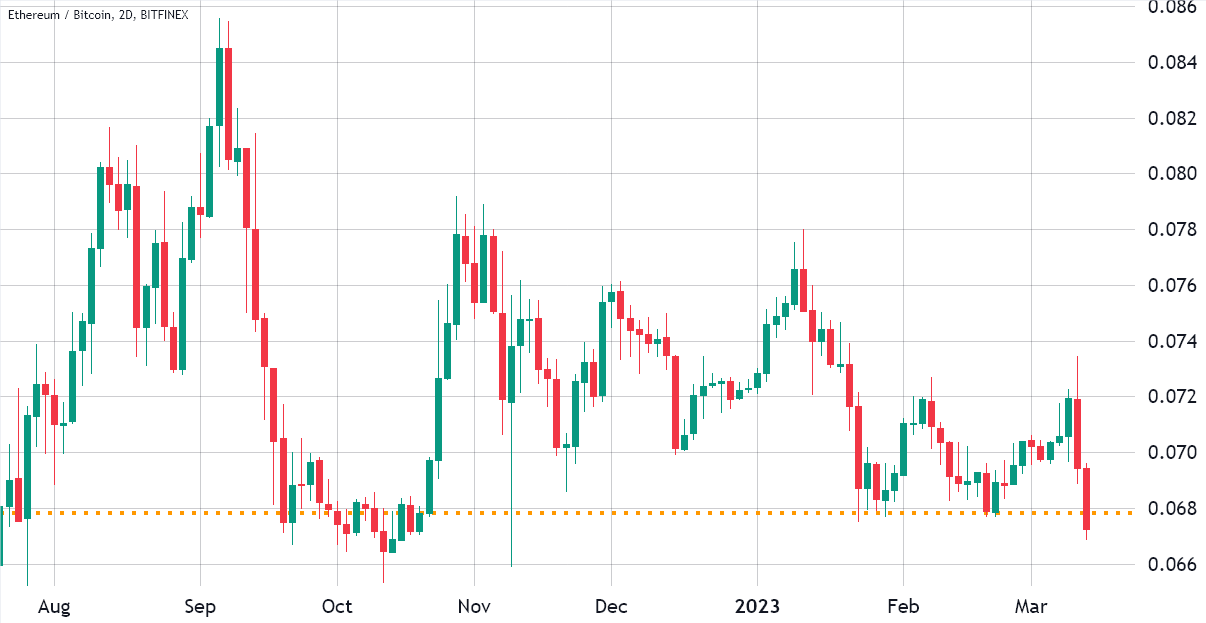

The previous six months should have been extremely beneficial to Ether’s (ETH) price, especially after the project’s most significant upgrade ever in September 2022. However, the reality was the opposite: between September 15, 2022, and March 15, 2023, Ether underperformed Bitcoin (BTC) za 10%.

The price ratio of 0.068 ETH/BTC had been holding since October 2022, a support that was broken on March 15. Whatever the reason for the underperformance, traders currently have little confidence in placing leverage bets, according to ETH futures and options data.

But first, one should consider why Ether’s price was expected to rise in the previous six months. On September 15, 2022, the Merge, a hard fork that switched the network to a proof-of-stake consensus mechanism, occurred. It enabled a much lower, even negative, coin issuing rate. But, more importantly, the change paved the way for parallel processing that aimed to bring scalability and lower transaction costs to the Ethereum network.

The Shapella hard fork, expected to take effect on the mainnet in April, is the next step in the Ethereum network upgrade. The change will allow validators who previously deposited 32 ETH to enter the staking mechanism to withdraw in part or in full. While this development is generally positive because it gives validators more flexibility, the potential 1.76 million ETH unlock is a negative consequence.

However, there is a cap on the number of validators that can exit; therefore, the maximum daily unstake is 70,000 ETH. Moreover, after exiting the validation process, one may choose between Lido, Rocket Pool, or a decentralized finance (DeFi) application for yield mechanisms. These coins will not necessarily be sold at the market.

Poglejmo Derivati etra data to understand if the recent drop below the 0.068 ETH/BTC ratio has affected investors’ sentiment.

Terminske pogodbe ETH so si opomogle od stanja panike

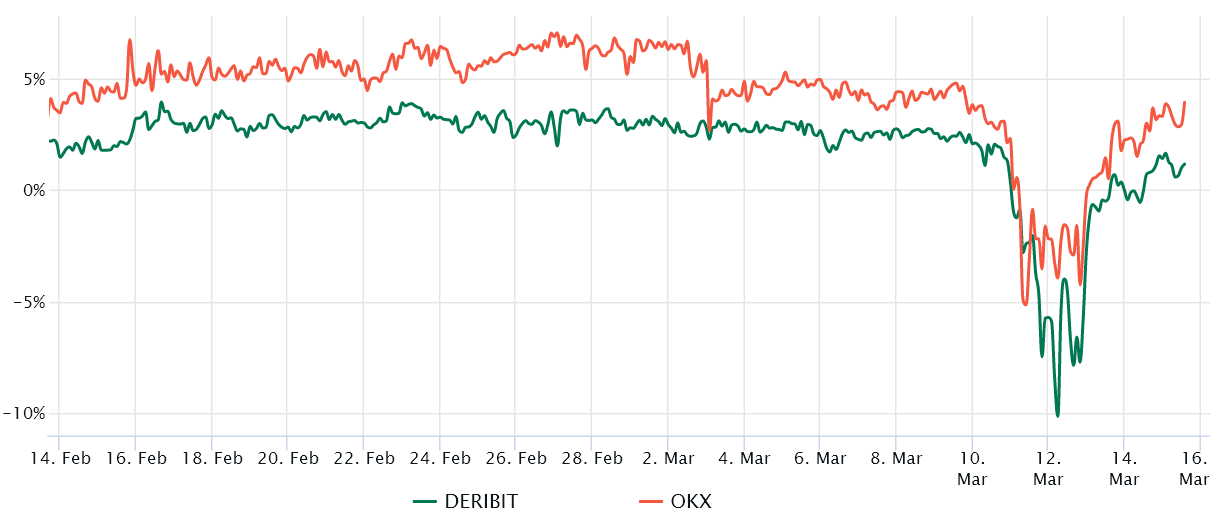

In healthy markets, the annualized three-month futures premium should trade between 5% and 10% to cover associated costs and risks. However, when the contract trades at a discount (backwardation) relative to traditional spot markets, it indicates traders’ lack of confidence and is regarded as a bearish indicator.

Trgovcem z izvedenimi finančnimi instrumenti je postalo neprijetno obdržati dolge (bikovske) pozicije s finančnim vzvodom, ko je premija terminskih pogodb za eter 11. marca padla pod ničlo, kar je manj kot 3.5 % le dva dni pred tem. Še pomembneje je, da trenutna 2.5-odstotna premija ostaja skromna in oddaljena od 5-odstotnega nevtralnega do bikovskega praga.

Nonetheless, declining demand for leverage longs (bulls) does not necessarily imply an expectation of negative price action. As a result, traders should examine Etherjevi trgi opcij razumeti, kako kiti in ustvarjalci trga cenijo verjetnost prihodnjih gibanj cen.

Povezano: Lark Davis o boju proti nevihtam družbenih medijev in zakaj je bik ETH — Hall of Flame

Možnosti ETH potrjujejo pomanjkanje nagnjenosti k tveganju

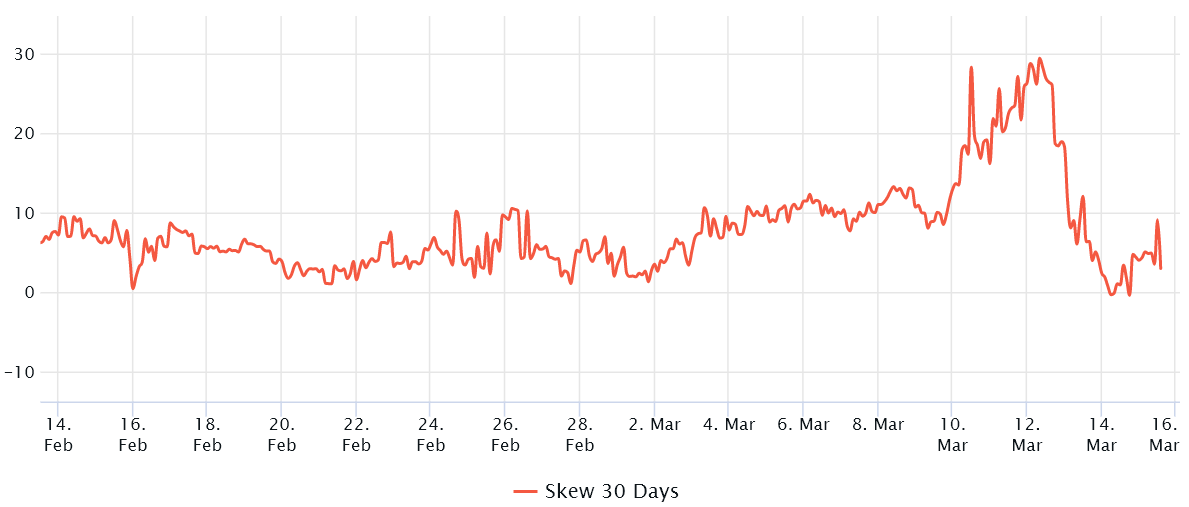

The 25% delta skew is a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection. In bear markets, options investors give higher odds for a price dump, causing the skew indicator to rise above 8%. On the other hand, bullish markets tend to drive the skew metric below -8%, meaning the bearish put options are in less demand.

3. marca je delta naklon presegel medvedji 8-odstotni prag, kar kaže na stres med poklicnimi trgovci. Raven strahu je dosegla vrhunec 10. marca, ko je cena etra padla na 1,370 $, kar je najnižja raven v 56 dneh, čeprav se je cena ETH 1,480. marca vrnila nad 12 $.

Surprisingly, on March 12, the 25% delta skew metric continued to rise, reaching its highest level of skepticism since November 2022. That happened just hours before Ether’s price rose 20% in 48 hours. That explains why ETH traders shorting futures contracts faced $507 million in likvidacije.

The 3% delta skew metric currently signals a balanced demand for ETH call and put options. When combined with the neutral stance on ETH futures premium, the derivatives market indicates that professional traders are hesitant to place either bullish or bearish bets. Unfortunately, ETH derivatives metrics do not favor traders expecting Ether to reclaim the 0.068 level against Bitcoin in the near term.

Tu so izražena stališča, razmišljanja in mnenja samo avtorji in ne odražajo nujno in ne predstavljajo stališč in mnenj Cointelegrafa.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- Platoblockchain. Web3 Metaverse Intelligence. Razširjeno znanje. Dostopite tukaj.

- vir: https://cointelegraph.com/news/ethereum-price-reaches-lowest-level-relative-to-bitcoin-in-5-months

- : je

- 000

- 1

- 10

- 11

- 2022

- 2023

- 32 ETH

- 70

- a

- nad

- Po

- Ukrep

- po

- proti

- sam

- Čeprav

- med

- in

- enoletno

- uporaba

- arbitražo

- SE

- AS

- povezan

- At

- BE

- Nosijo

- medvedji trgi

- Medvjedast

- ker

- pred

- spodaj

- koristno

- Stave

- med

- Bitcoin

- Bitfinex

- prinašajo

- Broken

- bull

- Bikovski

- Biki

- by

- klic

- CAN

- cap

- povzroča

- spremenite

- Izberite

- Coin

- Kovanci

- Cointelegraph

- kombinirani

- zaupanje

- Potrdi

- Soglasje

- Razmislite

- naprej

- Naročilo

- pogodbe

- stroški

- pokrov

- Crossed

- Trenutna

- Trenutno

- vsak dan

- datum

- Davis

- Dnevi

- Decentralizirano

- Decentralizirane finance

- decentralizirane finance (DeFi)

- Zmanjševanje

- Defi

- Delta

- Povpraševanje

- deponiran

- Izvedeni finančni instrumenti

- Mize

- Razvoj

- Popust

- navzdol

- slaba stran

- pogon

- Drop

- smetišče

- učinek

- bodisi

- omogočena

- Vnesite

- zlasti

- ETH

- Eter

- eter terminske pogodbe

- ethereum

- omrežje ethereum

- Cena Ethereuma

- Tudi

- VEDNO

- Izhod

- Izhod

- pričakovanja

- Pričakuje

- pričakovati

- Pojasni

- izražena

- izredno

- soočen

- prednost

- strah

- boju proti

- financiranje

- prva

- prilagodljivost

- za

- za donos

- vilice

- iz

- polno

- Prihodnost

- Prihodnja cena

- Terminske pogodbe

- splošno

- Daj

- daje

- Dvorana

- strani

- se je zgodilo

- Trdi

- trde vilice

- Imajo

- zdravo

- tukaj

- Oklevajoča

- več

- najvišja

- gospodarstvo

- URE

- Kako

- Vendar

- HTTPS

- in

- označuje

- Kazalec

- Vlagatelji

- izdajanje

- IT

- ITS

- Pomanjkanje

- Stopnja

- ravni

- Vzvod

- LIDO

- malo

- Long

- Poglej

- najnižji nivo

- glavno omrežje

- Ustvarjalci

- marec

- Tržna

- tržni ustvarjalci

- Prisotnost

- največja

- kar pomeni,

- Mehanizem

- mediji

- Spoji

- meritev

- Meritve

- milijonov

- mesecev

- več

- Poleg tega

- Najbolj

- gibanja

- Blizu

- nujno

- negativna

- mreža

- Nevtralna

- Naslednja

- november

- Številka

- zgodilo

- oktober

- Kvota

- of

- on

- ONE

- Komentarji

- Nasprotno

- možnosti

- Ostalo

- vzporedno

- del

- Kraj

- dajanje

- platon

- Platonova podatkovna inteligenca

- PlatoData

- bazen

- pozicije

- pozitiven

- potencial

- Premium

- prejšnja

- prej

- Cena

- CENA AKCIJA

- Predhodna

- Postopek

- obravnavati

- strokovni

- Projekt

- Dokaz o deležu

- zaščita

- dal

- Oceniti

- razmerje

- Doseže

- dosegli

- Reality

- Razlog

- nedavno

- odražajo

- ostanki

- predstavljajo

- povzroči

- Rise

- Tveganje

- tveganja

- Rocket

- Raketni bazen

- ROSE

- s

- Prilagodljivost

- sentiment

- september

- Kratek

- shouldnt

- podpisati

- signali

- pomemben

- saj

- SIX

- Šest mesecev

- Skepticizem

- nagniti

- socialna

- družbeni mediji

- prodaja

- vir

- Komercialni

- Staking

- Država

- Korak

- nevihte

- stres

- podpora

- da

- O

- Združitev

- zato

- te

- Prag

- do

- trgovini

- trgovci

- Trgovanja z dobičkom

- tradicionalna

- transakcija

- transakcijski stroški

- razumeli

- odklepanje

- nadgradnja

- Upside

- potrjevanje

- potrjevalci

- ogledov

- način..

- kiti

- medtem

- WHO

- bo

- z

- umaknejo

- donos

- zefirnet

- nič

![Najnovejša posodobitev — Sojenje nekdanjemu izvršnemu direktorju FTX Samu Bankman-Friedu [3. dan] Najnovejša posodobitev — Sojenje nekdanjemu izvršnemu direktorju FTX Samu Bankman-Friedu [3. dan]](https://platoblockchain.com/wp-content/uploads/2023/10/latest-update-former-ftx-ceo-sam-bankman-fried-trial-day-3-225x300.jpg)