Predstavitev

This report provides a comprehensive analysis of Bitcoin (BTC) for 4 July 2023. The data includes real-time price, volume, bid/ask, day’s range, technical indicators, and moving averages.

Pregled cene in obsega

As of 6:41 a.m. UTC on 4 July 2023, on Binance, Bitcoin is trading at $31,020.0, up by $343.1 (+1.12%) from its previous close. The trading volume over the last 24 hours was 48,609 BTC. The bid price is $31,020.0, and the ask price is $31,020.0. The day’s range is between $30,570.3 and $31,380.0.

Tehnični indikatorji

Tehnični indikatorji se uporabljajo za napovedovanje prihodnjih gibanj cen in tržnih trendov.

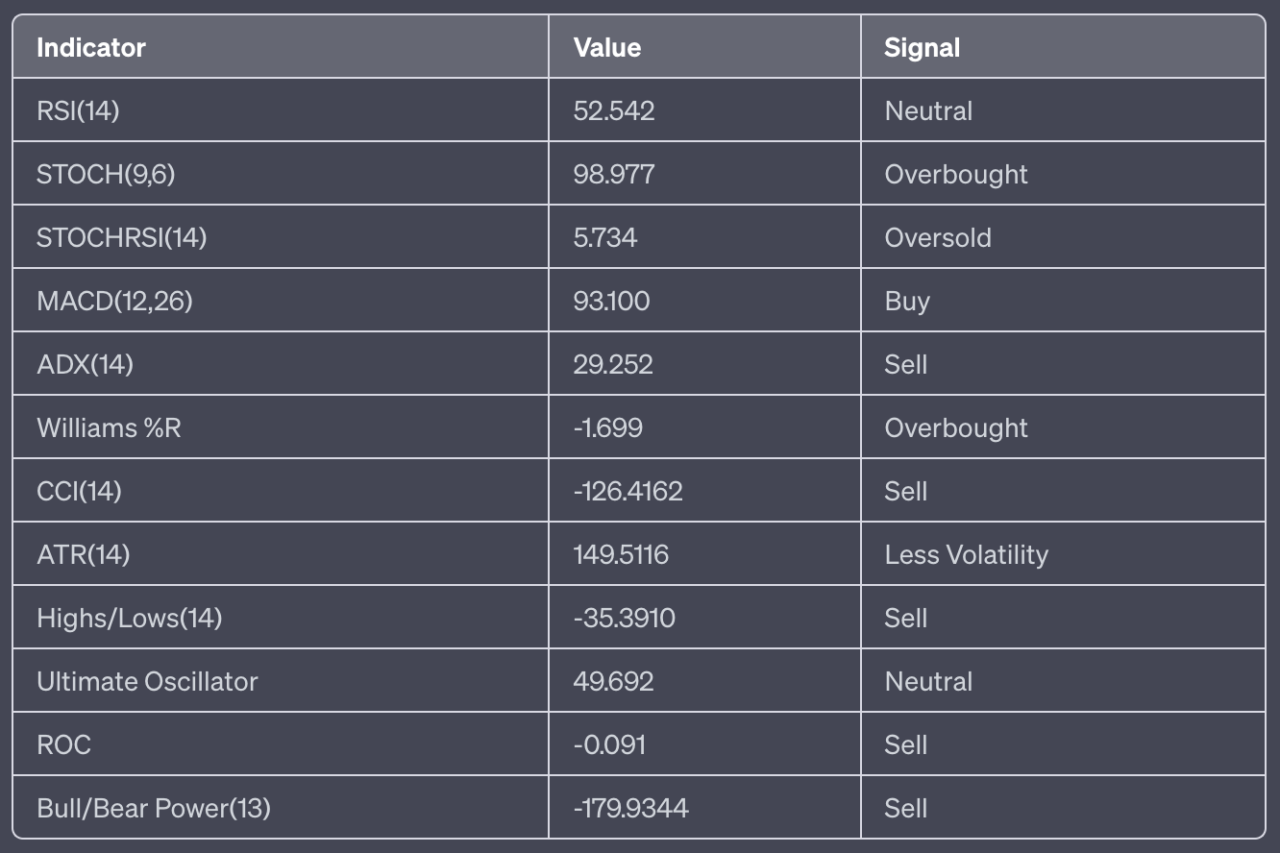

Here’s a detailed breakdown of the technical indicators for Bitcoin (BTC):

- RSI(14): The 14-day Relative Strength Index is 52.542, indicating a neutral position. The RSI measures the speed and change of price movements on a scale of 0 to 100. Traditionally, the asset is considered overbought when the RSI is above 70 and oversold when it’s below 30. In this case, BTC is in the neutral range, suggesting a balanced market condition.

- STOCH(9,6): The Stochastic Oscillator is 98.977, indicating an overbought condition. This momentum indicator compares a particular closing price of the asset to a range of its prices over a certain period of time. The current value suggests that BTC is closer to its highs than its lows, which is typically viewed as a bullish signal but also suggests a potential price correction due to overbought conditions.

- STOCHRSI(14): Stohastični RSI je 5.734, kar kaže na stanje preprodanosti. To je indikator tehničnega zagona, ki primerja raven RSI z njegovim visoko-nizkim razponom v določenem časovnem obdobju. Stanje preprodanosti bi lahko pomenilo priložnost za nakup, saj bi se lahko cena kmalu zvišala.

- MACD(12,26): The Moving Average Convergence Divergence is 93.100, indicating a buy position. The MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price. The MACD line crossing below the signal line can be a bearish signal, and when it crosses above, it can be a bullish signal. In this case, the MACD line is above the signal line, indicating a bullish signal.

- ADX(14): The Average Directional Index is 29.252, indicating a sell position. The ADX is used to measure the strength or weakness of a trend, not the actual direction. Values above 25 may indicate a strong trend.

- Williams %R: The Williams %R is -1.699, indicating an overbought condition. This momentum indicator measures overbought and oversold levels. Readings above -20 are considered overbought, and readings below -80 are considered oversold. The current reading suggests that BTC is in an overbought condition.

- CCI(14): Indeks blagovnih kanalov je -126.4162, kar kaže na prodajno pozicijo. CCI je oscilator, ki temelji na zagonu in se uporablja za pomoč pri ugotavljanju, kdaj naložbeno sredstvo doseže stanje prekupljenosti ali preprodanosti. CCI nad 100 lahko kaže na stanje prekupljenosti, medtem ko CCI pod -100 lahko nakazuje stanje preprodanosti.

- ATR(14): The Average True Range is 149.5116, indicating less volatility. The ATR is atechnical analysis indicator that measures market volatility by decomposing the entire range of an asset price for that period. Lower values typically represent less volatility and smaller price movements.

- Najvišje/padke (14): Vrednost je -35.3910, kar kaže na prodajno pozicijo. Ta indikator se uporablja za ugotavljanje najvišjih in najnižjih cen za sredstvo v določenem obdobju.

- Ultimate Oscillator: The value is 49.692, indicating a neutral position. This is a technical indicator that is used to measure momentum across multiple timeframes. A value below 30 often indicates an oversold condition, while a value above 70 indicates an overbought condition.

- ROC: Stopnja spremembe je -0.091, kar kaže na prodajno pozicijo. ROC je oscilator zagona, ki meri odstotek spremembe med trenutno ceno in preteklo ceno n-obdobja. Negativni ROC kaže na medvedji signal, ki nakazuje, da se cena znižuje.

- Moč bika/medveda (13): Vrednost je -179.9344, kar kaže na prodajno pozicijo. Ti indikatorji merijo razmerje moči med biki (kupci) in medvedi (prodajalci). Negativna vrednost pomeni, da imajo medvedi nadzor.

In summary, while the majority of the technical indicators suggest a “SELL” action, the overbought conditions indicated by the Stochastic Oscillator and Williams %R, as well as the oversold condition indicated by the Stochastic RSI, could suggest a potential price correction in the near future. The neutral condition indicated by the RSI and Ultimate Oscillator, however, suggests a balanced market condition for Bitcoin. The MACD indicates a “BUY” signal, suggesting a potential upward momentum.

Drseče povprečje

Drseča povprečja so vrsta tehnike glajenja podatkov, ki jo analitiki uporabljajo v tehnični analizi za prepoznavanje trendov v nizu podatkov, kot so cene delnic. Pomagajo zmanjšati šum in nihanje v podatkih o cenah, da predstavijo bolj gladko linijo in tako lažje vidijo splošno smer ali trend.

Tukaj je podrobna razčlenitev drsečih povprečij za Bitcoin (BTC):

Enostavno drseče povprečje (SMA)

<!–

-> <!–

->

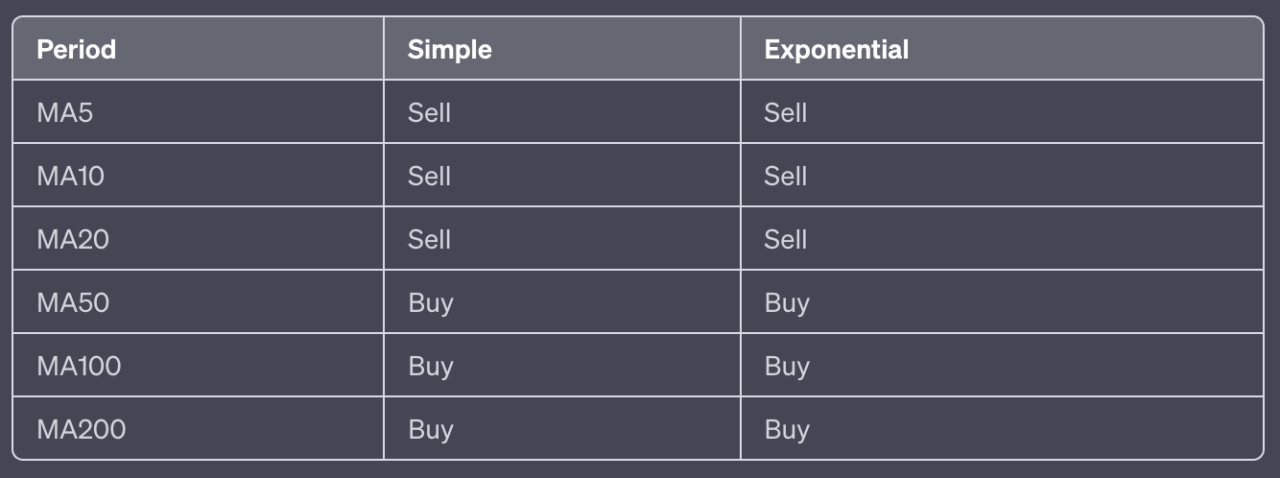

MA5: The 5-day SMA is at 31102.5, which is above the current price. This is a sell signal, suggesting that the price is trending downward in the short term. MA10: The 10-day SMA is at 31125.0, which is above the current price. This is a sell signal, suggesting that the price is trending downward in the short term. MA20: The 20-day SMA is at 31029.5, which is above the current price. This is a sell signal, suggesting that the price is trending downward in the medium term. MA50: The 50-day SMA is at 30762.2, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the medium term. MA100: The 100-day SMA is at 30651.6, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the long term. MA200: The 200-day SMA is at 30519.4, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the long term.

Eksponentno drseče povprečje (EMA)

MA5: The 5-day EMA is at 31066.8, which is above the current price. This is a sell signal, suggesting that the price is trending downward in the short term. MA10: The 10-day EMA is at 31081.2, which is above the current price. This is a sell signal, suggesting that the price is trending downward in the short term. MA20: The 20-day EMA is at 31019.9, which is above the current price. This is a sell signal, suggesting that the price is trending downward in the medium term. MA50: The 50-day EMA is at 30844.5, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the medium term. MA100: The 100-day EMA is at 30700.3, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the long term. MA200: The 200-day EMA is at 30370.3, which is below the current price. This is a buy signal, suggesting that the price is trending upward in the long term.

In summary, the moving averages suggest a neutral signal for Bitcoin, with six buy signals and six sell signals. The short-term trend, indicated by the 5-day, 10-day, and 20-day both simple and exponential moving averages, is bearish. However, the medium and long-term trends, indicated by the 50-day, 100-day, and 200-day moving averages, are bullish. This suggests a potential for price recovery in the longer term despite the short-term downward trend.

zaključek

In conclusion, as of 4 July 2023, the market sentiment for Bitcoin (BTC) is mixed. The comprehensive analysis of various technical indicators suggests a bearish sentiment, with five sell signals, one buy signal, and two neutral signals. The overbought conditions indicated by the Stochastic Oscillator and Williams %R, as well as the oversold condition indicated by the Stochastic RSI, could suggest a potential price correction in the near future.

The moving averages, on the other hand, present a neutral signal, with an equal number of buy and sell signals. The short-term trend, indicated by the 5-day, 10-day, and 20-day both simple and exponential moving averages, is bearish. However, the medium and long-term trends, indicated by the 50-day, 100-day, and 200-day moving averages, are bullish. This suggests a potential for price recovery in the longer term despite the short-term downward trend.

Despite these mixed signals, the overall trend for Bitcoin is neutral, suggesting that the price could go in either direction in the long term. It’s important to note that these insights are based on the current market conditions and historical data, and market dynamics can change rapidly. Therefore, investors should use these insights in conjunction with other market information and their own research when making investment decisions.

Kreditna predstavljena slika: Fotografija / ilustracija avtor “Dylan Calluy”Prek Unsplash

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Avtomobili/EV, Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- BlockOffsets. Posodobitev okoljskega offset lastništva. Dostopite tukaj.

- vir: https://www.cryptoglobe.com/latest/2023/07/bitcoin-btc-usd-price-analysis-report-4-july-2023/

- : je

- :ne

- $GOR

- 1

- 100

- 12

- 13

- 14

- 17

- 2023

- 24

- 25

- 26%

- 30

- 49

- 70

- 8

- 9

- 98

- a

- sem

- nad

- čez

- Ukrep

- dejanska

- oglasi

- ADX

- vsi

- Prav tako

- an

- Analiza

- Analitiki

- in

- SE

- AS

- sredstvo

- At

- povprečno

- povprečni smerni indeks

- Ravnovesje

- temeljijo

- BE

- Medvjedast

- Medvedi

- počutje

- spodaj

- med

- Ponudba

- binance

- Bitcoin

- tako

- Razčlenitev

- BTC

- BTC / USD

- Bikovski

- Biki

- vendar

- nakup

- kupci

- Nakup

- by

- CAN

- primeru

- nekatere

- spremenite

- Channel

- Zapri

- bližje

- zapiranje

- blago

- celovito

- Sklenitev

- stanje

- Pogoji

- veznik

- šteje

- nadzor

- Konvergenca

- bi

- kredit

- Trenutna

- datum

- odločitve

- Kljub

- podrobno

- Ugotovite,

- smer

- Razhajanja

- navzdol

- 2

- dinamika

- lažje

- bodisi

- EMA

- Celotna

- enako

- eksponentna

- nihanje

- za

- iz

- Prihodnost

- Prihodnja cena

- Go

- strani

- pomoč

- najvišja

- Najvišje

- zgodovinski

- URE

- Vendar

- HTTPS

- identificirati

- slika

- Pomembno

- in

- vključuje

- Povečajte

- Indeks

- Navedite

- naveden

- označuje

- Kazalec

- kazalniki

- Podatki

- vpogledi

- naložbe

- Naložbeno vozilo

- Vlagatelji

- IT

- ITS

- julij

- Zadnja

- manj

- Stopnja

- ravni

- vrstica

- Long

- dolgoročna

- več

- nižje

- najnižja

- Najnižje

- MACD

- Večina

- Izdelava

- Tržna

- tržnih pogojih

- tržne občutke

- Tržni trendi

- volatilnost trga

- max širine

- Maj ..

- merjenje

- ukrepe

- srednje

- morda

- mešano

- Momentum

- gibanja

- premikanje

- drseče povprečje

- drseče povprečje

- več

- Blizu

- negativna

- Nevtralna

- hrup

- Številka

- of

- pogosto

- on

- ONE

- Priložnost

- or

- Ostalo

- več

- Splošni

- pregled

- lastne

- zlasti

- preteklosti

- odstotek

- Obdobje

- platon

- Platonova podatkovna inteligenca

- PlatoData

- Stališče

- potencial

- moč

- napovedati

- predstaviti

- prejšnja

- Cena

- Analiza cen

- Cene

- zagotavlja

- območje

- hitro

- Oceniti

- dosegli

- reading

- v realnem času

- okrevanje

- zmanjša

- Razmerje

- relativna

- indeks relativne trdnosti

- poročilo

- predstavljajo

- Raziskave

- RSI

- Lestvica

- Zaslon

- zasloni

- glej

- prodaja

- Prodajalci

- sentiment

- nastavite

- Kratke Hlače

- kratkoročno

- shouldnt

- Razstave

- Signal

- signali

- Enostavno

- SIX

- velikosti

- GURS

- manj

- bolj gladko

- Kmalu

- hitrost

- zaloge

- moč

- močna

- taka

- predlagajte

- Predlaga

- POVZETEK

- tehnični

- Tehnična analiza

- Izraz

- kot

- da

- O

- njihove

- zato

- te

- jih

- ta

- čas

- do

- Trgovanje

- obseg trgovanja

- tradicionalno

- Trend

- trending

- Trends

- Res

- dva

- tip

- tipično

- Končni

- navzgor

- zagon navzgor

- uporaba

- Rabljeni

- UTC

- vrednost

- Vrednote

- različnih

- vozilo

- Volatilnost

- Obseg

- je

- šibkost

- Dobro

- kdaj

- ki

- medtem

- Williams

- z

- zefirnet