Konsolidacija na področju rudarjenja bitcoinov je po besedah vodilnih v panogi še vedno na začetku.

The industry will likely hit a “pain point” high in the fourth quarter — with more transactions happening — if it continues in the same trajectory, Argo Blockchain CEO Peter Wall argued Tuesday during a panel at the Digital Asset Summit.

Komentarji so prišli nekaj dni po tem, ko je bitcoin rudar CleanSpark objavil svojo drugi prevzem rudarskega objekta v roku enega meseca.

“That’s kind of the first we’re really seeing in this space. I would argue it’s definitely very, very early days,” said Jaime Leverton, CEO of Hut 8. “We’ve seen miners sell bitcoin (…), sell machines as well sell infrastructure, in order to cover some of their capital obligations. When when you run out of things to sell, that’s when you actually start to see some real opportunities for M&A and consolidation.”

While “market stress is starting to bubble up,” BTIG analyst Gregory Lew said it “may be too early for the M&A cycle to start,” in a report published this week.

“Selling non-core infrastructure locations (like we saw last week) to increase liquidity makes sense in the near-term,” he added.

CleanSpark je uspel izkoristiti trenutne tržne razmere, saj je od junija pridobil več kot 16,000 rudarskih strojev s popustom in sklenil posle za nakup dveh lokacij v Georgii od Waha Technologies in Mawson Infrastructure Group, ki kotira na Nasdaqu.

Argo’s Wall anticipates more of these types of asset transactions in the future rather than M&A deals. He has also seen that in past market cycles, for example with Riot’s nakup Whinstone, obrat v Teksasu, ki je bil prej v lasti Northern Data.

“All of us have baggage, all of us have management teams, some of us have debt,” he said. “How you put those together is more complicated (…) so if you’re able to acquire either infrastructure or rig and leave out all the rest of the baggage, then it’d be a fortress.”

Posel CleanSpark ni razpakiran

CleanSpark’s acquisition “improves operating leverage” and drives hash rate growth “beyond Street expectations,” according to a nedavno poročilo analitika Chardan Research.

“CLSK will likely remain opportunistic, potentially pursuing similar bolt-on acquisitions,” the Chardan analysts wrote.

Comments from CleanSpark’s leadership suggest continued attention on this front.

“The market has been preparing all summer for consolidation, and we are pleased to be on the acquiring side,” CleanSpark CEO Zach Bradford said last month. “Our focus on sustainability and maximizing value for our stakeholders have put us in a unique position to take advantage of the unprecedented opportunities that the current market has created.”

Mawson’s chief commercial officer Nick Hughes-Jones told The Block that the deal was a “win-win for both parties,” with CEO James Manning adding that the company will now focus its energy on its other facilities in the US.

Leverton je med torkovim dogodkom dejal, da je glede tega, kdo bo prišel naprej, ko se težave na trgu umirijo, veliko odvisno od tega, kako so se podjetja pripravila na upad trga.

“Those people in the space that have that have very healthy balance sheets, I think are in the best position to ultimately use this market as an opportunity to build and come out of it stronger,” he said.

Številni rudarji bitcoinov so v svojih drugih četrtletjih zabeležili znatne neto izgube, vključno s CleanSparkom, ki je poročal o 29.3 milijona dolarjev čiste izgube v najbolj produktivnem četrtletju doslej, kar zadeva izrudane bitcoine (964 BTC, 7-odstotno povečanje v primerjavi s prejšnjim četrtletjem).

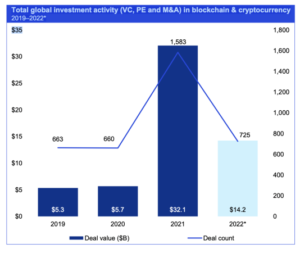

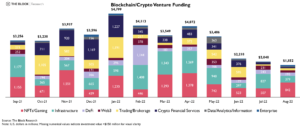

Declining bitcoin prices (around 50% down in the past six months) and rising power prices have thinned bitcoin miners’ margins in recent months. Monthly mining revenues have also gone down consistently since October of last year — $1.72 billion versus $656.97 million last month, according to data from The Block’s Data Dashboard.

© 2022 The Block Crypto, Inc. Vse pravice pridržane. Ta članek je na voljo samo v informativne namene. Ni na voljo ali namenjen uporabi kot pravni, davčni, naložbeni, finančni ali drug nasvet.

- Bitcoin

- Bitcoin trg

- Bitcoin mining

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- coinbase

- coingenius

- Soglasje

- konsolidacijo

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- Združitve in prevzemi

- Rudarstvo

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- Platoblockchain

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- Blok

- W3

- zefirnet