Developments around the global regulation, hash rate and adoption of Bitcoin made for a unique year in 2021. So how will 2022 play out?

This past year was certainly a unique one for bitcoin. We saw the first bitcoin exchange-traded fund (ETF) get approved in the United States, the largest-ever Bitcoin conference in Miami, the much anticipated Taproot upgrade, all-time highs nearing $70,000, oh, and a nation state made bitcoin legal tender. Despite all this exciting news, some things never change — the FUD was as prevalent as ever. Bitcoin saw a variety of bans throughout 2021 and, to no one’s surprise, China stole the show in this regard.

Below is a list of bitcoin bans in 2021 alone:

- Turkey banned all bitcoin payments

- Nigerija je vsem reguliranim institucijam (finančnim in nefinančnim) prepovedala "poslovanje s kriptovalutami ali omogočanje plačil za menjalnice kriptovalut"

- Iran banned the trading of bitcoin mined abroad in banned domestic bitcoin mining prav tako (čeprav je bil slednji ukrep odpravljen pred se ponovno naloži)

- Nenazadnje, China banned financial institutions and payments companies from offering bitcoin services; then it brought the hammer down on bitcoin mining

With 2021 nearly in the rearview mirror, I’ve been thinking a lot lately about what geopolitical bitcoin moves will occur throughout 2022. Below, I offer up a few questions to think about as we approach the new year:

- On a global scale, will we see bitcoin regulation turn friendly or grow increasingly hostile?

- Will hash rate continue to accumulate in the U.S. (possibly eclipsing a 50% share) or will we see a greater distribution moving forward?

- Will another country adopt bitcoin as legal tender? And if so, which one? There couldn’t be multiple throughout 2022, lahko tam?

Ta vprašanja spadajo v tri kategorije: stopnja razprševanja, ureditev in sprejetje. Spodaj sem podrobneje obravnaval vsakega.

Uredba

If we step back and look at 2021 regulation on a global scale, would you think the overall trend was friendly or hostile? Even with the passing of El Salvador’s Bitcoin law, I’d say the global regulatory environment is still quite hostile toward Bitcoin. Iran, Turkey and Nigeria all made hostile moves in 2021. Indija in New York tudi sovražni regulativni ukrep. Vsi vemo, kaj se je zgodilo na Kitajskem.

While the news of bans and corresponding FUD was prevalent, there is still a sense of optimism in the air. After the dust settled post-El Salvador’s bitcoin law, the obvious next question was: Who’s next? Many assumptions have been made about it being another Latin American country. This certainly makes sense.

Če pogledamo nazaj, je bil Salvador skoraj popolna država za ta velik preskok. To je majhen narod, ki se je gospodarsko boril in nima avtonomije nad svojo valuto. Kot dolarizirana država so Salvadorci podvrženi muhavosti ameriškega dolarja in Federal Reserve. Ne bom razpravljal o tem, ali je bila prekinitev vezi s colónom leta 2001 prava poteza (Alex Gladstein je dobro pokrival to temo tukaj), but I certainly think taking a step toward a Bitcoin standard was.

Salvadorju, tako kot številnim državam v Latinski Ameriki, pogosto škoduje zunanja politika ZDA in posredovanje Mednarodnega denarnega sklada (IMF). Učinek Cantillona, ki so ga ustvarile ZDA, je prizadel prebivalce Salvadorja z napihovanjem njihove lokalne valute (in Salvadorci ne vidijo nobenih ugodnosti, ki jih spremlja ta skriti davek), uvedbo sankcij in nadzorom trgovinske politike. IMF škoduje prebivalcem Salvadorja tako, da zadolžuje državo in degradira njeno kreditno kakovost, da bi zagotovil neugodne pogoje za prihodnja posojila (ali celo držal za talce prihodnja posojila).

“El Salvador bond spreads to U.S. Treasuries hit a record high on Thursday on growing investor fears the Central American nation will not reach a potential $1 billion loan agreement with the International Monetary Fund and faces negative credit implications linked to its use of bitcoin.”

Torej, kaj je El Salvador storil glede tega? Izključil se je (čeprav ne v celoti). Naredila je korak v smeri finančne suverenosti in ustrezen korak stran od zlobne ameriške države in finančne tiranije MDS. Toda Salvador ni edina država v Latinski Ameriki, ki ima težave z dolarizacijo. Torej, spet bom vprašal, kdo je naslednji?

Politiki po vsej Latinski Ameriki so bili opremijo svoje laserske oči, starting to engage with the bitcoin community and proposing pro-bitcoin legislation. Little has materialized as of this writing (on the surface, at least), but we all know bitcoin acts “gradually, then suddenly.”

Kongresnik Carlitos Rejala iz Paragvaja, Mehiški poslanec Eduardo Murat Hinojosa, Panamski kongresnik Gabriel Silva in Brazilski zvezni namestnik Aureo Ribeiro have all signaled support for bitcoin in one way or another.

It very well could be one of these countries that becomes the next Bitcoin hub, whether it be via a legal tender law or otherwise friendly regulation. And just maybe, we won’t be talking about another single country making bitcoin legal tender, but a handful when we look back at 2022.

Tudi če Napoved Aleksandra Höptnerja of five more developing countries adopting bitcoin as legal tender by the end of 2022 turns out to be accurate, there will still be FUD (there will vedno be FUD). We likely haven’t seen the last of Bitcoin bans and they may become more sophisticated and more strictly enforced as financial elites across the globe feel the increased pressure put upon them by this new freedom money.

"V resnici je gospodarska vladavina ZDA v regiji živa in zdrava in je pomagala pri spodbujanju groznih razmer, ki so sprožile nedavni val vstaj."

-Aleksander Main, direktorica mednarodne politike Centra za ekonomske in politične raziskave, o nedavnih protestih po Latinski Ameriki

Hash Stopnja

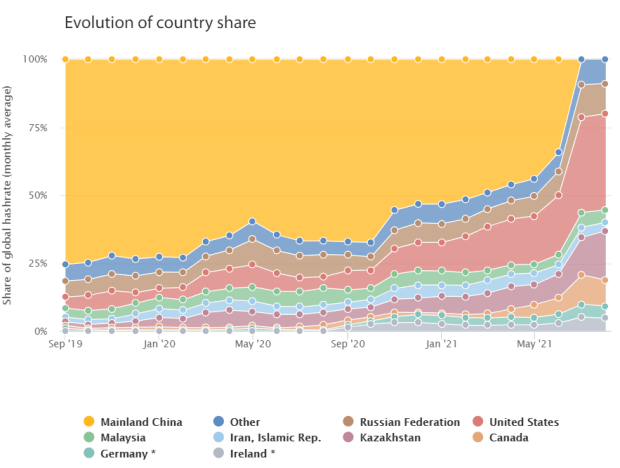

Jeseni 2019 je bila pod nadzorom celinska Kitajska approximately 75% of the global Bitcoin hash rate. Ta številka je padla, vendar je bil še vedno več kot 50 %, ko smo začeli leta 2021. Zdaj, v prvih dneh leta 2022, je sedi pri 0%.

This was one of the best stories in bitcoin in 2021. Sure, the FUDsters were sounding the alarm when China banned bitcoin mining this past summer, but that was to be expected and they failed to zoom out. China enacting a legitimate and all-out ban on bitcoin mining certainly hurt the overall hash rate at the time, so the price dropped accordingly. Alarms were sounded. Articles were written. The death of bitcoin was yet again declared.

Not so fast. Many bitcoiners knew this would actually be dobra stvar. Od zunaj morda ni bilo očitno, vendar je bilo tistim, ki to razumejo, jasno kot dan. A mass exodus of bitcoin mining from China would result in a greater distribution of global hash rate. This is a huge deal. Not to mention that this does away with one of the most prominent anti-bitcoin arguments — that China has too much control of Bitcoin infrastructure or might co-opt the network by a hostile miner takeover.

Kot je razvidno iz spodnje slike, so številne države imele koristi od prepovedi rudarjenja na Kitajskem: med njimi Rusija, Kazahstan in ZDA. ZDA so leto začele s približno 11-odstotnim deležem svetovne stopnje razprševanja. Ta številka (od avgusta po zadnjih razpoložljivih podatkih) znaša 35 %. Kakšne so možnosti, da bo to število še naprej raslo? Kdaj preide iz nečesa za praznovanje v točko skrbi?

Kot Američan sem bil vesel, ko sem videl rudarje, ki prihajajo v ZDA. Vendar pa verjamem, da obstaja razlog za zaskrbljenost, ko se umaknem in spoznam, kako hitro so ZDA potrojile svojo stopnjo razpršenosti. Ne bi želel, da bi katera koli država zahtevala izpraznjeni prestol Kitajske prevladujočega igralca v globalni stopnji razprševanja. Ali je možno, da bi bilo 75 % stopnje razpršenosti v ZDA dejansko slabše kot takrat, ko je bila ista koncentracija na Kitajskem?

ZDA morda zaostajajo za EU glede trajnostne ureditve, vendar se zdi, da nameravajo to vrzel hitro odpraviti. Ker se toliko korporacij nagiba k ESG, je tema ESG and Bitcoin is certainly not going anywhere. This would call into question bitcoin’s fungibility if “green bitcoin” were to be priced at a premium. It would also be in direct conflict with the free market ethos that Bitcoin naturally promotes.

While the Chinese regulatory environment was uncertain and oftentimes really harsh toward bitcoin, it ultimately decided to push miners out as opposed to co-opting them. Since miners benefit from economies of scale, they’ll likely trend toward centralization over time. This makes regulatory capture more of a concern, whether it be in China, the U.S. or another other country. The next time a major geopolitical move is taken by a global mining power, it might take the form of state control rather than a ban. Even though El Salvador mining bitcoin with geothermal energy is undoubtedly really cool, state-owned bitcoin mining facilities is not a trend I want to see emerge.

This might be a bit farther out than 2022. It might be unrealistic altogether. Maybe it’s even one of those chances bitcoiners would be willing to take, as it might not arise until we’re at or near hyperbitcoinization. Still, it’s worth some consideration as we look ahead to the short- and long-term futures of bitcoin.

Sprejetje

Bitcoin adoption has exploded over the years and is now po ocenah severno od 100 milijonov uporabnikov. Bitcoin users include institutional and retail investors, humanitarians, bankers, government officials, large and small businesses, refugees and everyone in between. Even if we were to say “that 100 million seems really low” and infer it might be closer to double that, we’d only be at roughly 4% to 5% of adults owning bitcoin globally. To je primerljivo z internetom leta 1999.

If we continue the trends seen in Bitcoin adoption over the past couple years, the number of global users will reach one billion sooner than we know it. Trying to predict what will happen to bitcoin’s price, hash rate or adoption in the short term is a fool’s errand, but we can say with near certainty that Bitcoin’s user base will expand over longer periods of time.

Nemogoče je natančno vedeti, koliko uporabnikov je, toda spodaj je nekaj trendov, ki jasno prikazujejo, kako hitro narašča uporaba:

- Šest odstotkov ameriških vlagateljev (defined as those with $10,000 invested in stocks, bonds or mutual funds) say they own bitcoin, up from 2% in 2018.

- Institutional investors are beginning to favor bitcoin over gold.

- Bitcoin’s use for everyday savings, peer-to-peer transactions and remittance payments is becoming more prevalent in the places that need it most (for example, adoption shot up 1,200 % letno v Afriki).

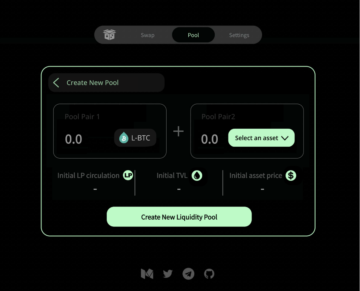

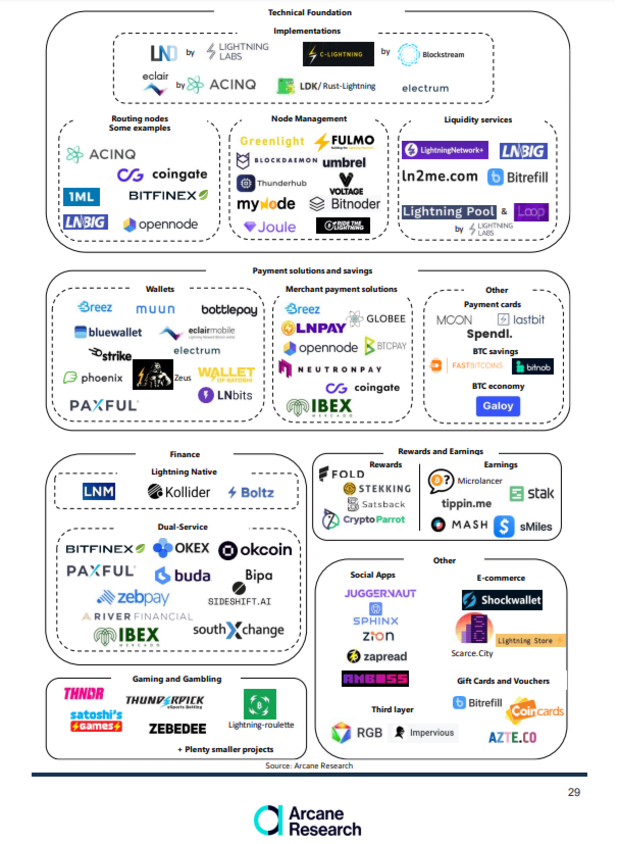

The final bullet point above goes hand in hand with the growth of the Lightning Network. This has been my personal favorite trend in Bitcoin adoption this year. Nation state and institutional adoption will certainly have a greater upward pull on bitcoin’s price, but the Lightning Network is how we onboard millions and eventually billions around the globe, enabling near-instant and zero-cost micropayments. The Lightning Network has more than tripled in capacity this year and the below image shows just how robust development is within the Lightning ecosystem.

The velocity with which Bitcoin is adopted by the average person may have less impact on the price compared to when whales make big splashes, but it is a signal that needs to be closely monitored. The President of El Salvador cited bitcoin’s adoption in Bitcoin Beach as a use case for the country’s legal tender law. Regulation and adoption go hand-in-hand, and often it is assumed that regulation will impact adoption, and not the other way around. That statement might sound logical, but bitcoin has been known to challenge our assumptions.

Places like Nigeria, Pakistan, India and China have all been quite hostile toward Bitcoin and yet, their citizens are among the most prevalent users. Why is that? That’s because bitcoin is freedom money. The potrebujemo for bitcoin in each of those countries is higher than that in the West.

Bitcoin is not just number go up (in monetary terms) technology, it is adoption go up technology. I’ve heard the phrase “bitcoin is inevitable” frequently used within the community. I’m not one to take things for granted, but that is a statement I agree with given a long enough time horizon. If I game out polar scenarios, one with favorable and one with unfavorable regulation, I end up at the same result of increased adoption.

Številni posamezniki in še več institucij potrebujejo prijazno regulacijo, da bi se lahko vključili, medtem ko bodo finančna tiranija, ekstremna inflacija in družbena represija prisilili neprisivljene, da se odpovejo svojemu trenutnemu denarnemu sistemu.

Closing out this point with one of my big questions for 2022: Will bitcoin adoption explode this upcoming year? Or will it go up at a more controlled pace?

I highly doubt I’ll be looking back at 2022 a year from now and be writing an article about how the number of global bitcoin users actually went navzdol odkar sem napisal ta komad. Namesto tega bom pozoren na nekatere padce domin, ki dvignejo stopnjo posvojitve na nekaj, česar še nikoli nismo videli.

Zavijanje Up

Čeprav sem v tem članku ločeno obravnaval stopnjo razpršenosti, sprejetje in regulacijo, jih v resničnem življenju zagotovo ni mogoče ločiti. Vsaka od teh treh idej je sama po sebi povezana.

I’m incredibly bullish on bitcoin looking ahead to 2022 and even more so as we look farther out. That doesn’t mean we don’t have anything to be weary of and that doesn’t mean that there isn’t a lot of work left to do, people to onboard, and FUD to fight, but I remain as optimistic as ever. My hope is that 2022 is another great year for Bitcoin and that one year from today I can pen a similar piece as we head into 2023.

To je gostujoča objava Nicka Fonseca. Izražena mnenja so povsem njihova in ne odražajo nujno mnenj BTC Inc oz Bitcoin Magazine.

Source: https://bitcoinmagazine.com/culture/how-geopolitics-will-shape-bitcoin-in-2022

- "

- 000

- 100

- 2019

- Ukrep

- Sprejetje

- Sporazum

- alex

- vsi

- Amerika

- Ameriška

- med

- Argumenti

- okoli

- članek

- članki

- Avgust

- Ban

- Prepovedi

- BEST

- Billion

- Bit

- Bitcoin

- sprejetje bitcoinov

- Bitcoin mining

- Uredba o bitcoinih

- bitcoinerji

- blockchain

- Bloomberg

- svet

- Obveznice

- BTC

- BTC Inc.

- Bikovski

- podjetja

- klic

- kapaciteta

- Vzrok

- izziv

- kvote

- spremenite

- šef

- Kitajska

- kitajski

- bližje

- prihajajo

- skupnost

- Podjetja

- koncentracija

- Konferenca

- konflikt

- naprej

- se nadaljuje

- Korporacije

- države

- par

- kredit

- kripto

- kripto valute

- cryptocurrency

- plačila

- valuta

- Trenutna

- datum

- dan

- ponudba

- Razprava

- Podatki

- Razvoj

- DID

- Direktor

- Dollar

- padla

- Zgodnje

- Gospodarska

- ekosistem

- okolje

- ETF

- Ethos

- EU

- Exodus

- Razširi

- obrazi

- FAST

- strahovi

- Zvezna

- zvezne rezerve

- finančna

- Finančne ustanove

- prva

- obrazec

- Naprej

- brezplačno

- Svoboda

- Sklad

- Skladi

- Prihodnost

- Terminske pogodbe

- igra

- vrzel

- Globalno

- Globalno

- dobro

- vlada

- veliko

- Grow

- Pridelovanje

- Rast

- Gost

- Gost Prispevek

- hash

- hitrost hash

- Glava

- visoka

- Kako

- HTTPS

- velika

- slika

- IMF

- vpliv

- india

- inflacija

- Infrastruktura

- Institucionalna

- Institucionalno sprejetje

- Institucije

- namen

- Facebook Global

- Mednarodni monetarni sklad

- Internet

- Investitor

- Vlagatelji

- Iran

- IT

- vzdrževanje

- velika

- Latinska Amerika

- Latinska Amerika

- zakon

- Pravne informacije

- Zakonodaja

- posojanje

- strele

- Lightning Network

- Seznam

- Posojila

- lokalna

- Long

- velika

- Izdelava

- Tržna

- merjenje

- mikroplačila

- milijonov

- Rudarji

- Rudarstvo

- ogledalo

- Denar

- premikanje

- Blizu

- mreža

- novo leto

- novice

- Nigerija

- sever

- ponudba

- ponujanje

- Komentarji

- Ostalo

- Paragvaj

- Plačila

- ljudje

- Predvajaj

- predvajalnik

- politika

- moč

- Premium

- Predsednik

- tlak

- Cena

- Protesti

- kakovost

- Reality

- begunci

- Uredba

- regulatorni

- Nakazilo

- Raziskave

- Trgovina na drobno

- Maloprodajni vlagatelji

- Reuters

- Rusija

- Sankcije

- Lestvica

- Občutek

- Storitve

- Delite s prijatelji, znanci, družino in partnerji :-)

- Kratke Hlače

- majhna

- mala podjetja

- So

- začel

- Država

- Izjava

- Države

- Zaloge

- ukradel

- zgodbe

- poletje

- podpora

- Površina

- presenečenje

- Trajnostni razvoj

- sistem

- pogovor

- davek

- Tehnologija

- Razmišljanje

- čas

- trgovini

- Trgovanje

- Transakcije

- Trends

- Turčija

- nas

- Velika

- Združene države Amerike

- Uporabniki

- VeloCity

- Wave

- West

- WHO

- v

- delo

- vredno

- pisanje

- Yahoo

- leto

- let

- zoom