To je tedenska funkcija, ki prikazuje 10 najboljših krogov financiranja tega tedna v ZDA. Oglejte si največje kroge financiranja prejšnjega tedna tukaj.

Some pretty substantial rounds took place this week, as companies had to raise at least $130 million to get into the top 10. Investors spread their money around again, from space and food truck delivery platforms, to AI and agtech. While venture dollars seemed to slow this spring, the season ended on a strong note for startups.

Išči manj. Zapri več.

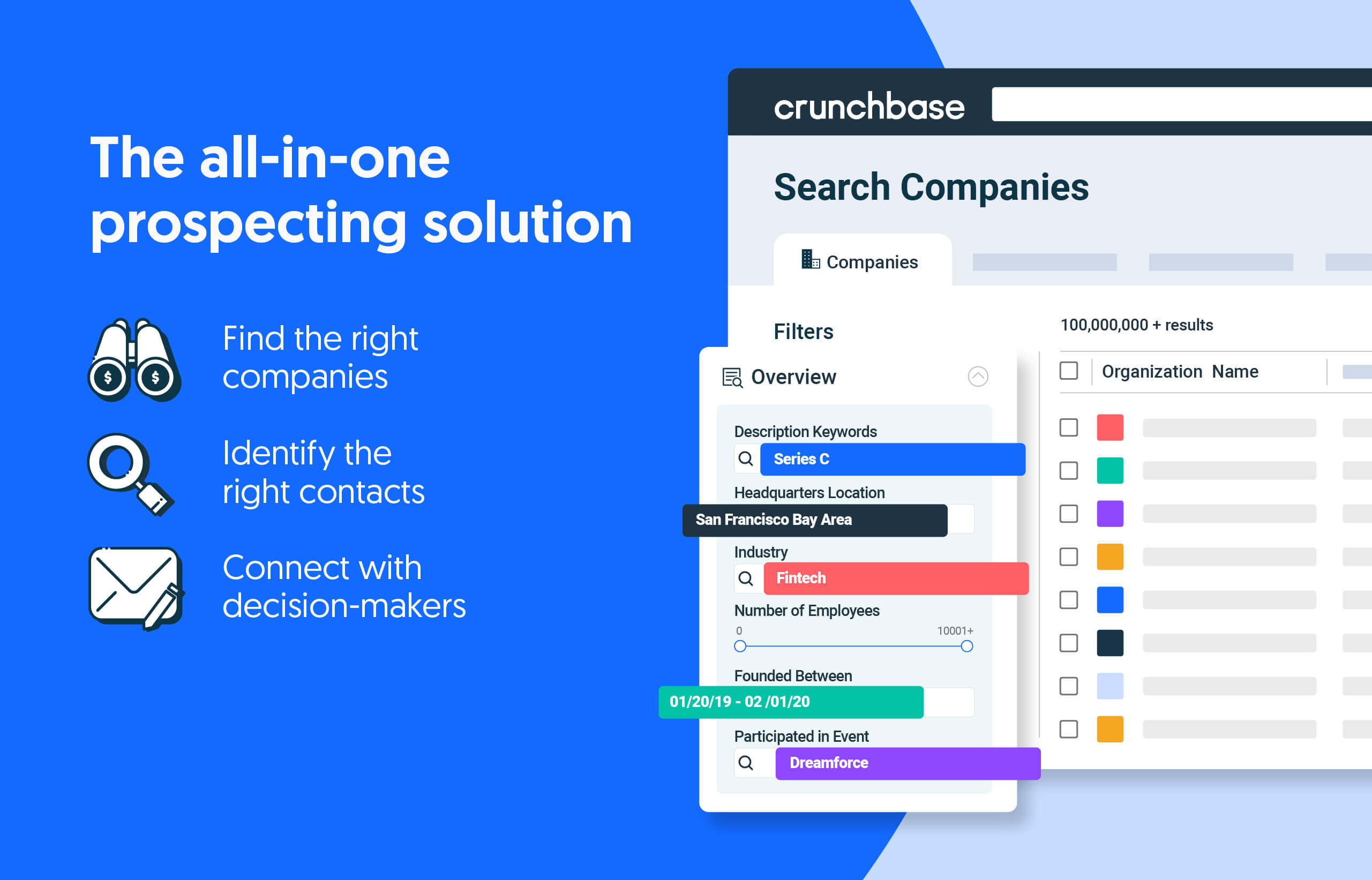

Povečajte svoj prihodek z rešitvami za iskanje potencialnih strank vse v enem, ki jih poganja vodilno podjetje na področju podatkov zasebnih podjetij.

1. SpaceX, 1.7 milijarde dolarjev, potovanje v vesolje: We talked about this round several weeks ago in this stolpec, but decided to include it again. There is now more clarity after it was officially filed this week. While it was reported that Elon Musk's space company was trying to raise vsaj 1.5 milijarde dolarjev-po navedbah Wall Street Journal—we now know it raised $1.68 billion. The Hawthorne, California-based company apparently looked to raise $1.725 billion.

2. Wonder, $350M, food delivery: Marc Lore’s food delivery startup Wonder gets the second spot this week after The Wall Street Journal poročali zagonsko podjetje s sedežem v New Yorku je zbralo 350 milijonov dolarjev pod vodstvom Bain Capital Ventures at a $3.5 billion valuation. Wonder is a slightly different kind of food delivery startup. It operates a network of food trucks from which consumers can order food through a mobile app. The truck then drives near the customer’s home and prepares the food fresh. Lore previously was CEO of retail giant Walmart's oddelek za e-trgovino.

3. Little Leaf Farms, 300 milijonov dolarjev, kmetijstvo: Investitorji so poured a lot of money into agtech over the past few years, as people’s buying habits have changed when it comes to their food’s taste, nutrition and sustainability. Devens, Massachusetts-based Little Leaf Farms is the latest in the space to see some significant funds roll its way. The company closed a $300 million equity financing led by TPG-ji Vzpon sklad. The startup will use the new cash for growth and expansion, which includes opening its fourth hydroponic greenhouse and making its lettuces accessible to more than half of the country’s population by 2026. Little Leaf’s lettuce is grown under glass and uses up to 90% less water than field-grown greens, according to the company. Founded in 2015, the company has now raised $435 million, according to Crunchbase data.

4. AlphaSense, 225 milijonov dolarjev, umetna inteligenca: We all have spent a lot of our lives searching for things on the internet, be it for work or home life. AlphaSense is betting it can help us do it better when it comes to searching for structured and unstructured market analysis and business intelligence. Well, at least the growth equity business within Goldman Sachs upravljanje premoženja in Viking globalno is betting on that. They led a $225 million investment into the New York-based company, valuing the company at $1.7 billion. That is nearly double what the company was valued after its $180 million Series C in September. The $225 million number does include a “substantial debt investment from funds and/or accounts managed by Blackrock,” the company said in a release. Founded in 2011, the company has raised $520 million, according to Crunchbase.

5. Zoovu, 169 milijonov dolarjev, e-trgovina: While buying things online has become commonplace, so has leaving things in your cart, walking away from your computer, and forgetting about what you planned to buy. Zoovu helps companies analyze customer behavior and product performance, and provides tips for optimization so they can close more e-commerce deals. The Boston-based company closed a deal of its own this week when it locked up $169 million led by FTV Capital. Investors must see the potential, since e-commerce purchasing has accounted for nearly 20% of worldwide retail sales in the past two years. That’s projected to grow to 24.5%within the next three years. Founded in 2006, the company has raised $183 million, per Crunchbase data.

6. Metropolis Technologies, 167 milijonov dolarjev, e-trgovina: Los Angeles-based mobility commerce platform Metropolis Technologies raised a $167 million Series B co-led by 3L kapital in Montažni podvigi. Podjetje, ustanovljeno leta 2017, je po podatkih Crunchbase zbralo skoraj 230 milijonov dolarjev.

7. Prodajalec, $150M, software: Boston-based SaaS buying platform Vendr closed a $150M Series B co-led by return investor Obrtni podvigi in nov vlagatelj Vizija sklad SoftBank 2 to domnevno values the company at $1 billion. Founded in 2019, Crunchbase data shows the company has raised $216 million.

8. Po zraku, 145 milijonov $, vesoljski: Santa Ana, California-based electric vertical takeoff and landing vehicle company Overair locked up a $145 million round of funding from Hanwha Systems in Hanwha Aerospace. Founded in 2019, the company has raised $170 million, according to Crunchbase data.

9. Ehodin, $135M, sensor: Seattle-based radar platform company Echodyne raised a $135 million round co-led by Baillie Gifford in Bill Gates. Founded in 2014, Crunchbase data shows the company has raised nearly $200 million.

10. PayCargo, 130 milijonov dolarjev, fintech: Coral Gables, Florida-based PayCargo, an online payment settlement system for the freight maritime industry, closed a new investment of up to $130 million from funds managed by Črni kamen. Founded in 2007, the company has raised $290 million, according to Crunchbase data.

Veliki globalni posli

Two large rounds well above a quarter-billion dollars went to startups outside the U.S. this week.

- S sedežem v Parizu EcoVadis, ki podjetjem omogoča, da ocenijo okoljsko in družbeno uspešnost svojih dobaviteljev, zaključil krog zasebnega kapitala v vrednosti 500 milijonov dolarjev.

- China-based robotics and AI firm MegaRobo zbral 300 milijonov dolarjev serije C.

Metodologija

Sledili smo največjim krogom v bazi podatkov Crunchbase, ki so jih ustvarila podjetja s sedežem v ZDA v sedemdnevnem obdobju od 11. do 17. junija. Čeprav je večina napovedanih krogov predstavljenih v zbirki podatkov, lahko pride do majhnega časovnega zamika, saj se o nekaterih krogih poroča pozno v tednu.

Ilustracija: Dom Guzman

- "

- $ 1 milijarde

- $3

- 10

- 2019

- 7

- a

- O meni

- absolutna

- dostopen

- Po

- Aerospace

- AI

- vsi

- omogoča

- Čeprav

- Ana

- Analiza

- analizirati

- razglasitve

- aplikacija

- okoli

- umetni

- Umetna inteligenca

- sredstvo

- postanejo

- Stave

- največji

- Billion

- Bloomberg

- poslovni

- Poslovna inteligenca

- nakup

- Nakup

- Kapital

- Denar

- ceo

- zaprto

- Trgovina

- Podjetja

- podjetje

- računalnik

- Potrošniki

- bi

- pokrov

- CrunchBase

- stranka

- datum

- Baze podatkov

- ponudba

- Ponudba

- Dolg

- odločil

- dostava

- drugačen

- dolarjev

- podvojila

- navzdol

- e-trgovina

- električni

- okolja

- pravičnost

- Širitev

- kmetovanje

- Kmetije

- Feature

- FINTECH

- Firm

- hrana

- Za startupe

- Ustanovljeno

- sveže

- iz

- Financiranje

- Skladi

- Globalno

- Grow

- Rast

- pomoč

- Pomaga

- gospodarstvo

- Domov

- HTTPS

- velika

- vključujejo

- vključuje

- Industrija

- Intelligence

- Internet

- naložbe

- Investitor

- Vlagatelji

- IT

- Revija

- Vedite

- velika

- Največji

- Zadnji

- Vodja

- Led

- malo

- zaklenjeno

- Izdelava

- upravlja

- Tržna

- Analiza trga

- milijonov

- Mobilni

- mobilna aplikacija

- mobilnost

- Denar

- več

- Najbolj

- Blizu

- mreža

- S sedežem v New Yorku

- Naslednja

- Številka

- na spletu

- o odprtju

- optimizacija

- Da

- lastne

- Plačilo

- performance

- Obdobje

- načrtovano

- platforma

- Platforme

- prebivalstvo

- potencial

- poganja

- precej

- zasebna

- Zasebni kapital

- Izdelek

- zagotavlja

- nakup

- radar

- dvigniti

- sprostitev

- zastopan

- Trgovina na drobno

- vrnitev

- Reuters

- prihodki

- robotika

- Roll

- krog

- kroge

- Je dejal

- Božiček

- iskanje

- Serija

- Storitev

- naselje

- več

- pomemben

- saj

- majhna

- So

- socialna

- rešitve

- nekaj

- Vesolje

- Potovanje po vesolju

- SpaceX

- Komercialni

- namaz

- pomlad

- zagon

- Ustanavljanjem

- ulica

- močna

- strukturirano

- precejšen

- dobavitelji

- Trajnostni razvoj

- sistem

- Tehnologije

- O

- stvari

- 3

- skozi

- čas

- nasveti

- vrh

- potovanja

- tovornjak

- Tovornjaki

- nas

- pod

- us

- uporaba

- Vrednotenje

- vrednoti

- vrednotenje

- vozilo

- podjetje

- Vizija

- hoja

- Wall Street

- Wall Street Journal

- Voda

- teden

- Tedenski

- Kaj

- medtem

- v

- delo

- po vsem svetu

- let

- Vaša rutina za