Eter (ETH) price has been dealing with some strong headwinds and on Sept. 11, the price of the altcoin endured a critical test when it plunged to the $1,530 support level. In the days that followed, Ether managed to stage an impressive recovery, by surging by 6%. This resurgence may signal a pivotal moment, following a month that had seen ETH endure losses of 16%.

Tudi ob nekoliko hitrem okrevanju cenovna uspešnost etra sproža vprašanja med vlagatelji o tem, ali ima možnost, da se povzpne nazaj na 1,850 $, in izvedenih finančnih instrumentov ETH in omrežne dejavnosti bi lahko imeli ključ do te uganke.

Macroeconomic factors have played a significant role in mitigating investor pessimism given that inflation in the United States accelerated for the second consecutive month, reaching 3.7% according to the most recent CPI report. Such data reinforces the belief that the U.S. government’s debt will continue to surge, compelling the Treasury to offer higher yields.

Redka sredstva so pripravljena izkoristiti inflacijski pritisk in ekspanzivne monetarne politike, namenjene premostitvi proračunskega primanjkljaja. Vendar pa se sektor kriptovalut spopada s svojim nizom izzivov.

Regulativna negotovost in visoke omrežnine omejujejo apetit vlagateljev

There’s the looming possibility of Binance exchange facing indictment by the U.S. Department of Justice. Furthermore, Binance.US has found itself entangled in legal battles with the U.S. Securities and Exchange Commission (SEC), leading to layoffs and top executives departing from the company.

Poleg regulativnih ovir, s katerimi se soočajo kriptovalute, je bilo omrežje Ethereum priča opaznemu upadu dejavnosti pametnih pogodb, ki je v središču njegovega prvotnega namena. Omrežje se še vedno spopada z vztrajno visokimi povprečnimi provizijami, ki se gibljejo nad mejo 3 USD.

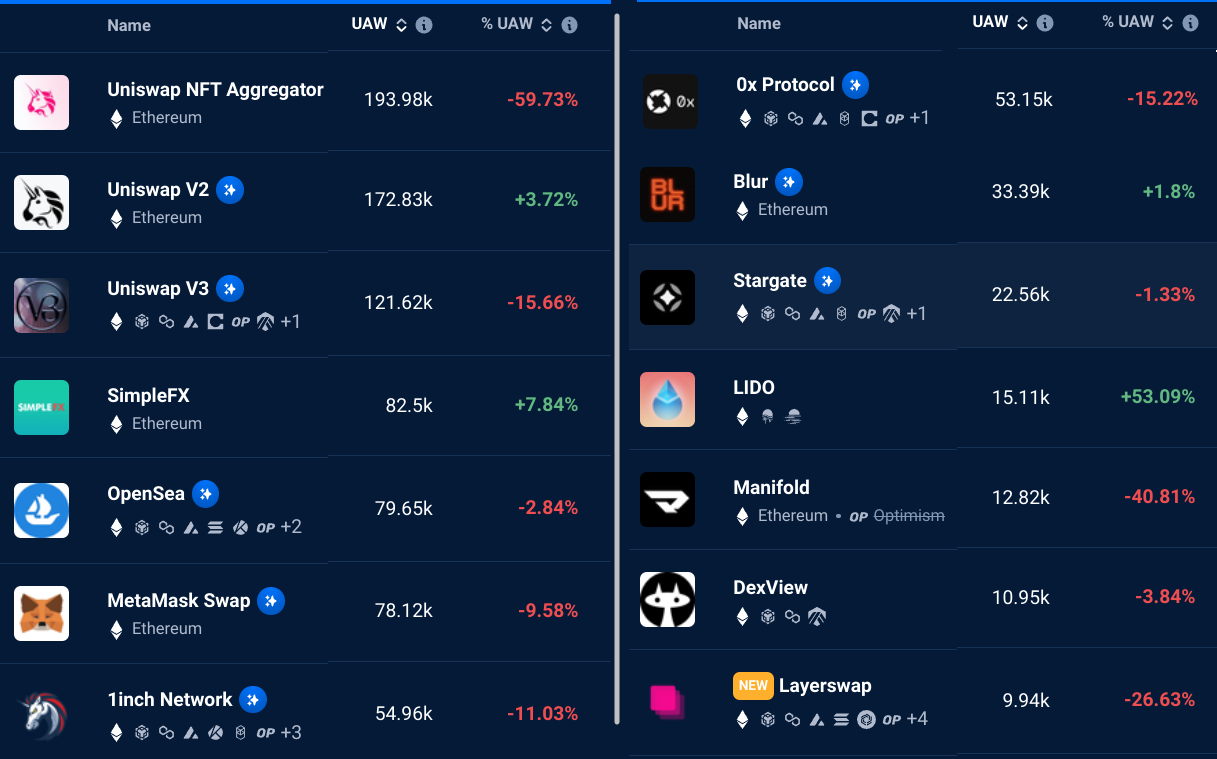

Over the past 30 days, the top Ethereum dApps have seen an average 26% decrease in the number of active addresses. An exception to this trend is the Lido (LDO) liquid staking project, which saw a 7% increase in its total value locked (TVL) in ETH terms during the same period. It’s worth mentioning that Lido’s success has been met with criticism due to the project’s dominance, accounting for a substantial 72% of all staked ETH.

Vitalik Buterin, co-founder of Ethereum, has acknowledged the need for Ethereum to become more accessible for everyday people to run nodes in order to maintain decentralization in the long term. However, Vitalik does not anticipate a viable solution to this challenge within the next decade. Consequently, investors have legitimate concerns about centralization, including the influence of services like Lido.

ETH futures and options show reduced interest from leverage longs

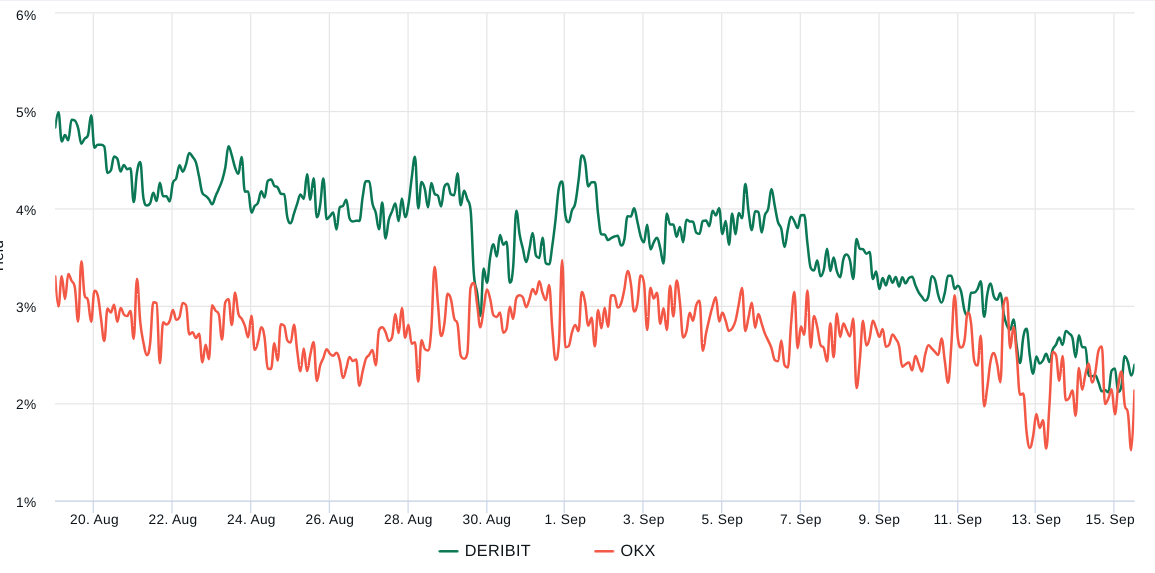

Pogled na meritve izvedenih finančnih instrumentov bo bolje razložil, kako so profesionalni trgovci z Etherjem postavljeni v trenutnih tržnih razmerah. Mesečne terminske pogodbe za eter običajno trgujejo s 5- do 10-odstotno letno premijo – stanje, znano kot contango, ki ni edinstveno za kripto trge.

Premija za terminske pogodbe na eter je dosegla najnižjo točko v treh tednih in je znašala 2.2 %, kar kaže na pomanjkanje povpraševanja po dolgih pozicijah s finančnim vzvodom. Zanimivo je, da niti 6-odstotni dobiček po ponovnem preizkusu ravni podpore 1,530 $ 11. septembra ni uspel potisniti terminskih pogodb ETH na 5-odstotni nevtralni prag.

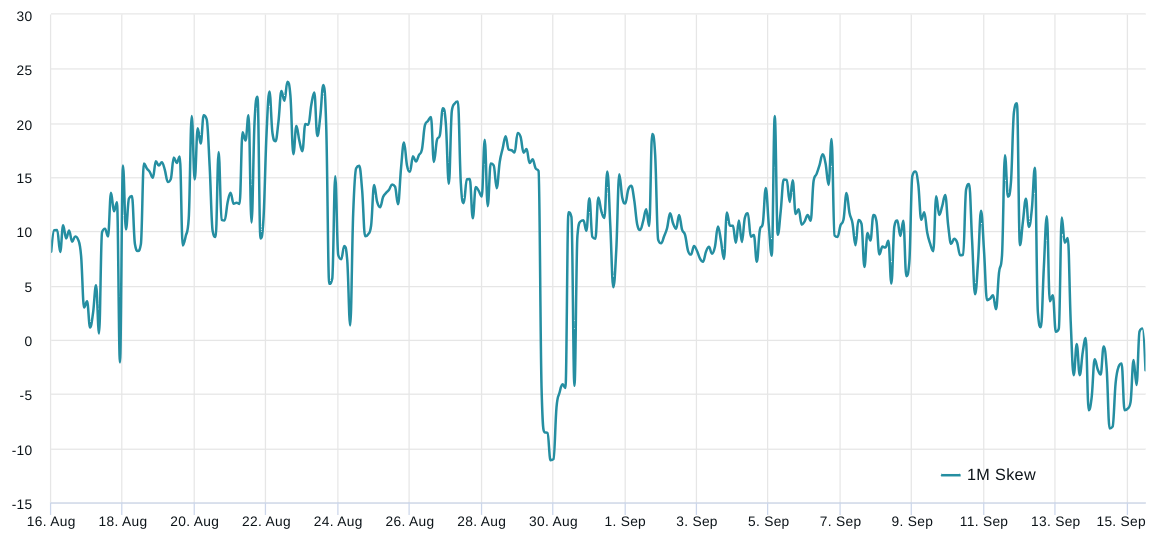

One should look at the options markets to better gauge market sentiment, as the 25% delta skew can confirm whether professional traders are leaning bearish. In short, if traders expect a drop in Bitcoin’s price, the skew metric will rise above 7%, while periods of excitement typically have a -7% skew.

On Sept. 14 the Ether 25% delta skew indicator briefly shifted to a bullish stance. This shift was driven by put (sell) options trading at an 8% discount compared to similar call (buy) options. However, this sentiment waned on Sept. 15, with both call and put options now trading at a similar premium. Essentially, Ether derivatives traders are displaying reduced interest in leverage long positions, despite the successful defense of the $1,530 price level.

On one hand, Ether has potential catalysts, including requests for a spot ETH exchange-traded fund (ETF) and macroeconomic factors driven by inflationary pressure. However, the dwindling use of dApps and ongoing regulatory uncertainties create a fertile ground for FUD. This is likely to continue exerting downward pressure on Ether’s price, making a rally to $1,850 in the short to medium term appear unlikely.

Ta članek je namenjen splošnim informacijam in ni namenjen in se ga ne sme jemati kot pravni ali naložbeni nasvet. Stališča, misli in mnenja, izražena tukaj, so izključno avtorjevi in ne odražajo ali predstavljajo nujno stališč in mnenj Cointelegrapha.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Avtomobili/EV, Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- PlatoHealth. Obveščanje o biotehnologiji in kliničnih preskušanjih. Dostopite tukaj.

- ChartPrime. Izboljšajte svojo igro trgovanja s ChartPrime. Dostopite tukaj.

- BlockOffsets. Posodobitev okoljskega offset lastništva. Dostopite tukaj.

- vir: https://cointelegraph.com/news/3-key-ethereum-price-metrics-suggest-that-eth-is-gearing-up-for-volatility

- :ima

- : je

- :ne

- $3

- $GOR

- 11

- 14

- 15%

- 2%

- 26%

- 30

- a

- O meni

- nad

- pospešeno

- dostopen

- Po

- priznali

- aktivna

- dejavnost

- naslovi

- nasveti

- Namerjen

- vsi

- sam

- Altcoin

- med

- an

- in

- enoletno

- pričakujte

- zdi

- SE

- članek

- AS

- Sredstva

- At

- povprečno

- nazaj

- bitke

- BE

- Medvjedast

- postanejo

- bilo

- prepričanje

- koristi

- Boljše

- binance

- Izmenjava binanc

- BINANCE.US

- tako

- premostitev

- Na kratko

- proračun

- Bikovski

- buterin

- nakup

- by

- klic

- CAN

- katalizatorji

- Centralizacija

- izziv

- izzivi

- plezanje

- So-ustanovitelj

- Soustanovitelj Ethereuma

- Cointelegraph

- Komisija

- podjetje

- v primerjavi z letom

- prepričljiv

- Skrbi

- Pogoji

- Potrdi

- zaporedna

- Posledično

- contango

- naprej

- Naročilo

- Core

- CPI

- ustvarjajo

- kritično

- kritika

- kripto

- Crypto Markets

- cryptocurrencies

- cryptocurrency

- Trenutna

- DApps

- datum

- Dnevi

- deliti

- Dolg

- desetletje

- decentralizacija

- Zavrni

- zmanjša

- Defense

- PRIMANJKALJ

- Delta

- Povpraševanje

- Oddelek

- oddelek za pravosodje

- Izvedeni finančni instrumenti

- Kljub

- Popust

- prikazovanje

- do

- ne

- Prevlada

- navzdol

- vozi

- Drop

- 2

- med

- v bistvu

- ETF

- ETH

- Eter

- eter terminske pogodbe

- ethereum

- ethereum dapps

- omrežje ethereum

- Cena Ethereuma

- Tudi

- vsak dan

- izjema

- Izmenjava

- s katerimi se trguje na borzi

- Vznemirjenje

- vodstvo

- ekspanziven

- pričakovati

- Pojasnite

- izražena

- soočen

- s katerimi se sooča

- dejavniki

- pristojbine

- sledili

- po

- za

- je pokazala,

- iz

- FUD

- Sklad

- Poleg tega

- Terminske pogodbe

- Gain

- merilnik

- gonila

- splošno

- dana

- vlada

- Igrišče

- imel

- strani

- Imajo

- čelni vetrovi

- tukaj

- visoka

- več

- hit

- držite

- Kako

- Vendar

- HTTPS

- Ovir

- if

- Impresivno

- in

- Vključno

- Povečajte

- Indeks

- Kazalec

- inflacija

- Inflacijski

- vplivajo

- Podatki

- namenjen

- obresti

- v

- naložbe

- Investitor

- Vlagatelji

- IT

- ITS

- sam

- Justice

- Ključne

- znano

- Pomanjkanje

- odpuščanje

- LDO

- vodi

- Pravne informacije

- legitimno

- Stopnja

- Vzvod

- finančni vzvod

- LIDO

- kot

- Verjeten

- LIMIT

- Tekočina

- vložki tekočine

- zaklenjeno

- Long

- Poglej

- statve

- izgube

- najnižja

- Makroekonomsko

- vzdrževati

- Izdelava

- upravlja

- znamka

- Tržna

- tržnih pogojih

- tržne občutke

- Prisotnost

- Maj ..

- srednje

- pol

- meritev

- Meritve

- morda

- ublažitev

- Trenutek

- Denarno

- mesec

- mesečno

- več

- Najbolj

- nujno

- Nimate

- mreža

- Nevtralna

- Naslednja

- vozlišča

- opazen

- zdaj

- Številka

- of

- ponudba

- on

- ONE

- v teku

- Komentarji

- možnosti

- Možnosti Trading

- or

- Da

- izvirno

- lastne

- preteklosti

- ljudje

- performance

- Obdobje

- obdobja

- vztrajno

- pesimizem

- ključno

- platon

- Platonova podatkovna inteligenca

- PlatoData

- igral

- potopljen

- Točka

- pripravljen

- politike

- pozicioniran

- pozicije

- potencial

- Premium

- tlak

- Cena

- strokovni

- Projekt

- Namen

- namene

- Push

- dal

- puzzle

- vprašanja

- povečuje

- rally

- uvrstitev

- dosegli

- nedavno

- okrevanje

- Zmanjšana

- odražajo

- regulatorni

- okrepi

- poročilo

- predstavljajo

- zahteva

- Rise

- vloga

- Run

- s

- Enako

- Videl

- SEC

- drugi

- sektor

- Vrednostni papirji

- Securities and Exchange Commission

- videl

- prodaja

- sentiment

- sedem

- Storitve

- nastavite

- premik

- premaknil

- Kratke Hlače

- shouldnt

- Prikaži

- Signal

- pomemben

- Podoben

- Razmere

- nagniti

- pametna

- pametna pogodba

- Rešitev

- nekaj

- nekoliko

- vir

- Stage

- Stavili

- Staking

- Države

- Še vedno

- močna

- precejšen

- uspeh

- uspešno

- taka

- predlagajte

- podpora

- ravni podpore

- prenapetost

- prenapetost

- SWIFT

- sprejeti

- Izraz

- Pogoji

- Test

- da

- O

- ta

- 3

- Prag

- do

- vrh

- Skupaj za plačilo

- skupna vrednost zaklenjena

- trgovini

- trgovci

- Trgovanje

- TradingView

- zakladnica

- Trend

- TVL

- tipično

- nas

- Ministrstvo za pravosodje ZDA

- Ameriška vlada

- Ameriški vrednostni papirji

- Ameriška komisija za vrednostne papirje in borzo

- negotovosti

- Negotovost

- edinstven

- Velika

- Združene države Amerike

- malo verjetno

- us

- uporaba

- vrednost

- preživetja

- ogledov

- vitalik

- Volatilnost

- je

- Weeks

- kdaj

- ali

- ki

- medtem

- bo

- z

- v

- priča

- vredno

- donosov

- zefirnet