Institutional investors and long term Bitcoin holders are showing signs of improved bullishness, hitting highs on several important indicators, poročali ARK Invest.

According to a new issue of Mesečnik Bitcoin, an “earnings report” that details on-chain activity, the balance of Bitcoin held on over-the-counter (OTC) desks has hit an all-time high. Nearly 8,000 Bitcoin are sitting on these desks, notching an impressive 60% increase this quarter.

Cathie Wood's ARK uses OTC desks as a proxy for institutional activity, suggesting that the numbers reported show institutions and other large capital allocators are focused increasingly on Bitcoin–a bullish sign, they say.

"Po našem mnenju povečana stanja na mizah OTC kažejo, da so institucije in drugi veliki razdeljevalci kapitala vse bolj osredotočeni na Bitcoin," je Ark zapisal v poročilu.

Keeping on the institutional trail, the report also touches upon Grayscale’s Bitcoin Trust (GBTC), one of the few firms that caters to large or accredited investors. It has been on quite the run this year, doubling in value–with its GBTC shares starting the year at $8.65 now spreminjanje hands at $20.

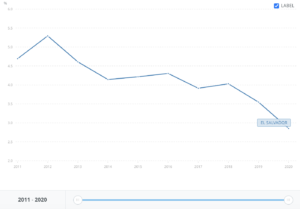

The so-called GBTC “Popust,” which refers to the difference between the price for the shares and the net asset value (NAV) of GBTC’s holdings–has narrowed to -30%, which ARK suggests could be the market’s optimistic sign to the recent ETF filings.

Long-term Bitcoin holders are often considered a sign of strength for the network, a sentiment that ARK said it agrees with. The report notes that nearly 70% of the 19 million circulating dobavi of BTC has not moved in more than a year–an all-time high in both relative as well as absolute terms.

O poročilo also showcases 13 metrics for Bitcoin’s network–ranging from percent supply in profit to miner difficulty. Only two of these metrics (transaction volume and time-weighted turnover) are considered neutral, whereas the rest, says ARK, are flashing bullish.

Bodite na tekočem s kripto novicami, prejemajte dnevne posodobitve v svoj nabiralnik.