Enforcement actions on cryptocurrency firms by regulators in the United States could result in a Bitcoin (BTC)-focused industry that will push its price over $250,000, according to MicroStrategy co-founder Michael Saylor.

In a June 13 Bloomberg intervju, the Bitcoin bull explained recent enforcement actions from the Securities and Exchange Commission (SEC) will eventually play in Bitcoin’s favor — the only crypto excluded from being a security by SEC chair Gary Gensler.

Saylor je dodal, da ameriški regulatorji "ne vidijo legitimne poti naprej za kriptovalute" in dodal, da "nimajo ljubezni" do stabilnih kovancev, kriptožetonov ali izvedenih finančnih instrumentov na osnovi kriptovalut.

Saylor je dejal, da bodo kripto borze katalizatorji za znaten porast cen:

»[SEC-ovo] mnenje je, da bi morale kripto borze trgovati in hraniti čisto digitalno blago, kot je Bitcoin, in tako je celotni industriji usojeno, da se racionalizira do industrije, osredotočene na Bitcoin, z morda pol ducata do ducatom drugih dokazov o delu žetoni."

"Naslednji logični korak je, da Bitcoin doseže 10x od tu in nato spet 10x," je trdil.

Regulativna jasnost bo vodila #Bitcoin posvojitev z odpravo zmede in tesnobe, ki je zadrževala institucionalne vlagatelje. Prevlada bitcoinov bo še naprej naraščala # Kriptovalut industrija racionalizira okoli $ BTC in postane mainstream. pic.twitter.com/Foq4lpderj

- Michael Saylor⚡️ (@saylor) Junij 13, 2023

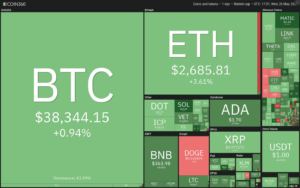

Saylor noted Bitcoin’s market share increased from 40% to 48% in 2023 which may be attributed in part to the SEC’s enforcement activity and having now labeled 68 cryptocurrencies as securities — none of which are proof-of-work.

Saylor meni, da se bo v prihodnosti ta prevlada povečala na 80 %, saj bo "mega institucionalni denar" pritekel v kripto, potem ko bo "zmeda in tesnoba" zaradi kripto izginila.

Vendar so bili Saylor in drugi zagovorniki, osredotočeni na Bitcoin, deležni precejšnjih kritik.

Anthony Sassano, voditelj oddaje The Daily Gwei, je pred kratkim pozval »Bitcoinerje«, ki so veseli, da SEC vlaga tožbe proti Coinbase in drugim borzam, ki navajajo žetone, ki jih SEC šteje za neregistrirane vrednostne papirje.

Neverjetno neprijetno je videti, koliko bitcoinerjev, ki se identificirajo kot "cypherpunks", se popolnoma slinijo ob dejstvu, da se SEC loteva Coinbase.

Nobeno podjetje v tej panogi ni naredilo več za prevzem Bitcoina kot Coinbase.

— sassal.eth (@sassal0x) Junij 7, 2023

Ethereum-based wallet MetaMask and many others also believe a “multichain future” is inevitable because different blockchains serve different purposes.

Povezano: Cena bitcoina lahko v naslednjih 20 mesecih 'zlahka' doseže 4 $ - Philip Swift

Mike McGlone, višji makro strateg pri Bloomberg Intelligence, je v začetku maja pojasnil, da "deflacijski propad" vpliva na trg surovin in bančne depozite - in da je kriptovaluta morda naslednja domina, ki bo padla.

Kripto bi lahko bile naslednje sredstvo, ki bo padlo v deflacijskih dominah – Bilo je leto skokov za skoraj vse, kar je leta 2022 padlo, z #kripto na vrhu med izvajalci z visoko stopnjo beta, vendar se deflacijski propad morda krepi, kot je razvidno iz padca #nastanitve in bančne depozite pic.twitter.com/H871jqA5xc

- Mike McGlone (@ mikemcglone11) Maj 3, 2023

In January, economist Lyn Alden told Cointelegraph there is “considerable danger ahead” for Bitcoin in the second half of 2023, stating that when the U.S. resolves its debt issue, significant liquidity will be pulled out of markets:

"Na tej točki bosta tako ministrstvo za finance kot Fed črpala likvidnost iz sistema, kar bi ustvarilo ranljiv čas za tvegana sredstva na splošno, vključno z BTC."

Revija: 3.4 milijarde $ bitcoinov v pločevinki za pokovko — zgodba hekerja Svilne poti

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- EVM Finance. Poenoten vmesnik za decentralizirane finance. Dostopite tukaj.

- Quantum Media Group. IR/PR ojačan. Dostopite tukaj.

- PlatoAiStream. Podatkovna inteligenca Web3. Razširjeno znanje. Dostopite tukaj.

- vir: https://cointelegraph.com/news/industry-will-focus-on-bitcoin-due-to-regulators-michael-saylor

- :ima

- : je

- 000

- 13

- 2022

- 2023

- 7

- 8

- a

- O meni

- absolutno

- Po

- dejavnosti

- dejavnost

- dodano

- dodajanje

- Sprejetje

- Zagovorniki

- po

- spet

- proti

- Prav tako

- med

- in

- Anksioznost

- kaj

- SE

- okoli

- AS

- Sredstva

- At

- nazaj

- Banka

- bančne vloge

- BE

- ker

- bilo

- zadaj

- počutje

- Verjemite

- meni

- Bitcoin

- sprejetje bitcoinov

- Bitcoin bik

- prevlado bitcoinov

- bitcoinerji

- verige blokov

- Bloomberg

- Bloombergova inteligenca

- tako

- BTC

- bull

- bankrot

- vendar

- by

- se imenuje

- CAN

- katalizatorji

- Stol

- trdil,

- jasnost

- So-ustanovitelj

- coinbase

- Cointelegraph

- Komisija

- Blago

- podjetje

- zmeda

- velika

- šteje

- naprej

- bi

- ustvarjajo

- kritika

- kripto

- Kriptovalute

- Kripto industrija

- na osnovi kripto

- cryptocurrencies

- cryptocurrency

- Cypherpunks

- vsak dan

- NEVARNOST

- Dolg

- deflacija

- deflacijski

- vloge

- Izvedeni finančni instrumenti

- drugačen

- digitalni

- Prevlada

- don

- opravljeno

- navzdol

- ducata

- pogon

- Drop

- 2

- Zgodnje

- Ekonomist

- odstranjevanje

- izvršba

- Celotna

- ETH

- sčasoma

- vse

- Izmenjava

- Izmenjave

- razložiti

- Dejstvo

- Padec

- prednost

- Fed

- file

- podjetja

- Pretok

- za

- Naprej

- iz

- gorivo

- Prihodnost

- pridobivanje

- splošno

- Gensler

- goes

- dogaja

- Grow

- Pol

- Imajo

- he

- tukaj

- hit

- držite

- gospodarstvo

- gostitelj

- Kako

- Vendar

- HTTPS

- udarne

- in

- Vključno

- Povečajte

- povečal

- Industrija

- neizogibno

- Institucionalna

- institucionalni vlagatelji

- Intelligence

- v

- Vlagatelji

- vprašanje

- IT

- ITS

- januar

- jpg

- junij

- samo

- Otrok

- tožbe

- legitimno

- kot

- likvidnostno

- Seznam

- logično

- ljubezen

- lyn alden

- Makro

- Mainstream

- več

- Tržna

- Maj ..

- pol

- Michael

- Michael saylor

- mikrostrategija

- mike

- mike mcglone

- mesecev

- več

- Naslednja

- opozoriti

- zdaj

- of

- on

- samo

- or

- Ostalo

- drugi

- ven

- več

- del

- pot

- izvajalci

- platon

- Platonova podatkovna inteligenca

- PlatoData

- Predvajaj

- zadovoljen

- potop

- Točka

- Cena

- porast cen

- dokazilo

- Dokazilo o delu

- namene

- Push

- nedavno

- Pred kratkim

- Regulatorji

- povzroči

- Tveganje

- tveganih sredstev

- cesta

- s

- Je dejal

- saylor

- SEC

- sec stol

- drugi

- Vrednostni papirji

- Securities and Exchange Commission

- glej

- videl

- višji

- služijo

- Delite s prijatelji, znanci, družino in partnerji :-)

- shouldnt

- pomemben

- svila

- Svilena cesta

- So

- Stablecoins

- Države

- Korak

- Strategist

- prenapetost

- SWIFT

- sistem

- kot

- da

- O

- Prihodnost

- POTEM

- Tukaj.

- jih

- ta

- čas

- do

- Boni

- Topi

- trgovini

- zakladnica

- nas

- Velika

- Združene države Amerike

- neprijavljeni

- neregistrirani vrednostni papirji

- Poglej

- Ranljivi

- denarnica

- kdaj

- ki

- WHO

- bo

- z

- delo

- bi

- leto

- youtube

- zefirnet