Bitcoin fee markets are showing small signs of life despite bitcoin’s price dropping roughly 70% since its latest all-time highs and hash cena — merilo vrednosti za stopnjo zgoščevanja — padec za približno enak znesek.

Provizije in dolgoročni obeti prihodkov od provizij za rudarje so tema, o kateri se vroče razpravlja, zlasti med medvedjimi tržnimi trendi. Medvedji trgi so najboljši čas za prepire o provizijah, ne samo zato, ker so udeleženci na trgu zdolgočaseni in nemirni, ampak tudi zato, ker se ta vir prihodkov v teh obdobjih znatno zmanjša.

Despite the on-going bear market — which just finished its eighth consecutive month — the bitcoin fee market is still showing signs of life. This article provides an overview of a few bits of surprising bear market fee data, and it discusses in context of these numbers the likelihood of deciding whether or not Bitcoin’s future is doomed or relatively positive, despite what a growing number of loud critics continue to assert.

Bitcoin Bear Market Fee Data

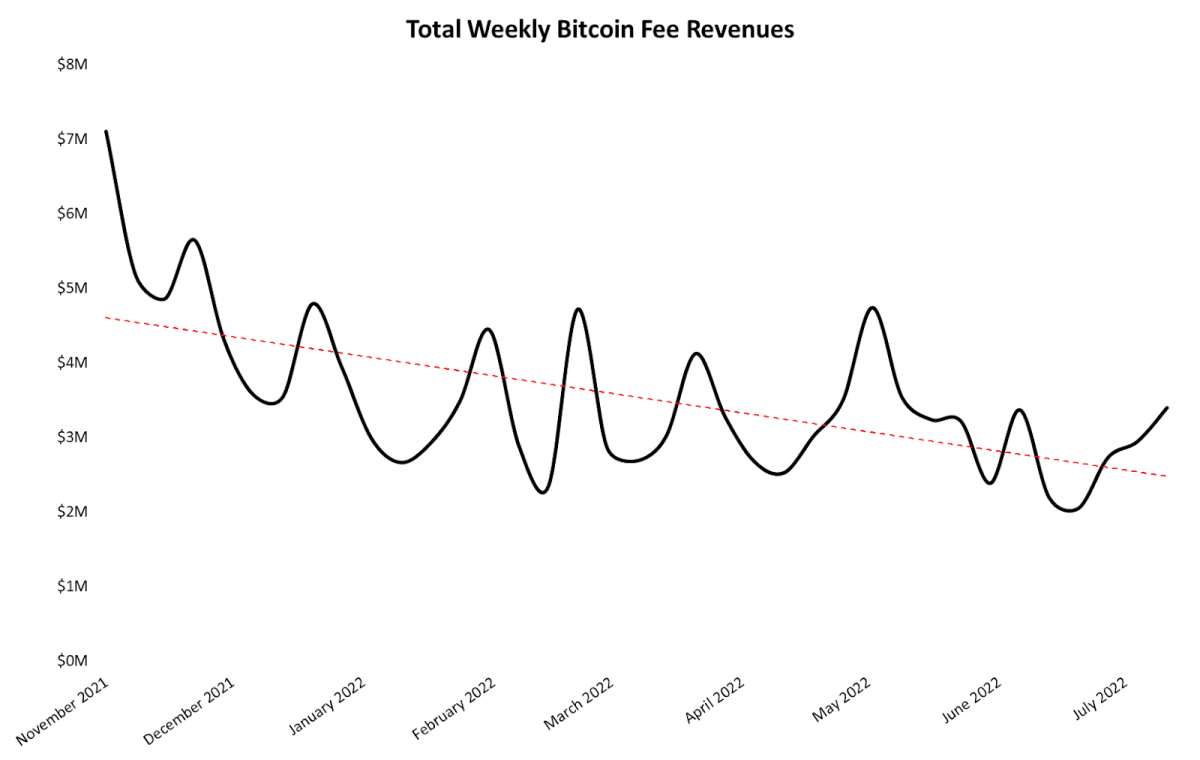

Začenši z absolutnimi prihodki od provizij, je trend rasti provizij v dolarjih še vedno rahlo padajoč. Vendar se je večina padca zgodila v zadnjih mesecih leta 2021, pristojbine od leta do danes pa so večinoma nespremenjene. Spodnji grafikon prikazuje skupni tedenski prihodek od provizij od vrhunca trga novembra 2021 do danes z logaritemsko trendno linijo, ki poudarja celotno krivuljo rasti provizij.

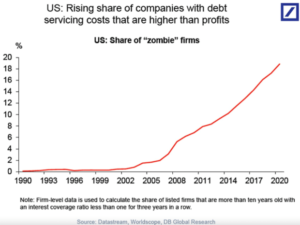

But weekly fees aren’t the most interesting data. Instead, looking at what percentage of mining revenue comes from fees is one of the strongest indicators of the industry’s health. A necessary condition for Bitcoin to have a healthy, long-term outlook is for fee revenue to eventually supplant a significant portion of the current subsidy revenue, such that miners remain incentivized to contribute energy to securing the network despite the eventual disappearance of subsidies, so that hash rate does not drop to dangerously low levels.

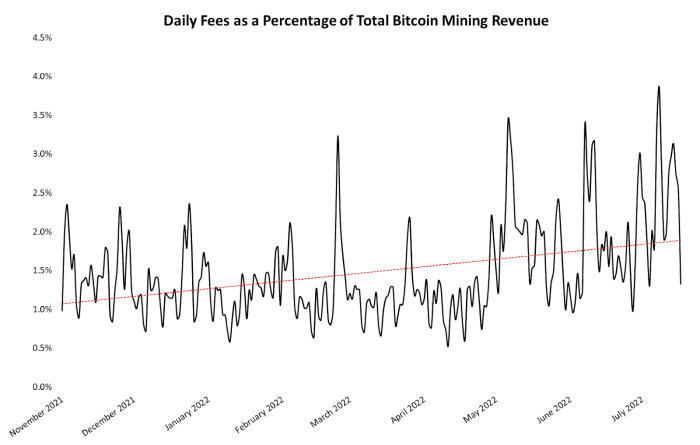

Somewhat surprisingly, even though the bitcoin market has continued dropping for months, the percentage of daily mining revenue coming from fees has slowly trended upward since after the start of the market’s price collapse in November 2021.

Seveda so provizije v razponu od 1% do 3% neverjetno veliko znižanje od 10- do 20-odstotni razpon, ki so ga rudarji uživali med vročino prejšnjega bikovskega trga. Pot do popolnega okrevanja prihodkov od provizij bo verjetno dolga in bo verjetno odvisna od ponovnega vzpona rasti cen.

Bitcoin Fee Market Criticisms

Single-digit percentage fee revenues are sure to bear the brunt of criticisms about Bitcoin for as long as the current bear market persists. Journalists are poročanje in mnenje on perceived bitcoin fee market weaknesses. Some trgovci in raziskovalci are seemingly convinced that low fees spell death for Bitcoin. And some prominent developers are zagovarjanje for changing Bitcoin to include a tail emission as a solution for the less-than-robust fee market.

Tudi ko se bo tržni trend premaknil, bodo nekateri kritiki še naprej zabijali svoje govorne točke as other blockchains see increased use of various applications not (yet?) built on Bitcoin. And some Bitcoin-adjacent builders are optimistični that a more robust fee market will come as more applications are built on Bitcoin.

A če pustimo ob strani vsa ta ugibanja, kritike in (v nekaterih primerih) splošno norost, pomembno je, da si to zapomnite podatki o honorarju kaže, da so – če nič drugega – prihodki od provizij ciklični, tako kot cenovni trendi. Kot smo že omenili, so medvedji trgi (ko so prihodki od provizij nizki) glavne priložnosti v tem ciklu za poudarjanje zaznanih temeljnih slabosti v omrežninah.

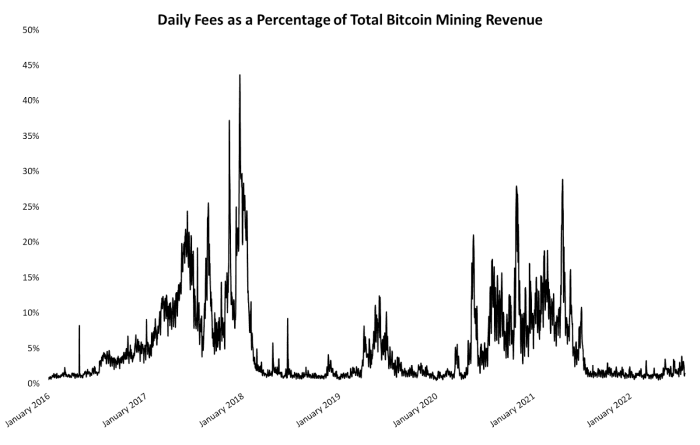

The line chart below shows daily fees as a percent of total mining revenue since early 2016. From even a cursory glance at the visualization, it’s easy to notice how the two major spikes in fee revenue coincide directly with the latest two bitcoin bull market periods. Also, the quasi-bullish market period during 2019 and a concurrent spike in fee revenue is apparent.

There are no indications that this cyclical fee pattern will break from bitcoin’s cyclical price action. The most likely short-term outcome is a continued battering of fee data by critics for as long as the bearish trend lasts.

But most builders and investors in the Bitcoin economy realize that current fee data is something that should be monitored but not panicked over. And cyclically-volatile fee revenue during the early years of Bitcoin’s second decade is not a catastrophic problem.

The Future Of Bitcoin Fees

Bitcoin’s fee market and “security budget” (the vsota of fee revenue and block subsidies) will always be meticulously-analyzed and hotly-debated topics. These conversations will likely become even more contentious as alternative blockchain protocols garner significant fee revenue — at times even more so than Bitcoin’s numbers — from various applications built for different use cases in the broader cryptocurrency industry.

But the Bitcoin economy continues to go strong, and despite what the loudest critics say, the current data gives no reason for long-term concern. Use of Bitcoin scaling protocols (e.g., Lightning Network) še naprej raste, rudarski sektor se nadaljuje Stavba in širi despite the bear market, and general use and awareness of Bitcoin is still močna, glede na tržne razmere.

To je gostujoča objava Zacka Voella. Izražena mnenja so v celoti njihova lastna in ne odražajo nujno mnenj BTC Inc ali Bitcoin Magazine.

- Bear Market

- Bitcoin

- Bitcoin Magazine

- Bitcoin mining

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- poslovni

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- Feature

- pristojbine

- strojno učenje

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- W3

- zefirnet