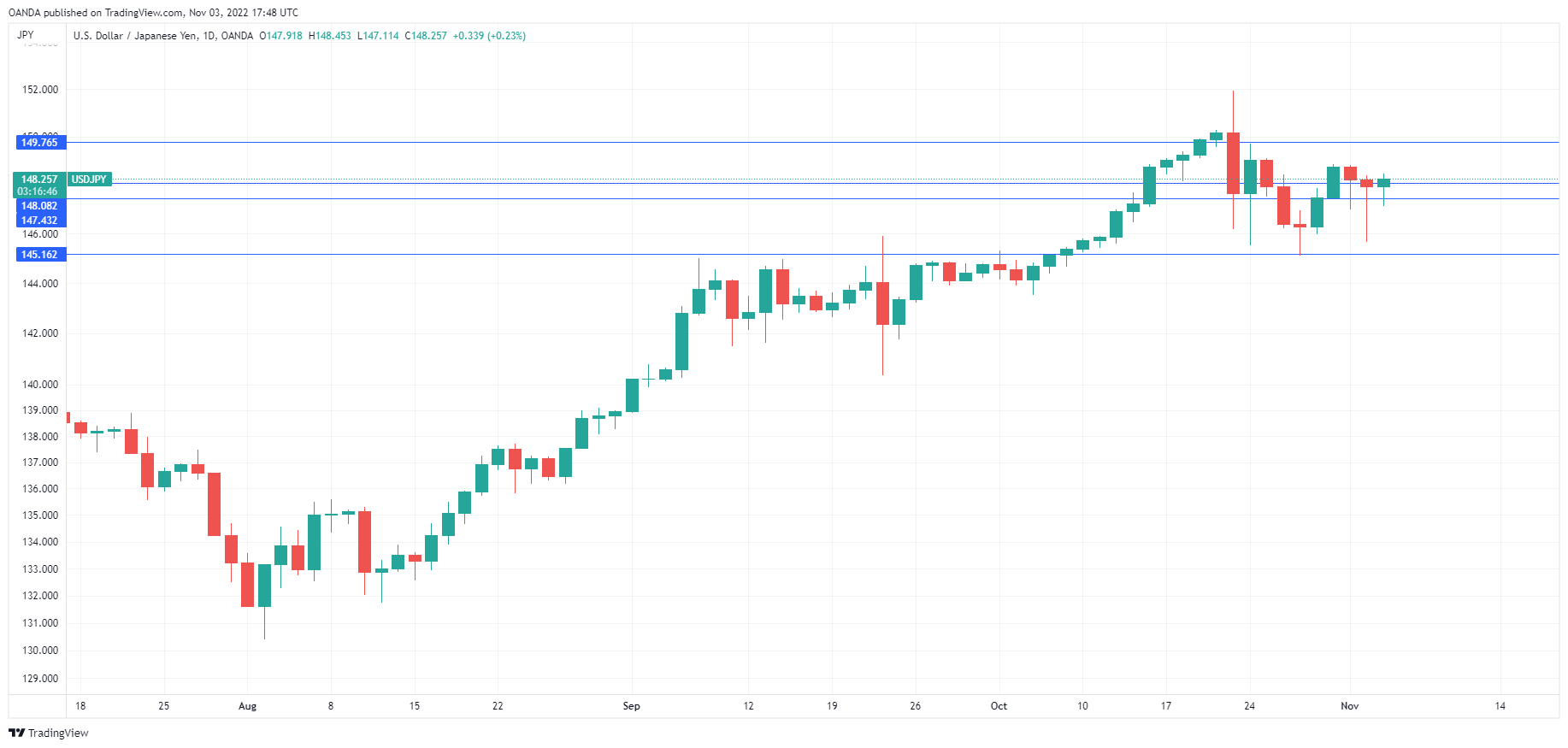

The yen has been steady for most of the week and is hovering around the 148 line. In the North American session, USD/JPY is trading at 148.09, up 0.12%.

Yen yawns after Fed rate hike

The Federal Reserve’s rate meeting roiled the financial markets and sent the US dollar sharply higher against the majors, but the Japanese yen defied the trend and has held its ground. The recent interventions by Japan’s Ministry of Finance (MOF) appear to have chilled the appetite of speculators to test the yen, as the MOF may have drawn its ‘line in the sand’ at the 150 level. Still, USD/JPY has been on a prolonged descent, losing 22% of its value this year, and I would not be surprised to see the yen resume its downturn shortly.

The Bank of Japan has shown time and time again that it is committed to an ultra-loose policy in order to support the economy, and has no interest in throwing a lifeline to the struggling yen, even with inflation rising. The US/Japan rate differential, which continues to widen, will weigh heavily on the yen, and unilateral currency interventions are unlikely to stem this downturn.

After the dramatic FOMC meeting, the US nonfarm payroll report, which will be released on Friday, is almost a footnote. The consensus stands at a modest 200,000 new jobs for October, below the 263,000 reading in September. Investors will be keeping a close eye on wage growth, which came in at a strong 5.0% in September and is expected to drop to 4.7%. With the December rate hike currently a toss-up between 0.50% and 0.75%, a stronger-than-expected NFP would raise the likelihood of a 0.75% and boost the dollar. Conversely, a soft reading would reinforce expectations of the Fed easing to 0.50%, which would be bearish for the dollar.

.

USD / JPY Tehnic

- USD/JPY testează rezistența la 148.08. Mai sus, există rezistență la 149.76

- 147.43 și 145.16 oferă suport

Acest articol are doar scop informativ. Nu este sfat de investiții sau o soluție pentru a cumpăra sau vinde titluri de valoare. Opiniile sunt autorii; nu neapărat cea a OANDA Corporation sau a oricăreia dintre filialele, filialele, ofițerii sau directorii săi. Tranzacționarea cu levier este cu risc ridicat și nu este potrivită pentru toți. Ați putea pierde toate fondurile depuse.

- banca Japoniei

- Bitcoin

- blockchain

- respectarea blockchain-ului

- conferință blockchain

- Băncilor Centrale

- coinbase

- coingenius

- Consens

- conferință cripto

- cripto miniere

- cryptocurrency

- descentralizată

- DEFI

- Active digitale

- ethereum

- Decizia privind rata Rezervei Federale

- FX

- Japan Ministry of Finance (MOF)

- JPY

- masina de învățare

- MarketPulse

- Noutăți și evenimente

- newsfeed-

- jeton non-fungibil

- Salarii non-agricole

- Plato

- platoul ai

- Informații despre date Platon

- Platoblockchain

- PlatoData

- platogaming

- Poligon

- dovada mizei

- Analiza Tehnica

- Raport privind salariile non-agricole din SUA

- Diferența de curs SUA/Japonia

- USD / JPY

- W3

- zephyrnet