Pošta Zakaj je Bitcoin dragocen? by Reid McCrabb pojavil prvi na Na bencin. Obiščite Na bencin da bi dobili več odličnih vsebin, kot je ta.

The craze behind Bitcoin has largely been based around its heroic rise in price. From $250 per Bitcoin in 2013 to an all-time high of just over $66,000 in 2021, these astronomical gains have caught the attention of more than just the seasoned trader.

The dramatic rise in Bitcoin has created such outsized returns for investors that the term “crypto millionaire” was created. Those fortunate enough to have bought into Bitcoin in the early days are not the typical investors you might expect. In fact, larger investors are some of the last to get their hands on crypto assets, as an investment in Bitcoin was deemed too risky.

Jamie Dimon, CEO and Chairman of JP Morgan, went as far to say, “I personally think that Bitcoin is worthless,” according to CNBC. Also anti-Bitcoin was legendary investor Warren Buffett, who turned up his nose at Bitcoin in 2018, comparing it to “rat poison.” Nonetheless, Bitcoin outpaced Buffett’s holding company Berkshire Hathaway in gains over the next four years. Regardless of your position on Bitcoin, the price has risen over the long term.

How does Bitcoin accrue its value? And is Bitcoin worth investing in, or has the train already left the station? These questions hold simpler answers than one might expect.

vsebina

How Is Bitcoin Funded?

Bitcoin is technically not funded by anyone; instead, its network incentivizes Bitcoin miners by rewarding their efforts with coins. Bitcoin mining is the process in which the network verifies transactions. Miners use expensive hardware to compete for the next block on the Bitcoin network. The fastest miners solve computational math problems that verify transactions in the network.

Miners are critical to the Bitcoin network as they keep transactions moving along and earn newly minted Bitcoins. Bitcoin mining holds a high barrier to entry and uses large amounts of energy.

This process of mining Bitcoin is known as proof of work (PoW). Many cryptocurrencies are replacing the PoW concept with proof of stake (PoS), a more affordable and energy-efficient process of verifying transactions. While the PoS concept is likely to overtake PoW in popularity, Bitcoin will remain with PoW, at least for the time being.

Kaj določa ceno Bitcoina?

The price of Bitcoin is determined by a simple variable — demand. Crypto assets move in the same manner that stocks move; more buyers than sellers pushes prices higher and vice versa. This demand is often affected by laws and regulation from governments. For example, when China announced a ban on Bitcoin, the price dipped. On the other hand, when countries announce formal adoption of Bitcoin, the price tends to swing upward. Price can also be impacted by influential people, companies and economic developments. The many factors that go into pricing Bitcoin cause its volatility.

Is Bitcoin Worth Investing In?

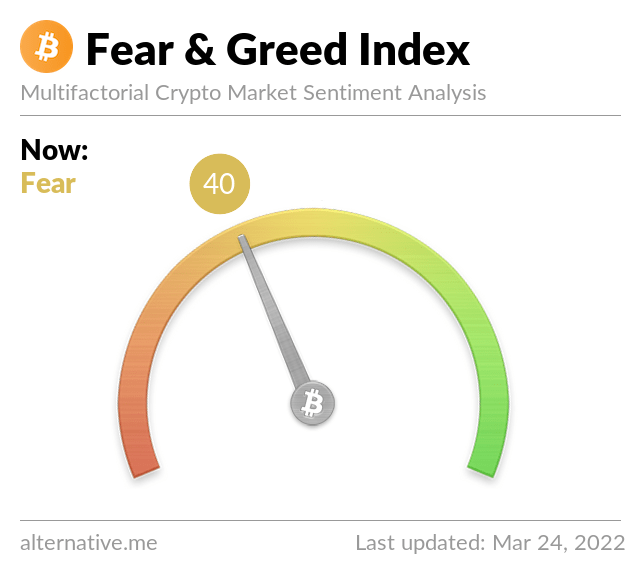

Bitcoin could be worth investing in. With the price well off all-time highs, many see it as a good buying opportunity. Recent geopolitical risks paired with potential Fed rate hikes have caused fear in the market. This sentiment can be seen in the Bitcoin fear-and-greed index.

The fear-and-greed index operates on a 0 to 100 scale where over 50 means the market is considered to be greedy and under 50 the market is deemed to be fearful. A fearful market typically is oversold and a greedy marketplace overbought. The fear-and-greed index has hovered around fearful from late 2021 through early 2022, as seen in Alternative’s index shown below.

vir: Alternative’s Fear and Greed Index

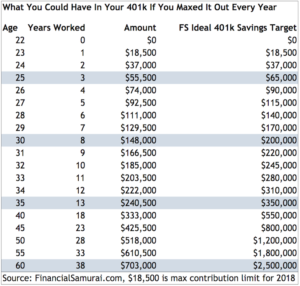

If you are interested in purchasing Bitcoin, a great method to try is dollar cost averaging. This strategy uses a predetermined amount of purchases of Bitcoin on a certain day. Transactions can take place weekly, bi-weekly, monthly or whatever suits your financial situation. Plenty of platforme za kripto trgovanje exist to facilitate this action. Some great places to buy Bitcoin are Gemini, eToro and Webull.

window.LOAD_MODULE_PRODUCTS_TABLE = res;

Gemini je menjalnica in skrbnik kriptovalut, ki vlagateljem ponuja dostop do več kot 100 kovancev in žetonov. Podjetje Gemini, ustanovljeno v ZDA, se širi po vsem svetu, zlasti v Evropo in Azijo. Ponudbe vključujejo tako velike projekte kriptovalut, kot sta Bitcoin in Ethereum, kot manjše altcoine, kot sta Orchid in 0x.

Gemini je eden od edinih posrednikov z več možnostmi platforme glede na raven znanja. Novi vlagatelji bodo navdušeni nad poenostavljenim vmesnikom Geminijevih mobilnih in spletnih aplikacij, medtem ko bodo napredni vlagatelji morda cenili vsa orodja, ki so priložena ActiveTraderju.

Poleg številnih izbir platform imajo uporabniki Gemini tudi dostop do zavarovanih vročih denarnic za shranjevanje žetonov, ne da bi jih skrbelo krajo digitalnih sredstev. Izvedite več o tem, kaj lahko Gemini naredi za vas v našem pregledu.

- Novi vlagatelji, ki iščejo preprosto mobilno in spletno aplikacijo

- Dnevni trgovci, ki želijo uporabljati orodja za tehnično analizo

- Uporabniki, ki iščejo trgovino na enem mestu za nakup, prodajo in shranjevanje vseh svojih kriptovalut

- Enostavne in hitre prijave – lahko začnete že v 5 minutah

- Številne platforme za prilagajanje trgovcem vseh ravni znanja

- Vroče denarnice vključujejo zavarovanje za zaščito pred krajo in poskusi vdora

- Uporabnikom, ki kupujejo in prodajajo prek namizja ali mobilne aplikacije, zaračunava provizijo in priročnost

eToro s sedežem na Cipru, v Angliji in Izraelu ponuja forex produkte in druge izvedene finančne instrumente CFD malim strankam od leta 2007. Pomemben plus eToro so njegove dejavnosti socialnega trgovanja, vključno z OpenBook, ki novim strankam omogoča kopiranje trgovanja z najboljšimi platformami. Njegove funkcije socialnega trgovanja so vrhunske, vendar eToro izgublja točke zaradi pomanjkanja valutnih parov, s katerimi bi bilo mogoče trgovati, in pomanjkljivih funkcij raziskovanja in storitev za stranke

- Trgovci s kriptovalutami s sedežem v ZDA

- Vlagatelji, ki želijo CopyTrade z drugimi trgovci

- Preprost uporabniški vmesnik

- Več glavnih kriptovalut in altcoinov

- Razširjeno omrežje funkcij socialnega trgovanja

- Velika baza strank za posnemanje novih trgovcev

- Na voljo samo 29 kovancev

Why Is Bitcoin Useful?

Bitcoin is useful because it is a fair and transparent form of money that cannot be controlled by one person or group. Bitcoin is peer-to-peer, which means it foregoes fees charged by banks. The finite amount of Bitcoin — no more than 21 million Bitcoin in existence — can make it an inflationary hedge against overprinted fiat currencies.

With more dollars in circulation to be spent, precious assets such as gold, commodities and Bitcoin tend to rise in price because devaluation of the dollar means increased valuation of all products the dollar is used to buy. Bitcoin’s peer-to-peer network, decentralized ownership and finite supply could become a safer form of currency.

How Was Bitcoin Founded?

Bitcoin was founded by an anonymous entity by the name of Satoshi Nakamoto in 2009. Satoshi Nakamoto was active in online forums, explaining the idea behind Bitcoin, a peer-to-peer unit of money that would transform the modern banking system. Along with these forums, a Bitcoin whitepaper explained the ideology and computation behind Bitcoin.

While many have claimed to be Satoshi Nakamoto, the identity of the person or group of people remains unsolved. This plan was likely by design, as Bitcoin’s purpose is to serve as the people’s form of money without a singular leader or group in charge. This selfless act contributes to Bitcoin’s continued superiority over other crypto assets with public teams and leaders.

How Is Bitcoin’s Network Secured?

The Bitcoin network pays miners to secure the blockchain and successfully validate a block, earning 6.25 bitcoin. With the high price for mining equipment and unpredictability of getting a block, pooled mining has become more popular. Groups of miners team up and earn more consistently. Bitcoin also funds and serves as a base technology for developers who build Layer 2 solutions, such as The Lightning Network, a scaling solution to lower transaction fees.

Bitcoin’s Outlook for 2022 and Beyond

Predicting Bitcoin’s price has been a recipe for disaster. Many in the crypto space believed the price per coin would reach new all-time highs of $100,000 per coin by the end of 2021. Instead, the coin bottomed around $32,000. While still possible for Bitcoin to reach this level, experts agree that continued volatility can be expected. In the long term, crypto enthusiasts believe that Bitcoin will go up in value as adoption increases.

A common comparison is between Bitcoin and gold. Gold holds a market cap of roughly $12 trillion dollars. Bitcoin holds a market cap of under $1 trillion. If Bitcoin is able to provide a store of value similar to gold, the price per Bitcoin and its market cap could increase to more closely mirror that of gold. While this is a tall task, Bitcoin is much easier to access and spend than physical gold.

As the market continues to mature, price volatility is to be expected. Those looking to be a part of this crypto transformation need to have strong stomachs and hold on tight.

Pošta Zakaj je Bitcoin dragocen? by Reid McCrabb pojavil prvi na Na bencin. Obiščite Na bencin da bi dobili več odličnih vsebin, kot je ta.

- '

- "

- 000

- 0x

- 100

- 2021

- 2022

- 9

- O meni

- dostop

- Po

- Zakon

- Ukrep

- aktivna

- Poleg tega

- Sprejetje

- napredno

- vsi

- že

- Altcoins

- znesek

- zneski

- Analiza

- Objavi

- razglasitve

- aplikacije

- okoli

- asia

- sredstvo

- Sredstva

- Ban

- Bančništvo

- Banke

- postanejo

- počutje

- Berkshire

- Berkshire Hathaway

- BEST

- Bitcoin

- Bitcoin mining

- Block

- blockchain

- meja

- posredniki

- izgradnjo

- nakup

- Kupi bitkoin

- kupci

- Nakup

- Lahko dobiš

- ujete

- Vzrok

- povzročilo

- ceo

- predsednik

- naboj

- zaračuna

- Kitajska

- možnosti

- CNBC

- Coin

- Kovanci

- kako

- Komisija

- Blago

- Skupno

- Podjetja

- podjetje

- Koncept

- vsebina

- se nadaljuje

- bi

- države

- ustvaril

- kritično

- kripto

- cryptocurrencies

- cryptocurrency

- Zamenjava kripto valute

- plačila

- valuta

- Za stranke

- Ciper

- dan

- Decentralizirano

- Povpraševanje

- Izvedeni finančni instrumenti

- Oblikovanje

- Razvijalci

- razvoju

- digitalni

- Digitalno sredstvo

- katastrofa

- Dollar

- dolarjev

- Zgodnje

- Gospodarska

- prizadevanja

- energija

- Anglija

- oprema

- ethereum

- eToro

- Evropa

- Event

- Primer

- Izmenjava

- širi

- pričakovati

- Pričakuje

- Strokovnjaki

- dejavniki

- sejem

- Lastnosti

- Fed

- pristojbine

- Fiat

- finančna

- prva

- Za vlagatelje

- forex

- obrazec

- Ustanovljeno

- stvarno

- Skladi

- Gemini

- pridobivanje

- Globalno

- Gold

- dobro

- Vlade

- veliko

- skupina

- taksist

- strojna oprema

- visoka

- več

- držite

- drži

- HTTPS

- Ideja

- identiteta

- slika

- vključujejo

- Vključno

- Povečajte

- povečal

- Indeks

- zavarovanje

- vmesnik

- vlaganjem

- naložbe

- naložbe

- Investitor

- Vlagatelji

- Izrael

- IT

- jp morgan

- znano

- velika

- večja

- Zakoni

- vodi

- Vodja

- UČITE

- Stopnja

- LG

- strele

- Lightning Network

- malo

- LLC

- Long

- si

- ljubezen

- velika

- Način

- Tržna

- Market Cap

- tržnica

- math

- zrel

- srednje

- milijonov

- Rudarji

- Rudarstvo

- ogledalo

- Mobilni

- Denar

- več

- Morgan

- premikanje

- premikanje

- ostalo

- mreža

- Ponudbe

- Ponudbe

- na spletu

- operacije

- Priložnost

- možnosti

- Ostalo

- Outlook

- lastništvo

- partner

- ljudje

- fizično

- platforma

- Platforme

- Veliko

- strup

- Popular

- PoS

- mogoče

- potencial

- PoW

- Cena

- cenitev

- , ravnateljica

- Težave

- Postopek

- Izdelek

- Izdelki

- projekti

- dokazilo

- zaščito

- zagotavljajo

- javnega

- nakupi

- nakup

- Namen

- ocena

- dosežejo

- Uredba

- Raziskave

- Trgovina na drobno

- vrne

- pregleda

- Tveganje

- tveganja

- Tvegano

- krog

- Satoshi

- Satoshi Nakamoto

- Lestvica

- skaliranje

- začinjeno

- zavarovanje

- prodaja

- Prodajalci

- sentiment

- Storitev

- Podoben

- Enostavno

- socialna

- Rešitev

- rešitve

- SOLVE

- Vesolje

- preživeti

- Sponzorirane

- delež

- začel

- postaja

- Zaloge

- trgovina

- Strategija

- racionaliziran

- močna

- Uspešno

- dobavi

- sistem

- skupina

- tehnični

- Tehnična analiza

- Tehnologija

- Kraja

- skozi

- čas

- Boni

- orodja

- vrh

- trgovini

- trgovec

- trgovci

- Trgovanje

- transakcija

- Transakcije

- Transform

- Preoblikovanje

- pregleden

- tipično

- us

- ZDA

- uporaba

- Uporabniki

- Vrednotenje

- vrednost

- Volatilnost

- W3

- Denarnice

- Warren

- Warren Buffett

- web

- Tedenski

- Kaj

- Bela knjiga

- WHO

- brez

- delo

- vredno

- let