Spodaj je izsek iz nedavne izdaje revije Bitcoin Magazine Pro, Revije Bitcoin glasilo premium markets. Če želite biti med prvimi, ki bodo te vpoglede in druge analize trga bitcoinov v verigi prejeli naravnost v svoj nabiralnik, naročite se zdaj.

Najnovejši razvoj javnih rudarjev

After writing on the potential for public miner capitulation and covering Core Scientific’s possible bankruptcy route, there’s been a wave of miner announcements and developments that show industry-wide risks taking more shape. The major risk is miners’ accumulated debt and lack of cash flow to afford the interest rate on that debt as profit margins are squeezed. The other risk is hash rate (ASIC mining machines) that has been used as collateral to secure this debt financing.

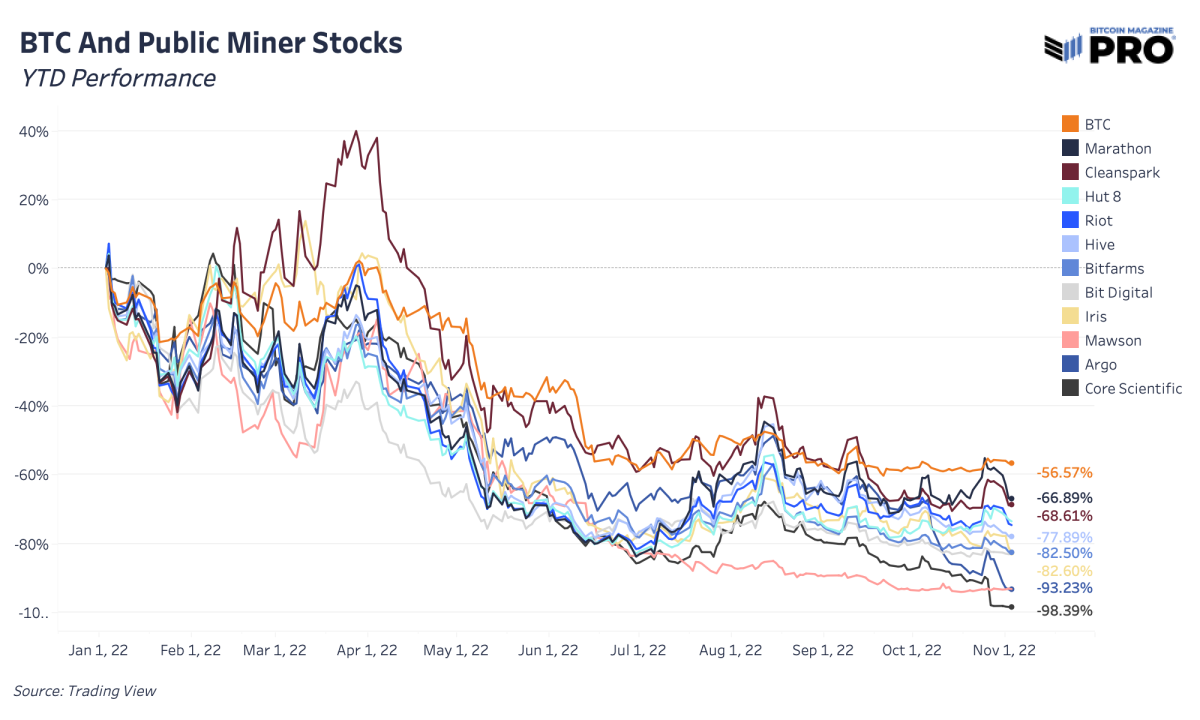

Public miners across the board continue to heavily underperform bitcoin in year-to-date performance. That’s not a new trend but now, as miners start to fall and the survivors emerge, the performance gap starts to widen in a big way. Miners on the edge of going under are down over 90% while the market’s chosen “stronger” miners are more in the 60-70% drawdown range.

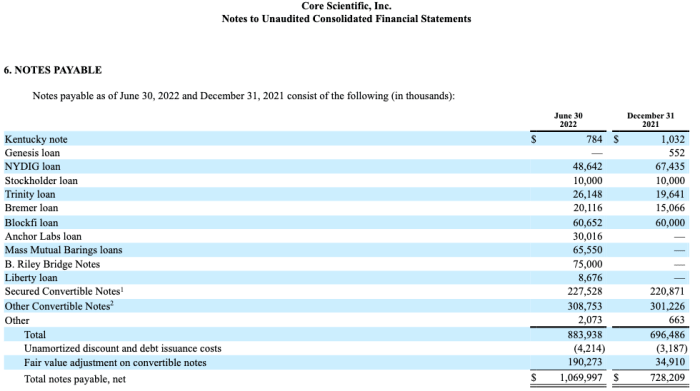

Začenši s Core Scientific, obstaja seznam podjetij, ki jim dolgujejo denar, vključno z BlockFi, NYDIG in Anchor Labs. Skupaj so upniki dolžni približno milijardo dolarjev in celo MassMutual Barings (investicijsko podjetje v lasti Mutual Life Insurance Co.) je na ožjem seznamu.

Argo Blockchain is one of those at the bottom, now down 93.23% this year. They released the biggest mining news of the week after announcing that a planned $27 million fundraise didn’t go through. Earlier this year, NYDIG agreed to a $70.6 million loan with Argo. Argo also used some of its bitcoin holdings in August to zmanjšajo svoje posojilne obveznosti, zavarovane z BTC tudi iz Galaxy Digital.

Energija perunike, poudarjena v a posodobitev financiranja ta teden, da je podjetje "currently capable of generating an indicative $2 million of Bitcoin mining monthly gross profit, compared to aggregate required monthly principal and interest payment obligations of $7 million." Po izposoji 71 milijonov dolarjev pri NYDIG, ki je bila zavarovana z napravami ASIC za eno od njihovih neporavnanih posojil, in nevarnosti, da bo potrebovala prestrukturiranje dolga, ima Iris skoraj 36,000 naprav, ki lahko dokaj hitro zamenjajo lastnika. Družba ne bi plačala teh posojil, če do 8. novembra ne najdejo novega dogovora.

Stronghold Digital Mining je ravno ta teden zaključil svoje dogovor o prestrukturiranju dolga z NYDIG, dobavo flote 26,200 rudarjev v zameno za izbris 67.4 milijona dolarjev dolga. Stronghold je tudi podaljšal drugo tranšo dolga, ki ga je treba odplačati v 36 mesecih namesto v 13, da bi kupil več gotovine. Te poteze so bile strateški ukrep za "hitro zmanjšanje naše bilance stanja in povečanje likvidnosti".

CleanSpark, ki je bil na mestu rasti in je sposoben nedavno kupite ASIC po nižjih cenah, ended up selling more of their bitcoin holdings (mined 532 BTC and spent 836) last month to support growth and operations. Although many major miners are still maintaining their HODL strategies and bitcoin balances, strong miners will tap into those holdings for growth opportunities or funding operations when absolutely needed.

TeraWulf, another bitcoin miner down 92.38% year-to-date, runs a relatively high debt-to-equity ratio compared to other miners (86%) and has 120 milijonov dolarjev dolga začeti vračati spomladi 2023 po 11.5-odstotni obrestni meri.

Ker večja zasebna posojilodajalca, kot sta BlockFi in NYDIG, ne razkrijeta, kolikšen je rudarski dolg v njihovih bilancah stanja, je nemogoče z gotovostjo vedeti, kako izpostavljeni so nekateri od teh posojilodajalcev širšemu tveganju bankrota rudarske industrije na obzorju. Ta posojila so lahko razumen del širših dejavnosti financiranja in dobro opremljena za obvladovanje tveganja neplačila, vendar je to dinamika, ki jo je vredno poudariti in bolje razumeti, saj pričakujemo, da se bo v naslednjih nekaj mesecih več rudarjev soočilo s pritiskom neplačila in/ali prestrukturiranja dolga .

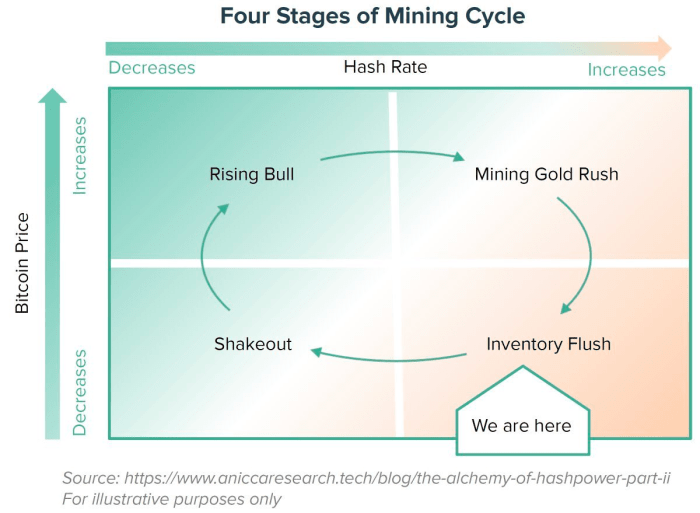

Eno mnenje generalnega direktorja družbe Marathon Digital Holdings Freda Thiela kaže na to Ogroženih bi lahko bilo približno 20 javnih rudarjev bankrota, kar je po njegovem mnenju popolna nevihta za industrijo. Nobenega dvoma ni, da večji, bolje pozicionirani rudarji iščejo potencialne, ugodne prevzemne posle, ki se bodo pojavili dokaj kmalu. Kot vsaka druga panoga pred njo je velika konsolidacija panoge neizogibna in javna Bitcoin rudarstvo looks primed to go through that next phase of its lifecycle. It’s likely we move to a world where there are only a few major bitcoin miner giants with a handful of much smaller miners behind them.

Podobno je povsem možno, da ko se ta cikel premakne iz spodnjega desnega kvadranta v spodnji levi, denarno bogati proizvajalci energije na javni in zasebni ravni začnejo zbirati ASIC-je za uvedbo v pripravah na naslednjo fazo bika.

vir: Alkimija

Končna opomba

The biggest risk inherent to the bitcoin market today remains the weak players hanging by a thread underneath the surface. The lack of meaningful price volatility in this $20,000 range is certainly encouraging from the standpoint of buyers and sellers finding a temporary equilibrium. But as the frequency of miner troubles continues to rise, along with the possibility of more fund-based leverage still in the market, max pain unequivocally is lower for industry participants. The brunt of the selling has taken place with bitcoin now at $20,000, but one has to question whether the marginal buyer is of sufficient size to stem the potential selling pressure on the horizon.

Sumimo, da se pritisk na posojilodajalce kriptovalut, ki so preživeli poletno okužbo, začenja povečevati zaradi vse večjih preglavic, s katerimi se soočajo nekateri rudarji v tem okolju.

- Argo Blockchain

- Bitcoin

- Bitcoin Magazine

- Bitcoin Magazine Pro

- Bitcoin Miner

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- poslovni

- CleanSpark

- coinbase

- coingenius

- Soglasje

- jedro znanstvenega

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- Maratonski digitalni gospodarji

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- Javni rudarji

- Opornica

- Terawulf

- W3

- zefirnet