from taking place mostly on centralized exchanges to occurring via decentralized applications powered by smart contracts. The trading volumes across decentralized exchanges and lending platforms have grown steadily, eventually overtaking most centralized counterparts. Margin trading, however, has only recently begun to see large adoption on-chain. As with any trading platform, a critical factor in user experience is the overall liquidity. Because of the difficulty in attracting liquidity to margin trading platforms, most have been restricted to using perpetual futures contracts rather than offering margin on spot trading. PrimeX is solving the liquidity problem by integrating directly with decentralized exchanges, and making use of the existing pools of deep liquidity present on these exchanges to settle trades. By integrating multiple DEXes at the same time, PrimeX can also find the best available options for a trade based on market conditions, in much the same way that DEX aggregators function for non-leveraged spot trading. Making use of existing liquidity limits the need for tokenomics-based bribes to incentivize liquidity to move to the platform.

In addition to connecting multiple DEXes in one environment, PrimeX will also pull together liquidity across the various blockchains themselves. Using pre-existing bridging solutions, traders will be able to seamlessly execute trades across chains that are compatible with the Ethereum Virtual Machine (including Ethereum, Moonbeam, Avalanche C-chain, etc.) in order to optimize their trades by composing liquidity from multiple ecosystems. Settling trades across multiple chains and multiple DEXes, PrimeX enables users trading on margin to gain access to the best prices and liquidity from a single interface.

PrimeX is also advancing margin trading technology by weaving together existing technologies and liquidity with novel mechanisms for assessing the risk of assets and using this information to determine the amount of leverage that should be possible to the trader while keeping the system safe. In addition the feature-set available to traders will be at parity with what is available on centralized exchanges, including limit orders, stop-loss and take-profit order types. PrimeX is also facilitating the growth of the exchange’s userbase by working closely with the teams of various layer 1’s, such as Moonbeam, that are planned to be integrated. he PrimeX team is made up of 25 professionals who are able to execute quickly and manage a large portfolio of integration partners, including layer 1’s and decentralized exchanges.

Over time on-chain activity is claiming a continually greater share of all cryptocurrency related activity and margin trading is not an exception. At CoinFund we’re excited to see PrimeX bringing spot margin trading fully on-chain by leveraging the already rich liquidity within decentralized exchanges and improve upon the current perpetual futures-based margin trading experience!

Despre CoinFund

CoinFund este o firmă de investiții diversificată, de top, axată pe blockchain, fondată în 2015, cu sediul în SUA Colectiv, avem o experiență extinsă în criptomonede, acțiuni tradiționale, credit, capital privat și investiții de risc. Strategiile CoinFund acoperă atât piețele lichide, cât și cele de risc și beneficiază de abordarea noastră multidisciplinară care sincronizează aptitudinea criptonativă tehnică cu experiența financiară tradițională. Cu o abordare „în primul rând fondatorii”, CoinFund colaborează îndeaproape cu companiile sale din portofoliu pentru a stimula inovația în spațiul activelor digitale.

Declinare a responsabilităţii

Conținutul furnizat pe acest site are doar scop informativ și de discuție și nu trebuie să se bazeze pe acesta în legătură cu o anumită decizie de investiție sau să fie interpretat ca o ofertă, recomandare sau solicitare cu privire la orice investiție. Autorul nu susține nicio companie, proiect sau simbol discutat în acest articol. Toate informațiile sunt prezentate aici „ca atare”, fără garanții de nici un fel, indiferent dacă sunt exprese sau implicite, și orice declarații prospective se pot dovedi a fi greșite. CoinFund Management LLC și afiliații săi pot avea poziții lungi sau scurte în token-urile sau proiectele discutate în acest articol.

![]()

Teză de investiții PrimeXLabs a fost publicat inițial în Blogul CoinFund pe Medium, unde oamenii continuă conversația subliniind și răspunzând la această poveste.

- "

- 2020

- acces

- peste

- Adoptare

- TOATE

- deja

- printre

- sumă

- aplicatii

- abordare

- articol

- activ

- Bunuri

- Automata

- disponibil

- Avalanşă

- fiind

- CEL MAI BUN

- binance

- BitMEX

- blockchain

- Companii

- companie

- conexiune

- conţinut

- contracte

- Conversație

- credit

- Cross-Chain

- cryptocurrency

- piata de criptare

- criptarea tranzacțiilor

- Curent

- descentralizată

- Aplicații descentralizate

- DEFI

- Dex

- diferit

- digital

- Active digitale

- ecosistemele

- permițând

- Mediu inconjurator

- echitate

- ethereum

- evoluţie

- schimb

- Platforme de tranzacţionare

- experienţă

- Caracteristică

- finanţa

- Firmă

- de perspectivă

- FTX

- funcţie

- Futures

- Creștere

- aici

- HTTPS

- stimuleze

- Inclusiv

- informații

- Inovaţie

- integrate

- integrare

- interacţiune

- interfaţă

- investind

- investiţie

- probleme de

- IT

- păstrare

- mare

- conducere

- împrumut

- Pârghie

- pîrghii

- Lichid

- Lichiditate

- LLC

- Lung

- major

- Efectuarea

- administrare

- marja de tranzacționare

- Piață

- pieţe

- mediu

- Modele

- cele mai multe

- muta

- oferi

- oferind

- Oportunitate

- Opţiuni

- comandă

- comenzilor

- Altele

- parteneri

- oameni

- platformă

- Platforme

- piscine

- sărac

- portofoliu

- posibil

- prezenta

- privat

- de capital privat

- Problemă

- Produs

- profesioniști

- Profil

- proiect

- Proiecte

- scopuri

- gamă

- record

- Risc

- evaluare a riscurilor

- sigur

- așezare

- Distribuie

- Pantaloni scurți

- inteligent

- Contracte inteligente

- soluţii

- Spaţiu

- specific

- Loc

- Declarații

- strategii

- de vară

- sistem

- Tehnic

- Tehnologii

- Tehnologia

- timp

- împreună

- semn

- indicativele

- urmări

- comerţului

- comerciant

- Comercianti

- meserii

- Trading

- tradiţional

- finanțe tradiționale

- ne

- utilizatorii

- aventura

- Virtual

- mașină virtuală

- volum

- Ce

- Ce este

- dacă

- OMS

- în

- fără

- de lucru

- ani