Welcome to the exciting world of payments! In this fascinating industry, acquiring is a key aspect. But what exactly is acquiring? And how does it differ from an issuing bank or a payment processor? Read on to learn more about this important part of the

payments ecosystem.

A customer’s transaction is just a tap away with their card. But what they don’t see is the complex web of financial institutions that make it all possible. The merchant acquiring bank is the backbone of it all. Merchant acquiring banks are financial institutions

that provide merchants with the ability to accept card payments (credit and debit cards).

Note: An acquiring bank can also be referred to as ‘merchant acquiring bank’ or the ‘merchant acquirer’. They are typically referred to as “acquirers.”

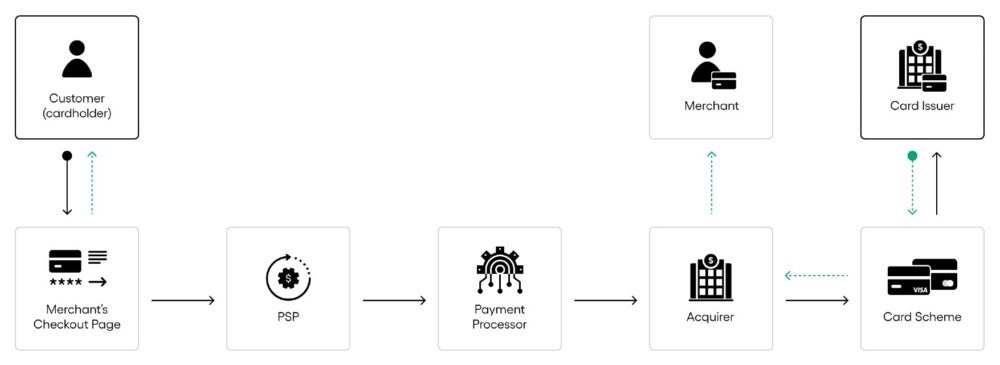

Klasični model plačila: korak za korakom

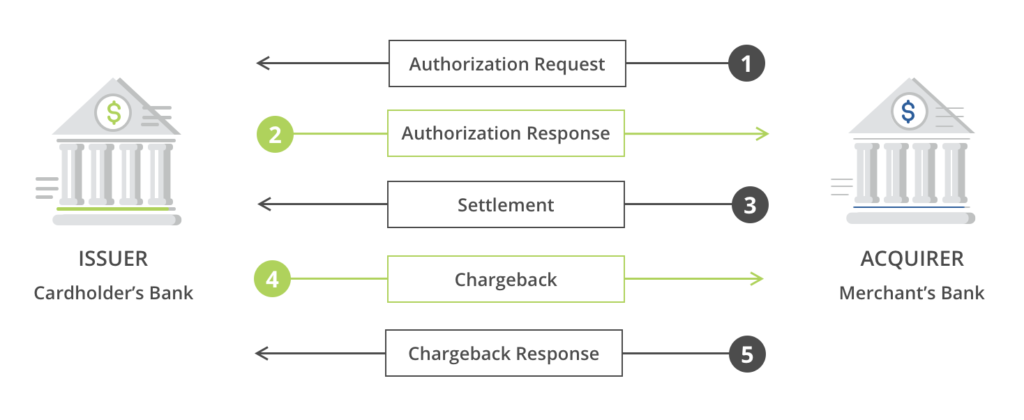

The classical payment model is a process that takes place each time a customer makes a purchase with their debit or credit card. The steps involved in this process are: Authorization, Clearing, and Settlement. Let’s take a closer look at each of these steps:

-

Dovoljenje: When the customer’s card is used (either online or physically in the store) the cardholder’s bank is contacted to approve the transaction. The cardholder’s bank will then either approve or decline the transaction based on

a number of fraud rules and a balance check to ensure there are sufficient funds. -

Obračun: The cardholder’s bank exchanges daily payment information with the merchant’s bank via the Card Scheme, resulting in the generation of a settlement file which is used for the following stage.

-

Naselje: The settlement step is when the cardholder’s bank pays the merchant’s bank for the transaction, who then settles the funds to the merchant beneficiary.

Najboljši način, da se seznanite s postopkom, je, da si ogledate podrobno razlago spodaj. Ko ste trgovec, boste pogosto sodelovali s ponudnikom plačilnih storitev (PSP), vendar bodo dejanska sredstva prišla iz vaše banke prevzemnice.

The standard practice in the card acquiring industry is for the consumer (the cardholder) to authenticate the purchase at checkout by entering their credit or debit card information (card number, cardholder name, expiration date, CVV number). Online payment

security can be enhanced with the use of 3DS (Varno za vizum,

Mastercard SecureCode,

Amex SafeKey), ki je oblika močne avtentikacije strank (»SCA«).

Kartična shema nato posreduje podatke o plačilu pravi banki izdajateljici za avtorizacijo. Postopek

pooblastilo includes confirming with the issuing bank that the card is valid and there are sufficient funds in the account to complete the transaction. The card issuer (or issuing bank) then verifies the customer’s identity and approves or

declines the transaction.

Če jo odobri banka izdajateljica, je transakcija avtorizirana in jo bo trgovec najprej 'zajel', kar pomeni, da predloži plačilo v obdelavo. Enkrat Zajeto, bo plačilo obračunano in naknadno poravnano. Naselje

takes place typically 2 – 5 days afterwards where funds are transferred from the issuing bank, via the card network, to the acquiring bank, before being credited to the merchant bank account.

The time it takes for a merchant to access their funds can vary depending on the merchant acquirer agreements, the currencies being exchanged (payment currency, settlement currency), the countries of the issuing and acquiring banks, delivery times and type

of products and service.

Opomba: Pri klasičnem modelu spletnega plačevanja sta procesor in prevzemnik običajno dve različni podjetji. Procesor obravnava tehnične vidike plačila in nato pošlje podrobnosti transakcije pridobitelju.

PSP, pridobitelj, izdajatelj, procesor: v čem je razlika?

Let’s take a look at the terms that have caused many heads to be scratched. Below we explain what a PSP is, and outline the differences between an acquiring bank vs. an issuing bank and a merchant acquirer vs. payment processor. Let us guide you through

the jungle of terminology.

Ponudnik plačilnih storitev (PSP)

A PSP is an entity that provides card services and access to alternative payment methods to businesses by having relationships and contractual agreements with several merchant acquirers and alternative payment method providers. Hence, rather than a merchant

needing to seek out multiple partners for different acceptance methods, the PSP does this on their behalf.

The PSP functions as the intermediary, meaning that it manages the connections between merchants and acquirers, but typically is never involved in the actual processing of payments. The PSP will provide the technical integration for the merchant, while the

acquirer is responsible for processing the payments and managing the associated risks.

Ena od ključnih vlog PSP je usmerjanje vaših plačil različnim pridobiteljem za optimizacijo glede na stopnje sprejemanja, ceno in tveganje.

Banka prevzemnica proti banki izdajateljici

In simple terms, the cardholder’s bank is the issuing bank and the merchant’s bank is the acquiring bank.

The issuing bank is the entity responsible for issuing cards to cardholders. They are incentivized to do so by receiving a small percentage (interchange fee) of each transaction. In addition to providing the cards, they authorise transactions after checking

for any fraudulent behaviour and whether the balance is sufficient to cover for the purchase.

The acquiring bank is responsible for settling funds to the merchant. They also take on the risk associated with any merchant fraud or failure to deliver on goods or services – hence, should the merchant go bankrupt (or vanish into thin air) and is unable

to fulfil any outstanding orders, the acquiring bank is responsible for refunding the cardholders. For this reason, opening a merchant account can sometimes be challenging for new businesses without a trading history.

Merchant accepter vs. plačilni procesor

Payment processors are important for facilitating the transaction on behalf of the acquirers and issuers. They act as the communication layer between the banks and the card schemes, sending and receiving the necessary information to authorise, clear and

settle a transaction. Note: the payment processor has a strictly technical function, meaning they are not involved in the money flow. However, people often use the term “payment processor” to refer to counterparties involved in the settlement of funds to the

merchant, helping to add to the confusion.

Procesorji so običajno integrirani neposredno s pridobitelji za sprejemanje transakcij, ti pa finančni instituciji in kartični shemi zagotovijo licenco za obdelavo transakcije.

Acquirers play an important role in the payment process by receiving funds from the card networks and ensuring that merchants receive the amounts due for their customer purchases. Acquirers are often, but not always, part of the technical transaction flow,

and regardless of their participation in the technical aspect they play a vital role in making sure that payments are processed smoothly and efficiently.

Now that we have a better understanding of what merchant acquiring banks are, let’s take a closer look at how they serve their merchants.

Vloga trgovcev pridobiteljev: več kot le obdelava kreditnih in debetnih kartic

The role of the merchant acquirer is not limited to accepting and processing credit and debit card payments. They also provide a number of value-added services that can help merchants run their businesses more efficiently. Understanding the role of acquirers

can help you make educated decisions about your payment processing options.

Nekatere ključne vloge, ki jih izpolnjujejo banke prevzemnice, so naslednje:

- Odpiranje trgovskega računa. Zagotavljanje, da je identiteta trgovca preverjena in potrjena, da res prodaja tisto, za kar trdi, da prodaja.

- Naselje. Sodeluje z izdajateljem kartice, da zagotovi, da trgovec prejme plačilo za transakcijo.

- Povpraševanje. V primeru, da stranka oporeka bremenitvi, bo pridobitelj sodeloval s trgovcem in izdajateljem kartice, da bi poskušal rešiti težavo.

- Preprečevanje goljufij. Uporaba orodij za spremljanje transakcij za prepoznavanje in preprečevanje goljufive dejavnosti. Pridobitelji prevzemajo tveganje goljufij in povratnih bremenitev, zato imajo v interesu, da to preprečijo.

- Analytics. Zagotavljanje vpogledov v vašo prodajo in meritve zdravja strank v realnem času, tako da ste lahko vedno na tekočem. To vam omogoča, da sprejemate premišljene odločitve o svojem podjetju, da bo lahko nemoteno delovalo.

- Podpora strankam. Zagotavlja podporo strankam tako trgovcem kot imetnikom kartic v primeru kakršnih koli težav s transakcijo.

Kako izbrati prevzemnika za vaše podjetje

Ne glede na to, ali odpirate spletno podjetje ali se želite razširiti, lahko pridobitelji igrajo ključno vlogo pri vašem uspehu. Obstaja več dejavnikov, ki jih morate upoštevati pri izbiri trgovca prevzemnika za vaše podjetje:

- Prepričajte se, da podpirajo vrste kart želite sprejeti.

- Morate vedeti, katere lokacije in valute vaš pridobitelj podpira. Prepričajte se, da pokrivajo državo, v kateri je registrirano vaše podjetje, in valute, ki jih boste sprejemali na svojem spletnem mestu.

- Bodite prepričani, da svojega potencialnega pridobitelja vprašate o njihovem sprejemljivosti. Losing out on customers because their transactions aren’t supported could be costly.

- How quickly can your business be onboarded? When time is of essence, it’s important to know how fast the

proces vkrcanja will be. The sooner you’re onboarded, the sooner you can start taking orders. - O hitrost poravnave je pomemben vidik za podjetja z omejenim denarnim tokom. Bistveno je vedeti, kako hitro boste prejeli plačilo, da boste čim prej imeli dostop do obratnega kapitala.

- You never know when payment issues will arise. That’s why odzivna podpora is important. How quickly does the acquirer respond to merchant queries? Do they have a dedicated support team? Check what other merchants are saying about the

storitev za stranke. - Koliko vas stane posamezna transakcija? To vam bo pomagalo izračunati

stroške vaših transakcij and figure out how much you’ll be charged. Acquirers typically charge a merchant varying fees. These fees cover network processing and merchant account-related services. - Ohranjanje stroškov vašega podjetja je pomembno. Eden od načinov za to je, da se prepričate, da se zavedate

koliko transakcij lahko obdelate vsak mesec, preden boste morali plačati dodatne stroške. - Preverite, ali obstaja omejitev obsega transakcij lahko obdelate vsak mesec. Zaradi tega boste morda potrebovali več kot enega pridobitelja.

- Zagotovite, da zahteve glede zavarovanja niso prehibitivni za vaše podjetje. Tj. koliko vaših prodajnih prihodkov bo prevzemnik rezerviral in za kakšno obdobje?

Zdaj, ko razumete ključne dejavnike, ki jih je treba upoštevati pri izbiri trgovca prevzemnika za vaše podjetje, je koristno podrobno razumeti s tem povezane stroške in provizije.

Pridobivanje trgovcev: dešifriranje stroškov in provizij

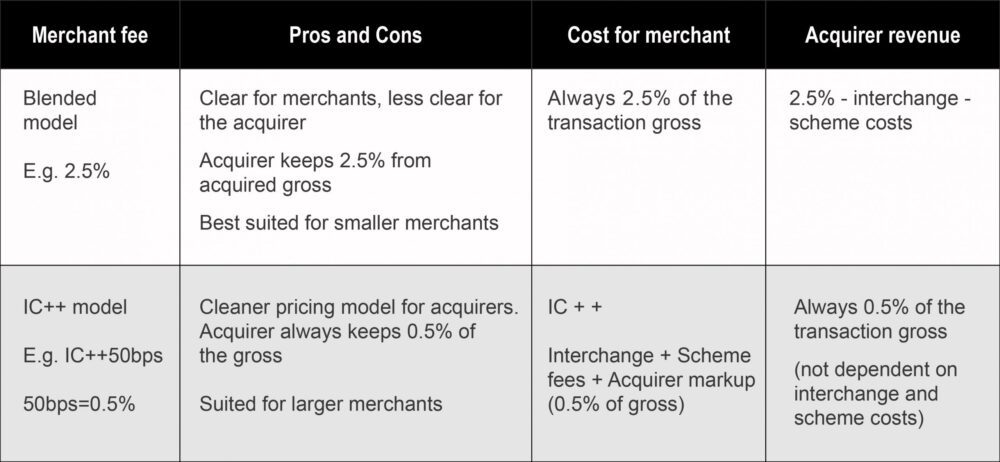

Cenovni modeli so lahko zelo zmedeni, zlasti ko gre za obdelavo kartic. Obstajata dva glavna cenovna koncepta: mešani in Interchange Plus ('Intercharge+').

Blended pricing is more common for small merchants and is an ‘all-in’ rate. With blended pricing, the merchant does not see the granularity of each transaction and hence the merchant profit can increase materially depending on the type and location of the

customer’s card.

For larger or more established merchants, Interchange+ pricing is more widely used as it is more transparent and allows for more granularity around processing fees. Interchange+ pricing is one model often used by merchant acquirers to help determine the

cost per transaction for merchants. This fee consists of two components: the interchange fee set by the card network, and the markup set by the card processor itself.

An example of how this works is as follows: Visa* interchange fees are 1.51% + $0.10 for a standard transaction. Let’s say a merchant acquirer charges a flat markup of 0.25% on top of these interchange fees. If a merchant were to process a transaction for

$100 using Visa, they would be charged 1.51% + $0.10 + 0.25% = $2.01 in fees.

* To je le primer in dejanska cena se bo razlikovala glede na vrsto kartice, znesek transakcije, trg MCC in trgovca pridobitelja.

When it comes to Interchange Plus Plus (Interchange++) pricing, there is not a world of difference between the two. The key distinction lies in the fact that with Interchange++, the acquirer also passes on the scheme fees from the card networks. This means

that there are three components to this type of pricing: the interchange, the first plus (the acquirer’s fee), and the second plus (the card scheme fee).

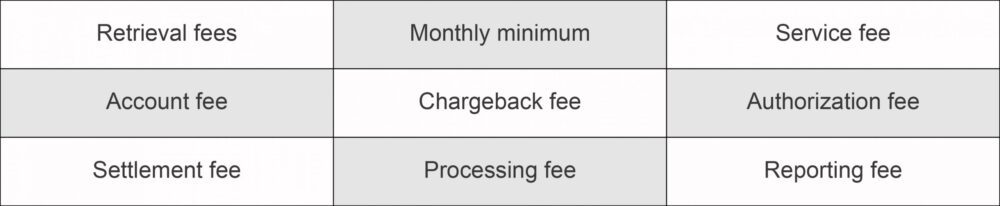

Now that you know about the two main pricing models, let’s take a look at the other fees that can vary depending on the acquirer. Some of the fees that you may see on your statement can include:

O nekaterih od teh pristojbin se je mogoče pogajati. Trgovci, ki si vzamejo čas za pregled in razumevanje svojih mesečnih izkazov, bi se morda lahko učinkovito pogajali o različnih cenah s svojimi pridobitelji.

Kaj pa varnost?

Z

nedavno povečanje in data breaches, it’s important that all parties involved in the credit and debit card payment process follow security standards for fraud prevention.

Varnostni standard industrije plačilnih kartic (PCI DSS) has guidelines to keep your customers’ information safe. If a company processes credit or debit cards, it should be fully compliant with

the PCI standard. This ensures that your customer’s information is secure when they make a purchase from your online store.

Fraud is a real threat to businesses, but it doesn’t have to be. Choosing the right type of PSP and acquirer can help you to significantly fend off fraudsters. We recommend using PSPs that offer anti-fraud solutions and fraud prevention tools to help prevent

cyberattacks and fraudulent activity.

Ključni odvzemi

There you have it — everything you need to know about merchant acquiring. We hope this guide has given you a better understanding of what acquiring is, how it works, and what to look for when choosing a merchant acquirer for your business. Don’t forget to

check out this list of the top

trgovci prevzemniki da vam pomagamo najti tisto, kar najbolje ustreza vašim poslovnim potrebam.

- ant finančni

- blockchain

- blockchain konferenca fintech

- chime fintech

- coinbase

- coingenius

- kripto konferenca fintech

- FINTECH

- fintech aplikacija

- fintech inovacije

- Fintextra

- OpenSea

- PayPal

- paytech

- plačilna pot

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- trak

- tencent fintech

- fotokopirni stroj

- zefirnet