- CryptoQuant reported that BTC and ETH show the highest leverage ratio.

- However, both coins have been trading low since 2022.

- Ethereum is currently giving a bullish stint, according to analysts.

Analytics platform CryptoQuant revealed that the leverage ratio for Bitcoin and Ethereum are high despite their low trading performances. Both the coins were trading 50% down since the beginning of the year.

Notably, Bloomberg reported these findings by CryptoQuant. The news platform wrote that the leverage ratio metrics signify a kind of break out from the narrowest market trading range in the past two years.

Crypto leverage is calculated by dividing the amount of open interest for perpetual swap contracts by the amount of coins held in reserve on exchanges.

Bitcoin experienced a meager surge of over 1.3% in the past 24 hours and trades at $19,960 at press time. However, the coin is in a critical zone as it did not break well its 9-day EMA line, and analysts such as Lark Davis predicted a “red September” for BTC.

Specifically, BTC’s current price is the same as the one it hit in December 2020.

Meanwhile, Ethereum is now 7.2% high at $1,677.51. ETH looks ahead for a prenapetost due to the forthcoming merge, according to crypto experts.

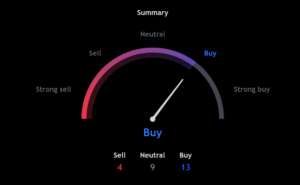

Speaking of the crypto market, Darius Sit of Singaporean crypto investment fund QCP Capital said that the crypto community thinks the market has “stabilized” and, therefore, they are preparing to make “bigger speculative positions.” He said the traders who claim a tail risk is “getting priced out.”

Contrastingly, in The David Rubenstein Show of Bloomberg recorded on August 17, FTX CEO Bankman-Fried opined that “crypto is coming back.” He is more optimistic about the future market situation.

Zavrnitev odgovornosti: Stališča in mnenja ter vse informacije, ki se delijo v tej analizi cen, so objavljene v dobri veri. Bralci morajo opraviti lastno raziskavo in ustrezno skrbnost. Vsakršno dejanje bralca izvaja izključno na lastno odgovornost. Coin Edition in njegove podružnice ne bodo odgovorne za kakršno koli neposredno ali posredno škodo ali izgubo.

Ogledi:

4

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- Coin Edition

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- Novice o trgu

- novice

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- W3

- zefirnet