The Australian dollar has started the trading week with sharp losses. AUD/USD is down 0.70% in Europe, trading at 0.6704.

China jitters send Australian dollar tumbling

Covid cases continue to rise in China despite the government’s zero-Covid policy, and the mass lockdowns have triggered protests across China. The demonstrators have clashed with police and some have even called for Chinese President Xi to step down. The scale of the unrest has sent jitters through the global markets, which are expected to cause new supply-chain issues and chill domestic demand.

The unrest in China has put a damper on risk appetite and sent the US dollar higher. The Australian dollar is particularly sensitive to developments in China, as the Asian giant is Australia’s number one trading partner. The Australian dollar fell more than 1% earlier today but has pared some of those losses. Still, if there is further negative news out of China, the Aussie will likely lose more ground.

Adding to the Australian dollar’s woes was a soft retail sales report for October. Retail sales fell 0.2% MoM, down from 0.6% in September and below the consensus of 0.4%. It was the first decline since December 2021 and will renew concerns that the domestic economy is slowing down due to the Reserve Bank of Australia’s steep rate-hike cycle. The RBA has eased the pace of hikes but remains wary of a wage-price spiral, and Governor Lowe has warned that the central bank will not hesitate to return to oversize rate hikes if needed.

After an abbreviated week due to the Thanksgiving holiday, it’s a busy week for US releases. CB Consumer Confidence will be released on Tuesday, with the November report expected to dip to 100.0, down from 102.5. The key release of the week is nonfarm payrolls on Friday, which could have a major impact on the Fed’s decision to raise rates by 50 or 75 basis points at the December 14th meeting. Currently, the likelihood of a 50-bp hike is about 75%, versus 25% for a larger 75-bp increase.

.

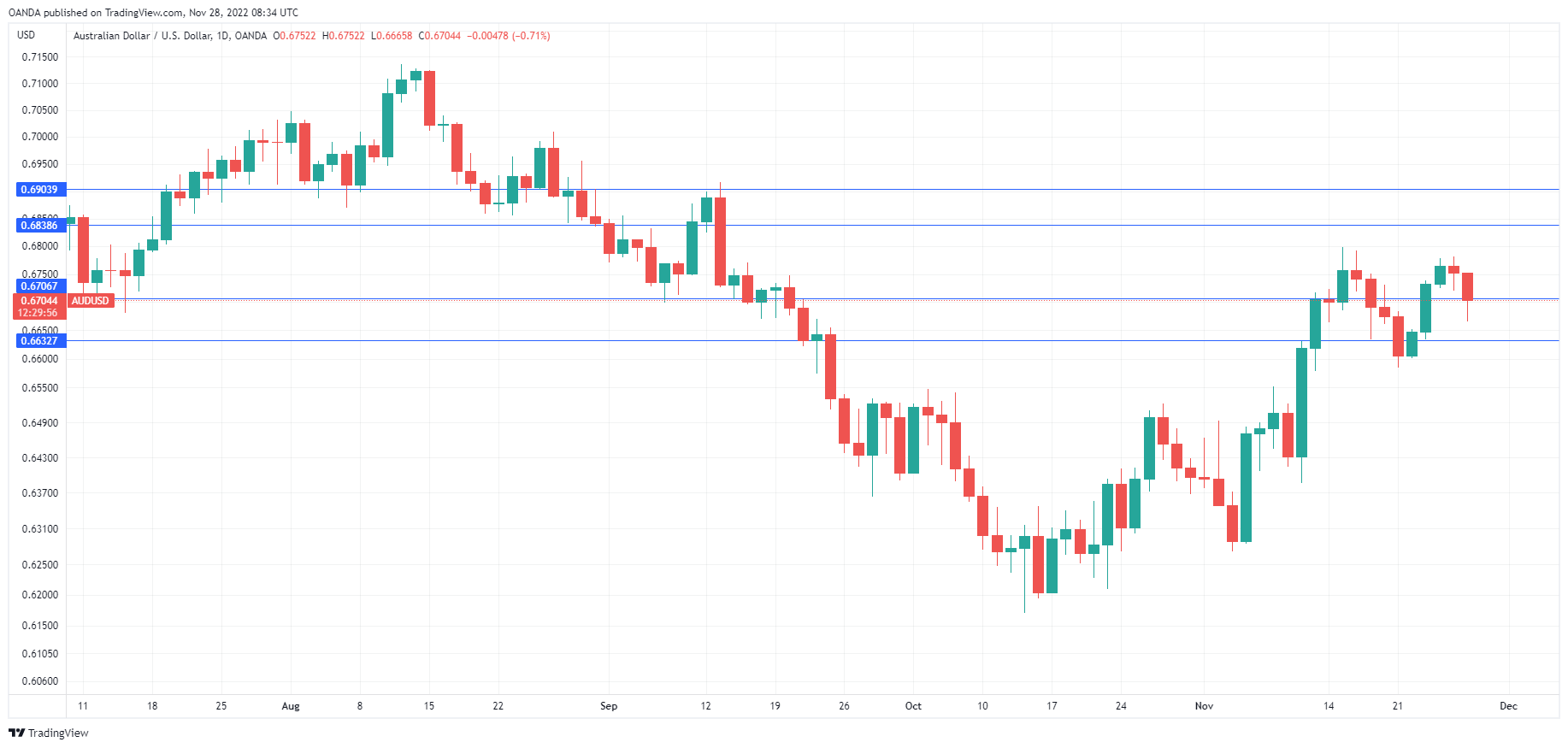

AUD / USD Tehnični

- AUD / USD testira podporo pri 0.6706. Spodaj je podpora na 0.6633

- Obstaja upor pri 0.6820 in 0.6903

Ta članek je samo za splošne informacije. To ni naložbeni nasvet ali rešitev za nakup ali prodajo vrednostnih papirjev. Mnenja so avtorji; ne nujno korporacije OANDA Corporation ali katere koli njene podružnice, hčerinske družbe, uradnikov ali direktorjev. Trgovanje z vzvodom je visoko tveganje in ni primerno za vse. Lahko izgubite vsa vložena sredstva.

- AUD

- AUD / USD

- Avstralska maloprodaja

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- Centralne banke

- Zaporke zaradi covida na Kitajskem

- Kitajska zero covid politika

- coinbase

- coingenius

- Soglasje

- Covid-19

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- Sestanek obrestne mere Fed

- FX

- strojno učenje

- MarketPulse

- Novice dogodkov

- Novice

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- Platoblockchain

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- RBA

- Tehnična analiza

- Zaupanje potrošnikov US CB

- Poročilo o plačilni listi za nekmetijstvo v ZDA

- W3

- zefirnet