Real estate ownership is the core aspiration driving the Modern Serfdom Model. Debt — and in particular, mortgages — is the mechanism that binds the serf to the system. Inflation covertly moves the finishing line further away each year. This is a game that’s impossible to win. The bad news is it’s getting even harder. But there are two pieces of good news. First, the model is close to its breaking point because home ownership is out of reach for almost all young people. Second, everyone, regardless of age, wealth or circumstances, has bitcoin as an escape hatch. On the system in which we indoctrinate people into this feudalism, Allan Watts said,

“…What we do is put the child into the corridor of this grade system with a kind of, “Come on kitty, kitty.” And you go onto kindergarten and that’s a great thing because when you finish that you get into first grade. Then, “Come on” first grade leads to second grade and so on. And then you get out of grade school and you got high school. It’s revving up, the thing is coming, then you’re going to go to college… Then you’ve got graduate school, and when you’re through with graduate school you go out to join the world. Then you get into some racket where you’re selling insurance. And they’ve got that quota to make, and you’re gonna make that. And all the time that thing is coming – It’s coming, it’s coming, that great thing. The success you’re working for. Then you wake up one day about 40 years old and you say, “My God, I’ve arrived. I’m there.” And you don’t feel very different from what you’ve always felt. Look at the people who live to retire; to put those savings away. And then when they’re 65 they don’t have any energy left. They’re more or less impotent. And they go and rot in some, old peoples, senior citizens community. Because we simply cheated ourselves the whole way down the line. If we thought of life by analogy with a journey, with a pilgrimage, which had a serious purpose at that end, and the thing was to get to that thing at that end. Success, or whatever it is, or maybe heaven after you’re dead. But we missed the point the whole way along. It was a musical thing, and you were supposed to sing or to dance while the music was being played.”

Začne se v šoli

Državni šolski sistemi so tam, kjer se začne model sodobnega kmetovanja. Otroke učijo biti predvsem poslušni. Naučijo se bati avtoritete, ne dvomiti o stvareh ali govoriti, da je družba nadzorovana od zgoraj navzdol. Seveda posledice niso vse slabe – še posebej, če lahko kasneje vprežete disciplino in samokontrolo v svojo korist. Najpomembneje pa je v zvezi z modelom, da so otroci oblikovani tako, da sledijo samo eni smeri: višja izobrazba in kariera, hkrati pa so poslušni služabniki države.

(Opomba: to je sama po sebi globoka zajčja luknja. Zelo priporočam kratek TED pogovor sira Kena Robinsona z naslovom "Ali šole ubijajo ustvarjalnost?", as well as various podcasts and books by Bitcoiners Daniel Prince in Saifedejski Ammous.)

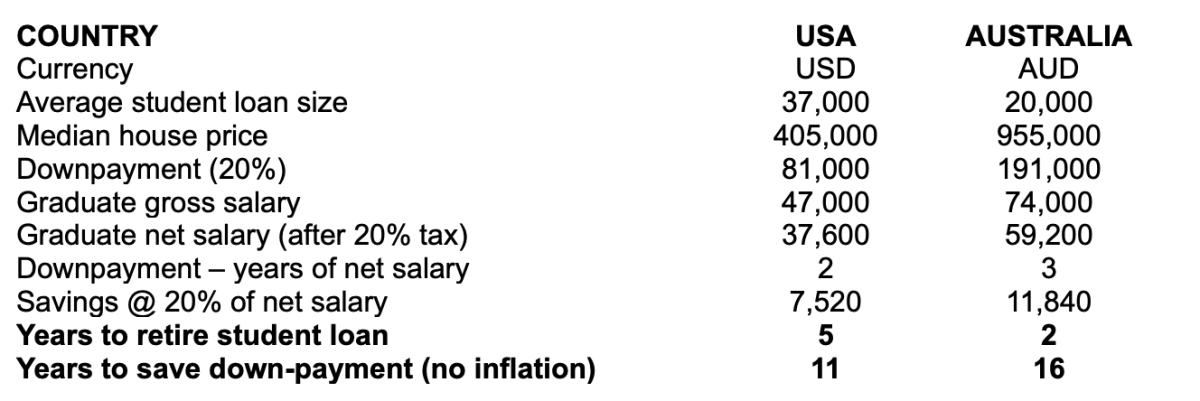

Prva dolgovska past

Če ste naredili, kar so vam naročili v šoli, je velika verjetnost, da se odpravljate na kolidž ali univerzo. Seveda je to tisto, kar bi moral storiti. Rečeno vam je (in ne dvomite v to), da brez diplome ne morete priti nikamor, kaj šele službe, ki je dovolj plačana za nakup hiše. Past je v tem, da ni zastonj, ne glede na to, kako ga vaša vlada pakira in prodaja. V mnogih državah obstajajo sistemi študentskih posojil. V drugih pa vi (in vsi drugi) plačujete z višjimi stopnjami dohodnine. V obeh primerih je neto dohodek po diplomi precejšen. Za tiste v državah s sistemi študentskih posojil obstaja močna spodbuda, da čim prej najdejo varno službo, da bi odplačali dolg. V ZDA je skupni neporavnani dolg študentskega posojila je več kot 1.7 bilijona dolarjev. Vsak četrti Američan (približno 45 milijonov ljudi) ima dolg za študentsko posojilo, ki v povprečju znaša več kot 37,000 $. Številke v moji rodni Avstraliji so podobne tam, kjer je skoraj 54 milijard AUD neporavnanega dolga HELP dolguje 1 od 10 ljudi. Povprečni neporavnani dolg je več kot 20,000 AUD, pri čemer ima veliko ljudi dolgove nad 100,000 AUD. Poskusite biti 18-letni podjetnik in dobiti posojilo te velikosti pri tradicionalni finančni instituciji.

Notably, not everybody will choose the higher education path. Some will pursue any form of work as soon as possible or vocational training in a trade. This will often be a quicker path to income without the same debt burden. Whether this is leveraged successfully is another matter, but it’s worth highlighting that many people find an alternative path for different reasons (not necessarily a direct rejection of the Model).

Sanje [vstavite državo tukaj].

Kot je razloženo v mojem članku "Why real estate investors should love Bitcoin,” real estate is unquestionably an emotional asset class. Something that currently performs the dual role of an investment and shelter is inevitably going to be. The Australian movie, “The Castle,” encapsulates this perfectly. With classic lines such as “it’s not a house, it’s a home” and “a man’s home is his castle,” the movie shows that for many people real estate is so much more than an investment. Similarly, home ownership has been a cornerstone of “The American Dream” for decades. Marketing slogans such as “rent money is dead money” are treated by many as investment gospel. The culture of home ownership and real estate investing is something most people have fully bought into and hold dear. It has become the societal norm, even expectation, that you should aspire to own a home. This is why it’s at the center of the Modern Serfdom Model. At state school you were taught not to question these types of norms. And given the rest of the system is designed to push you in that direction, you don’t get much of an opportunity.

Obljuba smrti

The word mortgage derives from Old French and Latin; it literally means “death pledge.” Many people will not enter into a mortgage on their first home until well into their 40s. With mortgage terms generally being 30 years (and most borrowers requiring the longest term possible in order to maximize borrowing capacity), they won’t be repaid until many borrowers are well into their 70s. The literal meaning of “mortgage” has never been more appropriate.

The mortgage is the key mechanism that enforces the Modern Serfdom Model. It would be impossible for most people to buy a home without a loan. The need to make your regular repayments creates an incentive for a stable, uninterrupted career of employment and disincentivizes entrepreneurial risk taking. In short, it binds you. Of course it is possible to escape. But it’s not easy. It’s contrary to everything you’ve been taught. And most will never try.

Nemogoče sanje

Po tipičnem 3- do 5-letnem visokošolskem izobraževanju, ob predpostavki, da ste tako dolgo obdržali in diplomirali, odidete s poverilnicami, ki jih večina delodajalcev zahteva, da vas le obravnavajo na razgovoru. Ali ste se naučili kaj koristnega, je sporno (in odvisno od stopnje/šole), vendar to ni tema tega članka. Skoraj gotovo je, da ste bili obremenjeni z velikimi dolgovi in jih boste želeli odplačati. Predpostavimo tudi, da želite prihraniti za hišo, ker naj bi to počela odrasla oseba, kajne? Kako dolgo bo torej trajalo, da se posojila upokojijo in odplačajo? Še 3 do 5 let, ko boš star 30 let? Čas je za nekaj osnovnih številk.

V ZDA povprečni dohodek gospodinjstva je bil leta 69,000 nekaj manj kot 2019 $, S povprečna osnovna plača za novega diplomanta je nekaj več kot 47,000 $ — približno 30 % manj od mediane dohodka gospodinjstva. Podobna je dinamika v Avstraliji, kjer je povprečni skupni letni zaslužek nekaj manj kot 94,000 AUD s povprečno plačo nekaj manj kot 68,000 AUD in povprečna izhodiščna plača za diplomante od 55,000 do 93,000 AUD, odvisno od panoge.

O Povprečna cena hiše v ZDA je nekaj manj kot 405,000 $, približno 6-kratnik mediane dohodka gospodinjstva in skoraj 9-kratnik povprečne diplomirane plače. The Avstralska povprečna cena hiše je več kot 950,000 AUD, približno 10-kratnik povprečne skupne plače in do 17-kratnik povprečne diplomirane plače.

Ob predpostavki preprostega 20-odstotnega predplačila mora tipični diplomant prihraniti 2 leti bruto plače v ZDA in 3 leta bruto plače v Avstraliji samo za predplačilo. Po nominalni vrednosti se to ne sliši slabo, vendar je treba globlje potopiti.

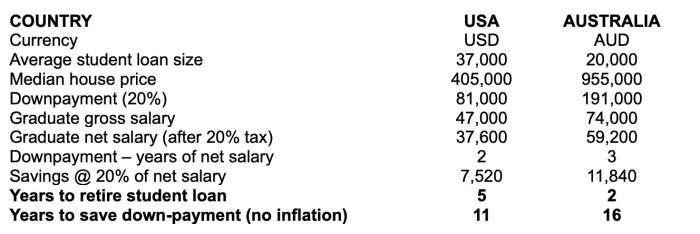

There are flaws in this analysis; it’s not designed to be perfect but to demonstrate a point. For example, median house prices are more expensive than “starter” homes that younger homeowners might target. Or not doing it on a city-by-city basis so that for major cities, higher salaries (but also substantially higher house prices) are captured. Conversely, the 20% savings rate is possibly generous for most new graduates given the personal savings rate in the U.S. is well under 10%. Personally, I don’t think these things matter because the above snapshot completely disregards inflation. Adding it blows the numbers out of the water even on conservative assumptions. Taking the U.S. example:

Tako je, ob predpostavki 3-odstotne letne rasti neto prihrankov (kar zahteva, da plače prehitevajo inflacijo!) in le 5-odstotne rasti cen stanovanj (precej manj od 15-20-odstotne ravni v večini današnjega sveta, vendar v skladu z 30-letno povprečje), bi za varčevanje za depozit trajalo 21 let. Še enkrat, to je nepopolno, a bistvo je, da ne traja 2.1 leta!

To pre-empt criticisms, some people may receive much larger salary increases over time due to promotions or job changes, i.e. at some point they may reach or exceed the average household income (but not necessarily before they have finished saving for a down-payment). Interest or investment earnings on the savings is also excluded. Interest rates are effectively zero presently and there are trade-offs for riskier investing of the downpayment. Also, some households may have savings rates in excess of 20%. For example, there will be dual-income, childless households saving towards this goal, which will greatly accelerate the process (although many would argue this dynamic is a direct response to the problem being discussed). The numbers are for a typical single person, not an outlier or high performer. Therefore, for most people even getting the keys to a mortgaged home is an increasingly difficult mountain to climb. It should be clear that inflation makes it even harder.

»Nič ne boš lastnik. In srečen boš.”

There’s starting to be a widespread recognition that most young people will take decades to save for their first home. For example, raziskave v Združenem kraljestvu ugotovila, da bi polovica vseh 20-35 letnikov še vedno najemala pri 40-ih, tretjina pa do trenutka, ko bi zahtevali pokojnino (časovni okviri, ki so smiselni na podlagi zgornje analize na visoki ravni). Kot Svetovni gospodarski forum pravi, »nič ne boš lastnik. In srečen boš.”

Doing what was the cultural norm and societal expectation has now become highly aspirational and unrealistic for many who will give up trying or set their sights on a different goal. This alone has the potential to break the Modern Serfdom Model even without the interference and existence of the most perfect alternative: Bitcoin.

Denar svobode

Bitcoin’s value, whether it be measured in fiat currency terms or purchasing power, is designed to pump forever. It benefits from what is colloquially termed Number Go Up (NgU) Technology. Due to its fixed supply of 21 million coins, it will ultimately be the most scarce asset that has ever existed. Bitcoin preserves and grows the value of your savings relative to all other assets due to the powerful combination of this scarcity and its adoption curve. It breaks the Modern Serfdom Model:

- Bitcoin provides options. When NgU works over a long enough timeframe you can become secure enough to walk away from a job you don’t like and not have to find another one immediately in order to make a mortgage repayment.

- You don’t have to save for 20 years for a downpayment to buy bitcoin. It can be acquired immediately in small sizes due to its divisibility. You can start growing your wealth as soon as you earn income, rather than being forced to speculate in the stock market or hoard a melting ice cube of cash for a house downpayment. Bitcoin incentivizes saving early in life and avoiding debt — the complete opposite of the Model.

- Bitcoin enhances flexibility and freedom of movement by being portable and borderless. If you choose to own bitcoin instead of real estate, you are no longer bound to a fixed location where your career started.

- Bitcoin is immune to and even benefits from central banks’ monetary inflation, a key driver behind the house price growth that makes the process of saving for a downpayment so lengthy. That same inflation also grows the equity of existing homeowners but they remain in a bind until the real estate is sold or downsized.

Ultimately bitcoin breaks the Modern Serfdom Model by being a boljše shranjevanje vrednosti kot nepremičnine. Država in zapuščeni finančni sistem se ga bojita z dobrim razlogom: razgradi njihove mehanizme nadzora na vseh ravneh.

To je gostujoča objava Jamesa Santija. Izražena mnenja so povsem njihova in ne odražajo nujno mnenj BTC Inc oz Bitcoin Magazine.

Source: https://bitcoinmagazine.com/business/modern-serfdom-model-and-bitcoin-escape

- "

- 000

- 100

- 20 let

- 7

- 9

- O meni

- pospeši

- Sprejetje

- Prednost

- vsi

- Čeprav

- Ameriška

- Američani

- Analiza

- letno

- Še ena

- kjerkoli

- članek

- sredstvo

- Sredstva

- Avstralija

- organ

- povprečno

- Osnova

- počutje

- Prednosti

- Billion

- Bitcoin

- bitcoinerji

- knjige

- Zadolževanje

- zlom

- BTC

- BTC Inc.

- nakup

- Kupi bitkoin

- kapaciteta

- Kariera

- Denar

- kvote

- otrok

- Otroci

- Mesta

- klasična

- Kovanci

- College

- kombinacija

- prihajajo

- skupnost

- države

- Mandatno

- Kultura

- valuta

- krivulja

- datum

- dan

- mrtva

- Dolg

- Podatki

- drugačen

- Ne

- navzdol

- voznik

- vožnjo

- dinamično

- Zgodnje

- Plače

- Gospodarska

- Izobraževanje

- zaposlovanja

- energija

- Podjetnik

- pravičnost

- nepremičnine

- Event

- vsi

- vse

- Primer

- Obraz

- Fiat

- Valuta Fiat

- finančna

- prva

- napake

- prilagodljivost

- obrazec

- je pokazala,

- brezplačno

- Svoboda

- francosko

- igra

- pridobivanje

- Cilj

- dogaja

- dobro

- vlada

- diplomiral

- veliko

- Pridelovanje

- Rast

- Gost

- Gost Prispevek

- srečna

- ob

- pomoč

- tukaj

- visoka

- Višja izobrazba

- zelo

- držite

- Domov

- Hiša

- gospodinjstvo

- gospodinjstva

- Kako

- HTTPS

- ICE

- slika

- prihodki

- inflacija

- ustanova

- zavarovanje

- obresti

- Obrestne mere

- Intervju

- vlaganjem

- naložbe

- Vlagatelji

- IT

- Job

- pridružite

- Ključne

- tipke

- večja

- UČITE

- Stopnja

- vrstica

- Posojila

- kraj aktivnosti

- Long

- ljubezen

- velika

- Tržna

- Trženje

- Matter

- mediji

- Meta

- milijonov

- Model

- Denar

- Najbolj

- Gibanje

- Film

- Glasba

- net

- novice

- številke

- Komentarji

- Priložnost

- možnosti

- Da

- Ostalo

- Plačajte

- Plačilo

- ljudje

- Osebni

- Poddaje

- moč

- Cena

- problem

- Postopek

- zagotavlja

- Črpalka

- vprašanje

- Cene

- nepremičnine

- Razlogi

- Priporočamo

- Odgovor

- REST

- Tveganje

- Je dejal

- shranjevanje

- <span style="color: #f7f7f7;">Šola</span>

- Šole

- Občutek

- nastavite

- Shelter

- Kratke Hlače

- Podoben

- Enostavno

- Velikosti

- majhna

- Posnetek

- So

- Društvo

- prodaja

- Nekaj

- Začetek

- začel

- Država

- zaloge

- borza

- trgovina

- močna

- študent

- precejšen

- uspeh

- Uspešno

- dobavi

- sistem

- sistemi

- Pogovor

- ciljna

- davek

- Tehnologija

- svet

- skozi

- čas

- danes

- vrh

- trgovini

- tradicionalna

- usposabljanje

- nas

- univerza

- vrednost

- Voda

- Wealth

- Kaj

- Kaj je

- WHO

- zmago

- brez

- delo

- deluje

- deluje

- svet

- Svetovni gospodarski forum

- vredno

- leto

- let

- nič