KEEP and Yearn Finance prices are bottoming up with light trading volumes. A close above $0.40 is definitive for KEEP/USD. On the other hand, provided YFI/USDT is above $40k, buyers stand a chance.

Finanțe anterioare (YFI)

In spatele YFI token is an automated, aggregating service for DeFi investors to earn maximum yields from token farming.

Performanța anterioară a YFI

Technically, YFI has more than halved, moving lower in tandem with the entire DeFi scene.

YFI prices are now moving in tight trade zones, inside a triangle.

For bulls, the May 24 high volume bull bar anchor the current price action. However, since May 19 bear bar is conspicuous, pessimists are cautious.

On the last day, YFI prices steadied, moving inside the triangle, under-performing versus ETH. Participation has, however, rallied to $387 million.

Zi înainte și la ce să ne așteptăm

YFI/USDT prices are moving inside a triangle inside May 24 bull bar but below the middle BB with decreasing trading volumes. Reaction points, in the short term, are at $40k and $52k, respectively.

Analiza tehnică YFI / USDT

From the daily chart, YFI prices are all over the place. Accordingly, risk-averse traders can stay on the sidelines until a clear trend is defined.

Consolidating, bulls can stay on the sidelines until there is a comprehensive close above the middle BB and $52k before ramping up, targeting $72k in line with the double-bar bullish reversal pattern of May 23 and $24.

If there is a break below the support trend line of the ascending triangle, YFI/USDT may disintegrate, falling towards $40k in a bear trend continuation pattern of May 19.

Păstrați rețeaua (Păstrați)

The KEEP token enables the Keep Network, where private data can be encrypted and stored in containers called Keeps, to operate trustlessly.

Past Performance of KEEP

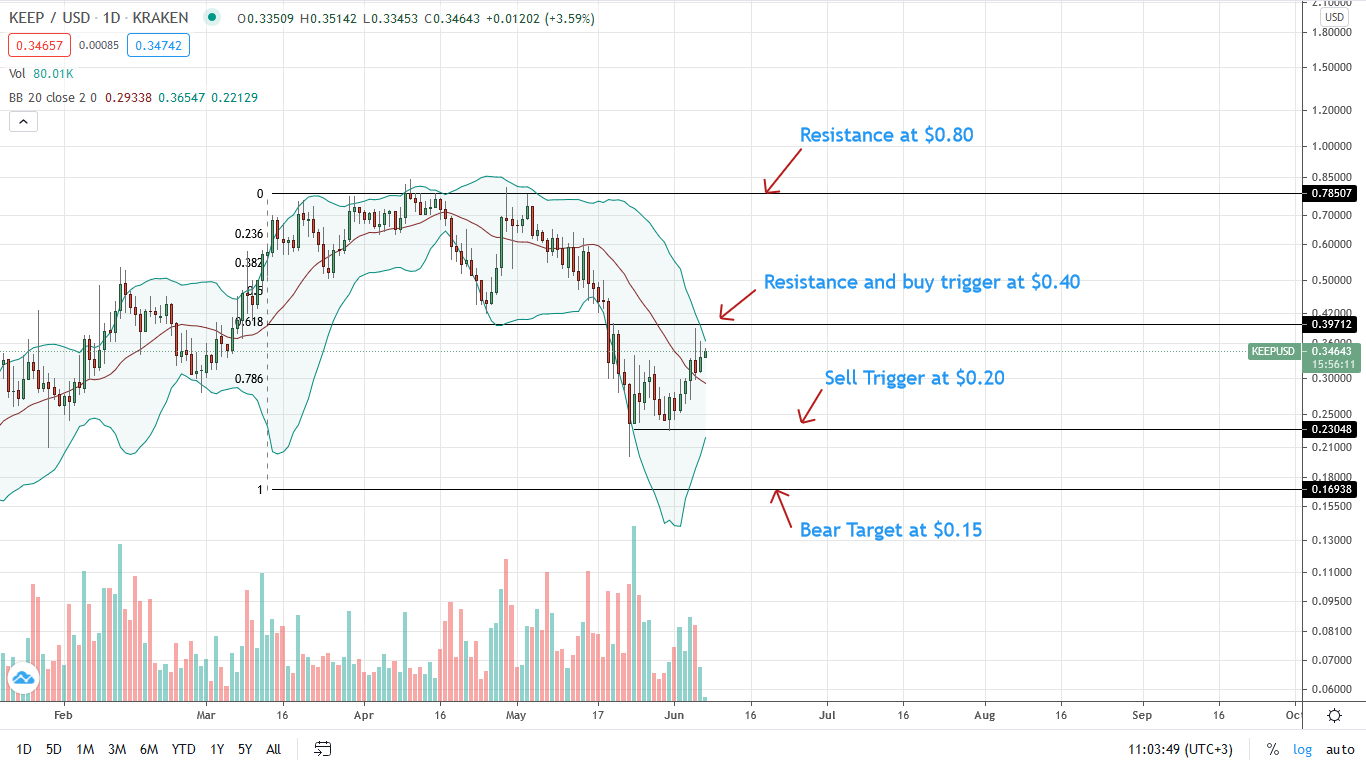

From the daily chart, the KEEP/USD is in a bear trading pattern.

Although there are attempts of highs as KEEP bulls absorb sell pressure, the path is southwards.

Trend reversals will depend on a close above $0.40 and a stretch from the middle BB.

At present, KEEP is down four percent even with dropping trading volumes which fell to $2.8 million.

Zi înainte și la ce să ne așteptăm

Overly, KEEP is consolidating with relatively low trading volumes.

A confirmation above the middle BB could catalyze participation, pushing prices towards $0.40.

Cautious traders can wait for a clear trend definition (above $0.40 or below $0.29) before riding the emerging trend.

KEEP/USD Technical Analysis

Provided KEEP is below $0.40, sellers are in control, and the token trading in a bear breakout pattern.

Nonetheless, aggressive traders can load the dips above the middle BB, aiming at $0.40.

Abrupt losses below the middle BB and $0.20 could easily see KEEP retrace deeper, wiping gains of Q1 2021 towards $0.15.

- "

- 7

- Acțiune

- activ

- Urmarind

- TOATE

- analiză

- Automata

- Bitcoin

- frontieră

- Breakout

- Bullish

- Bulls

- Containere

- Curent

- de date

- zi

- DEFI

- ETH

- agricultură

- Figura

- finanţa

- Înalt

- HTTPS

- Investitori

- ușoară

- Linie

- încărca

- milion

- reţea

- Altele

- Model

- performanță

- postări

- prezenta

- presiune

- preţ

- privat

- Q1

- reacţie

- Ronnie Moas

- vinde

- Vanzatorii

- Pantaloni scurți

- şedere

- a sustine

- Tehnic

- Analiza Tehnica

- semn

- comerţului

- Comercianti

- Trading

- Impotriva

- volum

- aștepta

- Randament