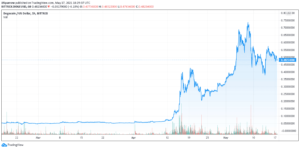

The crypto crash continues, but this shouldn’t be too surprising given the risky nature of virtual currencies. Crypto crashes have of course happened before, and each time tokens have regained their momentum after a period.

However, this year’s crash that began towards the end of April has been different. Not only is the crypto market crumbling, but it is also having greater impact on the stock market.

Indeed, movements in the crypto market could also be acting as signals for movements in stock sectors such as high-growth tech stocks.

How Tesla Helped Trigger Crypto Market Crash

Crypto assets across the board have been rapidly losing value, with Bitcoin down nearly 50% from its earlier $63,500 all-time high in mid-April. Bitcoin almost touched $30,000 at one point and again this weekend this month, although it regaining some momentum today. Ethereum has also tumbled, to around $2,500 at the time of writing.

The crypto crash has been attributed to several developments in the market, including Tesla’s anunț to no longer accept Bitcoin payments, a crypto payments crackdown in China and closure of mining firms in China.

The crash has prompted many retail traders to sell off their holdings in fear that the prices would fall even further. The crash has also been felt on Wall Street, where many stocks are losing their value.

Crypto Trading Influencing Stock Market and Vice Versa

The recent market movement has shown an interdependence between the stock market and the crypto market. When the crypto market tumbles, stock markets also struggled, causing a jittery period on Wall Street.

Equally, when the crypto market recovered slightly, stock markets also seemed to recover in what can be seen as an unusual trend. According to Jim Cramer, a reporter on CNBC, this influence of cryptocurrencies on the US stock market is not expected. “It’s Insane. It’s insane,” Cramer lamented.

The stock market and the crypto market are influencing each other because major companies listed on NASDAQ have invested in cryptocurrencies.

Amidst the crypto boom, a number of companies diversified into crypto and launched crypto products to meet the increased demand from investors.

What’s the Impact of Crypto Product Launches and BTC on Balance Sheets

Some of those companies have even gone as far as actually adding bitcoin to their balance sheets alongside cash. Also, with increasing numbers of investors holding cryptocurrencies in their portfolio, investors can get jittery every time the stock market falls and want to adjust their investments to manage risk.

A similar trend is emerging when the stock market rises. When the stocks of companies that have invested in cryptocurrencies also increase, it causes cryptocurrencies to increase in value. This is because jetoane crypto can be seen to derive some of their value from how well the company’s shares are performing.

Opportunity to profit from Crypto As a Leading Indicator?

This trend shows that the crypto market’s influence in financial markets is increasing. To some extent crypto could be acting as a leading indicator, with stock falls following in crypto’s wake, at least in certain sectors. Savvy investors could take advantage of such insights to make profits.

With the highly volatile nature of cryptocurrencies, this interdependence could cause instability in the stock markets – it may have led the US Treasury to call for more regulation of the crypto market over fears that crypto trading may cause financial instability.

Doriți să cumpărați sau să tranzacționați Bitcoin (BTC) acum? Investiți la eToro!

75% din conturile de investitori cu amănuntul pierd bani atunci când tranzacționează CFD-uri cu acest furnizor

Source: https://insidebitcoins.com/news/the-crypto-crash-is-impacting-stocks-how-you-can-profit

- "

- 000

- Avantaj

- Aprilie

- în jurul

- Bunuri

- Bitcoin

- Plăți Bitcoin

- bord

- bum

- BTC

- cumpăra

- cumpăra biți

- apel

- Bani gheata

- Provoca

- China

- închidere

- CNBC

- Companii

- continuă

- Crash

- cripto

- Piața Crypto

- cripto-tranzacționare

- cryptocurrencies

- Moneda

- Cerere

- ethereum

- temeri

- financiar

- Înalt

- Cum

- HTTPS

- Impactul

- Inclusiv

- Crește

- influență

- perspective

- Investiții

- investitor

- Investitori

- IT

- lansează

- conducere

- Led

- major

- Piață

- pieţe

- Minerit

- Impuls

- bani

- Nasdaq

- numere

- Altele

- plăți

- portofoliu

- Produs

- Produse

- Profit

- Recupera

- Regulament

- reporter

- cu amănuntul

- Risc

- pricepere

- sectoare

- vinde

- Acțiuni

- stoc

- bursa de valori

- Piețele de acțiuni

- Stocuri

- stradă

- tech

- Tesla

- timp

- indicativele

- comerţului

- Comercianti

- Trading

- us

- valoare

- Virtual

- monede virtuale

- Wall Street

- weekend

- scris