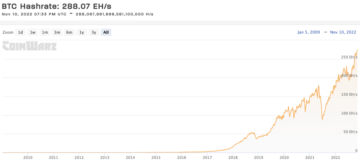

Bitcoin’s total hash rate has hit a new all-time high, according to Podatki Coin Metrics, le tedne po konec dvomesečnega obdobja kapitulacije za industrijo.

Rudarji so v bolj zahtevnem okolju postavljeni na preizkušnjo, ali lahko ohranijo donosnost. Bilance stanja padajo pod stresom, saj cena ostaja večinoma nespremenjena, medtem ko stopnja zgoščevanja in težave pri rudarjenju naraščajo.

A široka rudarska kapitulacija started in the beginning of the summer as the bitcoin price took a deep plunge, izbris vseh dobičkov, doseženih v prejšnjem letu. Pressured, most public miners who had previously committed to holding their BTC began selling their daily mined bitcoin to cover operating costs amid diminishing margins. Later, some would also start selling the BTC they had put in cold storage.

Bitcoin mining is a self-regulated market where players aim to find the cheapest energy sources and most favorable jurisdictions available around the globe in an effort to shrink costs and maximize profits. As more players join the market, it becomes more difficult to mine bitcoin. As difficulty increases, miners who were operating on low margins get flushed out of the market. To maintain 10 minutes between blocks on average, the network adjusts the mining difficulty to the downside, making it a bit easier to mine bitcoin and enabling other miners to join the industry.

With hash rate now making new highs, and a bitcoin price struggling to show signs of a sustained recovery, miners are facing a challenging environment.

“The big issue for miners right now I think is that energy costs have gone up while hash rate has gone up and bitcoin prices maintained low,” Fred Thiel, CEO of Nasdaq-listed bitcoin miner Marathon Digital Holdings, told Bitcoin Magazine.

Vendar pa po besedah Thiela vsi akterji v industriji niso enako prizadeti. "Tisti rudarji, ki so dobro pozicionirani, dobro kapitalizirani in lahko delujejo s položaja moči, bodo imeli od tega koristi."

Marathon, je trdil Thiel, je med njimi.

“Our models have been built around the fact that we believe that, for the balance of this year, bitcoin is going to grind along kind of where it is now, up and down a bit,” he said. “So, as a company, we plan around [that] scenario.”

Ko gre za pritisk na višjo globalno razpršitveno stopnjo, je Thiel trdil, da je Marathon v dobrem položaju, saj njegova lastna rast ne le zmanjša učinke novega ATH, ampak tudi sama prispeva k temu višjemu odčitku.

»Osredotočeni smo na močno povečanje stopnje zgoščevanja, s 3 EH [exahash] na 23 EH do sredine naslednjega leta,« je dejal. "Torej smo dejansko eno od podjetij, ki prispevajo k tej rasti zgoščene stopnje."

Izvršni direktor napoveduje, da se bo stopnja zgoščevanja vse leto še naprej povečevala, saj bo na farmah po vsem svetu nameščenih na tisoče naročenih strojev, ki jih drugi veliki igralci v industriji še niso dostavili.

"Bilo je veliko naročil za rudarje, ki so bili javno razkriti lani in v začetku tega leta, tako da samo domnevate, da bodo ljudje sledili tem namestitvam."

Tega pa ne moremo reči za male igralce.

»Mislim, da so ljudje, ki ne sledijo, navadno manjši rudarji, ki imajo manj kapitala. Imajo težave s financiranjem nakupa rudarjev ali pa so v položaju, ko so njihovi stroški energije šli nekoliko na glavo,« je dodal Thiel.

Miners enjoyed a prolonged honeymoon with profits in the past two years as a steep bull market ensued for the bitcoin price. Racketing incredible returns in dollar terms on HODLed coins, miners saw their margins balloon as bitcoin touched new highs. That reality prompted many companies to leverage up their business and take on debt to expand operations, a strategy that went south quickly as the bitcoin price started to plunge. Now, with rising hash rate, even more stress is put on these miners.

Geopolitične napetosti za industrijo se segrevajo, ko poročilo Bele hiše namiguje na prepoved

The new high in Bitcoin’s hash rate comes 18 months after the Chinese government banned bitcoin mining altogether, a move that cut the network’s hash rate in half as local miners turned off their machines and began relocating their operations overseas. As a result, the U.S. share of global Bitcoin hash rate increased sharply as the country posed itself as one of the main destinations for the outcast businesses. Kazakhstan and Russia also welcomed the machines.

Vendarle ZDA, ki po podatkih iz Cambridge Center za alternativne finance currently houses about 37% of Bitcoin’s global hash rate, has itself begun to show some signs of hostility toward the industry.

Zaradi skrbi glede porabe energije je Urad Bele hiše za politiko znanosti in tehnologije (OSTP) objavil a podrobno poročilo last week recommending that the Biden Administration ensure the development of Bitcoin and cryptocurrency at large in the country is accountable to concerns over climate change.

Na svojih več kot 30 straneh dokument, ki je plod Bidnov izvršni ukaz o digitalnih sredstvih od marca 2022, trdi, da čeprav lahko rudarjenje z dokazi o delu pomaga energetski industriji in podnebju na nekaterih specifičnih območjih, je njegov neto vpliv na oboje negativen. OSTP je šel tako daleč, da je administraciji in kongresu priporočil, naj razmislita o omejitvi ali popolni prepovedi uporabe dokazila o delu v ZDA.

One of the positive acknowledgments made by the report relates to the usage of bitcoin mining as a baseload energy demand mechanism.

“You’re providing extra capacity to the grid when it’s needed, and you’re not really a parasitic load on the grid because you’re behind the meter, using energy that would otherwise be wasted,” Thiel told Bitcoin Magazine. “If you position bitcoin mining behind the meter at a renewable site, you are incentivizing more renewable production.”

Thiel je tudi poudaril, da je glede na to, da so v ZDA leto vmesnih volitev, večina ostrega jezika v poročilu morda zgolj del političnih iger.

"Dogaja se veliko politikantstva in nekaj od tega je pozicioniranje s strani politikov," je trdil. "Osebno ne verjamem, da bo prišlo do splošne prepovedi dokazov o delu."

Though not impossible, it does appear that an eventual ban on PoW is very unlikely in the U.S. given the nature of its government compared to China’s, as well as the extent to which bitcoin mining is integrated into power grids and communities in the country.

However, were such an event come to fruition, the network would still be prepared to withstand such an attack. The same way the network didn’t perish when mining was banned in China –– the country with the highest share of hash rate at the time –– it is well positioned to show a similar outcome in a potential U.S. ban. Notwithstanding, the network might even be able to keep thriving in the U.S. during a ban, which is evidenced by the fact that there are still many machines hashing in China; according to CCAF, the Asian country still houses over 20% of the global Bitcoin hash rate.

- Bitcoin

- Bitcoin Magazine

- Bitcoin rudarji

- Bitcoin mining

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- poslovni

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- Feature

- hitrost hash

- strojno učenje

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- poligon

- Cena

- dokazilo o vložku

- W3

- zefirnet