- Financial markets in Germany and France are closed for Easter Monday

- Increased odds of Fed hike is weighing on the euro

- Eurozone releases retail sales and investor confidence on Tuesday

US dollar gets a boost from solid nonfarm payrolls

The US dollar is higher against all the majors today, including the euro, courtesy of the strong US employment report on Friday. The star of the show, nonfarm payrolls came in at 236,000 in March. This couldn’t keep up with the prior release, which was upwardly revised to 326,000, but kept close to the market consensus of 340,000.

Friday’s “goldilocks” employment report (strong job gains with limited wage growth) points to a surprisingly resilient job market, despite relentless rate hikes from the Fed. The labour market may be cooling, but the markets are convinced that it is still too hot for the Fed, which needs employment data to weaken so that inflation will fall more quickly. This likely means more rate hikes are needed before the Fed can wind up the current rate-tightening cycle. The odds of a 25 basis point rate hike in May have jumped to 68%, according to the CME Group, versus around 50% prior to Friday’s employment report.

The eurozone gets back into action on Tuesday, with the release of retail sales and investor confidence. The markets are braced for weak readings, which could add to the euro’s losses. Retail sales are expected to decelerate in March to -3.5% y/y, following -2.3% y/y in February. Sentix Investor Confidence, which has been mired in negative territory for a year, is projected to come in at -9.9 in April, after -11.1 a month earlier.

.

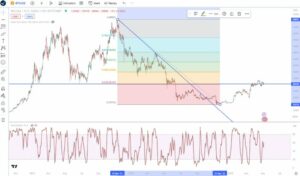

EUR / USD Tehnični

- EUR/USD preizkuša podporo pri 1.0889. Spodaj je podpora pri 1.0804

- Obstaja upor pri 1.0989 in 1.1074

Vsebina je samo za splošne informacije. To ni naložbeni nasvet ali rešitev za nakup ali prodajo vrednostnih papirjev. Mnenja so avtorji; ne nujno družbe OANDA Business Information & Services, Inc. ali katere koli njene podružnice, hčerinske družbe, uradnikov ali direktorjev. Če želite reproducirati ali ponovno distribuirati katero koli vsebino, ki jo najdete na MarketPulse, nagrajeni storitvi spletnega mesta z novicami in analizami forexa, blaga in globalnih indeksov, ki jo proizvaja OANDA Business Information & Services, Inc., dostopajte do vira RSS ali nas kontaktirajte na info@marketpulse.com. Obiščite https://www.marketpulse.com/ izvedeti več o utripu svetovnih trgov. © 2023 OANDA Business Information & Services Inc.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- Platoblockchain. Web3 Metaverse Intelligence. Razširjeno znanje. Dostopite tukaj.

- vir: https://www.marketpulse.com/news-events/non-farm-payrolls/euro-slips-on-fallout-from-strong-us-nonfarm-payrolls/kfisher

- : je

- $GOR

- 000

- 1

- 2012

- 2023

- 7

- 9

- a

- O meni

- nad

- dostop

- Po

- Ukrep

- nasveti

- podružnice

- po

- proti

- vsi

- Alpha

- Analiza

- Analitik

- in

- april

- SE

- okoli

- At

- Avtor

- Avtorji

- Nagrada

- nazaj

- temeljijo

- Osnova

- osnova točke

- BE

- pred

- spodaj

- povečanje

- Pasovi

- široka

- poslovni

- nakup

- by

- CAN

- Zapri

- zaprto

- CM razširitev

- Skupina CME

- COM

- kako

- Blago

- zaupanje

- Soglasje

- kontakt

- vsebina

- prispeva

- bi

- Ovitki

- Trenutna

- cikel

- vsak dan

- datum

- Kljub

- Direktorji

- Dollar

- prej

- zaposlovanja

- Lastniški vrednostni papirji

- Euro

- Evroobmočje

- Pričakuje

- izkušen

- Padec

- padavin

- februar

- Fed

- Fed Hike

- finančna

- Finančni trg

- Najdi

- Osredotočite

- po

- za

- forex

- je pokazala,

- Francija

- Petek

- iz

- temeljna

- zaslužek

- splošno

- Nemčija

- Globalno

- svetovnih trgih

- skupina

- Rast

- Imajo

- več

- zelo

- Pohod

- Pohodi

- HOT

- HTTPS

- in

- Inc

- Vključno

- indeksi

- inflacija

- Podatki

- vlaganjem

- naložbe

- Investitor

- Izrael

- IT

- ITS

- Job

- jpg

- Skočil

- Imejte

- Dela

- kot

- Verjeten

- Limited

- izgube

- velika

- Majors

- marec

- Tržna

- MarketPulse

- Prisotnost

- max širine

- Maj ..

- pomeni

- mesec

- več

- nujno

- potrebe

- negativna

- negativno ozemlje

- novice

- Nekmetija

- Nonfarm Payrolls

- Kvota

- of

- uradniki

- on

- na spletu

- Komentarji

- Plačilne liste

- platon

- Platonova podatkovna inteligenca

- PlatoData

- prosim

- Točka

- točke

- Prispevkov

- Predhodna

- Proizvedeno

- napovedane

- publikacije

- objavljeno

- namene

- hitro

- območje

- Oceniti

- Oceni pohod

- stopnje povišanj

- sprostitev

- Izpusti

- neusmiljen

- poročilo

- odporno

- Odpornost

- Trgovina na drobno

- Prodaja na drobno

- rss

- prodaja

- Vrednostni papirji

- iskanju

- Iščem Alpha

- prodaja

- Storitev

- Storitve

- več

- delitev

- Prikaži

- saj

- spletna stran

- So

- trdna

- Rešitev

- zvezda

- Še vedno

- močna

- podpora

- Testiranje

- da

- O

- Fed

- do

- danes

- tudi

- Torek

- us

- ameriški dolar

- Poročilo o zaposlovanju v ZDA

- Ameriške neplačne plače

- v1

- Proti

- obisk

- tehtanje

- ki

- bo

- veter

- zmago

- z

- delo

- bi

- leto

- Vi

- zefirnet