Crypto markets can be volatile. Over the past year, prices have swung wildly, only recently rebounding from a brisk “winter.” Up, down, sideways – it’s impossible to know which way the winds will blow. What people can control is, however, the way they prepare for such vicissitudes.

Treasury management is the practice of stewarding a project’s resources over time. The goal is, generally, to ensure a going concern can remain a going concern – that it has enough cash on hand to continue operating. This might involve paying near-term expenses such as payroll and rent, or making longer term strategic investments, such as acquisitions and R&D. Regardless of the expenditure, treasury management should carefully consider and aim to achieve a projects’ core operating goals.

Treasury management is a core function of any organization, but it is particularly relevant today given the uncertainty of present market conditions. From decentralized autonomous organizations, or “DAO,” to traditional startups, teams are reckoning with a market environment featuring high inflation, low yields, and a tightening of financing options across both public and private markets. In light of this new normal, teams should place greater emphasis on conservative cash management principles in order to weather storms and emerge stronger on the other side of them.

Here is a basic framework that teams can follow to do so.

1. Calculate monthly cash burn

The first step is to develop a realistic financial model. In accounting terms, that means tracking projected inflows and outflows on a monthly basis (e.g., “net burn”). More plainly, it means calculating how much cash a given project is expected to spend each month, relative to how much it is expected to earn. This analysis should specify the component parts that drive both earning and spending. For example, the expense side should break out the cash-spend across key operating functions (engineering, business development, legal, etc.), as well as any expected non-operating outflows (financing costs, taxes, other one time payments, etc.). The revenue side should similarly break the inflows down into operating and non-operating categories. This will help determine their relative predictability over time.

Conservative assumptions will help ensure a project does not overestimate its runway. This is particularly true when projecting revenue. In a downturn, revenue is likely to fall – or at least growth may slow – as customers scale down their budgets or, worse, potentially go out of business. Even revenue assumed to be recurring or contractually committed may become more difficult to collect. While this sort of financial planning does not always apply to the many crypto projects and early stage ventures that have yet to make money, factoring in these probabilities can help projects plan more realistically for the longer term.

Shrewd financial planning is a routine exercise for traditional startups – and it’s increasingly relevant for DAOs as well. DAOs differ from traditional startups in many regards, including their organizational structures and degree of decentralized control. In many cases DAOs may be comprised of various unaffiliated entities who are working together toward some shared purpose and who receive budgets from the broader DAO. Traditional companies are, on the other hand, likelier to have cash on the balance sheet from various financing rounds. Nevertheless, as DAOs continue to evolve and take on more sophisticated operating structures, it is critical that they too have visibility into their overall financial health. This will ensure they can meet operating expenses as they come due, including contributor payments, incentive programs, and more. It will also provide transparency into the operating state of the organization, enabling better decision making. While teams like MakerDAO have led the way on this type of analysis to date, we expect this will eventually become table stakes for all successful DAOs in the future.

2. Maintain operating expenses in cash

Once the rate of cash burn is determined, a project can begin developing an overall treasury management plan. The core objectives here are: ohranitev kapitala, likvidnostin prihodki, v tem vrstnem redu.

Priority number one is to cover near-term operating expenses. It’s critical to optimize for the safety and accessibility of capital before exploring opportunities for yield. This typically means maintaining vsaj 12 months – ideally, 18 months – of operating expenses in a basic cash account (e.g., bank deposit or money market account) or, in the case of a DAO, in visokokakovostni stabilni kovanci. This capital will earn relatively little yield, but it will be available to meet near-term liabilities as they come due. Be conservative.

In addition to maintaining near-term expenses in cash, projects should also ensure they match assets and liabilities by currency. In other words, if liabilities are denominated in USD, then a corresponding amount of liquid assets should also be denominated in USD. This is particularly relevant for companies or DAOs who hold crypto assets but have expenses denominated in dollars. To avoid having to sell depreciated assets in a down market, teams should ensure they are regularly converting assets into the appropriate currency to cover ongoing operating expenses; of course, they must also ensure they’re conducting any asset sales in a manner that complies with applicable regulatory restrictions and has the appropriate legal wrappers in place to enable them to pay taxes, where applicable. Always have what you need on hand.

Apparently, diversification is fairly uncommon. A Nedavna študija from Chainalysis, a crypto tracking firm, shows that 85% of DAOs store their entire treasury in a single crypto asset – typically their native governance token. Among those who do hold stablecoins, the majority hold 10% or less of their reserves in stablecoins. While some DAOs have limited operating expenses, for those that do have material operations, it’s possible they may be forced to sell their native tokens at depressed prices to cover operating expenses, or cut back on core strategic initiatives. That would be suboptimal.

Some projects may be reluctant to sell crypto for fiat currency or stablecoins out of a concern that it sends a negative signal to the market. These are project-specific decisions, and ones that depend on each project’s unique set of circumstances. They should always take account, however, of any regulatory and tax considerations.

Projects can avoid negative outcomes – like having to sell native tokens in a down market, or cutting back on strategic initiatives – by maintaining a sufficient cash buffer. Managing cash appropriately ensures projects can cover expenses for potentially prolonged periods, which may be critical during a downturn where access to financing markets can be challenging. Planning ahead also allows projects to maintain focus on core operating goals, knowing their working capital remains safe from loss.

3. Develop plan for additional capital

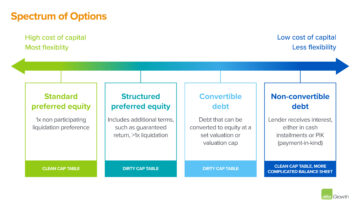

For companies holding cash in excess of their 12-to-18-month operating budget, it may make sense to explore opportunities for incremental yield. As with the working capital budget discussed in the previous section, this exercise should be informed by the project’s liquidity needs over time. The diagram below provides a high-level look at various products and when they might become appropriate to consider. In general, products offering greater yield become more appropriate as a project moves from operating cash (for meeting day-to-day needs) towards strategic cash (for pursuing growth and other opportunities).

Each product has different risk, yield, and liquidity profiles. Before allocating among them, it’s useful to develop a basic plan to guide the overall approach.

Tukaj template investment plan we often share with traditional portfolio companies – ones that fall in the left-hand column above – when discussing this topic. While some of these considerations may be inapplicable to earlier stage companies, DAOs, and other projects, they are nonetheless instructive for learning how companies with larger balance sheets think about managing cash.

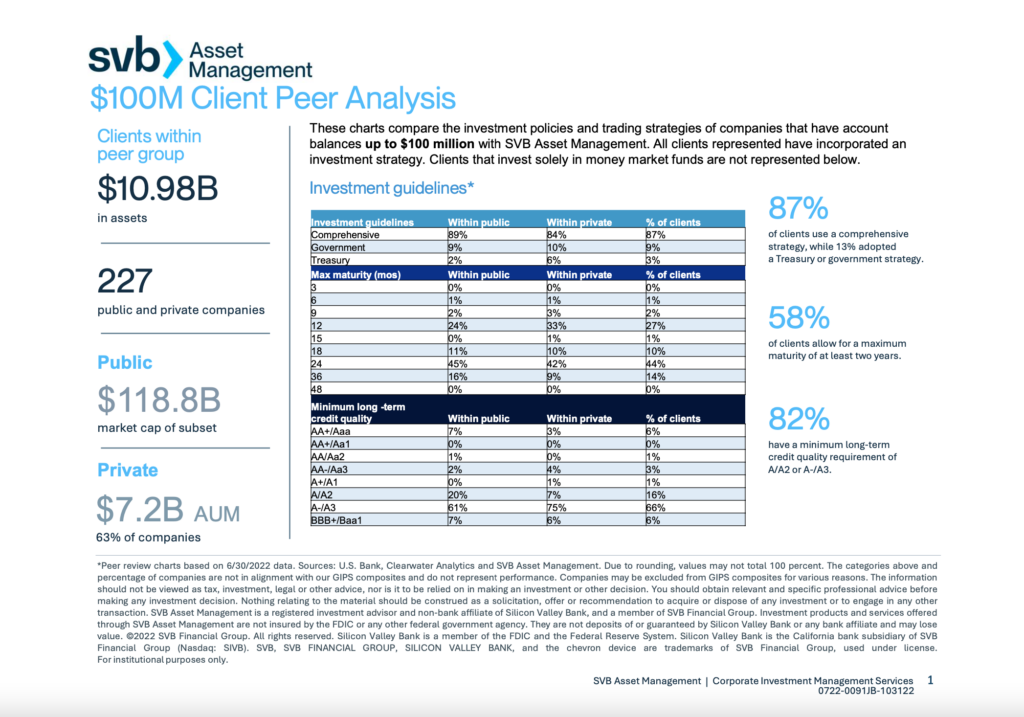

In general, traditional companies allocate excess cash toward safe holdings. These include products such as money market instruments and investment-grade fixed income securities (rated BBB or higher). In a given portfolio, these companies typically diversify assets across maturities, credit quality, sectors, and issuers. For a sense of what this looks like, below is a breakdown of allocations among mid-to-late stage companies with up to $100 million in assets with Silicon Valley Bank.

While we’ve seen some corporate treasurers take on additional risk in recent years, a more conservative strategy is often advisable. This is particularly true in the current rate environment, where yield is beginning to return to many traditional credit and banking products. For example, yields on certain money market instruments are beginning to approach 150 or 200 basis points in some cases, making them an attractive option for managing cash. A portfolio anchored around these types of assets is likely to be well-suited for many companies.

Meanwhile, for DAOs managing on-chain treasuries, a variety of money market and fixed-income products have emerged in recent years that may be appropriate to consider. These include products such as Sestavljeni, Element Financein Goldfinch, among others. For longer-term cash, it may make sense to explore staking with high-quality protocols like Lido and others. As with more traditional products, however, it’s important to consider the risk, yield, and liquidity profiles of these options before allocating to them. It’s also important to evaluate any technical or operational risks that may arise when interacting with assets or protocols on-chain to ensure a project isn’t exposing assets to risk of loss.

4. Build out operational capacity

With a strategy in place, it’s time to build out the various operational pieces needed to put the plan into action. For companies with more traditional treasury management plans, this includes finding a banking partner and an investment advisor, and putting in place internal processes to ensure proper custody, reporting, valuation, controls, tax, and audit requirements.

Projects don’t have to figure everything out all on their own. The banking partner should be able to help provide investment vehicles that fit within a company’s investment policy. The banking partner may also be able to recommend more sophisticated investment advisors to help maximize returns within specified risk parameters. Always consult with an accounting firm or auditor on proper practices and procedures as they relate to accounting for investments and related earnings.

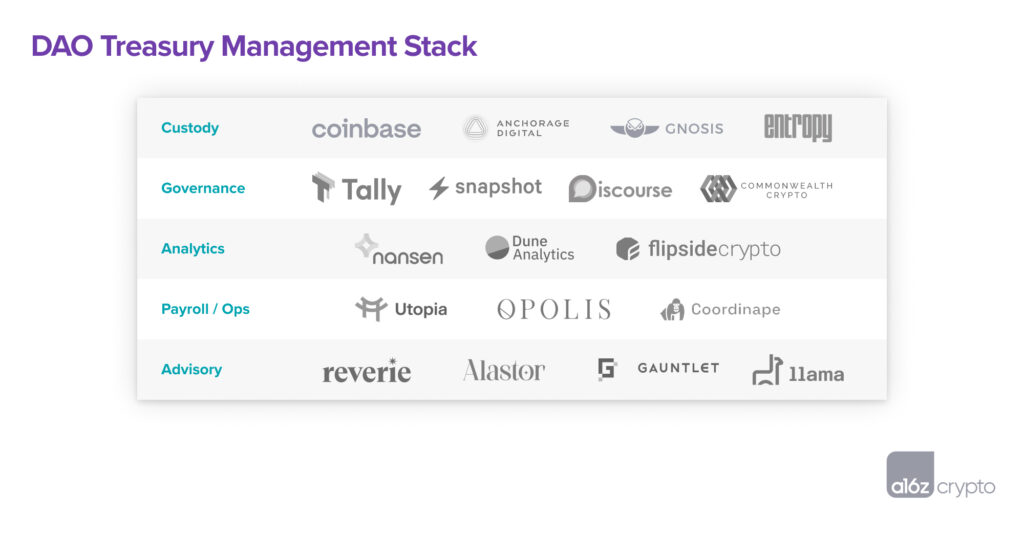

For DAOs or companies holding crypto, the diagram below lays out the key operational pieces that may be required as well as some of the leading options in each:

At a minimum, a secure wallet setup is necessary to ensure assets are always safely custodied. This is particularly relevant any time assets are being deployed into other protocols or otherwise moving on-chain. Options range from traditional custodians such as Anchorage or Coinbase to decentralized or multi-sig options, like Entropija or Gnosis.

Beyond custody, DAOs will typically also need some form of governance approval from tokenholders before executing a treasury management strategy. Tools like Posnetek in Tally can be used for voting, while forums like Diskurz in Commonwealth can help facilitate community discussion.

DAOs can also tap into the emerging suite of on-chain analytics products to monitor the state of their strategy over time, including Nansen, Dune in Kripto stran. Payroll and operations-related tools like Opolis, Koordinapein Utopia can also be used to manage budgets and track spending over time.

And finally, given the complexity of this task, it may be worthwhile to consult with firms who provide advisory services on this topic. These range from traditional advisors such as Banka Silicijeve doline to more crypto-native firms such as Sanjarenje, Alastor, Rokavicain Llama, among others. Teams should also make sure to conduct regulatory analysis of various strategies and engage outside counsel as appropriate.

5. Monitor and make adjustments as necessary

Finally, teams should actively monitor their cash positions and adjust their strategies as necessary. This requires updating burn projections to ensure cash is being managed properly. Teams should also regularly confirm that their strategies remain oriented around their core principles (capital preservation, liquidity, income). Doing so will ensure they do not take on unnecessary risk as their strategy evolves over time.

Tl;

Treasury management is an integral part of any projects’ long-term success. To maximize the chances for success, both cash management and longer-term capital allocation should be both well defined and well executed. The goals are ohranitev kapitala, likvidnostin prihodki, in precisely that order.

Under current economic conditions, it’s important to think critically about potential unforeseen business expenses that may arise outside of the course of normal operations. Once a project has a conservative estimate of the capital required to keep running, it should earmark an available cash balance equal to at least 12 months – or better, 18 months – of net cash outflows. Any remaining cash reserves can then be allocated according to a policy that should clearly define the relevant stakeholders, the specific roles of each stakeholder, the institutions involved in executing the strategy, and the reporting requirements associated with any holdings. After a strategy is put in place, the performance of holdings should be monitored and the suitability of the strategy periodically evaluated as it relates to the ever changing needs of a project.

Preparation now prevents pain later on.

***

Acknowledgements: Special thanks to Silicon Valley Bank for allowing us to share a breakdown of investment policies among a subset of its asset management group’s clients.

***

Tukaj izražena stališča so stališča posameznega citiranega osebja družbe AH Capital Management, LLC (»a16z«) in niso stališča družbe a16z ali njenih podružnic. Nekatere informacije, vsebovane tukaj, so bile pridobljene iz virov tretjih oseb, vključno s portfeljskimi družbami skladov, ki jih upravlja a16z. Čeprav so vzeti iz virov, za katere menijo, da so zanesljivi, a16z ni neodvisno preveril takšnih informacij in ne daje nobenih zagotovil o trenutni ali trajni točnosti informacij ali njihovi ustreznosti za dano situacijo. Poleg tega lahko ta vsebina vključuje oglase tretjih oseb; a16z ni pregledal takšnih oglasov in ne podpira nobene oglaševalske vsebine v njih.

Ta vsebina je na voljo samo v informativne namene in se je ne smete zanašati kot pravni, poslovni, naložbeni ali davčni nasvet. Glede teh zadev se morate posvetovati s svojimi svetovalci. Sklici na katere koli vrednostne papirje ali digitalna sredstva so samo v ilustrativne namene in ne predstavljajo naložbenega priporočila ali ponudbe za zagotavljanje investicijskih svetovalnih storitev. Poleg tega ta vsebina ni namenjena nobenim vlagateljem ali bodočim vlagateljem niti ji ni namenjena in se nanjo v nobenem primeru ne smete zanašati, ko se odločate za vlaganje v kateri koli sklad, ki ga upravlja a16z. (Ponudba za vlaganje v sklad a16z bo podana le z memorandumom o zasebni plasiranju, pogodbo o vpisu in drugo ustrezno dokumentacijo katerega koli takega sklada in jo je treba prebrati v celoti.) Vse naložbe ali portfeljske družbe, omenjene, navedene ali opisane niso reprezentativne za vse naložbe v vozila, ki jih upravlja a16z, in ni nobenega zagotovila, da bodo naložbe donosne ali da bodo imele druge naložbe v prihodnosti podobne značilnosti ali rezultate. Seznam naložb skladov, ki jih upravlja Andreessen Horowitz (razen naložb, za katere izdajatelj ni dal dovoljenja a16z za javno razkritje, ter nenapovedanih naložb v digitalna sredstva, s katerimi se javno trguje), je na voljo na https://a16z.com/investments /.

Grafi in grafi, ki so navedeni znotraj, so izključno informativne narave in se nanje ne bi smeli zanašati pri sprejemanju kakršnih koli investicijskih odločitev. Pretekla uspešnost ni pokazatelj prihodnjih rezultatov. Vsebina govori samo od navedenega datuma. Vse projekcije, ocene, napovedi, cilji, obeti in/ali mnenja, izražena v tem gradivu, se lahko spremenijo brez predhodnega obvestila in se lahko razlikujejo ali so v nasprotju z mnenji, ki so jih izrazili drugi. Za dodatne pomembne informacije obiščite https://a16z.com/disclosures.

- a16z kripto

- Andreessen Horowitz

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- coinbase

- coingenius

- Soglasje

- Kripto in splet3

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- Platoblockchain

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- W3

- zefirnet