Top US crypto exchange Coinbase has listed at least 20 cryptocurrencies while holding financial interests in related products, Poročila Financial Times (FT).

Of those digital assets, only 12 were publicly disclosed on Coinbase’s spletna stran page dedicated to its investment arm.

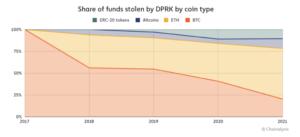

A number of the cryptocurrencies in question reaped big rewards on listing day but subsequently fared worse than Bitcoin and Ether.

One example is Decentralized Social (formerly BitClout), the blockchain project run by one-time stabilno issuer Nader Al-Naji.

Al-Naji rebranded Decentralized Social last September — an apparent bid to razdalja the startup from a series of technical snafus and cheap marketing ploys that drew widespread criticism.

At the same time, the US-based entrepreneur disingenuously attempted to pass off Decentralized Social’s DESO token sale, which ran from late 2020 until June 2021, as a fresh $200-million funding round led by venture capitalists like Andreessen Horowitz in Coinbase Ventures.

In reality, venture capital firms are reported to have contributed only half of the project’s funds.

The rest came from a mix of industry insiders and retail buyers over the course of approximately nine months — a far cry from any “traditional” funding round as purported by Al-Naji.

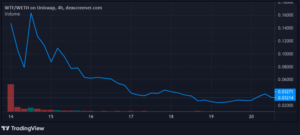

Coinbase listed DESO token in December. The news, which many had expected since Al-Naji plastered Coinbase Ventures’ branding across his website, briefly doubled DESO’s price.

Preberi več: [Ustvarjalec BitClouta ni zbral 200 milijonov dolarjev za "novo" verigo blokov - to je isto staro sranje]

This opened avenues for investors to capitalise by dumping their tokens. As Coinbase processes more trade volume than any other US platform, token listings are widely considered a liquidity event for early backers.

Sure enough, the price of Al-Naji’s DESO token halved shortly after its Coinbase-listing peak, as the project once again failed to attract enough buyers to justify its inflated price.

Coinbase promises venture wing doesn’t dictate listings

Andreessen Horowitz, one of Coinbase’s earliest investors, still holds a seat on the exchange’s board. The firm has also backed at least 12 projects that subsequently found their way onto Coinbase, noted FT.

As for why tokens listed on Coinbase performed so poorly despite an initial pump, independent crypto analyst Faisal Khan offered (via FT):

“I think that raises a lot of questions about if insiders are dumping on retail investors, as well as conflicts of interest between VCs and exchanges, who work together with zero oversight.”

Those concerns were echoed by Harvard Business School’s Marco Di Maggio, who flagged Coinbase’s poor disclosure practices for not mitigating conflicts of interests.

“Since the crypto community is not particularly open to these types of things, I would have expected them to be very careful about this,” said Di Maggio.

Preberi več: [A critic’s guide to BitClout, this cycle’s most hated Bitcoin project]

For what it’s worth, Coinbase told reporters that it ne maintain policies to mitigate conflicts of interests, and that it doesn’t make listing decisions in cahoots with outside investors or its own board.

The Delaware-headquartered company maintained that Coinbase Ventures has no influence over the cryptocurrencies and other digital assets it offers.

Coinbase je objavil a blog post promising to make its holdings “even more transparent” in response to FT. It also added seven missing tokens to its investment disclosure page.

As for Al-Naji’s DESO token, it’s now down 65% since its Coinbase-inspired local peak.

Sledite nam na Twitter za bolj informirane kripto novice.

Source: https://protos.com/coinbase-listing-crypto-exchange-undisclosed-conflicts-of-interest-deso/

- 2020

- O meni

- čez

- Analitik

- ARM

- Sredstva

- Bitcoin

- blockchain

- svet

- blagovne znamke

- poslovni

- Kapital

- ujete

- coinbase

- Coinbase Ventures

- skupnost

- podjetje

- prispevali

- kreator

- kripto

- kripto izmenjava

- kripto menjava Coinbase

- Kripto novice

- cryptocurrencies

- dan

- Decentralizirano

- digitalni

- Digitalna sredstva

- porazdeljena

- Ne

- navzdol

- Zgodnje

- Podjetnik

- Eter

- Event

- Primer

- Izmenjava

- Izmenjave

- Pričakuje

- finančna

- Financial Times

- Firm

- Za vlagatelje

- je pokazala,

- sveže

- Financiranje

- Skladi

- vodi

- harvard

- HTTPS

- obresti

- interesi

- naložbe

- Vlagatelji

- IT

- Led

- likvidnostno

- Navedeno

- seznam

- oglasi

- lokalna

- Trženje

- mesecev

- Najbolj

- novice

- Ponudbe

- odprite

- Ostalo

- platforma

- politike

- Cena

- Procesi

- Izdelki

- Projekt

- projekti

- vprašanje

- dvigniti

- povečuje

- Reality

- Odgovor

- REST

- Trgovina na drobno

- Maloprodajni vlagatelji

- Nagrade

- krog

- Run

- Je dejal

- prodaja

- Serija

- So

- socialna

- zagon

- dobavi

- čas

- skupaj

- žeton

- Boni

- trgovini

- us

- VC-ji

- podjetje

- tveganega kapitala

- podjetja tveganega kapitala

- Ventures

- Obseg

- Spletna stran

- Kaj

- WHO

- brez

- delo

- vredno

- nič