Decentralizirano financiranje se že nekaj časa obrača, odvzema posel centraliziranim finančnim institucijam in odvzema moč tradicionalnim posrednikom. Njegov razcvet so izstrelili institucionalni vlagatelji, ki so izrazili zanimanje za vesolje in milijone dolarjev, ki se vanj stekajo po vsem svetu. Vendar se regulativni organi počasi lotijo, saj še ne obstaja dokončen okvir za njegovo ureditev.

Sensing this wide gap, Japan’s Financial Services Agency (FSA) in its latest poročilo on FinTech addressed the importance of laying out rules for the Defi space. While the report took notice of the “benefits and opportunities” that the system provides, it also raised concerns about how DeFi can escape existing regulations.

Japan’s crypto-industry has been booming since the very start, with almost 3.5 million citizens trgovanje digital assets. Moreover, between October 2020 and February 2021, the monthly transaction value went up from 73 million yen to 417 million yen. The nation’s virtual currency vloge also hit a record high in March this year, soaring to 1.41 trillion yen, growing 7 times from the previous year.

Ta meteorski dvig je kripto-podjetjem v državi omogočil uspeh. Vodilna podjetja po vsej državi sprejemajo Bitcoin in druge valute kot legitimen način plačila. Pravzaprav je ameriški borzi Coinbase prejšnji mesec tudi uspelo zagotoviti vstop na japonski trg zaradi naraščajočega pomena regije na tem prostoru.

Such an inclusive environment could only exist due to Japan’s early regulatory moves. It was the first country to recognize crypto-assets as legal property under the Payment Services Act (PSA). Exchanges too are legalized in the country provided that they register under the specified norms. Non-compliance can also result in strict repercussions, as faced by Binance in bybit recently. Japan’s long tryst with technology has allowed its leaders to be first movers in terms of crypto-regulations.

Earlier in May, the Bank of Japan had issued another poročilo that tackled DeFi and its governance. The progressive report had concluded that there could be a rapid increase in DeFi adoption across the country, one which would cater to the needs of newer generations through the creation of new financial services while improving accessibility to financial products and services.

Vendar pa je obravnaval tudi potrebo po predpisih v primeru okvare pametne pogodbe ali sporazumov s finančnim vzvodom. Regulacija sistema DeFi je po vsem svetu zapletena, saj te institucije v nasprotju z bankami in drugimi posredniki ne morejo biti odgovorne. Poleg tega regulativni organi niso mogli slediti njegovemu hitremu širjenju in širjenju, saj se redno pojavljajo nova orodja in izdelki.

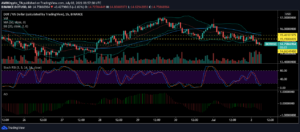

vir: DeFi impulz

While larger market corrections have momentarily stalled its growth, the attached chart highlighted the massive surge in DeFi investments over the last year. While the TVL was at $55.72 billion at the time of writing, it had touched an ATH of $88 billion in May.

Kam vlagati?

Naročite se na naše najnovejše novice in analize Crypto spodaj:

Vir: https://ambcrypto.com/japan-calls-for-regulations-on-defis-benefits-and-opportunities/

- 2020

- 7

- dostopnost

- Sprejetje

- Sporazumi

- Ameriška

- Analiza

- Sredstva

- Banka

- Banke

- Billion

- Bitcoin

- boom

- podjetja

- wrestling

- coinbase

- Podjetja

- Posoda

- Naročilo

- Popravki

- kripto

- Kripto novice

- kriptovalute

- plačila

- valuta

- Defi

- digitalni

- Digitalna sredstva

- dolarjev

- Zgodnje

- okolje

- Izmenjava

- Izmenjave

- Širitev

- Napaka

- financiranje

- finančna

- Finančne ustanove

- finančne storitve

- FINTECH

- prva

- obrazec

- Okvirni

- FSA

- vrzel

- upravljanje

- Pridelovanje

- Rast

- visoka

- Poudarjeno

- Kako

- HTTPS

- Povečajte

- Institucionalna

- institucionalni vlagatelji

- Institucije

- obresti

- naložbe

- Vlagatelji

- IT

- Japonska

- Zadnji

- vodi

- Pravne informacije

- Long

- marec

- Tržna

- milijonov

- novice

- Ostalo

- Plačilo

- Plačilne storitve

- Izdelki

- nepremičnine

- Uredba

- predpisi

- poročilo

- pravila

- Storitve

- pametna

- pametna pogodba

- Vesolje

- Začetek

- prenapetost

- sistem

- Tehnologija

- čas

- transakcija

- vrednost

- Virtual

- virtualna valuta

- po vsem svetu

- pisanje

- leto

- Yen