Spodaj je izsek iz nedavne izdaje revije Bitcoin Magazine Pro, Revije Bitcoin glasilo premium markets. Če želite biti med prvimi, ki bodo te vpoglede in druge analize trga bitcoinov v verigi prejeli naravnost v svoj nabiralnik, naročite se zdaj.

Posodobitev opcij in izvedenih finančnih instrumentov

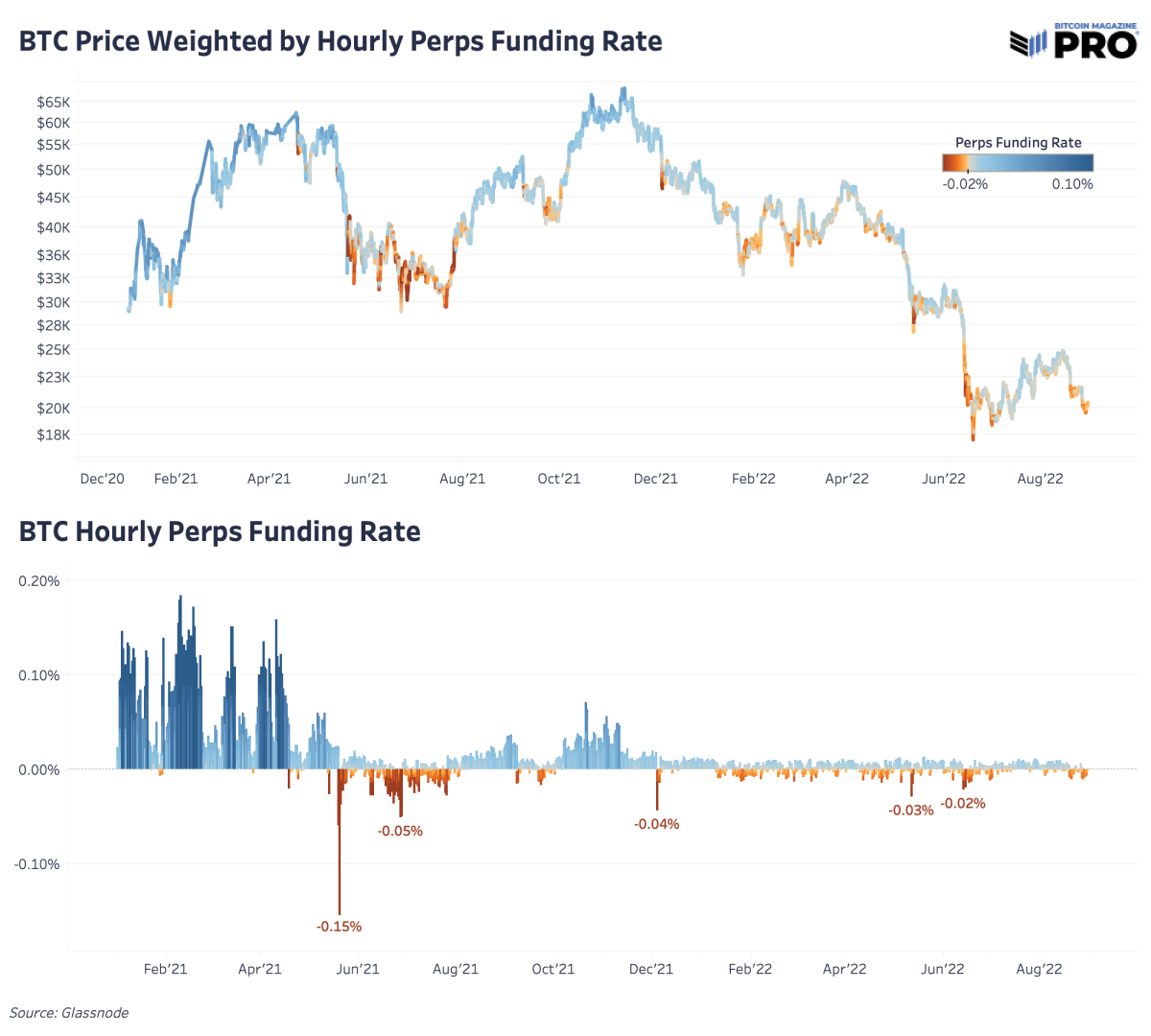

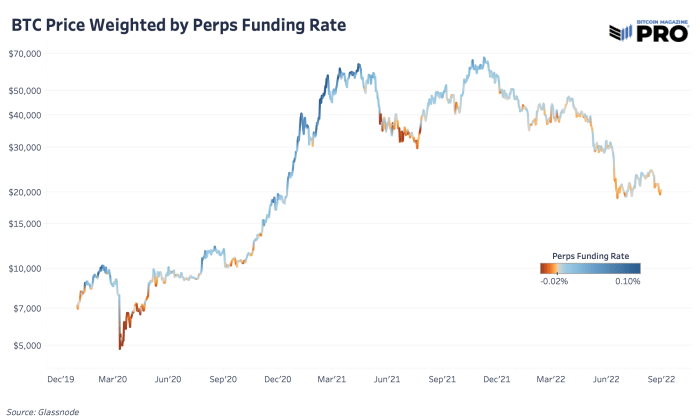

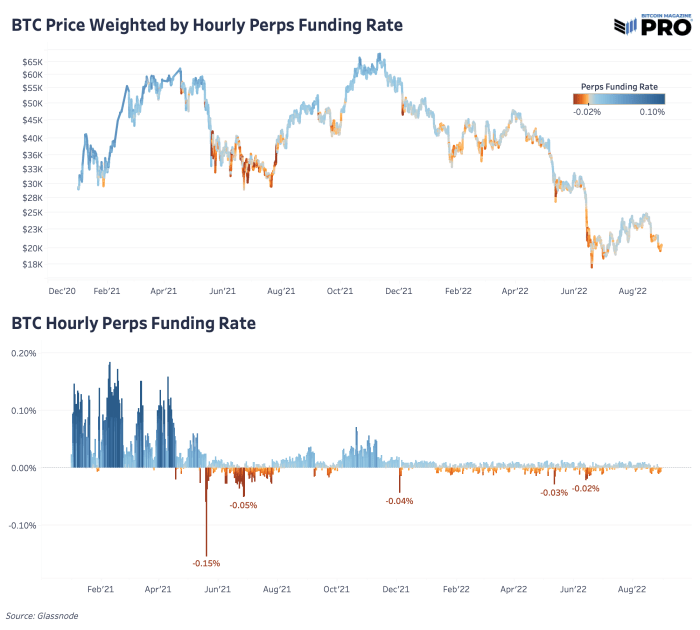

One dynamic and chart we’ve covered extensively before is bitcoin’s perpetual futures market funding rate compared to price. In the previous 2021 bull run, the perpetual (perps) futures market played a key role in moving short-term prices to both the upside and downside with excessive leverage. It’s worth reviewing the state of the derivatives market and the system’s current leverage as bitcoin price has broken down from its latest rally, following U.S. equities on a potential path towards new lows.

Od vrha novembra 2021 je bil trajni terminski trg dosledno nagnjen proti padcu (nevtralna stopnja financiranja je 0.10 %). Preprosto povedano, več udeležencev na trgu je bilo in je še vedno pristransko kratko v zadnjih osmih mesecih. Tudi med zadnjim dvigom medvedjega trga se to ni spremenilo. Nismo opazili, da bi stopnja financiranja presegla nevtralno območje, kar bi kazalo jasen znak, da se dolgotrajni špekulanti in nagnjenost k tveganju niso vrnili na trg.

With the successful launch of a bitcoin futures ETF in U.S. markets last fall, along with a general unwind in speculative activity across the bitcoin/cryptocurrency market, perp funding rates have been teetering from a neutral to short bias with much less explosive moves in funding rates. Although derivatives market dynamics have changed, it’s still worth watching for an actionable signal from the perps market where the shorting bias gets heavily offside as it’s shown to do throughout history marking significant bottoms. It’s worth noting that in previous bear market cycles (where new incoming spot demand was diminished by willing sellers) funding could stay negative for long periods of times, due to lack of demand to speculate/leverage the asset from the bulls.

In previous bitcoin bear markets, funding could stay negative for long periods of times due to lack of demand to speculate/leverage BTC.

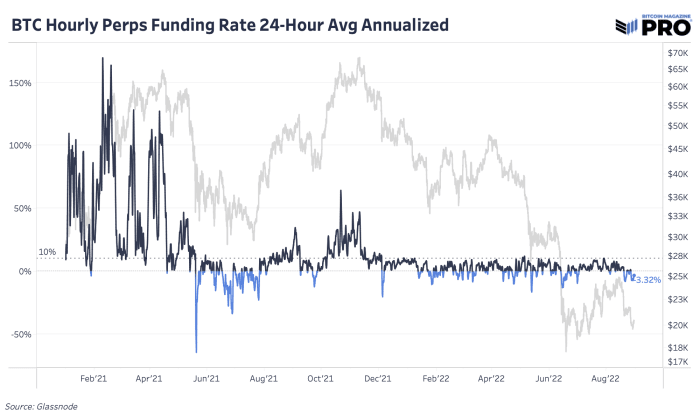

Drug način za vizualizacijo stopnje financiranja je pogled na letno vrednost s trenutnimi negativnimi stopnjami financiranja, ki prinašajo ocenjenih 3.32 % za dolgoročno posojilo proti večini kratkih. Od zloma novembra 2021 se trg še ni vrnil čez letno nevtralno stopnjo financiranja.

Cena se je gibala s trendom upadanja odprtega zanimanja terminskega trga za USD od vrha trga. To je lažje videti na drugem in tretjem grafikonu spodaj, ki prikazujeta samo tržni delež terminskih pogodb perps vseh odprtih terminskih obresti. Trg perps predstavlja levji delež odprtih obresti v višini več kot 75 % in se je znatno povečal s približno 65 % na začetku leta 2021.

Glede na količino finančnega vzvoda, ki je na voljo na perps trgu, je logično, zakaj ima dejavnost perps trga tako velik vpliv na ceno. Z uporabo grobega izračuna skupnega obsega trga perps iz Glassnode v višini 26.5 milijarde USD na dan (7-dnevno drseče povprečje) v primerjavi z Messarijev pravi spot (7-dnevno drseče povprečje, prilagojeno napihnjenim obsegom menjalnih tečajev) v višini 5.7 milijarde USD, se na perps trgu trguje skoraj petkrat več kot na promptnih trgih. Poleg tega se je dnevna promptna količina zmanjšala za skoraj 40 % glede na lansko leto, kar je statistika, ki pomaga razumeti, koliko likvidnosti je zapustilo trg.

Given the volume of the bitcoin derivative contracts relative to spot markets, one may arrive at the conclusion that derivatives can be used to suppress bitcoin. We actually disagree, given the dynamically priced interest rate associated with bitcoin futures products, we believe that on a long enough time frame the effect of derivatives is net neutral on price. While bitcoin likely exploded much higher than it otherwise would have due to the reflexive effects of leverage, those positions eventually were forced to close, thus an equal negative reaction was absorbed by the market.

- Bitcoin

- Bitcoin terminske pogodbe

- Bitcoin Magazine

- Bitcoin Magazine Pro

- Bitcoin Cena

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- Prisotnost

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- W3

- zefirnet