The Bitcoin mining network presents a potential vulnerability to the network that could prove to be an Achilles’ heel unless addressed.

V grški mitologiji Tetida je potopila svojega sina Ahila v reko Styx, da bi mu dal moč neranljivosti. Ahil je postal navidezno nepremagljiv bojevnik, vendar je bil podrt, ko ga je strupena puščica zadela v peto, prav na mestu, kjer ga je držala Tetida, ko ga je potopila v reko. Zgrešila je le eno drobno mesto, a to je bil Ahilov propad.

V sodobnem času je izraz »Ahilova peta« postal sinonim za vsako močno silo, ki jo premaga nepredvidena ali majhna šibkost, zgodovina pa je polna mogočnih ljudi in organizacij, ki so padle prav na ta način.

For the past 13 years, Bitcoin has been a very powerful force that has fended off all attackers. This has given many of Bitcoin’s advocates an air of confidence, but this might be ill-placed or even dangerous. The genius behind Bitcoin is clear, but this doesn’t make it perfect or invulnerable. In the years, decades and centuries ahead, unimaginable variables will emerge, and maybe one of Bitcoin’s greatest strengths will be manipulated and exposed as a weakness to become Satoshi’s heel.

The Bitcoin Architecture

Before diving deeply into this, reviewing certain aspects of Bitcoin’s architecture might be helpful.

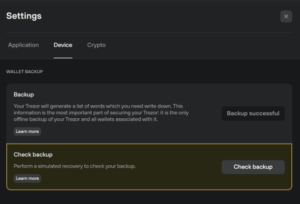

Satoshi designed Bitcoin with the intention that every 10 minutes, blocks (containing transactions) would be processed. Once a block is processed, or mined, it is presented to the nodes for validation and the transactions are posted to the ledger. For their services, miners receive compensation in the form of a block reward, which is the sum of a block subsidy and transaction fees.

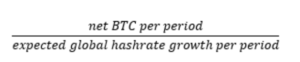

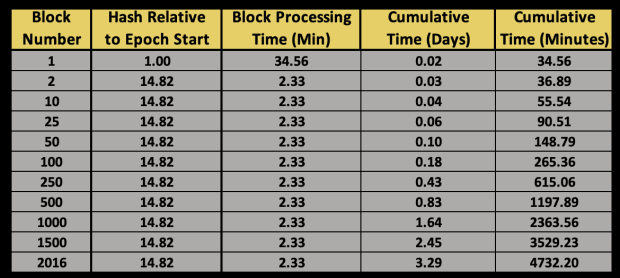

The block subsidy, currently 6.25 BTC, is the mechanism by which new Bitcoin enters circulation. A difficulty epoch is a segment of 2,016 blocks and, upon completion of each difficulty epoch, an analysis of the time required to process those blocks is performed. Since Satoshi’s goal was for the system to average 10 minutes to process each block, if the previous difficulty epoch was shorter than 10 minutes, block processing is made harder for the upcoming epoch, and vice versa if the previous difficulty epoch was longer than 10 minutes.

Nastajajoča ranljivost

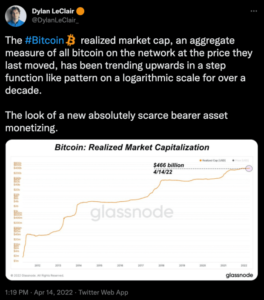

With some of the basics of mining in mind, there is an emerging vulnerability in the Bitcoin ecosystem to consider. Many people directly correlate an increase in global hash rate, or a good distribution of hash rate across the mining pools, with increased security in the network. There is some truth to these conclusions as, by both measures, the network appears quite strong and secure today; however, another layer deeper, there is a vector of vulnerability.

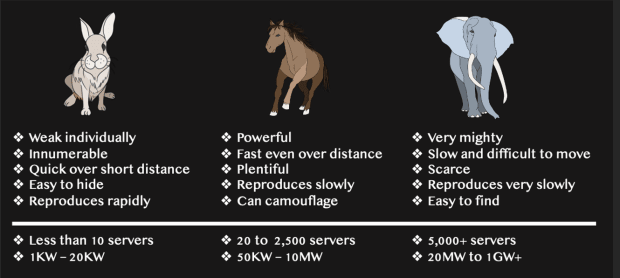

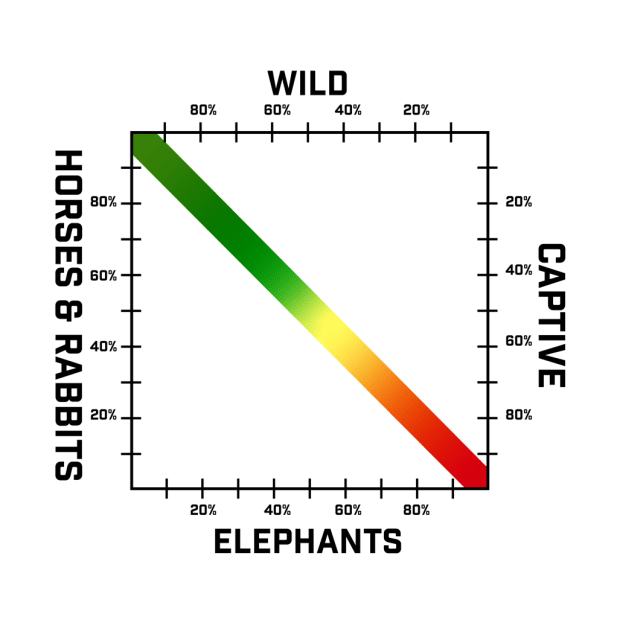

Ta plast je rast in prevlado rudarskih mest "slonov v ujetništvu" (glej spodnjo tabelo). Lokalno rudarsko mesto je tisto, v katerem vir energije nadzoruje tretja oseba, kar na splošno pomeni, da temelji na omrežju. Divje rudarsko mesto je tisto, kjer rudar proizvaja energijo in jo nadzira in je zato izven omrežja.

Če želite raziskati ranljivost, razmislite o scenariju, imenovanem »nočni strah«. Čeprav je skrajno in malo verjetno, kaže grožnjo.

Imagine a time in the future when captive elephant sites dominate the mining network. This domination is so complete that 99% of the Bitcoin mining network’s hash power is consolidated in several dozen captive elephant sites. In parallel, political and financial establishment forces across the globe have seen Bitcoin seriously erode their ability to implement their agendas. Knowing that the best way to attack Bitcoin is to shake the public’s confidence in its stability and reliability, Bitcoin’s detractors set a course of action to cripple the Bitcoin mining network. So, just before the completion of a difficulty epoch, a consortium of nation states coordinates a hostile shutdown of all captive elephant sites. They do this by forcing utility providers to instantly cut power to all sites, and they deploy troops to prevent the removal of any equipment from the sites.

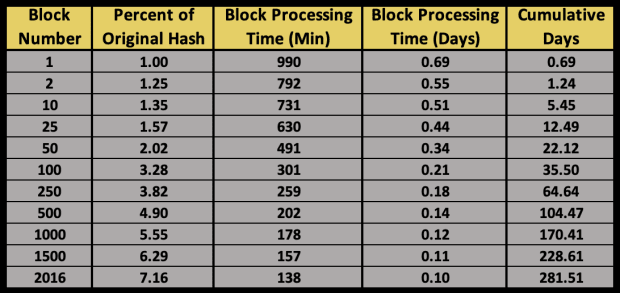

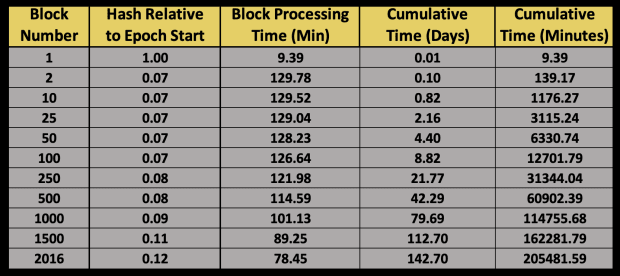

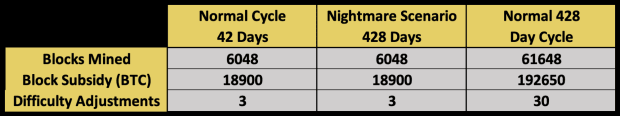

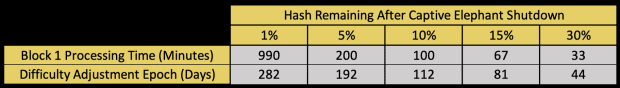

The Bitcoin mining network would be reeling from this blow because it instantly will be 99 times more difficult to process blocks. Instead of taking ten minutes to process the next block, the expected completion time would be 990 minutes, or 16.5 hours. This would drive the daily transaction capacity of the Bitcoin ecosystem from about 300,000 to just a few thousand. Worse yet, 2,016 blocks must be processed before the next difficulty adjustment, and with the vastly reduced hash capability of the network, this would not occur for another 1,386 days or 3.8 years (assuming no new hash power is added.) Additionally, new bitcoin would be entering circulation at a snail’s pace because money supply increases are completely dependent on the mining of blocks.

Obviously, panic would ensue, as many bitcoin holders seeking to sell or get their bitcoin into cold storage would be locked out. Off-chain movements on exchanges and transactions on Layer 2 protocols (like the Lightning Network) would be possible for a while, but they would soon become constrained because base layer (on-chain) settlement would become virtually impossible. After a few days in the Night Terror scenario, the Bitcoin ecosystem would be so dramatically impaired that the world’s confidence in it would be shaken to the core and irreparably damaged.

Scenarij nočne more

Vsekakor je scenarij nočne groze malo verjeten, a bolj verjeten, imenovan »scenarij nočne more«, predstavlja tudi zelo strašljiv izid.

This scenario assumes the same initial conditions of captive elephants possessing 99% of the global hashing power, and a shutdown and seizure of the sites. In this case, though, the Bitcoin community responds aggressively to try to save the ecosystem. The first move is from rabbits and horses, redeploying mining equipment that had previously been put out of service, and this instantly bumps up the remaining global hash power by about 25%.

Rudarsko opremo v distribucijskih kanalih bi hitro požrli in razporedili, v približno petih dneh pa bi omrežje verjetno napredovalo do obdelave dveh blokov na dan namesto enega. Po približno treh tednih bi moč omrežja narasla na povprečno tri bloke na dan. Končno bi lahko po približno devetih mesecih zajci in konji svojo stopnjo razpršenosti povečali za nekaj več kot sedemkrat in izboljšali zmogljivost omrežja na približno 10 blokov na dan.

The result would be that the difficulty epoch which had been expected to take two weeks would stretch out to an unbearable 281 days. Also noteworthy is that instead of the expected 127,000 bitcoin entering circulation during the entire nine-month period, only 6,300 would make it.

Povprečni čas bloka na koncu epohe je 138 minut in mnogi bi lahko pričakovali, da bi po tej boleči epohi naslednja prilagoditev težavnosti olajšala vrnitev na 10-minutni čas obdelave bloka. Vendar pa mreža še zdaleč ni izven gozda.

Bitcoin’s protocol has a maximum difficulty adjustment of four times in any one epoch and this means that the adjusted block processing time at the start of the next epoch adjusts to 34.6 minutes instead of 10. This sets up Bitcoin’s detractors for their next devious move — as the transition to the new difficult epoch occurs, the previously impaired captive elephant sites are turned back on.

In the blink of an eye, block processing times swing from slow to an exceptionally-fast two minutes and 20 seconds and a complete difficulty adjustment epoch would fly by in just over three days. 6,300 more bitcoin would enter circulation and would be largely controlled by detractors, and they would have the option of flooding the market with these bitcoin or further starving the market.

Naslednja prilagoditev težavnosti bi se začela z obdelavo blokov v skoraj 10 minutah, vendar bi lahko kontrolorji lokacij slonov v ujetništvu onemogočili njihova mesta in rudarsko omrežje bi se spet zmlelo. Čas obdelave blokov bi takoj presegel dve uri, dokončanje epohe težavnosti pa bi trajalo 142 dni.

This pattern of captive elephants turning on and off could continue for a long time, but it wouldn’t really be necessary as the damage to Bitcoin would have already been inflicted. Without any consistency in the ability to process transactions, nor any faith in the rate of inflation, confidence in Bitcoin would be ruined, and while it might survive with some limited value or purpose, it would never fulfill its vision and fade to irrelevance.

Satoshijeva peta: slediti industrijskim rudarjem

When the China ban of 2021 occurred, Bitcoin lost približno 50 % njegove moči zgoščevanja in ekosistem ga je premagal kot majhna hitrostna ovira. Kot je prikazano v scenariju Nightmare, bi bila izguba 99 % moči zgoščevanja katastrofalna, zato je nekje med tema dvema točkama nevarno območje.

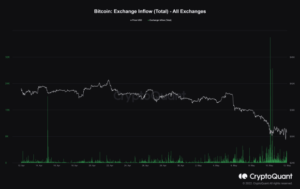

Zgornji grafikon ocenjuje vpliv izgub različnih stopenj zgoščevanja omrežja. Ob 70-odstotnem padcu stopnje razprševanja je omrežje nekoliko obremenjeno, vendar časi obdelave blokov niso grozni, težka prilagoditev pa v približno šestih tednih vrne omrežje na normalno delovanje. Vendar pa padci pod to raven začnejo premikati zmogljivost omrežja v nevarno območje.

If the network were attacked in a manner that caused global hash rate to fall by 85% or more, the shock on the network’s effectiveness becomes catastrophic and the resiliency of the ecosystem is grossly hampered. This may well be Satoshi’s heel. If so, it is a possibility only because the Bitcoin mining community created the vulnerability itself. And that vulnerability could come from the largest mining companies focusing on their own best short-term interests, and not the best long-term interests of Bitcoin.

Na splošno največja rudarska podjetja verjamejo, da lahko dosežejo najboljšo učinkovitost, stroškovno učinkovitost in zanesljivost s konsolidacijo svojih dejavnosti v velikih lokacijah in sodelovanjem s ponudniki komunalne energije v obojestransko koristnih ureditvah električne energije. Vendar, kot pravi pregovor, "dobre stvari je lahko preveč."

Kot je prikazano zgoraj, je prevelika gostota moči zgoščevanja na majhnem številu spletnih mest velika izpostavljenost. Varna raven moči zgoščevanja na teh mestih je največja pri približno 70 %, vse, kar je več kot 85 %, pa ogroža ekosistem.

Trenutno merjenje globalne stopnje razprševanja glede na te meritve ni mogoče, čeprav je zdaj verjetno v varnem območju. Vendar pa je ključnega pomena, da zajci in konji držijo korak, ko se sloni razširijo, in to se bo verjetno izkazalo za precej težko.

Kot primer, Atlas Power je napovedal novo naložbo v vrednosti 1.9 milijarde dolarjev v Severni Dakoti to bo prineslo 750 megavatov (MW) rudarske zmogljivosti na spletu pred koncem leta 2023. To pomeni, da morajo konji in zajci, da bi sledili tempu, dodati vsaj 322 MW rudarske zmogljivosti samo, da bodo sledili temu enemu mestu.

Ko pa so objekti, kot je ta Atlas Power, na spletu, običajno pridejo na splet z najsodobnejšimi rudarskimi stroji. To pomeni, da bo tej moči priloženo 150 tera hash na sekundo (TH/s) rudarska oprema (ali bolje). Zajci in konji so v preteklosti imeli težave z dostopom do te vrste opreme in/ali si jo lahko privoščijo, zato običajno zaostajajo za eno generacijo. . V tem primeru to pomeni, da bi običajno uporabljali tehnologijo 100 TH/sekundo. Zato bi ohranjanje tempa zahtevalo 50 % več strojev in 50 % več moči. Glede na to pomeni, da morajo lokacije za zajce in konje dodati 161,000 novih strojev, ki bodo porabili 483 MW v manj kot dveh letih, samo da bi sledili izpostavljenosti z enega mesta. In ob predpostavki, da spletno mesto Atlas Power uporablja električno energijo, ki temelji na omrežju, pomeni, da morajo biti na spletu tudi divji viri energije, ki znašajo 483 MW. Vsak primanjkljaj s strani konj in zajcev potisne ranljivost ekosistema bližje nevarnemu območju.

Decentralization is a fundamental tenet of Bitcoin, and rightly so. For Bitcoin to remain decentralized, the community must constantly look at all aspects of the ecosystem to flush out any possibility of centralization occurring. The mining industry is no exception.

Rudarjenje ima veliko spremenljivk, ki bi teoretično lahko postale centralizirane, vključno z geografijo, jurisdikcijo, viri energije, velikostmi lokacije, rudarskimi bazeni, viri čipov in sistemskimi viri. Ključnega pomena je, da je za vse spremenljivke vedno vzpostavljena varna raven raznolikosti. Če vektor katere koli spremenljivke začne težiti proti centralizaciji, ga je treba pred tem ustaviti.

This is true regardless of how safe centralization might appear in any given variable. For instance, there is a tremendous amount of site development in Texas right now and understandably so, given energy availability, energy costs and the welcoming attitude of communities and politicians. However, political winds can change quickly and there are scenarios where Bitcoin mining could go from a friend of Texas to an arch enemy in a very short window. And, issues with the power grid, directed terrorist attacks and natural disasters in Texas could also put the mining network into a perilous state.

For now, the real threats to Bitcoin are trends toward elephant sites and toward captive power. In the matter of just another year or two, these variables could enter the danger zone and because of the scale involved, they could be very difficult to reverse. It is imperative that the industry beef up machine deployment to rabbits and horses, and work to develop wild energy sources to prevent this exposure. Bitcoin’s detractors are feeling the heat and they will be looking hard for weaknesses in the ecosystem, so let’s not give them a shot at Satoshi’s heel.

To je gostujoča objava Boba Burnetta. Izražena mnenja so povsem njihova in ne odražajo nujno mnenj BTC Inc oz Bitcoin Magazine.

- 000

- 100

- 116

- 2021

- 9

- O meni

- dostop

- čez

- Ukrep

- vsi

- že

- Čeprav

- znesek

- Analiza

- razglasitve

- Še ena

- Arhitektura

- razpoložljivost

- povprečno

- Ban

- Osnove

- Goveji

- počutje

- BEST

- Billion

- Bitcoin

- Bitcoin mining

- BTC

- BTC Inc.

- kapaciteta

- povzročilo

- spremenite

- kanali

- Kitajska

- čip

- bližje

- Hladilnica

- skupnosti

- skupnost

- Podjetja

- Odškodnina

- zaupanje

- naprej

- stroški

- bi

- ključnega pomena

- dan

- Decentralizirano

- globlje

- uvajanje

- Razvoj

- Razvoj

- nesreče

- distribucija

- raznolikost

- Ne

- navzdol

- ducata

- dramatično

- Drop

- ekosistem

- učinkovitosti

- smirkovim

- energija

- Vstopi

- oprema

- ocene

- Primer

- Izmenjave

- Razširi

- Pričakuje

- oči

- zbledi

- pristojbine

- finančna

- prva

- obrazec

- Izpolnite

- Prihodnost

- splošno

- pridobivanje

- Globalno

- Cilj

- dobro

- Mreža

- Grow

- Rast

- Gost

- Gost Prispevek

- hash

- hash moč

- hitrost hash

- mešanje

- pomoč

- zgodovina

- imetniki

- Kako

- HTTPS

- vpliv

- izvajati

- nemogoče

- izboljšanje

- Vključno

- Povečajte

- povečal

- industrijske

- Industrija

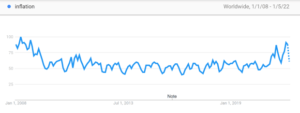

- inflacija

- Infrastruktura

- interesi

- naložbe

- vključeni

- Vprašanja

- IT

- vzdrževanje

- velika

- Ledger

- Stopnja

- strele

- Lightning Network

- Limited

- malo

- zaklenjeno

- Long

- si

- Stroji

- Tržna

- Matter

- Meritve

- moti

- Rudarji

- Rudarstvo

- rudarski stroji

- Rudarski bazeni

- Denar

- mesecev

- premikanje

- mreža

- vozlišča

- sever

- na spletu

- operacije

- Komentarji

- Možnost

- organizacije

- Panic

- Vzorec

- ljudje

- performance

- strup

- političnih

- Bazeni

- možnost

- mogoče

- moč

- močan

- Postopek

- protokol

- hitro

- zahteva

- obvezna

- vrne

- nazaj

- varna

- Lestvica

- zavarovanje

- varnost

- prodaja

- Storitev

- Storitve

- nastavite

- naselje

- Kratke Hlače

- primanjkljaj

- shutdown

- Spletna mesta

- SIX

- majhna

- So

- svoje

- hitrost

- Komercialni

- Stabilnost

- Začetek

- Država

- Države

- shranjevanje

- močna

- subvencije

- dobavi

- sinonim

- sistem

- Tehnologija

- texas

- Osnove

- grožnje

- čas

- danes

- transakcija

- Transakcije

- ogromno

- trending

- Trends

- pripomoček

- vrednost

- Vizija

- ranljivost

- Wikipedia

- brez

- delo

- deluje

- svetu

- leto

- let