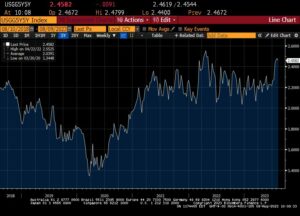

US stocks declined after a disappointing round of earnings, retail sales topped expectations which suggests the economy can handle more rate hikes, and some hawkishness from Fed’s Daly and Williams. Fed’s Daly noted that 4.75% to 5.25% is a reasonable range for the Fed to raise interest rates, which is a little higher than what money markets are pricing in.

The impressive retail sales data release prompted fears that the economy might be a little bit too resilient and prone to more Fed rate hikes.

Earnings from Micron dragged the semiconductor space down as a weak demand outlook was accompanied by a slashing of its capital spending plan. Eventually, when the global economy recovers, we might see this excess inventory problem quickly become an inflationary problem.

Target shares got punished after the big-box retailer cut its fourth-quarter outlook and announced a $3 billion cost-saving plan over the next three years. Target is concerned about a weakening consumer and the big profit miss is a bad sign heading into the key holiday period.

Datele din SUA

The consumer is still healthy after retail sales impressed in October. Corporate earnings might be telling a mixed picture, thank you Walmart and Target, but overall signs of consumer resilience remain. Retail sales rose 1.3%, a tick above expectations, which shows the consumer is still able to handle the latest round of price increases. The retail sales reading ex-auto impressed with a 1.3% gain, much higher than the 0.5% consensus estimate. The retail sales group which feeds into GDP also remained strong, rising 0.7%.

The NAHB housing market index tumbled to a decade low as inflationary pressures are accompanied by a weakening consumer. The November headline index dropped 5 points from a month ago to 33. A lot of challenges remain for the housing market and further pain is likely ahead.

FTX contagion remains the primary focus for the cryptoverse. If the current mood for crypto traders needed a theme song, it would be the Rolling Stones hit, “Another one bites the dust.” The latest crypto casualty that might bite the dust is the lending arm of the crypto investment bank Genesis Global Trading. Genesis tweeted that they had to temporarily suspend redemptions and new loan originations in the lending business.

Bitcoin and ethereum are lower on the day as contagion fears remain elevated and as the broader markets are dragged down after a round of hawkish Fed speak and mixed signals about the US consumer.

Acest articol are doar scop informativ. Nu este sfat de investiții sau o soluție pentru a cumpăra sau vinde titluri de valoare. Opiniile sunt autorii; nu neapărat cea a OANDA Corporation sau a oricăreia dintre filialele, filialele, ofițerii sau directorii săi. Tranzacționarea cu levier este cu risc ridicat și nu este potrivită pentru toți. Ați putea pierde toate fondurile depuse.

- Bitcoin

- blockchain

- respectarea blockchain-ului

- conferință blockchain

- Băncilor Centrale

- coinbase

- coingenius

- Consens

- conferință cripto

- cripto miniere

- cryptocurrency

- descentralizată

- DEFI

- Active digitale

- Sezonul câștigurilor

- ethereum

- Daly, membru al Fed

- Membrul Fed Williams

- Federal Reserve

- Genesis Global Trading

- masina de învățare

- MarketPulse

- micron

- Noutăți și evenimente

- newsfeed-

- jeton non-fungibil

- Plato

- platoul ai

- Informații despre date Platon

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- dovada mizei

- Ţintă

- Vânzări cu amănuntul de bază în SUA

- Indicele pieței locuințelor NAHB din SUA

- Vânzări cu amănuntul din SUA

- Stocuri americane

- W3

- zephyrnet