To je uvodnik mnenj Pierra Corbina, producenta in režiserja dokumentarca »The Great Reset And The Rise of Bitcoin«.

In his book, William N. Goetzmann describes that there have been periods in history during which people had greater financial education than the general public has today.1 One such period was during the great times of Ancient Greece, particularly in Athens.

Atene leta 400 pred našim štetjem so bile zelo posebne in ostajajo posebne v naši zgodovini, saj je bila tam izumljena demokracija. Vendar je bila njihova demokracija drugačna od naše sodobne demokracije. Še posebej, ko gre za vključenost njihovih državljanov v vsakodnevne dejavnosti vlade. Atene so ustvarile zapleten sistem bankirjev in zavarovalnic, da bi poenostavile trgovanje z žitom in povečale varnost portfeljev vlagateljev. Veliko ladij se je potopilo v Eganskem morju v teh časih, in ti finančni instrumenti so jim omogočili, da prek zavarovanja zaščitijo svoje naložbe in delijo tveganje svojega poslovanja z industrijo.

Of course, there were often disputes around these topics that needed to be settled in court. The court system in Athens was built to accommodate this particular type of issue, and was used for every other topic, too. Here are a few rules on how their court system worked that Goetzmann shares in his book1 :

- The jury was composed of 500 citizens per trial, chosen randomly from society.

- The maximum length of the trial was one day — the matter was settled at the end of the day.

- The jury did not deliberate together, they voted.

- The defendant and plaintiff represented themselves, but sometimes had their speeches written out by famous orators.

Atene so imele na vrhuncu okoli 4. stoletja pr. n. št. 30,000 odrasli moški državljani z volilno pravico v skupščini (dodatnih 70,000 državljanov, ki so bili ženske, otroci in drugi moški, niso smeli glasovati. Znotraj mestnega obzidja je živelo tudi 150,000 tujcev in sužnjev, ki niso bili šteti kot državljani in niso sodelovali pri odločitvah mesta), tako da je 500 ljudi, vključenih v posamezno sojenje, predstavljalo 1.6 % prebivalstva.

Predstavljajte si to v današnjem svetu: 5.3 milijonov Američanov bi moral biti del vsake žirije. oz 22 milijonov kitajskih državljanov bi bil vpleten. Sliši se nemogoče, čeprav imamo eno tehnologijo, ki je v Atenah ni bilo in ki bi lahko poenostavila zadevo: internet. Mogoče bi se dalo takšno žirijo danes na novo prilagoditi? Izid poskusov ne bi bil vir takšne razprave, ker se lahko 1.6 % naključno izbranih posameznikov šteje za dovolj velik vzorec, da predstavlja družbo kot celoto za dano sojenje. Poleg tega, da vodi do sistema poštenega sojenja, vodi tudi k večji preglednosti in zmanjšuje moč vplivanja, ki včasih obstaja za pomembna sojenja.

V svojem življenju se je povprečen Atence udeležil več sodnih procesov, vključno s tistimi zapletenimi, in se soočil s temami, kot so finance, tveganje, dolgoročne naložbe, mešanje itd. Danes imamo še vedno zapise o takih sojenjih. En primer je zgodba o Demostenu, Atenci, ki so mu strici ukradli dediščino, ker je bil premlad, ko mu je umrl oče. Kot odrasel je svoje strice odpeljal pred sodišče. Tu je izvleček njegovega opisa situacije:

“My father, men of the jury, left two factories, both doing a large business. One was a sword-manufactory, employing thirty-two or thirty-three slaves, most of them worth five or six minae each and none worth less than three minae. From these my father received a clear income of thirty minae each year. The other was a sofa-manufactory, employing twenty slaves, given to my father as security for a debt of forty minae. These brought him in a clear income of twelve minae. In money he left as much as a talent loaned at the rate of a drachma a month, the interest of which amounted to more than seven minae a year… Now, if you add to this last sum the interest for ten years, reckoned at a drachma only you will find that the whole, principal and interest, amounts to eight talents and four thousand drachmae”.1

Koliko povprečnih državljanov našega sodobnega sveta bi lahko sledilo takšnemu argumentu? Omenja dve podjetji, posojila, obrestne mere in njune mešane učinke. Danes večina ljudi ne razume, kaj so obrestne mere, in to je eden najpreprostejših konceptov dolgoročnega razmišljanja v financah.

Naš finančni sistem je sestavljen iz številnih ravni kompleksnosti in je predstavljen kot zapletena tema, tudi ko gre za osebne finance. Menim, da so ljudje, ki delajo v industriji, to skozi čas počeli iz dveh razlogov:

- By making individuals believe it is a complex topic, they will hire professionals to manage and custody their funds.

- Governments can give the impression of being in control of our financial system, and force their citizens to rely on their expertise, thereby lowering their personal engagement.

Danes ljudje začenjajo razumeti, kakšen vpliv ima lahko inflacija na njihova življenja. Ni nujno, da razumejo, od kod prihaja, razumejo pa, da morajo nekaj narediti glede svojih osebnih financ, ali pa bo njihove prihranke počasi sesula inflacija. Ta inflacijski način razmišljanja je bil vedno prisoten. To je del razloga, zakaj ljudje vlagajo v nepremičnine in je dvignilo cene tako visoko. Danes ljudi sili k še bolj tveganim naložbam. To je del razloga, zakaj je svet kriptovalut doživel takšen razmah in se mnogim zdi tako privlačen – visoka nagrada, a tudi visoko tveganje.

People entering the cryptocurrency space will slowly start making the distinction between bitcoin and altcoins at some point (often because of a shitcoin losing 99% of its value or a hack making them lose their funds). We will write a follow-up article about this topic in particular: Bitcoin is not crypto.

Because of the way Bitcoin is built, people gain their financial independence. You are the sole owner of your assets and no-one can take control of your assets unless you give access to them. This is extremely empowering, but can also be a scary endeavor: it has the potential of opening users up to more risk. This means that people need to take responsibility for their financial decisions. Every decision is their own, and in order to avoid mistakes, people need to educate themselves.

This education starts with understanding bitcoin wallets, but quickly moves on to more complex topics:

- Kaj je Bitcoin blockchain?

- Kako deluje?

- Kaj je denar?

- What does store of value mean?

- What is modern monetary theory?

- Kaj je kvantitativno popuščanje?

- Who controls and benefits from our system?

In še veliko drugih, ki enega za drugim odpirajo misli o tem, kako deluje naš finančni sistem. V prostoru je veliko odličnih mislecev in sodelavcev, ki pomagajo razumeti te točke.

Ljudje so zdaj prisiljeni prevzeti nadzor nad lastnimi sredstvi in odgovornostjo za svoje osebne finance. Tančica, ki je vedno ležala na svetu financ, se počasi odstira in stvari, ki so bile včasih zelo kompleksne, za mnoge postajajo vsakodnevne. To je posledica dejstva, da zaupanja, ki smo ga nekoč imeli v centralizirane finančne institucije, zdaj ni več zaradi desetletij zlorab strank, reševanja in drugega.

The Athenian system was not able to scale with the growing number of people in cities and in countries. But given our current technologies, is a similar system so hard to imagine today? Maybe bitcoin can be the asset that leads the way in this direction, thanks to its cryptographic properties, but also thanks to the added benefit of its passive properties, including the fact users need to educate themselves, which can only benefit them and our society.

Viri:

- Money Changes Everything – How Finance Made Civilization Possible | William N Goetzmann

To je gostujoča objava Pierra Corbina. Izražena mnenja so v celoti njihova lastna in ne odražajo nujno mnenj BTC Inc. ali Bitcoin Magazine.

- Bitcoin

- Bitcoin Magazine

- blockchain

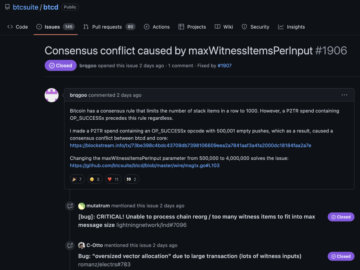

- skladnost z verigo blokov

- konferenca blockchain

- coinbase

- coingenius

- Soglasje

- kripto konferenca

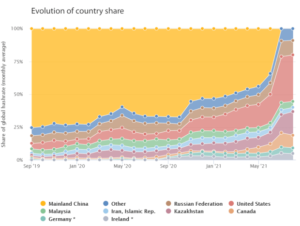

- kripto rudarstvo

- cryptocurrency

- Kultura

- Decentralizirano

- Defi

- Digitalna sredstva

- Izobraževanje

- ethereum

- financiranje

- zgodovina

- strojno učenje

- nezamenljiv žeton

- Mnenje

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- W3

- zefirnet