Crypto giant Coinbase seems to be strategically steering its ship amid constant crypto industry turbulence in 2023. The company recently unveiled its lending platform for institutional investors, aiming to fill the void left behind by major players during 2022’s crypto winter, when firms such as Celsius Network, BlockFi and Genesis went bankrupt.

Do te poteze je prišlo po tem, ko je podjetje maja zaradi regulativnega nadzora zaprlo storitev izposoje za maloprodajne stranke. Storitev je nekaterim strankam omogočila uporabo kripto kot zavarovanja za prejem gotovinskega posojila. Nova posojilna rešitev pa se osredotoča na institucionalne vlagatelje – podjetja ali organizacije, ki vlagajo v imenu svojih strank, kot so vzajemni skladi in pokojninski načrti.

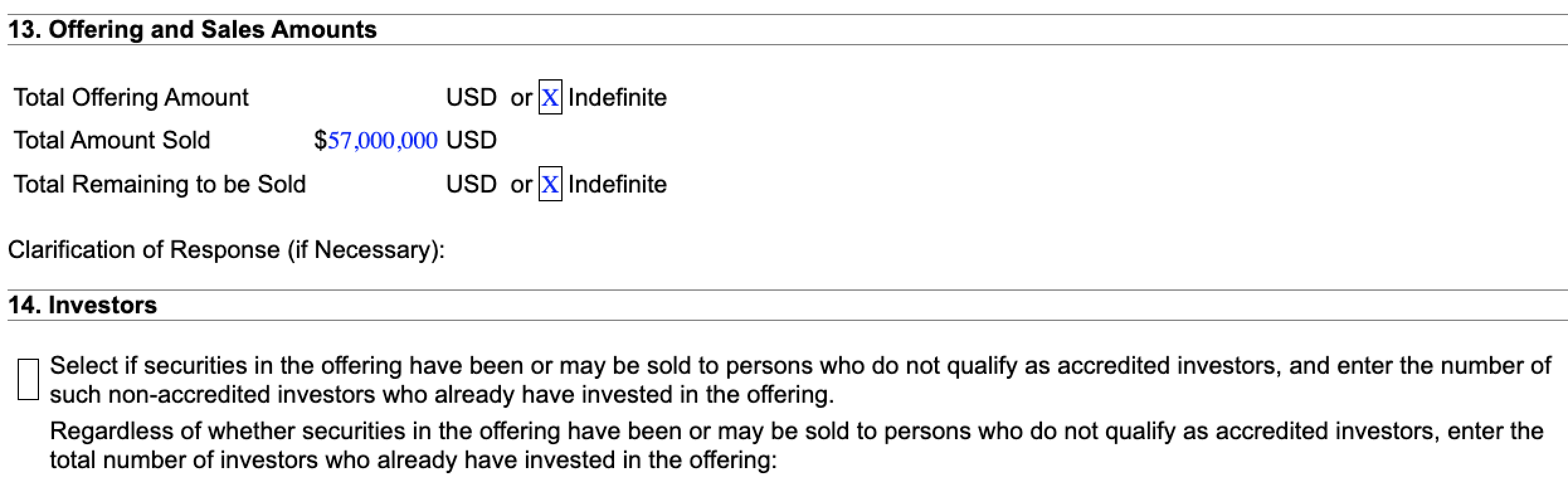

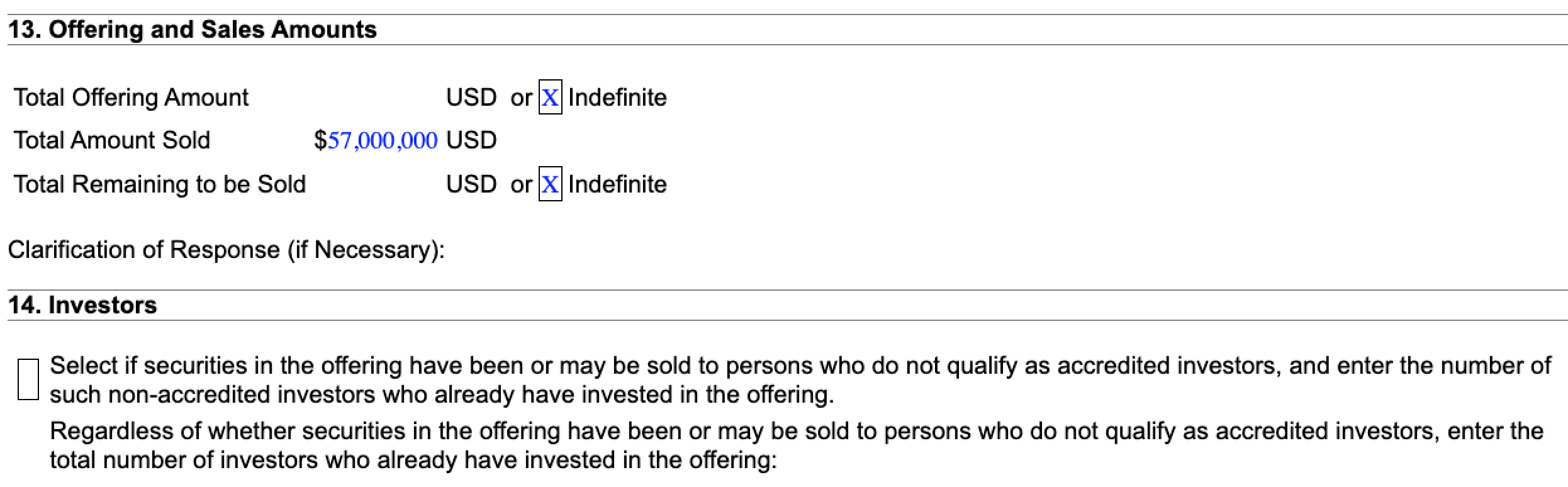

Novi podvig Coinbase je v nekaj dneh po ustanovitvi zbral milijone kapitala, kažejo dokumenti, vloženi pri ameriški komisiji za vrednostne papirje in borzo (SEC). Kljub težavam in negotovosti prvenec storitve kaže, da je v Združenih državah še vedno povpraševanje po kripto posojilih med uglednimi vlagatelji.

Ta teden Crypto Biz raziskuje tudi najnovejše poročilo Marathon Digital o rudarjenju bitcoinov, potezo Hana Bank, da ponudi skrbništvo nad kriptovalutami, in Googlovo novo politiko kripto oglasov.

Coinbase lansira platformo za posojanje kriptovalut za ameriške institucije

Coinbase za izmenjavo kriptovalut has rolled out a crypto lending service for institutional investors in the U.S., which reportedly seeks to capitalize on massive failures in the crypto lending market. According to a filing with the SEC, Coinbase customers have already invested over $57 million in the lending program since the first sale occurred on Aug. 28. In another headline, Coinbase’s recently released Base network reached over 700,000 nonfungible tokens (NFTs) minted in August. The tokens minted were part of the launch’s strategy to spur adoption. Base’s launch, however, has not been flawless. The network utrpel izpad on Sept. 5 when its sequencer stopped producing blocks. Several scams have also been promoted on the network, including a $6.5 million rug-pull by Magnate Finance.

Marathonova stopnja rudarjenja bitcoinov je avgusta padla za 9 %

Crypto mining operator Marathon Digital Holdings produced 1,072 Bitcoin in August — 9% less than in July. According to the company, the smaller production resulted from increased curtailment activity in Texas due to record-high temperatures. The term curtailment refers to the reduction of electricity generated to maintain a balance between demand and supply. The temporary shutdowns more than offset the progress made by the company to increase its operational hash rate and optimize operations, according to its CEO, Fred Thiel. Marathon increased its U.S. operational hash rate by 2% month-over-month to 19.1 exahashes in August. The performance increase is attributed to the upgrade of Bitmain Antminer S19j Pro miners to the more efficient S19 XP models.

Google bo od 15. septembra dovolil oglase za igre NFT

Google ima updated its cryptocurrency advertising policy to allow for blockchain-based NFT gaming advertisements as long as they don’t promote gambling or gambling services. The new policy will continue to ban advertisements for games that allow players to wager or stake NFTs against other players or for rewards. NFT casino games offering players to wager or play for prizes — such as NFTs, cash or cryptocurrency — will also continue to be banned. Google previously banned all cryptocurrency-related advertising across its platforms in March 2018.

NFT gaming advertisements will soon be welcome on Google’s Search platform as long as they don’t promote any form of gambling. https://t.co/gSVeHxxkjx

- Cointelegraph (@Cointelegraph) September 6, 2023

Južnokorejska Hana Bank vstopa v posel skrbništva nad kripto z BitGo

One of the largest South Korean banks, KEB Hana Bank, is moving to offer digital asset custody services through a new partnership with cryptocurrency custody firm BitGo Trust Company. According to local media reports, KEB Hana Bank signed a strategic business agreement with BitGo to jointly establish digital asset custody in South Korea. The commercial bank has a network of 111 branches with local banking assets of nearly $10 billion and equity of $490 million. Together, Hana Bank and BitGo plan to launch their joint cryptocurrency custody venture in the second half of 2024.

Crypto Biz je vaš tedenski utrip poslovanja, ki stoji za blockchainom in kriptovalutami, dostavljen neposredno v vaš nabiralnik vsak četrtek.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Avtomobili/EV, Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- PlatoHealth. Obveščanje o biotehnologiji in kliničnih preskušanjih. Dostopite tukaj.

- ChartPrime. Izboljšajte svojo igro trgovanja s ChartPrime. Dostopite tukaj.

- BlockOffsets. Posodobitev okoljskega offset lastništva. Dostopite tukaj.

- vir: https://cointelegraph.com/news/crypto-biz-coinbase-s-lending-bet-a-new-ads-policy-at-google-and-marathon-s-mining-performance

- :ima

- : je

- :ne

- 000

- 1

- 19

- 2%

- 2018

- 2023

- 2024

- 28

- 700

- a

- Po

- čez

- dejavnost

- Sprejetje

- oglasi

- Oglaševanje

- po

- proti

- Sporazum

- Usmerjanje

- vsi

- omogočajo

- dovoljene

- že

- Prav tako

- zbrano

- Sredi

- med

- an

- in

- Še ena

- Antminer

- kaj

- AS

- sredstvo

- Sredstva

- At

- avgust

- Avgust

- Ravnovesje

- Ban

- Banka

- Bančništvo

- bančna sredstva

- bankrot

- Banke

- prepovedana

- baza

- BE

- bilo

- ime

- zadaj

- Stavim

- med

- Billion

- Bitcoin

- Bitcoin mining

- poročilo o rudarjenju bitcoinov

- BitGo

- Bitmain

- Bitmain AntMiner

- biz

- blockchain

- temelji na blockchainu

- BlockFi

- Bloki

- sposodim

- veje

- poslovni

- by

- Kapital

- kapitalizirati

- Denar

- Casino

- casino igre

- Celzija

- Celzijeva mreža

- ceo

- nekatere

- stranke

- coinbase

- Coinbase's

- Cointelegraph

- zavarovanje

- prihaja

- komercialna

- Komisija

- Podjetja

- podjetje

- stalna

- naprej

- kredit

- kripto

- Kripto oglasi

- kripto skrbništvo

- Kripto industrija

- Kripto posojilo

- Kripto zima

- cryptocurrency

- Skrbništvo

- Stranke, ki so

- Dnevi

- Prvenec

- dostavi

- Povpraševanje

- Kljub

- digitalni

- Digitalno sredstvo

- Skrbništvo digitalnih sredstev

- Digitali

- neposredno

- Dokumenti

- don

- dont

- navzdol

- 2

- med

- učinkovite

- elektrika

- Vstopi

- pravičnost

- vzpostaviti

- Tudi vsak

- Izmenjava

- raziskuje

- Nekaj

- vložena

- Vložitev

- izpolnite

- financiranje

- Firm

- podjetja

- prva

- Osredotoča

- za

- obrazec

- iz

- Skladi

- Igre na srečo

- Games

- igre na srečo

- ustvarila

- Genesis

- velikan

- Googlova

- Pol

- hash

- hitrost hash

- Imajo

- naslov

- čelni vetrovi

- odmeven

- Holdings

- Vendar

- HTTPS

- in

- Vključno

- Povečajte

- povečal

- označuje

- Industrija

- Institucionalna

- institucionalni vlagatelji

- investirali

- vlaganjem

- Vlagatelji

- ITS

- skupno

- julij

- korea

- Korejski

- Največji

- Zadnji

- kosilo

- izstrelki

- začetek

- levo

- posojanje

- posojilna platforma

- manj

- posojila

- lokalna

- Long

- je

- vzdrževati

- velika

- Maraton

- MARATON DIGITALNI

- Maratonski digitalni gospodarji

- marec

- Tržna

- ogromen

- Maj ..

- mediji

- milijonov

- milijoni

- Rudarji

- Rudarstvo

- rudarsko poročilo

- kovane

- modeli

- več

- učinkovitejše

- premikanje

- premikanje

- vzajemno

- Vzajemni skladi

- skoraj

- mreža

- Novo

- nova kriptovaluta

- nova politika

- NFT

- Igre NFT

- NFT igre

- NFT

- Negotov

- Nezamenljivi žetoni

- zgodilo

- of

- ponudba

- ponujanje

- odmik

- on

- operativno

- operacije

- operater

- Optimizirajte

- or

- organizacije

- Ostalo

- ven

- več

- del

- Partnerstvo

- nastanitev

- performance

- Načrt

- načrti

- platforma

- Platforme

- platon

- Platonova podatkovna inteligenca

- PlatoData

- Predvajaj

- Igraj za

- igralci

- politika

- prej

- nagrade

- za

- proizvodnjo

- proizvodnja

- Program

- Napredek

- spodbujanje

- Promovirano

- impulz

- Oceniti

- dosegel

- prejeti

- Pred kratkim

- Zmanjšanje

- nanaša

- regulatorni

- sprosti

- poročilo

- Poročila

- Trgovina na drobno

- Nagrade

- Valjani

- s

- prodaja

- prevare

- pregled

- Iskalnik

- SEC

- Vložitev SEC

- drugi

- Vrednostni papirji

- Securities and Exchange Commission

- Išče

- Zdi se,

- sedem

- Storitev

- Storitve

- več

- LADJE

- Prikaži

- Zaustavite

- zaustavitve

- podpisano

- saj

- manj

- Rešitev

- Kmalu

- vir

- South

- Južna Koreja

- južnokorejski

- delež

- Začetek

- Države

- krmiljenje

- Še vedno

- ustavil

- Strateško

- strateško poslovanje

- Strateško

- Strategija

- taka

- dobavi

- začasna

- Izraz

- texas

- kot

- da

- O

- njihove

- jih

- skozi

- četrtek

- do

- skupaj

- Boni

- Zaupajte

- turbulenca

- nas

- Negotovost

- Velika

- Združene države Amerike

- Komisija za vrednostne papirje in borze ZDA

- predstavil

- nadgradnja

- uporaba

- podjetje

- Tedenski

- dobrodošli

- šla

- so bili

- kdaj

- ki

- bo

- Winter

- z

- v

- xp

- Vaša rutina za

- zefirnet