To je uvodnik mnenja Taimurja Ahmada, podiplomskega študenta na univerzi Stanford, ki se osredotoča na energijo, okoljsko politiko in mednarodno politiko.

Opomba avtorja: Gre za prvi del tridelne publikacije.

1. del predstavlja standard Bitcoin in ocenjuje Bitcoin kot varovanje pred inflacijo, pri čemer gre globlje v koncept inflacije.

2. del se osredotoča na trenutni fiat sistem, kako nastane denar, kakšna je ponudba denarja in začne komentirati bitcoin kot denar.

3. del se poglobi v zgodovino denarja, njegov odnos do države in družbe, inflacijo na globalnem jugu, progresivni argument za/proti bitcoinu kot denarju in alternativne primere uporabe.

Bitcoin As Money: Progressivism, Neoclassical Economics, And Alternatives Part I

Prologue

Nekoč sem slišal zgodbo, ki me je usmerila na pot, da bi poskušal razumeti denar. Gre nekako takole:

Predstavljajte si, da pride turist v majhno podeželsko mesto in se nastani v domači gostilni. Kot pri vsakem uglednem mestu, morajo plačati 100 diamantov (to je tisto, kar mesto uporablja kot denar) kot varščino za škodo. Naslednji dan lastnik gostilne ugotovi, da je turist na hitro zapustil mesto in za seboj pustil 100 diamantov. Glede na to, da je malo verjetno, da se bo turist vrnil nazaj, je lastnik navdušen nad tem obratom: bonus 100 diamantov! Lastnik se odpravi k lokalnemu peku in s tem dodatnim denarjem odplača njihov dolg; pek nato odide in poplača njun dolg pri lokalnem mehaniku; mehanik nato izplača krojača; krojač pa jim potem v domači gostilni poplača dolg!

Vendar to ni srečen konec. Naslednji teden se isti turist vrne po nekaj puščene prtljage. Lastnik gostilne, ki se zdaj počuti slabo, ker še vedno ima varščino in ker mu ni treba poplačati dolga do peka, se odloči turista opomniti na 100 diamantov in mu jih vrniti. Turist jih brezbrižno sprejme in pripomni, »oh, to je bilo itak samo steklo,« preden jih zdrobi pod noge.

Varljivo preprosta zgodba, a vedno težko oviti glavo okoli nje. Pojavlja se toliko vprašanj: če so bili vsi v mestu dolžni drug drugemu, zakaj tega niso mogli preprosto preklicati (težava pri usklajevanju)? Zakaj so si meščani medsebojno plačevali storitve v dolgovih – dolžniške dolžnosti –, turist pa je moral plačati denar (problem zaupanja)? Zakaj nihče ni preveril ali so diamanti pravi in ali bi jih lahko tudi če bi želeli (standardizacija/problem kakovosti)? Ali je pomembno, da diamanti niso bili pravi (kaj je potem pravzaprav denar)?

Predstavitev

Če si sposodim od Adama Toozeja, smo sredi polikrize. Ne glede na to, kako klišejsko se sliši, je sodobna družba glavna prelomna točka na več medsebojno povezanih frontah. Ne glede na to, ali gre za svetovni gospodarski sistem – ZDA in Kitajska, ki igrata komplementarni vlogi potrošnika oziroma proizvajalca – geopolitični red – globalizacija v unipolarnem svetu – in ekološki ekosistem – poceni energija iz fosilnih goriv, ki spodbuja množično potrošnjo – temelji, na katerih je preteklost nekaj desetletij zgrajenih se trajno premikajo.

Koristi tega večinoma stabilnega sistema, čeprav neenakopravnega in visokega stroška za številne družbene skupine, kot so nizka inflacija, globalne dobavne verige, videz zaupanja itd., se hitro razkrijejo. To je čas za postavljanje velikih, temeljnih vprašanj, od katerih nas je bilo večine dolgo časa preveč strah ali preveč raztresenih, da bi jih postavili.

Zamisel o denarju je v središču tega. Tu ne mislim nujno na bogastvo, ki je predmet številnih razprav v sodobni družbi, temveč na pojem denarja. Naš fokus je običajno na tem, kdo ima koliko denarja (bogastva), kako ga lahko pridobimo več zase, sprašujemo se, ali je trenutna razdelitev poštena itd. Pod tem diskurzom je domneva, da je denar v veliki meri inertna stvar, skoraj svetoskrunstvo. predmet, ki se vsak dan premika.

V zadnjih nekaj letih, ko sta dolg in inflacija postala vse bolj razširjena tema v glavnem diskurzu, so vprašanja o denarju kot konceptu pritegnila vse večjo pozornost:

- Kaj je denar?

- Od kod prihaja?

- Kdo ga nadzoruje?

- Zakaj je ena stvar denar, druga pa ne?

- Se/lahko spremeni?

Two ideas and theories that have dominated this conversation, for better or for worse, are Modern Monetary Theory (MMT) and alternative currencies (mostly Bitcoin). In this piece, I will be primarily focusing on the latter and critically analyzing the arguments underpinning the Bitcoin standard — the theory that we should replace fiat currency with Bitcoin — its potential pitfalls, and what alternative roles Bitcoin could have. This will also be a critique of neoclassical economics which governs mainstream discourse outside the Bitcoin community but also forms the foundation for many arguments on top of which the Bitcoin standard rests.

Why Bitcoin? When I got exposed to the crypto community, the mantra I came across was “crypto, not blockchain.” While there are merits to that, for the specific use-case of money especially, the mantra to focus on is “Bitcoin, not crypto.” This is an important point because commentators outside the community too often conflate Bitcoin with other crypto assets as part of their critiques. Bitcoin is the only truly decentralized cryptocurrency, without a pre-mine, and with fixed rules. While there are plenty of speculative and questionable projects in the digital asset space, as with other asset classes, Bitcoin has well established itself to be a genuinely innovative technology. The proof-of-work mining mechanism, that often comes under attack for energy use (I wrote against that and explained how BTC mining helps clean energy tukaj), is integral to Bitcoin standing apart from other crypto assets.

To repeat for the sake of clarity, I will be purely focusing on Bitcoin only, specifically as a monetary asset, and mostly analyzing arguments coming from the “progressive” wing of Bitcoiners. For most of this piece, I will be referring to the monetary system in Western countries, focusing on the Global South at the end.

Since this will be a long, occasionally meandering, set of essays, let me provide a quick summary of my views. Bitcoin as money does not work because it is not an exogenous entity that can be programmatically fixed. Similarly, assigning moralistic virtues to money (e.g. sound, fair, etc.) represents a misunderstanding of money. My argument is that money is a social phenomenon, coming out of, and in some ways representing, socioeconomic relations, power structures, etc. The material reality of the world creates the monetary system, not vice versa. This has always been the case. Therefore, money is a concept constantly in flux, necessarily so, and must be elastic to absorb the complex movements in an economy, and must be flexible to adjust to the idiosyncratic dynamics of each society. Lastly, money cannot be separated from the political and legal institutions that create property rights, the market, etc. If we want to change the broken monetary system of today — and I agree it is broken — we must focus on the ideological framework and institutions that shape society so we can better use existing tools for better ends.

Disclaimer: I hold bitcoin.

Kritika sedanjega monetarnega sistema

Proponents of the Bitcoin standard make the following argument:

Vladni nadzor nad denarno ponudbo je privedel do divje neenakosti in devalvacije valute. Cantillonov učinek je eden glavnih vzrokov za to naraščajočo neenakost in gospodarsko izkrivljanje. Cantillonov učinek, ki je povečanje denarne ponudbe s strani države, daje prednost tistim, ki so blizu centrov moči, ker prvi dobijo dostop do njega.

This lack of accountability and transparency of the monetary system has ripple effects throughout the socioeconomic system, including decreasing purchasing power and limiting the saving capabilities of the masses. Therefore, a programmatic monetary asset that has fixed rules of issuance, low barriers to entry and no governing authority is required to counter the pervasive effects of this corrupt monetary system which has created a weak currency.

Preden začnem ocenjevati te argumente, je pomembno, da to gibanje umestim v širšo družbeno-ekonomsko in politično strukturo, v kateri živimo. V zadnjih 50 letih je bilo precej empiričnih dokazi pokazati, da so realne plače stagnirale, čeprav je produktivnost naraščala, neenakost naraščalo, gospodarstvo je bilo vse bolj finančno finančno, kar je koristilo bogatim in lastnikom premoženja, finančni subjekti so bili vpleteni v korupcijske in kriminalne dejavnosti in večina svetovnega juga je trpela zaradi gospodarskih pretresov – visoka inflacija, neplačila itd., — v izkoriščevalskem svetovnem finančnem sistemu. Neoliberalni sistem je bil neenakopraven, zatiralski in dvoličen.

V istem obdobju so politične strukture šepale, celo demokratične države padla žrtev to state capture by the elite, leaving little space for political change and accountability. Therefore, while there are many wealthy proponents of Bitcoin, a significant proportion of those arguing for this new standard can be seen as those who have been “left behind” and/or recognize the grotesqueness of the current system and are simply looking for a way out.

It is important to understand this as an explanation to why there is an increasing number of “progressives” — loosely defined as people arguing for some form of equality and justice — who are becoming pro-Bitcoin standard. For decades, the question of “what is money?” or the fairness of our financial system has been relatively absent from mainstream discourse, buried under Econ-101 fallacies, and confined to mostly ideological echo chambers. Now, as the pendulum of history turns back towards populism, these questions have become mainstream again, but there is a dearth of those in the expert class that can sufficiently be sympathetic towards, and coherently respond to, people’s concerns.

Zato je ključnega pomena razumeti, od kod izvira ta standardna pripoved o Bitcoinu, in je ne zavrniti neposredno, tudi če se z njo ne strinjamo; namesto tega se moramo zavedati, da si mnogi od nas, ki dvomimo o sedanjem sistemu, delimo veliko več, kot se s tem ne strinjamo, vsaj na ravni prvih načel, in da je vključevanje v razpravo onkraj površinske ravni edini način za dvig kolektivne zavesti na faza, ki omogoča spremembe.

Is A Bitcoin Standard The Answer?

I will attempt to tackle this question at various levels, ranging from the more operational ones such as Bitcoin being an inflation hedge, to the more conceptual ones such as the separation of money and The State.

Bitcoin kot varovanje pred inflacijo

This is an argument that is widely used in the community and covers a number of features important to Bitcoiners (e.g., protection against loss of purchasing power, currency devaluation). Up until last year, the standard claim was that as prices are always going up under our inflationary monetary system, Bitcoin is a hedge against inflation as its price goes up (by orders of magnitude) more than the price of goods and services. This always seemed like an odd claim because during this period, many tveganih sredstev delovali izjemno dobro, vendar se na noben način ne štejejo za zaščito pred inflacijo. Poleg tega so razvita gospodarstva delovala v režimu sekularne nizke inflacije, zato ta trditev ni bila nikoli zares preizkušena.

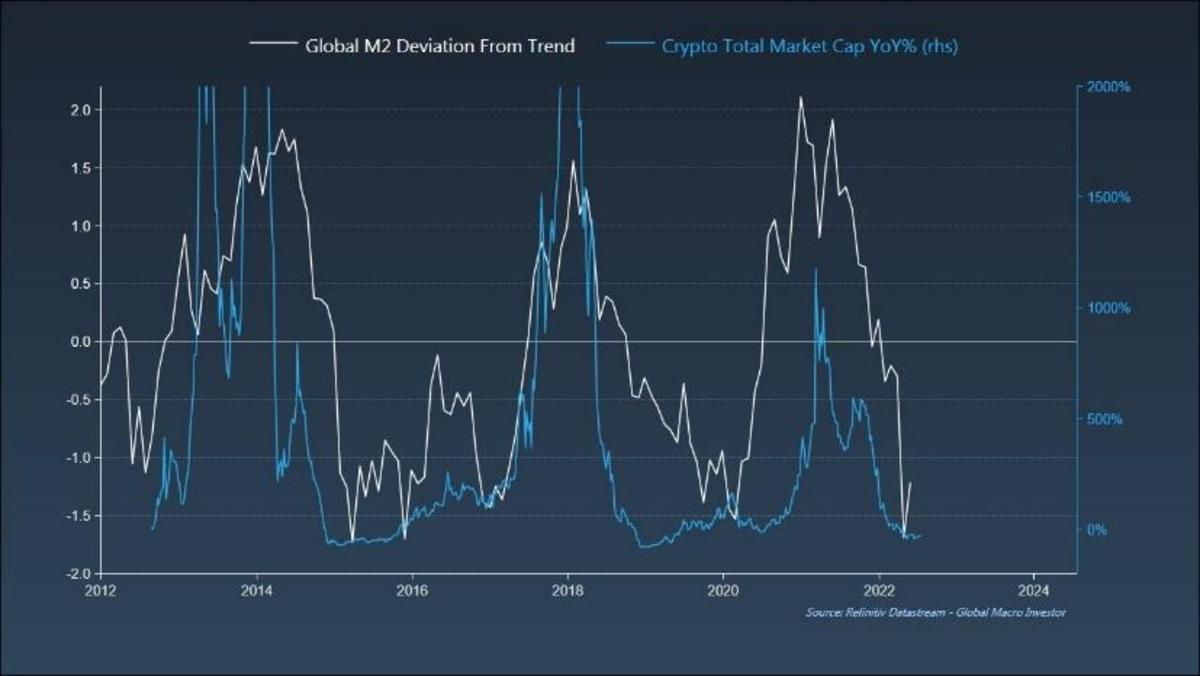

More importantly though, as prices surged higher over the past year and Bitcoin’s price plummeted, the argument shifted to “Bitcoin is a hedge against monetary inflation,” meaning that it doesn’t hedge against a rise in the price of goods and services per se, but against the “devaluation of currency through money printing.” The chart below is used as evidence for this claim.

To je tudi nenavaden argument iz več razlogov, od katerih bom vsakega podrobneje pojasnil:

- It again relies on the claim that Bitcoin is uniquely a “hedge” and not simply a risk-on asset, similar to other high-beta assets that have performed well over periods of increasing liquidity.

- It relies on the monetarist theory that increase in the money supply directly and imminently leads to an increase in prices (if not, then why do we care about the money supply to begin with).

- It represents a misunderstanding of M2, money printing, and where money comes from.

1. Is Bitcoin Simply A Risk-On Asset?

Pri prvi točki Steven Lubka o nedavnem epizoda of the What Bitcoin Did podcast remarked that Bitcoin was a hedge against inflation caused through excessive monetary expansion and not when that inflation was supply-side, which, as he rightly pointed out, is the current situation. In a recent kos on the same topic, he responds to the critique that other risk-on assets also go up during periods of monetary expansion by writing that Bitcoin goes up more than other assets and that only Bitcoin should be considered as a hedge because it is “just money,” while other assets are not.

However, the extent to which an asset’s price goes up shouldn’t matter as a hedge as long as it is positively correlated to the price of goods and services; I’d even argue that price going up too much — admittedly subjective here — pushes an asset from a hedge to speculative. And sure, his point that assets like stocks have idiosyncratic risks like bad management decisions and debt loads that make them distinctly different to Bitcoin is true, but other factors such as “risk of obsolescence,” and “other real-world challenges,” to quote him directly, apply to Bitcoin as much as they apply to Apple stock.

There are many other charts that show Bitcoin has a močna korelacija with tech stocks in particular, and the equity market more broadly. The fact is that the ultimate driving factor behind its price action is the change in global liquidity, particularly U.S. liquidity, because that is what decides how far across the risk curve investors are willing to push out. In times of crisis, such as now, when safe haven assets like the USD are having a strong run, Bitcoin is not playing a similar role.

Therefore, there doesn’t seem to be any analytical reason that Bitcoin trades differently to a risk-on asset riding liquidity waves, and that it should be treated, simply from an investment point of view, as anything different. Granted, this relationship may change in the future but that’s for the market to decide.

2. Kako definiramo inflacijo in ali je denarni pojav?

It is critical to the Bitcoiner argument that increases in money supply leads to currency devaluation, i.e., you can buy less goods and services due to higher prices. However, this is hard to even center as an argument because the definition of inflation seems to be in flux. For some, it is simply an increase in the price of goods and services (CPI) — this seems like an intuitive concept because that’s what people as consumers are most exposed to and care about. The other definition is that inflation is an increase in the money supply — prava inflacija kot ga imenujejo nekateri — ne glede na vpliv na ceno blaga in storitev, čeprav bi to moralo voditi v podražitve sčasoma. To je povzeto po citatu Miltona Friedmana, ki je po mojem mnenju zdaj preoblikovan v meme:

"Inflacija je vedno in povsod denarni pojav v smislu, da je in jo lahko ustvari le hitrejše povečanje količine denarja kot proizvodnje."

Okay so let’s try to understand this. Price increases due to non-monetary causes, such as supply chain issues, are not inflation. Price increases due to an expansion of the money supply are inflation. This is behind Steve Lubka’s point, at least how I understood it, about Bitcoin being a hedge against true inflation but not the current bout of supply-chain induced high prices. (Note: I am using his work specifically because it was well articulated but many others in the space make a similar claim).

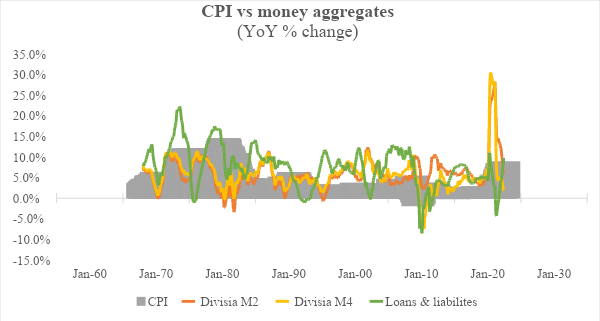

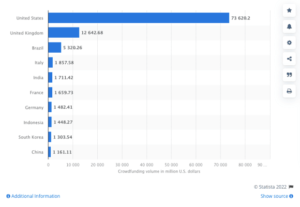

Ker nihče ne trdi o vplivu dobavne verige in drugih fizičnih omejitev na cene, se osredotočimo na drugo trditev. Toda zakaj je sprememba v ponudbi denarja sploh pomembna, razen če je povezana s spremembo cen, ne glede na to, kdaj pride do teh sprememb cen in kako asimetrične so? Tu je grafikon, ki prikazuje letno odstotno spremembo različnih mer ponudbe denarja in CPI.

Tehnična opomba: M2 je ožje merilo ponudbe denarja kot M4, saj prvo ne vključuje visoko likvidnih denarnih nadomestkov. Vendar Federal Reserve v ZDA zagotavlja samo podatke M2 kot najširše merilo ponudbe denarja zaradi nepreglednosti finančnega sistema, ki omejuje pravilno oceno široke ponudbe denarja. Tudi tukaj uporabljam Divisia M2, ker ponuja metodološko boljšo oceno (z uporabo teže za različne vrste denarja) namesto pristopa Federal Reserve, ki je povprečje preproste vsote (ne glede na to, da so podatki Fed M2 tesno usklajeni s podatki Divisie ). Posojila in zakupi so merilo bančnega kredita in ker banke ustvarjajo denar, ko posojajo, namesto da reciklirajo prihranke, kot bom razložil kasneje, je pomembno dodati tudi to.

Iz grafikona lahko vidimo, da obstaja šibka korelacija med spremembami v ponudbi denarja in CPI. Od sredine 1990-ih do začetka 2000-ih se stopnja spreminjanja denarne ponudbe povečuje, medtem ko se inflacija znižuje. Obratno velja v zgodnjih 2000-ih, ko se je inflacija povečevala, ponudba denarja pa se je zmanjševala. Obdobje po letu 2008 morda najbolj izstopa, ker je bil to začetek režima kvantitativnega sproščanja, ko so bilance stanja centralnih bank rasle po stopnjah brez primere, vendar razvita gospodarstva nenehno niso uspela doseči svojih inflacijskih ciljev.

Eden od možnih protiargumentov temu je, da je inflacijo mogoče najti v nepremičninah in delnicah, ki so večino tega obdobja naraščale. Čeprav obstaja nedvomno močna povezava med temi cenami sredstev in M2, menim, da apreciacija delniškega trga ni inflacija, ker ne vpliva na kupno moč potrošnikov in zato ne zahteva varovanja. Ali obstajajo distribucijska vprašanja, ki vodijo v neenakost? Vsekakor. Toda za zdaj se želim osredotočiti samo na pripoved o inflaciji. Kar zadeva cene stanovanj, je to težko šteti kot inflacijo, ker so nepremičnine glavni naložbeni nosilec (kar je globoko strukturni problem sam po sebi).

Zato empirično ni pomembnih dokazov, da bi povečanje M2 nujno vodi do povečanja CPI (tu velja spomniti, da se osredotočam predvsem na razvita gospodarstva in da bom kasneje obravnaval temo inflacije na globalnem jugu). Če bi obstajala, Japonska ne bi ostala v a nizka inflacija gospodarstva, precej pod ciljno inflacijo, kljub širjenju bilance stanja Banke Japonske v zadnjih nekaj desetletjih. Trenutni inflacijski izbruh je posledica cen energije in motenj v dobavni verigi, zato se države v Evropi — z veliko odvisnostjo od ruskega plina in slabo premišljeno energetsko politiko — na primer soočajo z višjo inflacijo kot druge razvite države.

Sidenote: it was interesting to see Peter McCormack’s reaction when Jeff Snider made a similar case (regarding M2 and inflation) on the What Bitcoin Did Podcast. Peter je pripomnil, da je to smiselno, vendar se mu zdi v nasprotju s prevladujočo pripovedjo.

Četudi monetaristično teorijo vzamemo za pravilno, se poglobimo v nekaj podrobnosti. Ključna enačba je MV = PQ.

M: ponudba denarja.

V: hitrost denarja.

P: cene.

V: količina blaga in storitev.

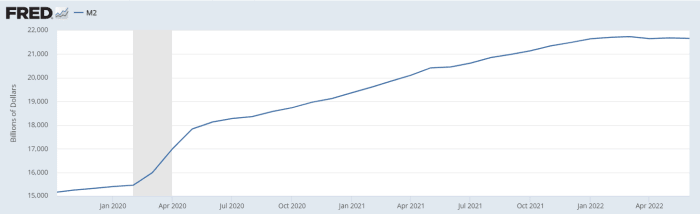

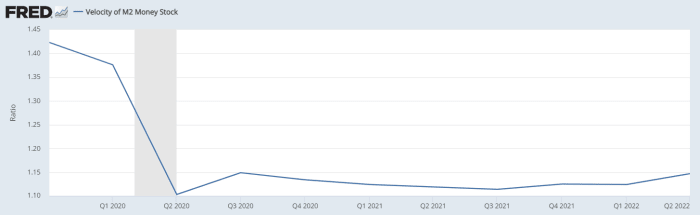

Ti grafikoni in analize, ki temeljijo na M2, pogrešajo, kako se spreminja hitrost denarja. Vzemimo za primer leto 2020. Ponudba denarja M2 se je povečala zaradi fiskalnega in monetarnega odziva vlade, zaradi česar so mnogi napovedovali hiperinflacijo za vogalom. Medtem ko se je M2 leta 2020 povečal za ~25 %, se je hitrost denarja zmanjšala za ~18 %. Tudi če monetaristično teorijo vzamemo za nominalno vrednost, je dinamika bolj zapletena kot preprosto risanje vzročne povezave med povečanjem ponudbe denarja in inflacijo.

As for those who will bring up the Webster dictionary definition of inflation from the early 20th century as an increase in money supply, I’d say that change in money supply under the gold standard meant something completely different to what it is today (addressed next). Also, Friedman’s claim, which is a core part of the Bitcoiner argument, is essentially a truism. Yes, by definition higher prices, when not due to physical constraints, is when more money is chasing the same goods. But that does not in and of itself translate to the fact that increase in the money supply necessitates an increase in prices because that additional liquidity can unlock spare capacity, lead to productivity gains, expand the use of deflationary technologies, etc. This is a central argument for (trigger warning here) MMT, which argues that targeted use of fiscal spending can expand capacity, particularly through targeting the “reserve army of the unemployed,” as Marx called it, and employing them rather than treating them as sacrificial lambs at the neoclassical altar.

To bring this point to a close then, it’s hard to understand how inflation is, for all intents and purposes, anything different to an increase in CPI. And if the monetary expansion leads to inflation mantra does not hold, then what is the merit behind Bitcoin being a “hedge” against that expansion? What exactly is the hedge against?

I will admit there are a plethora of issues with how CPI is measured, but it is undeniable that changes in prices happen because of a myriad of reasons across the demand-side and supply-side spectrum. This fact has also been noted by Powell, Yellen, Greenspan, and other central bankers (eventually), while various heterodox economists have been arguing this for decades. Inflation is a remarkably complicated concept that cannot be simply reduced to monetary expansion. Therefore, this calls into question whether Bitcoin is a hedge against inflation if it is not protecting value when CPI is surging, and that this concept of hedging against monetary expansion is just chicanery.

V 2. delu razložim trenutni fiat sistem, kako nastane denar (to ni vse, kar počne vlada) in kaj bi Bitcoinu kot denarju lahko manjkalo.

To je gostujoča objava avtorja Taimurja Ahmada. Izražena mnenja so v celoti njihova lastna in ne odražajo nujno mnenj BTC, Inc. ali Bitcoin Magazine.

- Bitcoin

- Bitcoin Magazine

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- coinbase

- coingenius

- Soglasje

- CPI

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- Economics

- ethereum

- inflacija

- strojno učenje

- Prisotnost

- Marty's Bent

- Denar

- nezamenljiv žeton

- Mnenje

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- W3

- zefirnet