Različica tega članka je bila prvotno objavljena tukaj.

V vsakem novem in razvijajočem se prostoru bo zagotovo veliko hrupa. Nove rešitve tekmujejo za nov trg z obstoječimi monopoli, ki trenutno posedujejo trg, in z drugimi tehnologijami, ki jih poskušajo izpodriniti.

Težko razumeti

To še posebej velja za tiste prelomne inovacije/odkritja, ki spremenijo naš svet in nas prisilijo, da uporabimo novo lečo, da ga razumemo. Zaradi prejšnjih pristranskosti je manj verjetno, da bomo nove inovacije raziskovali na podlagi prvih načel. Podatki so dediščina naših obstoječih modelov – ne teh novih. Novi morajo biti intuitivni, da lahko napovedujejo, kaj se bo zgodilo, namesto da bi napovedovali z uporabo zgodovinskih podatkov. Poenostavimo modele v naših možganih, da prihranimo čas in posledično se večina ljudi ujame v past napovedovanja svojega prihodnjega vedenja s pogledom nazaj v svojo preteklost.

To je isti razlog, da pri uporabi telefona Blackberry, ko je bil izdan iPhone, nismo mogli predvideti, kako se bodo spremenile naše misli – in naše misli, ki se bodo spremenile zaradi nove ustvarjene vrednosti, bodo spremenile industrijo. Takoj se premaknemo, ko dobimo nekaj večje vrednosti, in nemogoče je predvideti to potezo, preden je ne »vidimo«.

To je isti razlog, zakaj je Kodak uničila prav digitalna kamera, ki jo je ustvaril Kodak, in Blockbusterju ni uspelo videti grožnje Netflixa, dokler ni bilo prepozno.

In to je isti razlog, zakaj vsi monopoli propadejo, ko napačno razumejo ustvarjanje vrednosti, ki jo družbi zagotavlja nova tehnologija. Sprejetje tehnologije je najpogosteje od spodaj navzgor in od zgoraj navzdol. Zakaj? Preprosto zato, ker ljudje, ki so najbolj oddaljeni od monopolne oblasti, največ pridobijo, ljudje, ki so najbližje monopolu, pa največ izgubijo.

Če k temu dodamo, da je vedno veliko večje število ljudi dlje od monopola kot blizu njega, postane enostavno videti, kako hitro se lahko nekaj, kar ustvarja večjo vrednost za te ljudi, uveljavi in postane močnejše – zaradi česar je monopol nemočen v boj z njim.

Opomba: Ta okvir je pomembno upoštevati ne glede na to, ali je monopol znotraj industrije ali pa se nanaša na sam denar.

Težje razumeti

Še težje je razumeti splošne namenske tehnologije, kot je umetna inteligenca, ki vplivajo na vse industrije ali napovedujejo njihovo stopnjo napredka. Ker te splošne tehnologije veljajo za Najbolj ustvarjanja vrednosti skozi čas, zlahka podcenimo ustrezen vpliv na vsako podjetje in posledično na naša življenja. Na primer, pretvarjanje, da ozka ali splošna umetna inteligenca nekega dne ne bo negativno vplivala na naše delo, je nekaj, kar želeli verjeti, kar zagotavlja, da so pripovedi, ki podpirajo to smer razmišljanja, priljubljene – tudi če so neresnične.

Najtežje razumeti

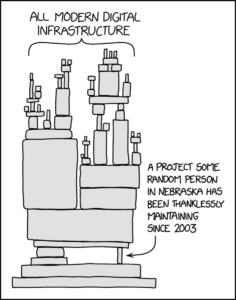

Toda inovacije, ki jih je najtežje razumeti, so odprte, decentralizirane tehnologije na ravni protokola. Ti protokoli ustvarjajo vrednost v obliki novega temelja, ki nastaja počasi in metodično. Protokoli so zgrajeni v plasteh, kar pomeni, da na splošno ne moremo videti, kaj je mogoče na naslednji plasti, dokler ni že zgrajena. Tehnološki protokol osnovne plasti (plast 1), ki je omogočal povezovanje računalnikov v omrežje, se imenuje protokol za nadzor prenosa in internetni protokol (TCP-IP), razvila pa ga je Agencija za napredne obrambne raziskovalne projekte (DARPA). v poznih tridesetih letih prejšnjega stoletja. To je bilo šele leta 1989 Tim Berners-Lee je izumil protokol za prenos hiperbesedila (HTTP) na ravni 4, ki bi povezal te računalnike in spletne strani ter oblikoval svetovni splet.

Zato, če bi poskušali razložiti sloj odprtega protokola TCP-IP, ki je prej izoliranim računalnikom omogočal medsebojno komunikacijo ali celo HTTP z nekom v zgodnjih 1990-ih, ali jim poskušali povedati, da bo nekega dne ista tehnologija (večinoma nespremenjena) bi nastali iPhone, Google, Zoom, Amazon in vse ostalo, kar imamo danes za samoumevno, bi nejeverno zavijali z očmi.

Vrednost izkušamo z izdelki in storitvami, ki nam dajejo vrednost, namesto da bi poskušali razumeti zapletene podrobnosti vodovodne napeljave, ki povzroča te izdelke in storitve.

I am going to attempt to use a framework for considering how this applies to Bitcoin, and the predictable rise of altcoins, decentralized finance (DeFi) Web3, Metaverse and the entire blockchain space.

Toda preden gremo tja, moramo začeti na višji ravni, ker abstrakcija na višji ravni vpliva in krepi vse ostalo.

Začeti moramo pri denarju. Tam moramo začeti iz istega zgoraj navedenega razloga.

Namreč:

- Vrednost doživljamo z izdelki in storitvami, ki nam dajejo vrednost, namesto da bi poskušali razumeti zapletene podrobnosti vodovodne napeljave, ki povzroča te izdelke in storitve, in

- Denar je temeljna plast, iz katere nastane vse ostalo.

Zato, ko se denar zlomi, vztrajanje na mestu, ko tla popustijo, ne bo zagotovilo le malo varnosti.

Denar je le informacija

This might be hard to see because it is important information, but we don’t desire more pieces of paper (or the digital units it represents). We desire the feeling we get from having those pieces of paper and what it can buy us. Regardless of whether that “buy” is a feeling of safety, a legacy in the form of giving to your children, a vacation, status, a home or freedom. Money is just the information (a ledger) that allows us to measure what we have, and what it will take (in our own minds) to achieve our desired result. Fear, greed and the human desire to want more comes on top of that ledger and comparison to other people.

Potem je logično logično, da prvič, če je denar le informacija, in drugič, centralne banke manipulirajo z denarjem s hitrostjo brez primere, da bi se izognile kreditnemu kolapsu sistema, potem so dezinformacije morajo rasti v celotnem sistemu. (Izpeljanka drugega reda teh dezinformacij je zaupanje morajo upadajo v celotnem sistemu.)

Ampak to je nesrečen sistem, v katerem živimo, in ima zelo negativne posledice. Ker merimo sistem znotraj sistema, bi bilo za večino prebivalstva resnice praktično nemogoče videti. Podobno je vsako podjetje, organizacija in politična stranka sestavljena iz podobnih ljudi, ki sistem merijo na sistem, medtem ko vsak član naše družbe na splošno verjame, da lahko bolje vidi skozi te dezinformacije kot drugi.

(Caveat emptor: Čeprav se osebno trudim poglobiti vprašanja, da razumem obe strani in kje se morda motim, to vključuje mene in besede na tej strani.)

Posledično je povsem logično videti, da vladajo teorije zarote, zmeda, polarizacija, pristranskost v skupini, zunaj skupine in družbeni kaos.

Te dezinformacije v obliki denarja ne bi samo ustvarile polarizacije. Ker denar povezuje vrednost med ljudmi in narodi, bi povzročil ogromno napačno razporeditev kapitala in virov, saj so vsi posamezni akterji v sistemu sistem poslabšali s svojimi dejanji, da bi zaslužili dovolj denarja za pobeg iz sistema. Loviti vedno višje donose, ne bi bila samo širša javnost. Celo pokojninski načrti, ki potrebujejo določene donose rasti, da ostanejo plačilno sposobni za plačilo obveznosti v obliki pokojnin, bi iskali višje »prave« donose – vsi in tudi mi iščemo načine za rešitev problema rasti, da bi se izognili zelo sistem, ki povzroča problem.

V svetu, ki bi izgledal tako, bi se bilo zlahka ujeti v past piramide in shem za hitro obogatenje, da bi se rešili. Pravzaprav bi sama struktura manipuliranja z denarjem (informacijami) in ustrezna struktura spodbud zagotovila, da bi trg zrasel, da bi ga zlorabil – tako v kriptovalutah kot na celotnem trgu. Vsi, ki merijo in poskušajo ustvariti vrednost iz tega sistema, bi nevede prispevali k večji negotovosti. Nihče ne bi bil izvzet. Vsi, ki iščejo višji donos, da bi se izognili obstoječemu znižanju vrednosti valut, so se natlačili na trge, ki posledično škodujejo drugim.

With this one, misinformation as a backdrop, and two, a new protocol layer technology emerging, (remember that open protocols provide the most value to society and are the hardest to understand) it would be extraordinarily difficult to see why Bitcoin alone stands out as a breakthrough technology and where it is heading. By extension, it would be relatively easy in this environment for ill-informed or bad actors to conflate Bitcoin with crypto, Web3, DeFi, blockchains, Metaverse and other naming conventions to gain an advantage for their offering. A public market that one, believed these were similar and watching a meteoritic rise in Bitcoin over the last 13 years (while they were concurrently losing purchasing power in their own currencies) and two, lacked the time to do deep research, would be easy targets for copycats, fraudsters and even well-intentioned actors who might be misinformed, promoting the next big thing.

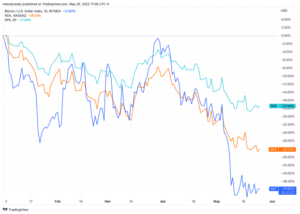

This would act to amplify the cycles of highs and lows in Bitcoin and obfuscate its true nature. Firstly, by bringing more leverage, hypothecation and rehypothecation into the overall space by leveraging bitcoin (which has no counterparty risk) as a pristine bearer asset and amplifying the price of bitcoin on the way up. And secondly, as each of the altcoins and DeFii schemes tied to them, then fell due to that same leverage, creating “bank runs” that would amplify bitcoin’s fall in price (in USD terms) as the pristine bearer asset (BTC) was sold into a failing market to cover losses.

Ko se je veliko večji trg denarja zlomil, ( svetovna bilanca stanja is approximately four orders of magnitude larger than bitcoin market cap today) and the Federal Reserve and other central banks eased or tightened in fiat terms, it would only amplify the entire process described here and create additional confusion.

With that as a backdrop, I will provide a simple framework to explain why Bitcoin is without equal in its design so others can use that framework to decide for themselves. My hope is that by understanding the necessary trade offs required in the design of any blockchain, a general public, and/or policy makers can more accurately understand the trade offs and see the signal through the noise. In doing so, I’ll also show why the rise of competing blockchains and altcoins are predictable, the advantages and disadvantages of them and why, in my opinion, each will fail in the end.

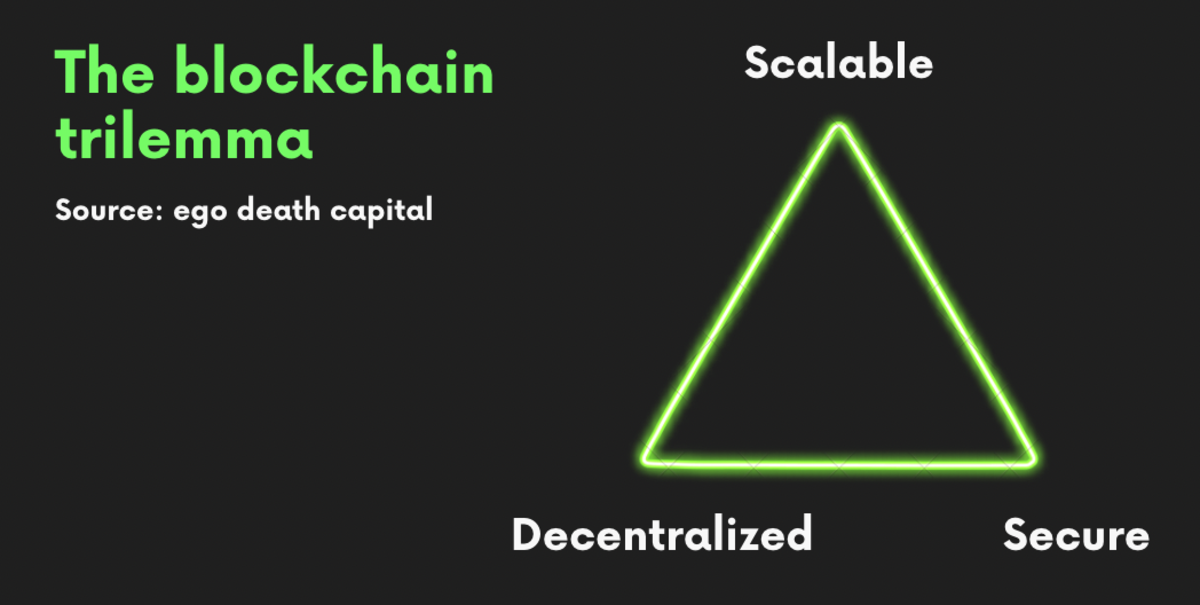

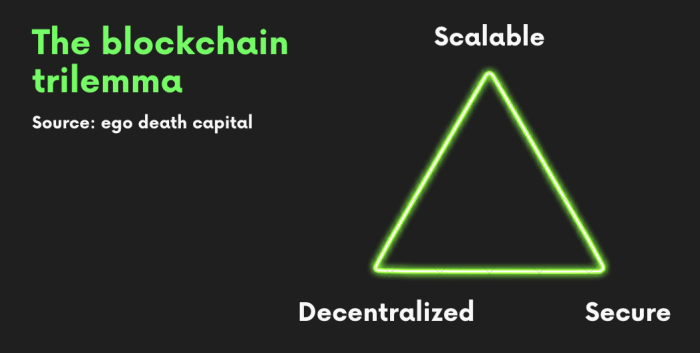

Decentralizacija, varnost, razširljivost

Bitcoin (on Layer 1) solved decentralization and security. Never in history has society had decentralization and security together. Thirteen years after its discovery/invention by the pseudonymous Satoshi Nakamoto and no matter the amount of nation state, economic challenge, or fear, uncertainty and doubt (FUD) thrown at it, it remains decentralized and completely secure. This is a bigger deal than it seems at first glance. Because society throughout time could never rely on decentralization and security together, it needed to rely on trust in institutions and the rule of law (to keep those institutions in check) for protection, the Magna Carta, Declaration Of Independence and many other such frameworks over time enshrining rights to citizens from unchecked power over them by their rulers. The problem is that over a longer time horizon, money surpasses laws, so laws alone cannot solve trust. Laws change over time ensuring those with access to money either re-write the laws or prevail in court. A reflection of the world we live in shows this unfortunate truth, i.e., where money is most broken, rule of law breaks down!

Pravna država državljanov ne ščiti pred manipulacijo z denarjem. Ščiti tiste, ki so najbližje manipulaciji.

Bitcoin remains decentralized and secure because of its design. Two critical design elements led to this outcome: One, a limited block size and two, using energy to secure the network through proof of work. (Dodatni elementi oblikovanja, povezani s tema dvema elementoma oblikovanja, ostajajo ključnega pomena za varnost in decentralizacijo omrežja. Za bralca, ki želi iti globlje, bodo ti raziskani kasneje v tej objavi s povezavami do nekaterih velikih miselnih voditeljev in vsebine.) It is important to remember, Bitcoin is open source which means it is open to everyone (to audit or use freely), controlled by no one and freely available for anyone to change through a fork to try to design in a different way that creates more value for users.

By designing in such a way, Bitcoin over the last 13 years became an excellent store of value, but also remained largely unviable to be used as a currency or broader technology stack due to its lack of transaction speed at five to seven transactions per second (on the first layer). The transaction speed wasn’t the only limitation. By keeping block size small to ensure continued decentralization, Bitcoin left an opening for competing blockchains/altcoins to do more on Layer 1. Venture capital, entrepreneurs and developers raced into this ecosystem because one, inventing a new coin that could compete with bitcoin would achieve massive short-term profits for its founders and venture capital backers, and two, with a larger block size and more permissive blockchain, more could be done. These competing blockchains would give rise to smart contracts, non-fungible tokens (NFTs) and “decentralized” finance.

It would be easy to show Bitcoin as old technology, instead of a protocol layer to an audience looking for scalability and other use cases. That same choice though, either transaction speed or providing more capability through smart contracts on Layer 1, obvezna te verige blokov žrtvovati decentralizacijo ali varnost, da bi dosegli svoje cilje.

Iz dolge zgodovine konkurenčnih verig blokov boste videli, da so vse postanejo centralizirani (prek sveta ali majhnega števila ljudi/vozlišč, ki sprejemajo odločitve za vse) ali postanejo ranljivi za vdore/izpade, ko se povečajo.

Bitcoin je sam pri decentralizaciji in varnosti.

Zakaj? Ker preprosto ni možnosti zaobiti izbire dveh od treh za verigo blokov na ravni 1.

Logičen sklep pa je, da če nekdo žrtvuje varnost zaradi razširljivosti, veriga blokov odpove, ker ni varna, or Če žrtvujemo decentralizacijo zaradi razširljivosti, mora veriga blokov sčasoma postati neuporabna iz ekonomskih razlogov. In čeprav lahko trdite, da je to stališče iz ekosistema, za katerega se zdi, da zagotavlja vrednost za določeno časovno okno, ekonomski kompromisi vodenja blokovne verige, ki je centralizirana, zagotavljajo, da ne more delovati na dolgi rok. Preprosto povedano, če je centralizacija zahteva zasnove, je zbirka podatkov veliko cenejša rešitev - v smislu ekonomike in porabe energije. Samo ta ekonomski razlog izniči vse dolgoročne koristi (razen začetnih imetnikov žetonov) centralizirane verige blokov za udeležence sistema, ker mora nekdo za to plačati.

Ki zagotavlja da morajo vsi projekti, zgrajeni na teh alternativnih verigah blokov (Web3, Metaverse, NFT itd.), ne glede na namene ustanoviteljev teh projektov, doživeti enako usodo kot osnovna veriga blokov.

Graditi na živem pesku ni dobra dolgoročna strategija.

Nekaj hitrih vprašanj za jasnost:

- How could decentralized finance occur on a centrally-controlled blockchain?

- How would Web3’s promise be any different than today’s monopoly power in technology if it was built on a base layer that was more costly, and controlled by very few?

- Kakšna je dolgoročna vrednost digitalne kopije (NFT) nečesa, povezanega z verigo blokov, ki ne uspe?

- If a lower cost (through Layers 2 and 3) and decentralized alternative existed that enabled gaming and virtual reality companies to control their own destiny rather than risk their future on a centrally-controlled blockchain, what would these entrepreneurs choose? Wouldn’t it be more likely that this new protocol, instead of a centrally-controlled one, forms the foundation of the “metaverse”?

Ves čas podjetniki gradijo na teh verigah blokov, splošni javnosti in regulatorjih

se morda ne zavedajo dolgoročne narave ranljivosti. Še huje, kapital in veliki imetniki različnih shem nadomestnih kovancev bi lahko postali hote ali nehote udeleženci v perverzni spodbujevalni shemi, kjer obogatejo ali izstopijo ravno pravi čas, na račun nezavedne javnosti. Charlieja Mungerja znan citat »Pokaži mi spodbudo in pokazal ti bom izid« tukaj dobro velja. Če sta vloženi kapital (s strani tveganih kapitalistov) in čas (s strani podjetnika ali ekipe) šel v oblikovanje ene od teh blokovnih verig ali izgradnjo podjetja na vrhu ene, nam človeška narava pravi, da je veliko lažje zamegliti resnico in jo prodati višjega ponudnika, preden propade, kot priznati napačno strategijo.

Kot vedno sledite denarju.

Vrstica postane še posebej izkrivljena zaradi menjalnic, ki ponujajo te kovance neznani javnosti. S ponudbo množice vrednostnih papirjev (altkoinov, 20,000 in štetje) that all eventually suffer a similar fate, they create enormous wealth at society’s expense, making transaction fees on the way in and out, every time someone trades any one of these 20,000-plus coins. It’s a very low-risk business enabled by a highly susceptible public. That same wealth is then used to advocate/lobby governments for favorable policies to allow them to operate. Seeing opportunities for investment and jobs from the largest exchanges, while believing that bitcoin and altcoins are similar in nature, ensures policy makers are easily swayed. Much of this adds to the public and media being completely misinformed about Bitcoin and proof of work.

Why? Because conflating Bitcoin, blockchains and altcoins is key to operating profits.

Globlji potop na treh straneh piramide

1. Varnost

Through proof of work, Bitcoin offers miners a way to compete to solve cryptographic hash puzzles to verify new transactions on the blockchain. Miners purchase the latest hardware, to compete for Bitcoin in the form of block rewards. The reward follows a halving schedule where the reward for solving the hash puzzle is programmatically reduced every 210,000 blocks. Starting in 2009 at 50 bitcoin per verified new transaction on the blockchain (approximately once every 10 minutes) to 25 bitcoin in 2013, to 12.5 in 2016, to 6.25 BTC today, and to be reduced by half every 210,000 blocks until the year 2140. In the natural competition that arises in the free market with other economic actors trying to “win” bitcoin, an incentive is created where miners win bitcoin by securing the network. Because the primary costs of mining are one, the hardware (required to solve the cryptographic hash puzzles) and two, the intensive energy costs to run the hardware, miners are incentivized through competition to gain advantage over other miners which adds hash rate to the network (hash rate is the total computational power securing the network).

Nakamoto je razvil nov način za zaščito omrežja in izkoristil teorijo iger, ko je omrežje padalo in teklo z najnovejšimi izboljšavami strojne opreme, ki omogočajo hitrejše računalništvo, in nova vozlišča, ki so bila dodana ali odstranjena iz omrežja. Omrežje, imenovano prilagoditev težavnosti, samodejno prilagodi težavnost vsakih 2,016 blokov glede na čas, potreben za rudarjenje zadnjih 2,016 blokov, da ohrani povprečno time for finding the next block at 10 minutes. This takes advantage of greed and fear in a free market of economic actors working in their own best interests for gain, to constantly balance and protect the network. As more compute power is added to the network, the difficulty adjustment automatically makes it harder to find the next 2,016 blocks and conversely, as compute power is removed, the difficulty automatically adjusts to make it easier to find the next 2,016 blocks. This process creates more and less profitable mining operations which take advantage of the free market. For example, when China instituted a ban on all bitcoin mining in May 2021, Bitcoin hash rate padla v obdobju dveh mesecev s približno 185 milijonov terahašev na sekundo na 58 milijonov terahašev na sekundo. Vsaka dva tedna se je težavnost prilagodila navzdol, da je povprečni čas bloka znašal 10 minut. Z manj rudarji, ki tekmujejo za nagrade, in prenasičenostjo na novo razpoložljive rudarske opreme, ki prihaja na trg, kar ustvarja pritisk na zniževanje cen opreme, je rudarjenje postalo veliko bolj donosno. Številna ameriška podjetja so pohitela, da bi zapolnila praznino (in gospodarsko priložnost), ki jo je ustvarila Kitajska. Sledila je "zlata mrzlica" za rudarjenje. Ko je več gospodarskih akterjev hitelo, da bi izkoristili lahke dobičke, in je bila prilagoditev težavnosti višja, so se dobički znova racionalizirali.

In tako, ne glede na napad nacionalne države ali cikel razcveta, ki ga vodita pohlep in strah,

network, globally, is always protected through the difficulty adjustment in creating a natural incentive to win a larger share of an economic prize. As more market entrances race in to take advantage of the higher profit opportunity created by an easier difficulty rate, they add additional security to the network — in turn taking the difficulty rate higher and their profits lower. (Bitcoin hash rate is currently 212 million terahashes)

Poleg tega je postopek plačevanja dodatne opreme, ki je sčasoma zastarela, ko nova oprema postane boljša, drag. To ima učinek podpore novim udeležencem/zamislim na trgu. Z drugimi besedami, njegova sama narava zmanjšuje monopolne težnje trga, da se konsolidira okoli nekaj velikih rudarjev in ceni druge.

The boom and bust cycles of bitcoin mining should be looked at as the free market competition for an advantage in a perfectly transparent market with each rational actor, in their own minds trying to find an advantage (which leads to energy innovation, see below). All the while, securing the network as a byproduct of this natural competition.

Energija (kot del varnosti)

While many people falsely believe that Bitcoin and the way it uses proof of work to validate blocks is bad for the planet because of the energy used to secure the network, the truth is that Bitcoin is the samo stvar, ki sem jo našel in bo omogočila prehod v sistem planetarne poravnave in obilja. Kot sem že pogosto izjavil: obilje denarja ustvarja pomanjkanje povsod drugje, pomanjkanje denarja pa ustvarja obilje.

Na najvišji ravni je to zato, ker naš trenutni ekonomski sistem za planet ni skladen s tem, kam nas pelje tehnologija in življenje na končnem planetu.

Kot je pojasnjeno v "Cena jutrišnjega dne: Zakaj je deflacija ključna za bogato prihodnost« in v »Največja igra«.

Konflikt je treba rešiti na sistemski ravni:

- Exponentially increasing efficiency driven by technological progress requires a currency that allows for deflation (bitcoin). We get more for less work.

- The existing fiat monetary system requires inflation and consequently, it needs manipulation to remain viable. We get less for more work.

Ker obstoječi sistem temelji na kreditu, ne more dovoliti stalne deflacije brez popolnega zloma (ker bi bil kredit izbrisan in kredit is sistem). Družba nikoli ne bi glasovala za propad celotnega načina življenja. Kar pomeni, da obstaja paradoks, kjer bo družba na koncu vedno vztrajala pri manipulirani "rasti" zaradi strahu pred posledicami propada in te manipulirane rasti is glavni vir težav, s katerimi se sooča družba – vključno z okoljsko škodo.

Navsezadnje je to zato, ker namesto da bi dovolili, da cene padejo (in da družba pridobi čas in svobodo) z naraščajočo produktivnostjo, predpostavlja, da lahko »rastemo« za vedno. In sama rast predpostavlja, da je denar mogoče ustvariti iz nič, da bi jo dosegli. Ta »rast« za več delovnih mest, da bi lahko plačali račune, da bi plačali višje cene, ki so zmanipulirane višje, sploh drži družbo na hrčkovem kolesu, ne da bi videla, da je sistem sam s svojo vgrajeno obveznostjo rasti storitev neplačljivega dolga, ki je odgovoren za vse bolečine. Postaja še slabše – v obstoječem sistemu je treba vsako novost, ki znižuje ceno ali prihrani čas v prihodnosti, izravnati z večjo manipulacijo valute, da se ohrani obstoječa denarna shema. Energija sama je dober primer. Ni tako, kot da ni bilo obilice tehnologije, uporabljene v raziskovanje, proizvodnjo, transport in razvoj novih virov energije. Ko ugotovite, da je glavni razlog (pomembno je tudi naraščajoče povpraševanje) cene energije, ki so se zvišale zaradi nove energije, ki prihaja na spletu, in povečanja učinkovitosti obstoječih virov energije ta, da se morajo dvigniti, da bi podprli obstoječi kreditni sistem, se tudi zavedate, da ni pot ven iz sistema.

Beyond the environmental problem being unsolvable from the existing system, Bitcoin provides a path to a Kardašev planet tipa 1 kjer izkoristimo vso energijo, ki lahko doseže zemljo od sonca.

It does so because it provides a positive economic incentive in a transition to abundant energy. From the perspective of supply and demand, Bitcoin’s high energy cost to secure the network is a feature because an economic incentive is created that is both natural and positive to build out energy abundance. Energy is the number one driver of profitability in Bitcoin mining, meaning that low-cost energy is required for profits. A bitcoin miner cannot remain profitable by paying for energy at rates that a retail customer will, so it doesn’t compete with that energy.

Instead, it unleashes the same free market behavior in energy production and utilization. Namely searching for lower cost or stranded energy. By doing so, it provides a floor price for energy and a way to allocate capital to investments that would otherwise not be made. Those new energy investments, along with renewables, allow regions that were once cut off from the world due to a lack of reliable energy to build wealth and energy independence. The constant competition to find lower costs in energy and/or to use the heat provided from Bitcoin mining for other commercial uses such as heating greenhouses or commercial buildings unleashes a wave of entrepreneurial talent onto the challenge of energy utilization. All by way of free market competition to ensure a reliable abundance of energy and utilization.

Večini opazovalcev bi moralo biti že jasno, da je energija v našem življenju pomembnejša od količine natisnjenih papirnatih bankovcev ali digitalnih predstavitev teh bankovcev. Tiskanje več papirja ali digitalnih enot samo ustvarja dodatno pomanjkanje energije. Energija nadomešča dolarje, ker brez energije ni gospodarstva.

Bitcoin’s tie to energy for security and its corresponding positive effect on real growth and energy abundance is then perhaps its most under-appreciated feature (and one that the mainstream press has completely backwards).

Ta odlomek iz Gigi (@dergigi) ponuja nov način razumevanja, kako energija ščiti omrežje:

“Anything that doesn’t have any real cost—cost that is immediately obvious and can be verified by anyone at a glance—can be trivially forged or simply made up. In the words of Hugo Nguyen: ‘By attaching energy to a block, we give it ‘form’, allowing it to have real weight & consequences in the physical world.’

“If we remove this energy, let’s say by moving from miners to signers, we reintroduce trusted third parties into the equation, which removes the tie to physical reality that makes the past self-evident.

“It is this energy, this teža, that protects the public ledger. By bringing this unlikely information into existence, miners create a transparent force-field around past transactions, securing everyone’s value in the process—including their own—without any use of private information.

“It is this energy, this teža, that protects the public ledger. By bringing this unlikely information into existence, miners create a transparent force-field around past transactions, securing everyone’s value in the process—including their own—without any use of private information.

“Here comes the part that is tricky to understand: the value that is protected is not only value in the denarno smisel, ampak zelo moralna vrednost celovitosti sistema. Z razširitvijo poštene verige z največ dela se rudarji odločijo ukrepati iskreno, protecting the very rules that everyone agrees to. In turn, they are rewarded monetarily by the collective that is the network.”

2. Decentralizacija

There are two major design choices that lead to the ongoing decentralization of Bitcoin:

1. Prvi je narava dokaza o delu pri reševanju Problem bizantinskih generalov. Pomembno je, da gre za odkritje, ki ga ni mogoče znova rešiti. Lahko ga kopiramo, kar postavlja svoje izzive, ali pa ga spremenimo, da ga poskušamo rešiti na drugačen način. Toda zaradi splošne relativnosti njeno spreminjanje ne more rešiti problema brez uvedbe oraklja in centralizacije. Poglobimo se v vsako od teh:

a. A copy by necessity isn’t the longest chain because it must start later than Bitcoin which has the most proof of work protecting its history. The longest blockchain, by definition, is the one with the most trust. Therefore, a copy cannot have the same security or trust. Which begs the question, what utility would the new copy of Bitcoin provide that wouldn’t be better achieved through utilizing the most trusted and secure chain? Or how would a new chain without utility gain enough traction to compete with Bitcoin, while at the same time Bitcoin was exponentially increasing its security and hash rate because of its trust?

b. There is no such thing as universal time. Einstein’s theory of general relativity says the way we experience time is from our point of view. Time is relative to us — where we are. Depending on orbits, this “time” difference from our point of view on earth to Mars is between four minutes and 24 minutes. This same time difference occurs on earth as well but in such small intervals that we don’t notice it in our daily lives. The fact that we do not notice them, doesn’t change the fact that these small time differences exist. When computer systems are searching for cryptographic keys to prove they found the next block and won the prize, these small differences in time between different regions become critically important. Two Bitcoin miners on different sides of the world could solve the cryptography at exactly the same “time” because of these small variations and both be correct. It is not just theoretical, it has happened numerous times on the Bitcoin protocol and the way it is solved is, again, the longest chain, or most trust wins. For a period of 10 minutes then, or until the next block is mined, these two chains can both be valid until the next block is mined and the nodes confirm the longest chain. Miners choose which block they believe is valid and as 51% of them choose the valid block, the other miners move to the longest chain. It is a waste of energy and resources to mine on top of an orphaned block. Again, the longest chain is the one with the most trust.

Zaradi tega odkritja, ki povezuje energijo in dokaz o delu, obstaja le še en način za rešitev težave s časom. To vključuje uvedbo "zaupanja vrednega" agenta ali orakla, ki definira "pravila" in nato izbere, katere transakcije so veljavne (katera transakcija je bila prva). Ko pa se za rešitev problema uvede orakelj, se vanj zaupa, pravila se lahko spremenijo in decentralizacija se izgubi.

Bitcoin, through proof of work, is the only way to solve the problem. As Neil Degrasse Tyson poudarja, "Po zakonih fizike je vse ostalo mnenje."

2. The second design choice that keeps Bitcoin decentralized is the size of the block. Sacrificing additional block size on Layer 1 of Bitcoin meant a lower number of transactions per 10 minute block and/or less room for smart contracts in the underlying code. By keeping the block size small, the tens of thousands of full node operators around the world are the true rule enforcers of the network. (Tomer Strolight gives a great firsthand account of this power in the hands of the node operators tukaj.)

Medtem ko rudarji tekmujejo kot gospodarski akterji za zaščito omrežja, jih nadzorujejo vozlišča (odprta vsakomur, ki jih je enostavno nastaviti in zagnati), ki potrjujejo transakcije. Vsako od teh polnih vozlišč ima celotno zgodovino verige blokov in potrdi vsako njeno transakcijo. Ker je velikost bloka majhna, to pomeni, da so ta vozlišča zelo ekonomična za strojno opremo in stroške energije, kar posledično vodi do več vozlišč ali udeležencev, ki validirajo sistem (decentralizacija).

By adding additional information or space to the blockchain on Layer 1, the cost in energy and compute power to secure the network explodes, and in turn leads to only the most powerful or wealthy having enough money to run nodes, which in turn controls the decisions, i.e., centralization. The Blocksize Wars starting in 2015 to 2019 were fought over this key issue with many of the most powerful Bitcoin proponents at the time favoring a rule change that would bring more functionality to Layer 1, but in turn would give them more control in the form of centralization. Bitcoin hard forked over this fight with new code representing the new rules. Unlike soft forks which are agreed to by the miners and nodes and are backwards compatible, hard forks create a new chain. For example, if you owned bitcoin prior to August 1, 2017, and a hard fork to Bitcoin Cash occured, you would own coins in both chains. You could then elect to sell one of them in favor of the other or keep both. Below is a snapshot of what the market determines as value in both coins:

Market capitalization of Bitcoin as of August 6, 2022: $443 billion

Market capitalization of Bitcoin Cash as of August 6, 2022: $2.7 billion

Razlika v ceni forka ponovno dokazuje, da čeprav lahko vsakdo spremeni pravila in ponudi drugačen kovanec, ima najdaljša veriga z največ dokazi o delu največ zaupanja in jo udeleženci na trgu posledično bolj cenijo. Decentralizacija je velik del tega zaupanja.

3. Prilagodljivost

As reinforced throughout this article, the design choices that led to decentralization and security which itself wasn’t possible before Bitcoin, also led to design choices that lacked scalability. It is here that much of the conflict and confusion in blockchains originate. From a human nature perspective, it is easy to see that there would be conflicts, some users that wanted to build more in terms of scaling or differentiation on top of Bitcoin and felt blocked by its slow and methodical consensus of nodes protecting the ecosystem. They then decided to create their own blockchains with differentiation and tried to convince others that the new blockchains were better in some way. While many were/are complete fraudsters looking to make a quick buck on the back of ignorance, some may not have even been aware of the long-term implications of their design decisions in creating blockchains that must fail — either due to one, centralization and lack of economic incentives, or two, security vulnerabilities. And once created, there was no way out but to admit failure, or to keep changing while promising to solve the paradox at some point in the future.

Drugačen način povečanja

Protocols scale in layers. Scaling Bitcoin in layers provides a way to retain security and decentralization of Layer 1, but also gain scalability in the second or third layers instead of sacrificing the first, similar to the layers that form the building blocks of the internet and ultimately the products that you use every day. Each of the different protocols operate only at that layer. This abstraction ensures that each layer is self-contained, only needing to know how to interface with the layer above and below it, which simplifies design and flexibility without sacrificing what another layer provides. This kratek YouTube video nudi dober pregled nad plastmi omrežnega protokola večplastnega modela TCP-IP.

Because of the misunderstanding that protocols scale in layers, and the overall noise in the market, innovations like Lightning that allow Bitcoin to scale would be largely dismissed by an audience that saw Bitcoin as slow-moving, old technology, uncompromising in its security and decentralization.

To bi zagotovilo asimetrično priložnost za narode, podjetnike, kapital in javnost, ki so si vzeli čas, da bi razumeli, kaj se dogaja v ekosistemu, v primerjavi s tistimi, ki so to zavrnili.

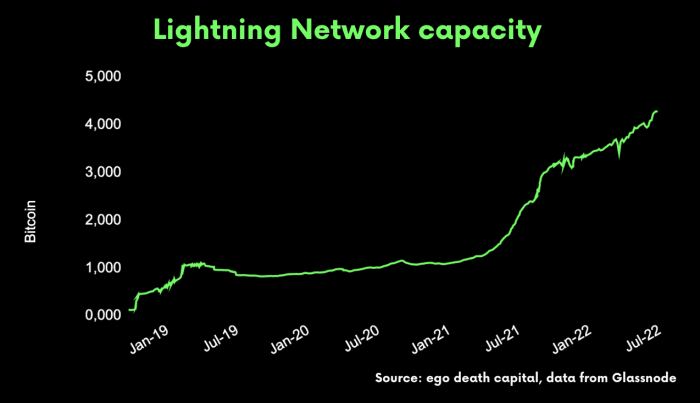

I believe that we are at that inflection point where technologies such as Lightning, Fedimint, Taro and others will usher in a wave of innovation in the space. I also believe although it is still in its infancy, Bitcoin and the protocol are unstoppable.

Spodaj je grafikon uporabe Lightninga od začetka:

Od nedavne mojstrovine Lyn Alden naprej Mreža strele:

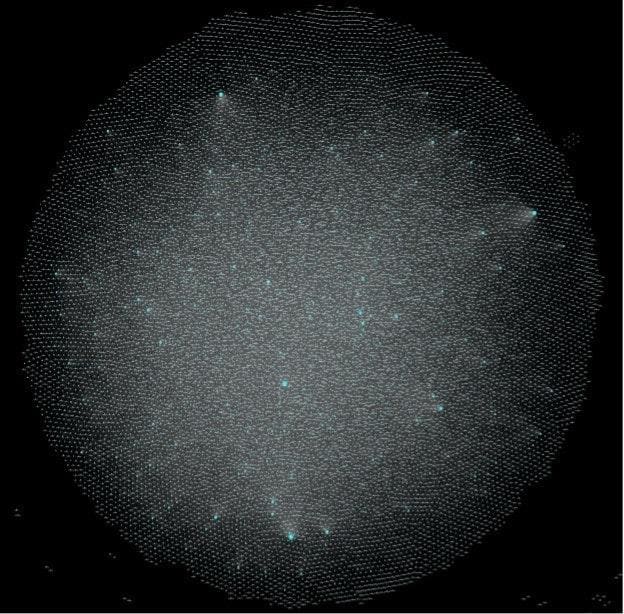

»Predstavljajte si globalni sistem z ogromnim številom med seboj povezanih vozlišč. Vsak lahko vstopi v omrežje z novim vozliščem in začne ustvarjati kanale. Poleg tega številne skrbniške storitve svojim imetnikom računov omogočajo tudi dostop do omrežja prek svojih vozlišč in kanalov.

»Tukaj je trenutno vizualizacija javnega omrežja Lightning. To je rastoča mreža medsebojno povezanih vozlišč, ki jih povezujejo plačilni kanali, pri čemer tiste večje pike predstavljajo posebej dobro povezana vozlišča:«

Zgodaj je in ne bo vse šlo po načrtih, a vsak uspeh po stopnjah okrepi in v ekosistem prinese več talentov in kapitala. Nekateri od teh kosov sestavljanke (kot so Strela, Taro in Fedimint) bodo delovali skupaj na načine, ki še niso popolnoma razumljeni – s pospeševanjem sprejemanja bodo vsi gradili na temeljih 1. ravni, ki so trdni. Pri tem bo veliko dolgoročnih "primerov uporabe" alternativnih kovancev izginilo in eden za drugim bodo propadli.

The Bitcoin protocol, scaling in layers, will provide a base layer that merges a new peer-to-peer internet and money natively within it. This will form a completely secure, open to anyone, integral foundation for technology more broadly. Like the dawn of the internet, but this time decentralized and secure, ensuring with its design a hopeful path for humanity where the natural abundance gained through technology is broadly distributed to society instead of being consolidated in the hands of a few. Regulators in certain nations could try to slow or stop it, but in doing so, they would be making a grave mistake, analogous to shutting down the internet from their citizens and blocking the innovation that came with it. It wouldn’t stop the innovation but would instead ensure that the innovation, and value derived from that innovation moved to other nations. Over time, people will realize that instead of pricing bitcoin “from the system” that they live in today, bitcoin will price vse v tem sistemu.

Prišlo bo do neverjetnih uspehov, neuspehov in učenja. Najpomembneje pa je, da bo obstajala trajna vrednost za družbo, ki bo nastala na trdnih temeljih, ki jih majhna skupina ljudi ne podkupi – decentralizirana in varna po svoji zasnovi. Ta novi sistem, ki ga je leta 2009 predstavil Nakamoto, spremeni vse.

Nekateri vodilni misleci v vesolju in njihovo delo:

This is a guest post by Jeff Booth. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

- best of bitcoin magazine

- Bitcoin

- Bitcoin Magazine

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Kultura

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- Feature

- Hiperbitkonizacija

- strojno učenje

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- Signal

- W3

- zefirnet