Recently, there was a lot of buzz around how the RBI has found four viable products for cross-border payments under its regulatory sandbox. Many of our readers and colleagues didn’t know/hadn’t heard of ‘Regulatory Sandbox. In this blog, we deconstruct what

a regulatory sandbox is and how it shapes the disruption in the traditional financial sector. It means more innovative products become accessible, and whatever product these fintech giants have created is in line with the regulations that protect customers’

interesov.

India is a hotbed for fintech innovation and houses more than 4200 fintech startups. With so many fintechs around, it was imperative to regulate fintech disruption so that the interest of the Indian consumers stays safe and innovations remain accessible,

which gave birth to the regulatory sandbox.

So, we will discuss the regulatory sandbox in general, then gradually deep dive into the RBI’s regulatory sandbox journey. We will also discuss how it shaped the fintech industry we see today. However, if you want to jump into specific sections directly,

you can use the content table at the top.

Kaj je regulativni peskovnik?

Sandboxes operate under specific regulatory exemptions, allowances, or limited time-bound exceptions. The regulatory sandbox entered an era of rapid technological innovation in financial and BFSI markets. It manages the contentions between regulators’ urge

to motivate and facilitate fintech innovation and regulatory goals such as economic resilience and consumer protection.

Simply put, a regulatory sandbox is a highly controlled environment provided by the central financial body to fintechs/financial institutions to test out newer concepts and innovations before launching to the majority of the public. Therefore, financial

regulatory bodies of individual nations have set up sandboxes for fintech innovation within the regulatory boundaries.

Zdaj, ko razumemo regulativni peskovnik v definiciji, se bomo poglobili v domišljijo in nastanek regulativnega peskovnika RBI.

Regulativni peskovnik RBI

After UPI’s launch and demonetization implementation, RBI saw 4 trillion UPI transactions and 55 trillion Aadhaar authentications. These events signaled that India was already at the cusp of completely digitizing its banking system. The nation won’t lag

behind its international counterparts if proper steps are taken to grow financial technology. More importantly, it had to be done within the regulatory framework while keeping the best interest of the Indian population in mind.

Financial capitals like the UK, Europe, the USA, and many others were already in the advanced stages of their banking sectors’ digital transformation. They had created a structurally sound and flexible environment for businesses to test financial innovation

called regulatory sandboxes.

2016 Delovni odbor RBI za dešifriranje regulativnih izzivov Fintech

In July 2016, RBI set up a Working Committee consisting of 13 individuals to unearth the regulatory challenges faced by the fintechs and digital banks in India. The working committee submitted the report on November 23, 2017. Below are the recommendations

submitted by the Working Committee:

- Pred ureditvijo tega prostora je treba globlje razumeti različne produkte FinTech in njihovo interakcijo s finančnim sektorjem ter s tem posledice za finančni sistem.

- Regulativni ukrepi se lahko razlikujejo od »razkritja« do »lahke ureditve in nadzora« do »stroge ureditve in popolnega nadzora«, odvisno od posledic tveganja.

- Treba je razviti podrobnejše razumevanje tveganj, povezanih s FinTechom, ki temelji na platformi.

- Regulatorji finančnega sektorja morajo opredeliti produkte FinTech in regulativne pristope, specifične za sektor.

- Sprejetje digitalnih kanalov za zamenjavo zamudnih ročnih procesov krepi delovno silo strank in zavarovalniški sektor.

- Ustanovijo se lahko inovacijski laboratoriji, vključno z zavarovalnicami, ki združujejo vodje blagovnih znamk in izdelkov s tehnološkimi in analitičnimi viri.

- Ko udeleženci Fintech predstavijo produkte trga vrednostnih papirjev, lahko regulatorji ocenijo produkt in ugotovijo, ali ga lahko SEBI ali RBI spremljata tako, da ju registrirajo kot posrednika ali prek predpisov o dejavnosti.

- Zavarovalnice lahko sodelujejo s subjekti ali startupi »Insurtech«, da bi zagotovile boljšo in stroškovno učinkovitejšo izkušnjo za stranke.

- Regulatorji finančnega sektorja morajo sodelovati s subjekti FinTech, da oblikujejo ustrezne regulativne odzive ter ponovno uskladijo ureditev in nadzor kot odgovor na spreminjajoče se okolje.

- A’ dedicated organizational structure’ within each regulator needs to be created to identify and monitor the challenges associated with developing significant FinTech innovations and respond to opportunities and risks arising for the financial system from

these innovations. - Zagotoviti okolje za razvoj FinTech inovacij in testiranje aplikacij/API-jev, ki so jih oblikovale banke in FinTech podjetja.

- RBI may introduce an appropriate framework for a “Regulatory Sandbox/innovation hub” within a well-defined space and duration. The financial sector regulators will provide the requisite regulatory support to increase efficiency, manage risks and create

new opportunities for Indian consumers within regulatory jurisdictions. - Because of IDRBT’s unique positioning as a research and development institute, due to its activities, IDRBT is well placed to create and maintain a regulatory sandbox in collaboration with RBI to enable innovators to experiment with their banking/payments

solutions for eventual adoption. The Institute may continue to interact with RBI, banks, and solution providers regarding testing new products and services and, over time, upgrade its infrastructure and skill set to provide a full-fledged regulatory sandbox

environment. The Reserve Bank of India may actively engage with the Institute. - Regulativne in pravne reforme so bistvenega pomena za trajnostni razvoj digitalne finančne industrije.

- Partnerstva/povezave med regulatorji, obstoječimi akterji v industriji, strankami in podjetji FinTech bodo omogočili razvoj bolj dinamične in robustne industrije finančnih storitev.

- Regulatorji lahko raziščejo uporabo Reg-Tech za olajšanje zagotavljanja regulativnih zahtev bolj učinkovito in uspešno kot obstoječe zmogljivosti.

- RBI mora preusmeriti organizacijsko strukturo regulatorjev in prakse človeških virov (HR), da se sooči z izzivi inovacij v zvezi s prilagojenimi profili zaposlovanja kadrov, učenjem in izobraževalnimi programi.

- V državi obstaja potreba po samostojni zakonodaji o varstvu podatkov in zasebnosti.

- Banke/regulirani subjekti se lahko spodbujajo, da sodelujejo s FinTech/startupi, da bi izboljšali njihovo uporabniško izkušnjo in operativno odličnost. Razmislijo lahko tudi o izvajanju FinTech dejavnosti na področju plačil, analitike podatkov in upravljanja s tveganji.

- Modeli sodelovanja in kontrolni seznam, ki jih mora razviti vsak regulator za vsako dejavnost.

- Glede na to, da so FinTech podjetja v povojih, vendar rastejo, lahko vlada razmisli o uvedbi davčnih subvencij za trgovce, ki sprejmejo določen delež svojih poslovnih prihodkov iz digitalnih plačil.

- Vsi regulatorji trga bi morali izpostaviti zahtevo po povečanju ravni izobraženosti/ozaveščenosti kupcev.

- Lahko se spodbuja samoregulativni organ za podjetja FinTech.

The above recommendations laid the foundation for the first draft of the Indian regulatory sandbox. RBI launched the final framework for Regulatory Sandbox on August 13, 2019. That is how the regulatory sandbox for Fintechs, Insurance-techs, and Regtechs

looking to make financial innovations came into being in India.

Kohorte in izbira pravih finančnih tehnologij za vodenje inovacij

Accordion to RBI, fintech companies, including startups, banks, financial institutions, and other companies partnering with or providing support to financial services businesses, can apply for entry into the regulatory sandbox. They will be subject to the

below sandbox criteria.

Poudarek regulativnega peskovnika bo spodbujanje inovacij, namenjenih uporabi na indijskem trgu na področjih, kjer:

- Ni zahtevanih regulativnih predpisov;

- Obstaja potreba po omilitvi omejitev, da se predlagana novost začasno omogoči;

- Izum obljublja znatno olajšanje/vpliv na zagotavljanje finančnih storitev.

RBI chose to break down the schedule of intake of fintechs into cohorts. Each cohort will comprise a group of fintechs focused on innovation in specific sectors based on themes like retail payments, cross-border payments, MSME lending, and mitigating financial

fraud. We can see an elaborate list of all the cohorts on the Spletna stran RBI.

Nedavno je RBI objavila seznam fintech podjetij, ki so uspešno zapustila drugo kohorto. Druga kohorta se je osredotočila na omogočanje čezmejnih plačil za hitro izmenjavo nakazil.

India accounts for 15% of the global share in remittances, making it the largest recipient of inbound remittances globally. In 2019, India received $83 bn, and in the first half of 2020 received $27.4 bn. The daily turnover of OTC foreign exchange instruments

in India is approximately $40 bn. By leveraging new technologies faster, the cohort needed to spur innovations for a low-cost, secure, convenient, and transparent system for cross-border payments.

In this cohort, RBI selected eight entities to test the boundaries of cross-border payments technology in a sandbox environment. This test can last for seven months to a year. Each section is divided into four weeks, each lasting from 4 weeks to 12 weeks.

The participating entities are supported(relaxing regulations) and scrutinized(gauging performance and profitability) during each section to ensure that RBI can form appropriate rules. IDRBT doesn’t tolerate any entities’ failure in any of the test sections.

These stringent measures provide filtering and keep only a few capable fintechs that can drive innovation and create customer value.

V drugi kohorti osmih so preizkus opravili le štirje fintechi:

- Open Financial Technologies Private Limited:

Open is an all-in-one business banking platform. Open helps manage banking, payments, accounting, expense management, taxes, and loans in one place. Open proposed blockchain-based frictionless and tamperproof monitoring capabilities for a cross-border payment

system that leverages current infrastructure. - Fairex Solutions Private Limited:

Fairex je združevalna platforma vodilnih ponudnikov čezmejnih plačil za odhodna nakazila. - Nearby Technologies Private Limited:

»Paynearby«, produkt tehnologije Nearby, olajša usmerjanje notranjih čezmejnih nakazil na prejemnikovo številko Aadhaar kot virtualni bančni račun z uporabo obstoječega mehanizma RDA. - Brezgotovinska plačila India Private Limited:

Čezmejna plačilna platforma Cashfree omogoča indijskim vlagateljem nakup sredstev, kot so delnice, ki kotirajo na borzi, in skladi, s katerimi se trguje na borzi, ki kotirajo prek lokalnih plačilnih metod na tujih borzah.

Vpliv regulativnega peskovnika RBI

Po predstavitvi regulatornega peskovnika RBI igralcem v prostoru fintech je fintech okolje doživelo drastične spremembe. Te spremembe so navedene spodaj:

Spodbudite inovacije in raziskave

The Indian fintech industry has made a lot of innovations in the last few years, such as QR Codes, NFC enabled Cards, Instant Settlements, and Video KYC. The QR code, once used to track luggage, was repurposed and is now used to make instant UPI transactions.

RBI introduced QR codes with much fanfare. It was slow to take off. However, now we see stickers stuck at every shop, taxi, and bus to make faster cashless payments.

Podobno so se kartice NFC uveljavile med Covid-19, ko naj bi bile vse transakcije brezkontaktne. Kartico hranite blizu terminala PoS in pravilen znesek denarja bo odštet od stanja kartice.

Instant Settlement is a boon in disguise. With billions of transactions happening daily, it had become imperative to have a similarly fast settlement process. With UPI and IMPS from NPCI, settling accounts and making instant transfers to bank accounts instead

of any wallet became easy.

Video KYC will be groundbreaking innovation for the credit card industry as identity verification is a vital process before disbursing credit. However, given the manual method, establishing an individual’s identity took a long time. The Video KYC process

has made identity verification faster.

AePS ali Aadhaar omogoča plačilni sistem, kjer so biometrične informacije integrirane v sistem Aadhaar, ki je nato povezan z vsemi bančnimi računi, ki jih lahko finančne institucije uporabljajo za preverjanje pristnosti in hitrejša plačila.

Spodbujanje rasti

With all the innovative products in the market, the time required for tiring operations has become shorter, enabling SMEs and other businesses to have more time on their hands. With this extra time, they can focus on innovating their product or marketing,

which needs a lot of mental space and time.

For example, if a business has a single place where they can manage their banking transactions, bills, invoices, payroll, accounting, and taxes would be so amazing. They could also take loans, and the ability to see how effectively they have been running their

business when required will be bliss. The company can focus on activities promoting growth with the time saved.

Ohranite interese strank nedotaknjene

It is in the interest of the regulatory sandbox to pass the fintech or financial institutions that don’t dilute customers’ interest in innovation. Therefore, RBI puts necessary data privacy policies and regulations to protect customer data. Applicants for

sandbox must comply with the following regulatory requirements to ensure the interests of consumers and the safety and soundness of the financial sector:

- Zaupnost podatkov o strankah

- Ustrezna in primerna merila

- Ravnanje z denarjem in sredstvi strank s strani posrednikov

- Preprečevanje pranja denarja in boj proti financiranju terorizma,

- Število strank

- Obseg transakcije

- Posebne skupine strank

- Informacije za stranko

Razširite finančno vključenost

The regulatory sandbox aims to extend the financial instruments’ reach to the less privileged. Spreading awareness among customers to empower them with the latest tech and improve their life is something that RBI wants to achieve. Several fintechs target

niche customer segments not only for competitive advantage but also as a part of the RBI sandbox guidelines.

India is the country with the second highest internet penetration globally. And yet, 1 out of 5 Indians don’t have access to essential banking services. It is a challenge and an opportunity to make financial services accessible to the unbanked. With innovations

in technology, financial services are accessible after minimal paperwork, one of the biggest challenges that fintechs overcame. Take gold, for example. India privately holds $1.5 trillion in gold in assets, mainly acquired through unsecured loans. Therefore,

it is an excellent opportunity to extend tech-driven credit services as it requires less investment from fintech and less paperwork to attract people to gold loans. Fintechs can explore one of many opportunities to make financial instruments more accessible.

Pritegnite naložbe

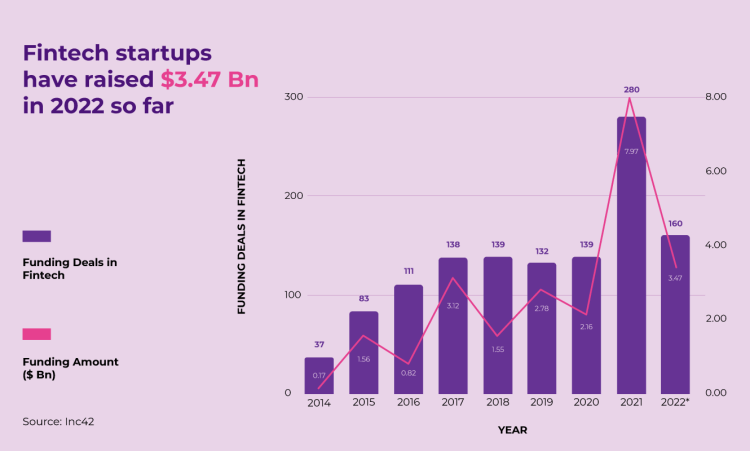

Industrija finančne tehnologije je med letoma 23.6 in 2014 prejela skoraj 2022 milijarde dolarjev. 30 najboljših vlagateljev je sklenilo 676 od 1219 poslov financiranja v vesolju, 14 vlagateljev med njimi pa je bilo iz ZDA.

If you look closely at the graph, there was a steady rise in investments after 2016. RBI set up the Working Committee to understand the Fintech industry in 2016. As time progressed and RBI set up the regulatory framework in 2019, there was a slight dip because

fintech regulations were still developing, and Covid-19 struck India.

Covid forced banks and financial institutions to evolve and make financial services accessible to the unbanked. It was a challenging as well as an excellent opportunity for fintechs to come up with innovative products and services. These immense opportunities

attracted funding that exploded in the year 2021.

Zgradite dobre predpise

Z veliko močjo prihaja velika odgovornost. Fintehnologije in druge finančne institucije so izkoristile pomembne prednosti priložnosti, ustvarjene zaradi pandemije, in omogočile dostop do finančnih instrumentov osebam, ki nimajo bančnih storitev.

The regulatory sandbox ensured that the fintechs delivered what was promised and never fell short of it. However, the regulatory sandbox also saw fintechs’ offerings, and if any, regulation became a hindrance rather than a support system. They made tweaks accordingly,

keeping in mind the interest of fintechs and consumers.

zaključek

RBI Regulatory Sandbox has played a significant role in shaping the fintech industry, nurturing and guiding the fintechs in the right direction while keeping the interest of the consumers in focus. The thematic-based framework is inspired by regulatory sandboxes

across various financial capitals globally, and it never falls sort of any expectations so far. Moreover, the sandbox has helped financial institutions go in the right direction to empower the unbanked and draw the attention of suitable investors.

Pomagal je pridobiti ne le novejšo tehnologijo, temveč tudi poglobiti tržni prodor finančnih instrumentov na indijskem trgu s ponudbo storitev po nižjih cenah.

- ant finančni

- blockchain

- blockchain konferenca fintech

- chime fintech

- coinbase

- coingenius

- kripto konferenca fintech

- FINTECH

- fintech aplikacija

- fintech inovacije

- Fintextra

- OpenSea

- PayPal

- paytech

- plačilna pot

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- trak

- tencent fintech

- fotokopirni stroj

- zefirnet