The U.S. Treasury Department is reportedly preparing a review highlighting challenges posed by stablecoin redemptions and the effect of a possible run on the crypto asset market.

According to a Sept.16 report from Bloomberg citând anonymous sources, Treasury officials are readying policy recommendations designed to ensure stablecoin holders can freely convert between their tokens and other assets.

The report states the lawmakers hope to mitigate “the most urgent risks” associated with Tether (USDT) and other stable tokens, also emphasizing the threats a “fire-sale run” on crypto assets could wreak for financial stability broadly.

Critics have long scrutinized Tether’s redemption process and backing and found it wanting, with some holders revendicare to have been unable to redeem USDT for fiat using the company’s website over the years.

After years of failing to deliver promised audits, Tether has recently published attestation reports claiming the stablecoin is backed by $62.6 billion in assets — 49% of which is foaie comerciala while cash and bank deposits comprise just 10%.

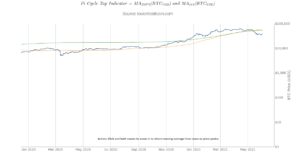

While Treasury officials reportedly are most concerned about Tether, the once hegemonic status of USDT over the stablecoin markets is waning — with the token’s relative market share receding by 25% since the start of 2021.

After starting the year representing roughly 76% of stablecoin capitalization, Tether’s dominance over the sector has fallen by one-quarter to represent 56.5% of combined stable token market cap today, according to CoinGecko.

This year has seen USD Coin (USDC) and Binance USD capture significant market share amid Tether’s decline, with USDC and BUSD growing from 13.7% and 3.40% of stablecoin capitalization to 23.9% and 10.4% respectively today.

Decentralized stable tokens have also shown notable growth during 2021, with TerraUSD growing from 0.65% to 2.11% while MakerDAO’s DAI increased from 4.23% to 5.13%.

CoinGecko’s data also notes a decline in the market share of Paxos Dollar, which shrunk from 1.15% to 0.85%. However, every stablecoin tracked by CoinGecko saw its overall market cap grow during 2021.

- activ

- Bunuri

- Bancă

- Miliard

- binance

- Bloomberg

- BUSD

- capitalizare

- Bani gheata

- Monedă

- CoinGecko

- Cointelegraph

- criză

- cripto

- activ cripto

- Industria criptelor

- DAI

- de date

- Datorie

- Dolar

- Decret

- financiar

- Crește

- În creştere

- Creștere

- HTTPS

- industrie

- IT

- parlamentarii

- Lung

- Piață

- Capul pieței

- pieţe

- Altele

- paxos

- Politica

- raportează

- Rapoarte

- revizuiască

- Risc

- Alerga

- Distribuie

- Stabilitate

- stablecoin

- Începe

- Statele

- Stare

- Tether

- Tether (USDT)

- amenințări

- semn

- indicativele

- Departamentul Trezoreriei

- ne

- USD

- USD Moneda

- USDC

- USDT

- website

- an

- ani