US dollar resumes its downturn

The US dollar resumed its correction lower overnight as the euro rose on renewed Russian gas flows, US yields fell, and investor sentiment rose in the equity space. The dollar index fell by 0.40% to 106.60 overnight, although heightened nerves in the equity space today have seen it rise by 0.23% to 108.84. The 106.40 area was tested for the 4th time overnight and now looms as a critical inflexion point. Failure signals more losses towards 1.0500 and 1.0350. Resistance is at 107.30 and 108.00.

EUR/USD traded in a wide range overnight, bounced around by Russian gas, Italy, and the ECB. In the end, it had onto much of its gaseous gains, finishing 0.50% higher at 1.0230. The first sign of trouble in US stock futures has prompted a US dollar rally in Asia, which doesn’t bode well for the single currency. EUR/USD has fallen 0.32% to 1.0197 as a result. It has resistance at 1.0275, but only a sustained break above 1.0360 would suggest a longer-term low is in place. EUR/USD has support at 1.0150 and 1.0100.

GBP/USD closed almost unchanged overnight at 1.2000, having spiked to a low of 1.1900 intraday. In Asia, the dollar rebound sees GBP/USD easing 0.25% to 1.1975. Sterling has support at 1.1900 and 1.1800, with resistance at 1.2060 and 1.2200. A rise above the 1.2060 wedge formation signals a larger rally to the 1.2400 regions, but it would take a sustained break above 1.2400 to call for a longer-term low by sterling. Its fate is probably tied to EUR/USD’s direction today.

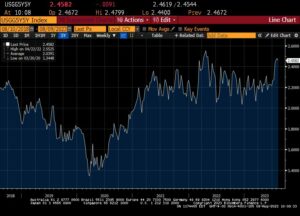

Lower US yields across the curve saw the Japanese yen emerge a winner overnight as the US/Japan rate differential narrowed, with the street still long to the eyeballs of USD/JPY. USD/JPY finished 0.65% lower at 137.35 overnight, rising slightly to 137.55 in Asia. A loss of 137.00 could set off a deeper correction to 135.50 initially. Initial resistance is distant at 139.00, followed by 139.40. The US/Japan rate differential continues to hold USD/JPY in its thrall.

AUD/USD and NZD/USD rose overnight, falling 0.20% and 0.35% to 0.6920 and 0.6230 on US dollar strength in an inconclusive Asian session this morning. They continue consolidating their respective topside wedge breakouts. Only a move back below either 0.6800 or 0.6150 changes the short-term bullish technical outlook.

Bank Indonesia surprised markets by holding rates unchanged yesterday, and unsurprisingly, USD/IDR is above 15,000.00 at 15,015.00 this morning. Asian currencies were a mixed bag overnight, without any strong directional moves. The US dollar correction continues to pass the Asia FX space by, with regional currencies remaining at, or near, recent lows versus the greenback. We may need to wait for the FOMC outcome next week to see another directional move.

Acest articol are doar scop informativ. Nu este sfat de investiții sau o soluție pentru a cumpăra sau vinde titluri de valoare. Opiniile sunt autorii; nu neapărat cea a OANDA Corporation sau a oricăreia dintre filialele, filialele, ofițerii sau directorii săi. Tranzacționarea cu levier este cu risc ridicat și nu este potrivită pentru toți. Ați putea pierde toate fondurile depuse.

- AUD / USD

- Decizia ratei BI

- Bitcoin

- blockchain

- respectarea blockchain-ului

- conferință blockchain

- Băncilor Centrale

- coinbase

- coingenius

- Consens

- conferință cripto

- cripto miniere

- cryptocurrency

- descentralizată

- DEFI

- Active digitale

- Indicele dolarului

- Decizia ratei BCE

- ethereum

- EUR / USD

- Întâlnirea ratei FOMC

- FX

- GBP / USD

- Italia

- masina de învățare

- MarketPulse

- Noutăți și evenimente

- newsfeed-

- jeton non-fungibil

- NZD / USD

- Plato

- platoul ai

- Informații despre date Platon

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- dovada mizei

- gazul rusesc

- Analiza Tehnica

- trezoreriile

- Randamentele SUA

- USD / JPY

- W3

- zephyrnet