Do selitve pride kljub zadržkom ustanovitelja glede sredstev iz resničnega sveta

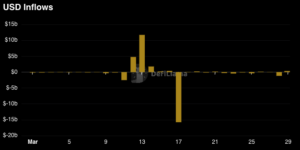

The largest DeFi lender will soon invest up to $500M of USDC into U.S. treasuries and corporate bonds.

A $1M test transaction has already been začeti with the full amount to follow shortly. MakerDAO aims to increase the productivity of USDC, the largest asset on Maker’s balance sheet, according to a February forum post which preceded a glas upravljanja maja.

Maker is the largest DeFi protocol with $7.6B in total value locked (TVL), according to The Defiant Terminal.

Maker TVL, Source: Kljubovalni terminal

The USDC will come from what’s called the peg stability module (PSM), which allows users to swap U.S. dollar-pegged stablecoins like USDC for DAI, Maker’s stablecoin. The bond portfolio will be managed by Monetalis, a DeFi asset manager.

Regulativni pomisleki

The move to allocate up to $500M towards traditional assets comes at a time when Rune Christensen has been pushing against making further inroads into real-world assets like corporate bonds.

V odgovor na Denarne sankcije Tornado, the Maker founder wrote on Maker’s forums that the regulatory environment had turned increasingly divisive. “Either you’re [a] fully compliant, regulated bank, or you’re a terrorist,” Christensen Napisal.

The vote to move assets into traditional bonds continues a trend of third parties looking to partner with Maker — in late September, Gemini, the crypto exchange founded by the Winklevoss twins, proposed to pay Maker 1.25% on deposits of the exchange’s GUSD stablecoin.

Coinbase has also ponujen to pay Maker 1.5% if the DAO deposits $1.6B of USDC from its PSM into Prime, Coinbase’s institutional offering.

Chris Blec, a Maker governance delegate, is strongly against the proposed partnerships. “DAI is under severe threat of being captured by corporations,” he wrote on Twitter, citing the moves by Coinbase, Gemini, and Monetalis as examples.

The protocol’s MKR token has outperformed over the last month, rising 19% to $865 while Bitcoin has remained flat and Ether has dropped 19%.

MKR Price + ETH Price + BTC Price, Source: Kljubovalni terminal

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- Platoblockchain

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- Zavračevalec

- W3

- zefirnet