My son recently celebrated his fifth birthday. We had a party for him and we did the obligatory “party packs” for the children. The highlight was the bubbles. It always is. The kids ran around and showered one another in bubbles. But there weren’t as many bubbles at that party as there have been bitcoin bubble-critics, nekateri od njih so svetovno znani intelektualci.

Ne morem si pomagati, da ne bi gledal na te kritike na enak način kot na otroke na sinovi zabavi. Ne mislim tega na prizanesljiv način. Ne bi mogel biti prizanesljiv do teh intelektualnih velikanov, tudi če bi hotel biti. A iskreno, kako drugače gledate na nekoga, ki ne more (ali preprosto noče) predvideti širše perspektive?

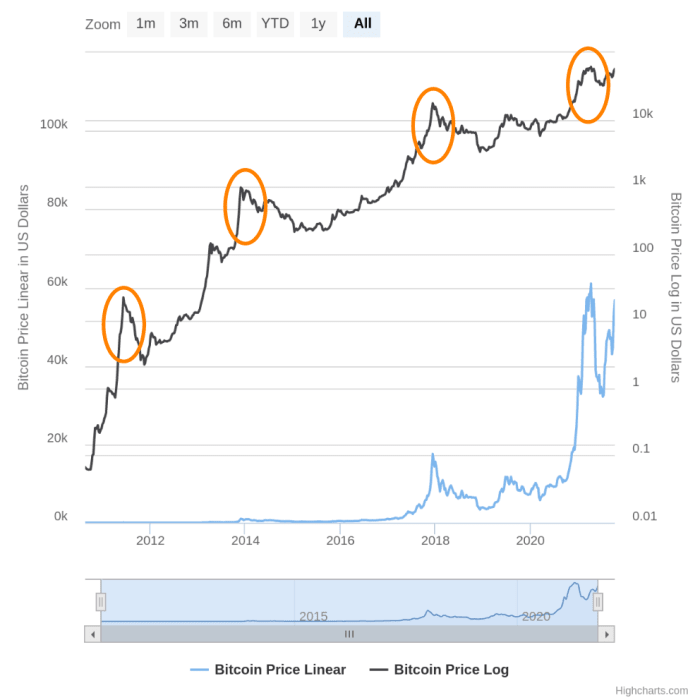

It is entirely true that bitcoin did, at various stages in its 13-year history, enter “bubble-territory” where the price was due for a major correction. But describing bitcoin itself as a bubble (in its entirety) ignores any comparison between its price history and that of other infamous bubbles.

But before I go any further I have to put a disclaimer here. I am not qualified to draw conclusions based on the technical analysis of price charts. This article only attempts to make a generalized comparison between what we know were bubbles, and bitcoin’s price history. Based on that it should be pretty clear that, whatever it is, bitcoin is something other than what is usually described as a bubble.

Bubbles pop. And while markets may recover, bubbles certainly do not re-inflate themselves again and again. If bitcoin is a bubble, it’s a magic bubble. It would be something that exists in an entirely new category unlike any other bubble we’ve ever seen before.

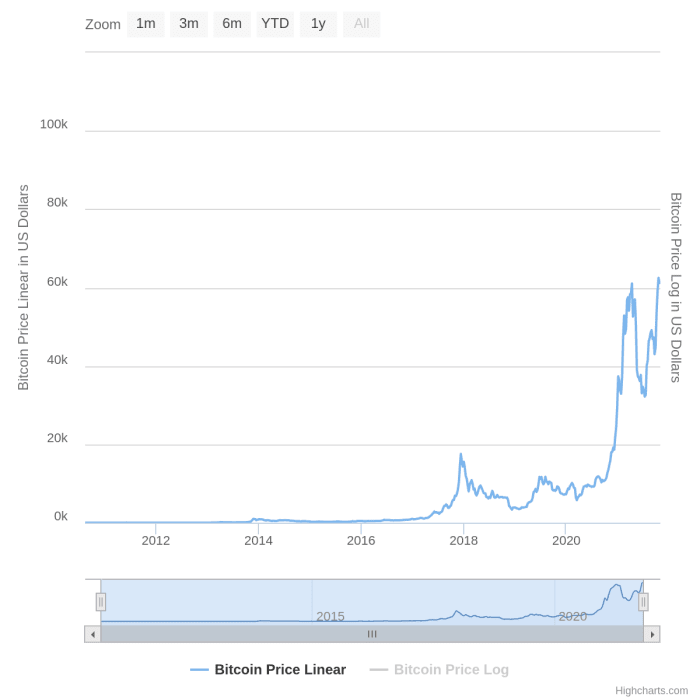

Having recently set a new all-time-high at over $68,500, the bitcoin price surpassed it’s previous all-time high of $64,000 from April 2021. Which, in turn, surpassed the December 2017 all-time high of $20,000. This has happened FIVE times in less than 13 years.

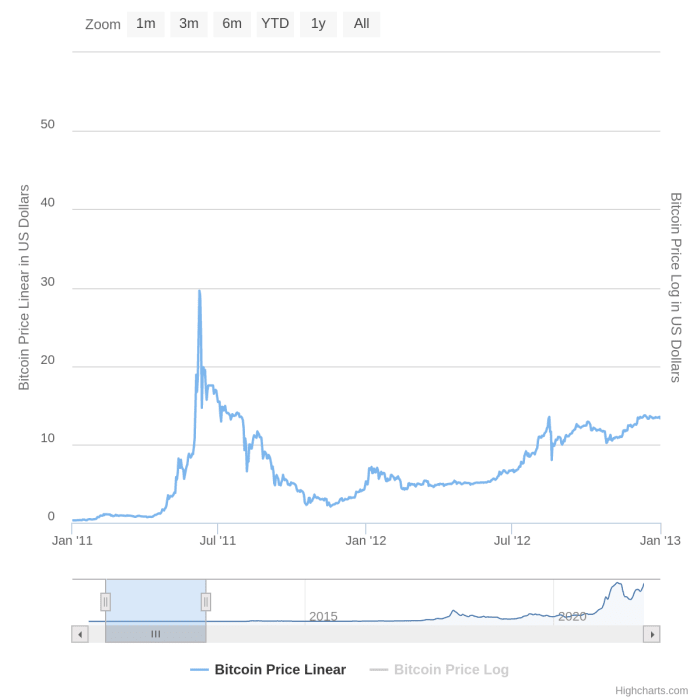

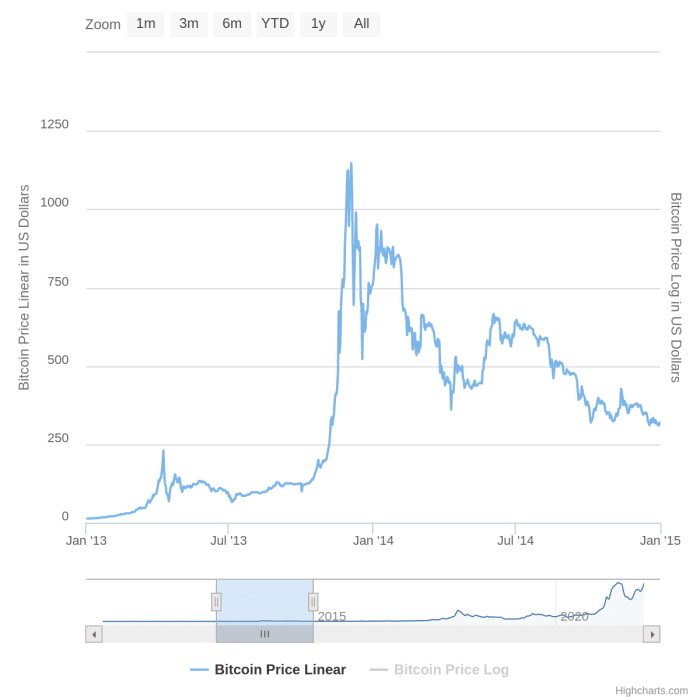

Not only that, but soon after bitcoin entered what traditional experts labelled “bubble territory” during these new successive all-time high peaks, a catastrophic “crash” of 50% – 80% always followed — only for the price to consolidate again, then build to new all-time highs at levels multiple times higher than previous records, all within relatively short periods of time. This pattern has played itself out around record highs set in mid-2011, late-2013, late-2017, April 2021 and now again in November 2021.

BTC – 1 dolar. Mehurček, strmoglavljenje. Konsolidirati.

BTC – 10 dolar. Mehurček, strmoglavljenje. Konsolidirati.

BTC – 100 dolar. Mehurček, strmoglavljenje. Konsolidirati.

BTC – 1,000 dolar. Mehurček, strmoglavljenje. Konsolidirati.

BTC – 10,000 dolar. Mehurček, strmoglavljenje. Konsolidirati.

BTC – 100,000 $ – ?

Bitcoin spominja na feniksa vstaja iz lastnega pepela osmrtnice, veliko bolj kot je podoben mehurčku. Bilo je razglašen za mrtvega multiple times since 2010 and yet, despite multiple major corrections, bitcoin has maintained a 200-odstotna letna stopnja donosa skozi vse to.

(Vir slik)

In preprosto povedano, drugi mehurčki sredstev običajno tega ne storijo.

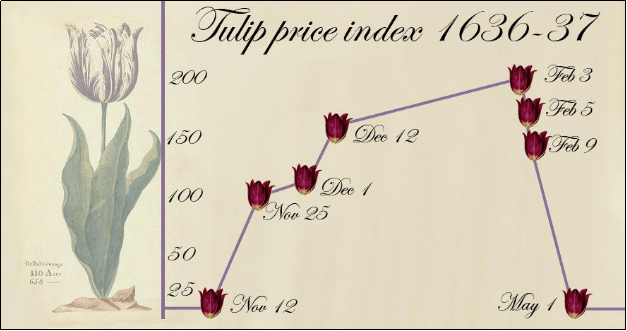

(Vir slik)

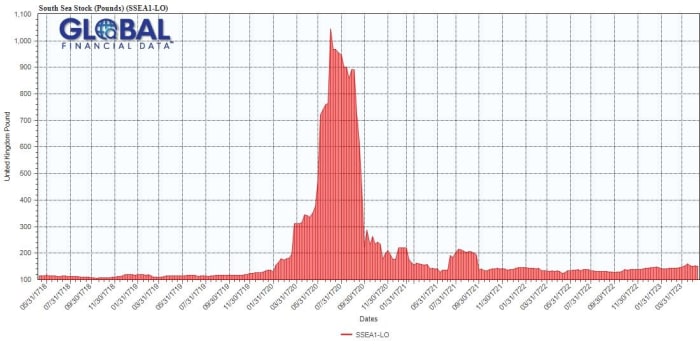

Pravzaprav nobeden od najbolj znanih mehurčkov v zgodovini tega ni storil.

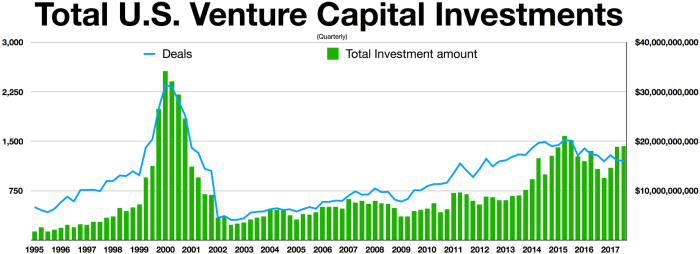

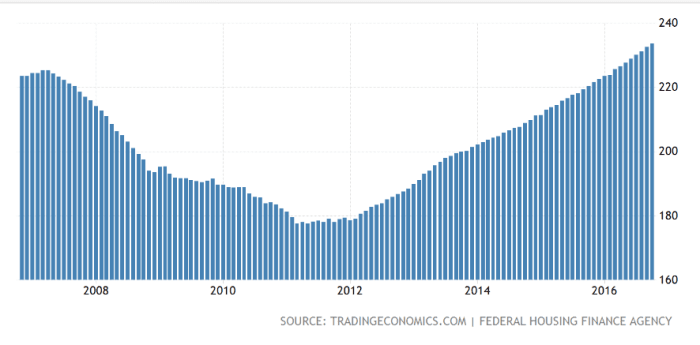

Nizozemska tulipanomanija (zgodnja 1600-ih) ne, niti South Sea Company (1700-a), zlom na Wall Streetu leta 1929 pred veliko depresijo, razcvet dot com (konec 1990-ih) ali stanovanjski balon v ZDA iz sredine 2000-ih, ki je je privedla do velike recesije 2007-2009.

(Vir slik)

Vsi so vstopili na ozemlje napihnjenih mehurčkov, strmoglavili in se nikoli več ne opomogli. Ali pa si opomogel, vendar v nič manj kot desetletju ali več.

(Vir slik)

Toda nobeden od teh, niti ameriški nepremičninski balon, ni strmoglavil in se ponovno napihnil v manj kot desetih letih. Kaj šele PETkrat v nekaj več kot desetletju na ravneh, večkrat višjih kot prej.

(Vir slik)

This makes the notion that bitcoin is a bubble less likely each and every time bitcoin does its thing. And, instead of several consecutive magically self-reinflating bubbles, even the hardcore skeptic must admit it’s beginning to look like waves of adoption.

(Vir slik)

Above is bitcoin’s all-time price history in simple linear terms, but it is deceiving because it does not give the full picture of what happened in 2011, 2013 and 2017. Seen in linear terms, 2020 and 2021 completely overshadows the other “bubbles.”

(Vir slik)

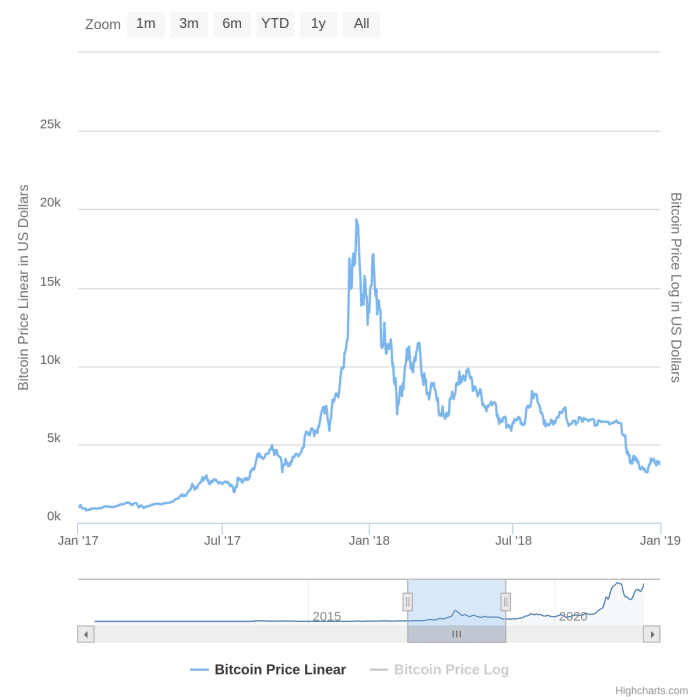

Če jih gledamo v relativnem smislu, postanejo ti »mehurčki« primerljivi: apreciacija in korekcija cene, ki ji sledi konsolidacija na ravneh, ki so precej višje od tiste, ki smo jo videli pred »mehurčkom«.

(Vir slik)

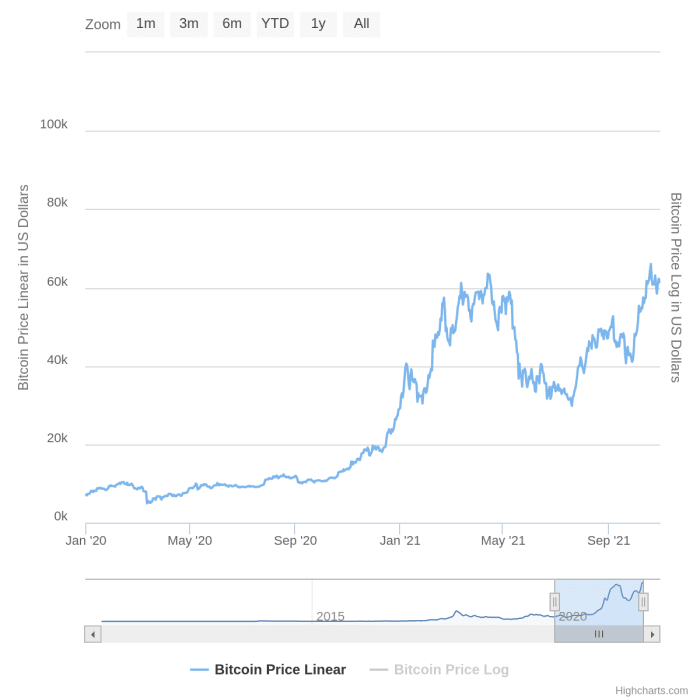

And again, in 2021, we have the same story: a sllow build-up, dramatic rise, correction, consolidation, ultimately followed by further buildup and yet another all-time high.

Zato so dnevni grafikoni uporabni. Omogoča vam, da vidite vse te "mehurčke" na istem grafikonu, vendar v logaritmični lestvici, tako da lahko cenovne cikle, ki se razlikujejo po velikostih, primerjate drug ob drugem.

Relativno gledano "mehurčki" iz let 2011, 2013, 2017 in aprila 2021 sledijo podobnemu trendu:

(Vir slik)

Modra črta linearno prikazuje ceno, z njeno lestvico na levi, ki se pomika navzgor v intervalih po 20,000 $. Medtem ko črna črta prikazuje ceno na logaritmični lestvici z njeno lestvico na desni, se pomika navzgor v večkratnikih 10X, začenši z 0.01 $, nato 0.10 $; 1 dolar; 10 $; 100 $; 1,000 $ in 10,000 XNUMX $, z oranžnimi krogi, ki poudarjajo »mehurčke«.

It seems clear that there’s a steady upward trend and that the price could be heading towards a plateau of sorts. Plus, the volatile cycles for which bitcoin has become so infamous for, are becoming less so.

I just don’t see how anyone can confuse the bitcoin price chart with any of the other charts above. And I’d welcome any effort to disprove this perspective. But I suspect that, even based purely on its price charts and ignoring all of its other paradigm-shifting fundamentals, bitcoin looks unlike any other bubble in history, no matter what chart you look at.

In če ste sumljivi ravno zato, ker je bila apreciacija cene drugačna od vsega prej, če mislite, da je zaradi tega, če ni balonček, to nekakšna Ponzijeva shema, potem obstaja množica odličnih članki kar ponazarja, zakaj temu ni tako.

“As the number of users grows, the value per coin increases. It has the potential for a positive feedback loop; as users increase, the value goes up, which could attract more users to take advantage of the increasing value.” – Satoshi Nakamoto

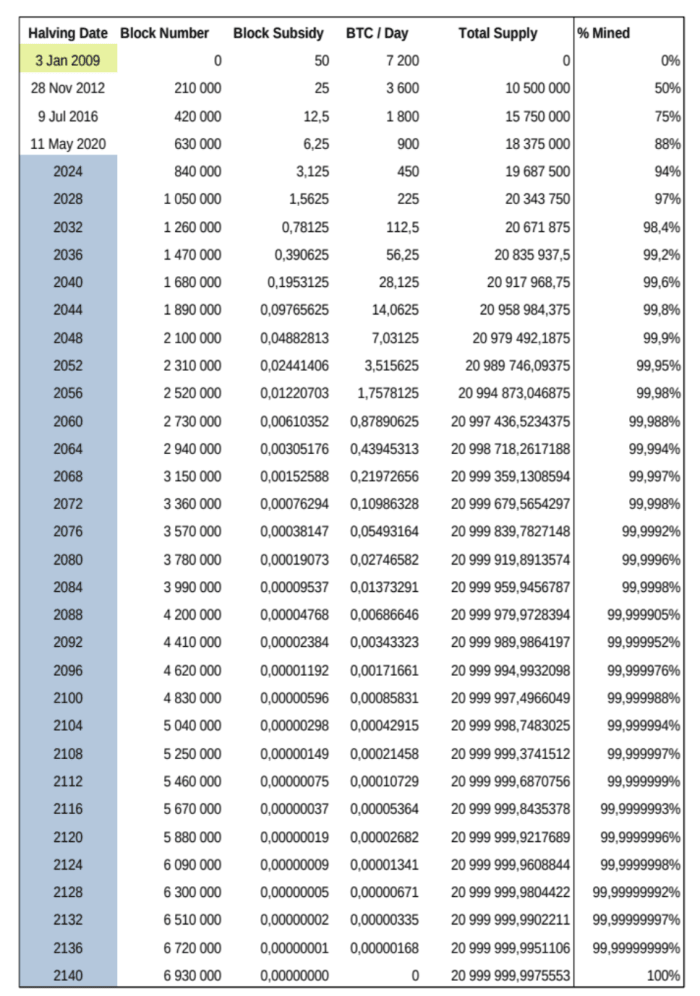

Dovolj je reči, da obstajajo trdne razlage za to zelo nenavadno zvišanje cen, najpogostejša pa je ugotovitev, da so cenovne cikle v veliki meri poganjali prepolovitvenih ciklov, which is a pre-programmed diminishing supply schedule hard coded into the Bitcoin protocol.

(Vir slik)

Z vsakim naslednjim prepolovljenjem (vsakih 210,000 blokov, ki se pojavljajo približno vsaka štiri leta) začne stabilno povpraševanje dvigovati ceno. To zvišanje cene pritegne več ljudi, ustvari več povpraševanja, še dodatno dvigne ceno, dokler ni spet začasno prekupljen in se mora popraviti.

Vendar pa se je do trenutka, ko se popravi, dovolj novih ljudi naučilo o osnovah omrežja in njegovi osnovni mehaniki, ki je 100-odstotno pregledna za tiste, ki želijo pogledati. Ti ljudje postanejo hodlerji in tako rekoč preživijo nevihto. Ker končno vrednost omrežja ni strogo opredeljena z nihajočo promptno ceno sredstva, temveč s težavami, ki jih rešuje.

Tako se oblikuje prag cene, ki je višji od prejšnjega, ki temelji na dejstvu, da vsak naslednji val za seboj pušča bolj izobražene uporabnike kot tiste, ki so bili panični in so bili odneseni v morje. Tako je pripravljena faza, da se naslednji cikel začne znova, ko pride do prepolovljenja in stabilno povpraševanje začne znova dvigovati cene.

There’s no denying it: In most cases it’s self interest and profit (or least wealth preservation) that initially attract people to Bitcoin. But those who stay, do so to learn about the technology.

Because at the end of the day, if you stay long enough, you’ll learn that the dollar value of bitcoin pales in comparison to its value as the world’s first working implementation of a fully-distributed societal coordination and consensus mechanism.

And ultimately the price history reflects the steadily-spreading understanding that bitcoin is set to change the world’s power structures forever.

To je gostujoča objava Hermanna Vivierja. Izražena mnenja so v celoti njihova in ne odražajo nujno mnenj družbe BTC Inc. Bitcoin Magazine.

Source: https://bitcoinmagazine.com/culture/bitcoin-magic-bubbles-and-history

- "

- &

- 000

- 2020

- Sprejetje

- Prednost

- vsi

- Analiza

- april

- okoli

- članek

- sredstvo

- Bitcoin

- Razpolovitev bitcoinov

- Bitcoin Cena

- črna

- Bloomberg

- boom

- zlom

- BTC

- BTC Inc.

- bubble

- izgradnjo

- ki

- primeri

- spremenite

- Charts

- Otroci

- Coin

- Skupno

- podjetje

- Soglasje

- konsolidacijo

- Popravki

- Crash

- Ustvarjanje

- datum

- Termini

- dan

- Povpraševanje

- depresija

- Podatki

- DID

- Dollar

- vozi

- vožnjo

- Nizozemski

- Zgodnje

- Event

- Strokovnjaki

- prva

- sledi

- polno

- Osnove

- veliko

- Gost

- Gost Prispevek

- Razpolovitev

- tukaj

- visoka

- Označite

- zgodovina

- Hodlerji

- Ohišje

- Kako

- HTTPS

- slika

- Povečajte

- obresti

- IT

- otroci

- UČITE

- naučili

- Led

- vrstica

- Long

- Pogledal

- velika

- Prisotnost

- mediji

- Meta

- mreža

- Pojem

- Komentarji

- naročila

- Ostalo

- Vzorec

- ljudje

- perspektiva

- slika

- ponzi

- Ponzijeva shema

- moč

- Cena

- Dobiček

- protokol

- recesija

- evidence

- Obnovi

- Satoshi

- Lestvica

- MORJE

- nastavite

- Kratke Hlače

- Enostavno

- Velikosti

- So

- svoje

- South

- Komercialni

- Stage

- bivanje

- Storm

- ulica

- dobavi

- tehnični

- Tehnična analiza

- Tehnologija

- Razmišljanje

- čas

- nas

- us

- Uporabniki

- vrednost

- Wall Street

- Wave

- valovi

- Wealth

- Kaj je

- WHO

- Wikipedia

- v

- let