29. marec 2022 / Unchained Daily / Laura Shin

Dnevni deli

-

Digital asset investment product inflows skupaj $193 million last week – the largest influx of capital since mid-December.

-

Siva barva je upoštevamo suing the SEC over the yet-to-be-approved bitcoin ETF.

-

A $350,000 Bored Ape Yacht Club NFT je bila prodana za $ 115.

-

Thanks to additional crypto tax reporting requirements, the Biden administration meni it can bring in $10 billion+ in revenue over the next ten years.

-

$140 million in BTC shorts were likvidiran during Bitcoin’s rise above $48k.

-

The US Treasury is deluje with the IRS to gather more information on offshore crypto holdings.

-

Former Mt. Gox CEO Mark Karpeles is začetek an NFT collection to commemorate the infamous exchange.

-

World of Women NFTs is one of the most priljubljeni collections on the market right now.

- Google searches for The Merge hit an all-time recently.

Danes v Crypto Adoption…

-

A new proposal from the SEC has crypto experts Skrbiabout DeFi projects in the US.

-

Rio de Janeiro načrti to accept tax payments for real estate with crypto in 2023.

-

Ameriški zakonodajalci so raziskovati “ECASH.”

$$$ kotiček…

-

Greenridge Generation Holdings, which owns a large mining facility in New York, received $40 million in funding to razširitioperations in the US.

-

Bitcoin rudar Iris Energy prejetih $71 million in funding from NYDIG.

- NFT marketplace Blur postavljeno 11 milijona dolarjev v krogu začetnega financiranja.

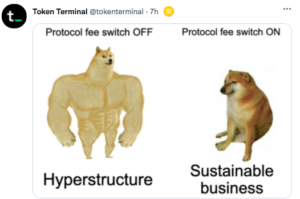

Kaj si meme?

Kaj je Poppin?

An SEC ‘Shadow-Attack’ on DeFi?

The US Securities and Exchange Commission (SEC) proposed a change to the definition of a “government securities dealer” yesterday that, if passed, would bring automated market makers and liquidity providers with platforms larger than $50 million under the jurisdiction of the SEC. While not ostensibly written in the context of digital assets, a footnote on page 15 of the proposal suggests that it could be used against the digital asset industry.

“Proposed Rule 3a5-4 would apply to securities as defined by Section 3(a)(10) of the Exchange Act, and proposed Rule 3a44-2 would apply to government securities as defined by Section 3(a)(42) of the Exchange Act, including any digital asset that is a security or a government security within the meaning of the Exchange Act.”

The proposed rule could potentially shoehorn many DeFi entities under the SEC’s purview. According to data from CoinMarketCap, over 20 dexes olajšano $50 million in volume yesterday. While volume is not a direct parallel to liquidity, it is somewhat related. Furthermore, datum from DeFi Llama shows that 289 dApps hold $50 million+ in total-value-locked. (However, it is unclear if the rule would extend beyond AMMs and their liquidity providers to other dApps.)

“The SEC just proposed a rule that would expand the definition of regulated “dealers” to include people who “employ passive market making strategies” that have “the effect of providing liquidity” to others,” razložiti Blockchain Association’s Jake Chervinsky on Twitter. “Unfortunately, the SEC continues to introduce massive confusion & uncertainty into the very same markets it seeks to regulate. In a healthy rulemaking process, we wouldn’t have to guess at the SEC’s intent or its underlying goals.”

Chervinsky noted that in the SEC’s 200-page proposal, “DeFi” was not mentioned once, despite the seemingly drastic consequences the proposal could wreak on the crypto space.

According to Gabriel Shapiro, the SEC is proposing an “all-out shadow attack on decentralized finance.”

Shapiro believes that the SEC’s proposal would characterize every AMM liquidity provider as an unregistered dealer – which is a felony. “SEC will argue that all AMM LPs are unregistered dealers. That would be like saying all Bitcoin miners are VASPs–if enforced, it would kill the tech. Many of us warned SEC could take this view, but never thought they’d secretly rewrite the rules to avoid having to prove it,” Shapiro argued.

According to Shapiro, adding such a requirement puts an unrealistic burden on the government. “I think [it] also shows that the SEC has 0 interest in DeFi participants ‘coming in & registering.’ Can you imagine FINRA processing 100,00 [sic] dealer applications from individual DeFi liquidity providers?” he posited.

Crypto lawyer Collins Belton agreed with Shapiro. “Even assuming some process where millions could self reg/report, there’s no feasible way for SEC/any SRO to oversee that,” he tweeted.

That being said, Belton thinks tighter regulation could have a bright side – as it would force DeFi protocols to truly decentralize. “That said, my attitude has shifted on this feckless approach & IMO rules like this will simply separate the truly decentralized wheat from the CeDeFi chaff,” wrote Belton.

Priporočena branja

-

Tascha Che on whether crypto is in a bear or bull market:

-

Ethereum’s best threading pastry on what to look for as The Merge approaches:

-

Mario Gabriele on Multicoin:

Na The Pod ...

Do Kwon podpira UST z bitcoini – in tukaj je, kaj še gradi

Do Kwon je izvršni direktor Terraform Labs in direktor pri Luna Foundation Guard. Na Unchained pojasnjuje, zakaj LFG vodi načrt za delno podporo Terrinega stabilnega kovanca UST v vrednosti 15 milijard dolarjev z Bitcoinom. Poglablja se tudi v drugo projektno idejo, ki bi plače razvijalcev spremenila v finančna sredstva, o kateri, kolikor vem, še ni javno spregovoril.

1. del: Vse, kar morate vedeti o Terri, UST in BTC.

-

kako deluje Terra in zakaj Do misli, da bo UST kmalu tretji največji stabilcoin

-

zakaj sta se Do in LFG odločila podpreti UST z bitcoinom

-

zakaj Do meni, da se bo cena LUNA še naprej povečevala kljub novi odvisnosti UST od bitcoina

-

kako bi lahko deloval UST, če bi cena bitcoina strmoglavila

-

zakaj bi diverzifikacija UST z različnimi vrstami zavarovanj lahko politično pomagala Terri

-

kako namerava LFG uporabiti mostove, pametne pogodbe in rezervni sklad AMM za zavarovanje svojega bitcoina

-

zakaj Do misli, da je Terra zdaj projekt plasti 2 za Bitcoin

-

kdo se odloča za nakup bitcoina in kdo določa, katera druga sredstva kupiti kot zavarovanje za UST

-

kako bi rezervni sklad za bitcoin pomagal UST-u, da ne bo odvezan od dolarja

-

ali Do meni, da je Anchorjeva donosnost 19 %+ vzdržna in zakaj se Anchor seli v druge verige

2. del: Do, samoopisani »izdelovalec igrač« DeFi.

-

zakaj Do fascinira ustvarjanje zamenljivega trga dela

-

kako bi lahko delovni čas razvijalca postal žeton, s katerim se trguje na AMM in se uporablja za najemanje posojil

-

zakaj Do meni, da bi morale biti plače razvijalcev v kriptovalutah ciklične

-

kako bosta identiteta in zgodovina v verigi podobni kreditnim rezultatom

-

zakaj je Do osebni oboževalec Thorchaina – vendar ga ne želi uporabiti kot most za LFG

-

zakaj se Do zanima za Prism Protocol

-

kaj Do misli, da bo imel prokripto predsednik vpliv na Južno Korejo

Posodobitev knjige

Moja knjiga, Kriptopisci: idealizem, pohlep, laži in ustvarjanje prve velike kriptovalute, ki govori o Ethereumu in ICO maniji 2017, je zdaj na voljo!

Kupite ga lahko tukaj: http://bit.ly/cryptopians

Pošta "Senčni napad" SEC? DeFi bi lahko bil v težavah pojavil prvi na Nerazvrščeni Podcast.

- "

- &

- 000

- 10

- 100

- 2022

- O meni

- Po

- Zakon

- Dodatne

- uprava

- vsi

- Še ena

- aplikacije

- pristop

- sredstvo

- Sredstva

- Avtomatizirano

- postanejo

- počutje

- meni

- BEST

- Bidena

- Billion

- Bitcoin

- Bitcoin ETF

- blockchain

- MOST

- BTC

- Kapital

- ceo

- spremenite

- klub

- Coindesk

- CoinMarketCap

- CoinShares

- zbirka

- Komisija

- zmeda

- naprej

- se nadaljuje

- pogodbe

- bi

- Ustvarjanje

- kredit

- kripto

- Kripto davek

- cryptocurrency

- DApps

- datum

- Decentralizirano

- Decentralizirane finance

- Defi

- Kljub

- Razvojni

- drugačen

- digitalni

- Digitalno sredstvo

- Digitalna sredstva

- neposredna

- Direktor

- učinek

- energija

- subjekti

- nepremičnine

- ETF

- ethereum

- vse

- Izmenjava

- Razširi

- Strokovnjaki

- razširiti

- Sklad

- krivično delo

- financiranje

- finančna

- prva

- Fundacija

- Financiranje

- generacija

- Cilji

- vlada

- ob

- višina

- pomoč

- tukaj

- zgodovina

- držite

- HTTPS

- ICO

- Ideja

- identiteta

- vpliv

- vključujejo

- Vključno

- individualna

- Industrija

- Podatki

- namen

- obresti

- naložbe

- IRS

- IT

- Jake Chervinsky

- dela

- Labs

- velika

- večja

- zakonodajalci

- likvidnostno

- ponudniki likvidnosti

- LP

- Izdelava

- znamka

- Tržna

- tržni ustvarjalci

- tržnica

- Prisotnost

- ogromen

- kar pomeni,

- meme

- milijonov

- milijoni

- Rudarji

- Rudarstvo

- več

- Najbolj

- premikanje

- MT

- Mt. Gox

- NY

- NFT

- NFT

- Ostalo

- Udeleženci

- Plačila

- ljudje

- Osebni

- Platforme

- bazen

- predstavitev

- Predsednik

- Cena

- Postopek

- Izdelek

- Projekt

- projekti

- snubitev

- protokoli

- zagotavljanje

- nakup

- nepremičnine

- Uredba

- Zahteve

- prihodki

- krog

- pravila

- Je dejal

- SEC

- zavarovanje

- Vrednostni papirji

- Securities and Exchange Commission

- varnost

- seme

- Financiranje semen

- Shadow

- kratke hlače

- Podoben

- pametna

- Pametne pogodbe

- South

- Vesolje

- stabilno

- trajnostno

- davek

- tech

- Zemlja

- žeton

- Transform

- us

- uporaba

- Poglej

- Obseg

- W

- teden

- Kaj

- ali

- WHO

- v

- Ženske

- deluje

- deluje

- let

- donos