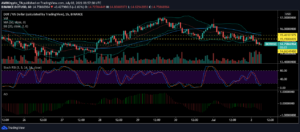

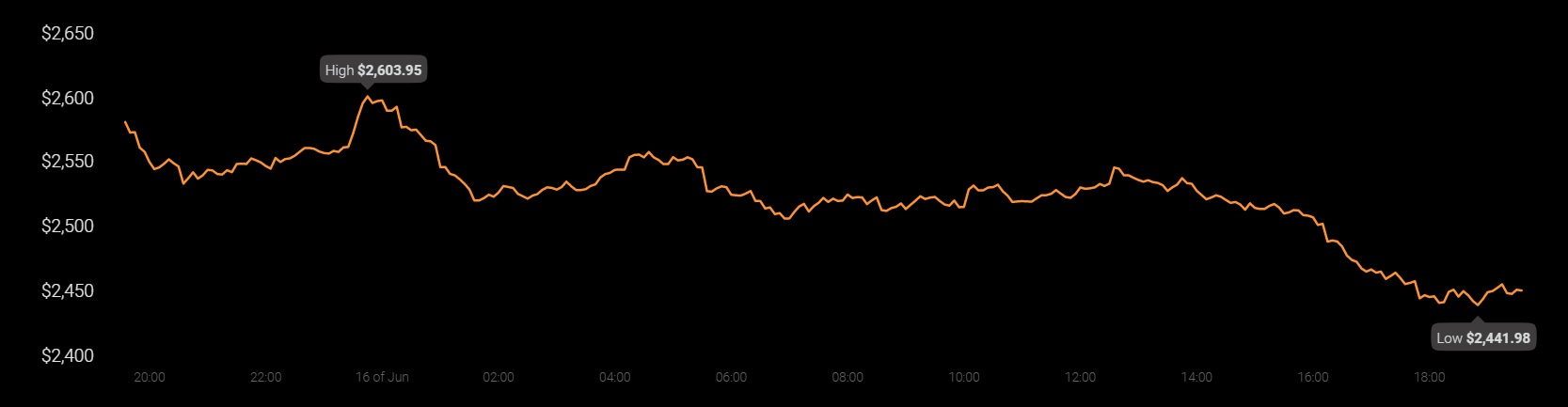

Ethereum, at the time of writing, was over 40% off its ATH of $4,356 on the back of the depreciation event that struck the wider crypto-market in mid-May. While steady, sustained, and steep recovery has been hard to come by, of late, the world’s largest altcoin has been somewhat dependant on the price action of Bitcoin. The same wasn’t as prominent back when ETH was surging past one ATH after the other a few months ago.

vir: Kovanci

And yet, many in the community remain optimistic about ETH’s price fortunes. Popular trader and analyst Lark Davis is one of them, with the YouTuber recently poudarjanje a few reasons why he thinks the altcoin might climb as high as $10,000 on the price charts.

Po mnenju Davisa ethereum 2.0, the transition to PoS, and other events such as the upcoming EIP-1559 protocol upgrade will all contribute to the long-term health and price potential of the altcoin,

The aforementioned factors, Davis believes, will help Ethereum ward off criticism about its potential environmental impact, especially at a time when the likes of Bitcoin have come under attack for the same reasons. Inclusions of EIPs like 559 will also fuel Ethereum’s march towards becoming a deflationary asset, with its reduced supply fueling greater scarcity and the evolution of ETH as “ultrasound money.”

Z ostrenjem omrežja in razširljivostjo na prednostnem seznamu načrtov Ethereuma,

"… Še naprej spodbuja pripoved, da je Ethereum inovativna kriptovaluta, ki se še naprej prilagaja novi realnosti tehnologije."

Finally, the popularity and demand associated with the presence of Defi apps with the “deepest liquidity” on Ethereum are also contributing to the bullishness of ETH. These are the reasons, he concluded, why the “big money crowd” is contemplating switching to or moving some of their holdings into Ethereum.

Zdaj je vse to dobro in dobro. Navsezadnje gre za pogovore, s katerimi se skupnost ukvarja mesece. Kaj pa pravijo verižne metrike? Ali delijo to stopnjo bikovega optimizma?

Nasprotno, po nedavnem poročilo by Santiment, Ethereum’s on-chain sentiment can be best characterized as one of “inertia.”

Razmislite o tem - povprečne provizije v omrežju Ethereum so nedavno padle na 6-mesečno najnižjo vrednost. Zdaj bi morale pristojbine, ki padejo na takšno raven, spodbujati veliko več aktivnosti na verigi blokov in veliko več interakcije z omrežjem. Tokrat pa ni bilo tako, saj je število dnevnih naslovov ETH še naprej upadalo kljub "popustu pri plačilu".

vir: Santiment

Še več, morda najboljša ponazoritev omenjene vztrajnosti je,

“... količina edinstvenega ETH, ki se dnevno giblje po omrežju, in je pred kratkim padla na 6-mesečno najnižjo vrednost 607. "

vir: Santiment

What do these findings suggest? Well, they mean that while there is cause for optimism for Ethereum, most of the factors/talking points the community is so keen to talk about are all long-term factors. ETH, at this moment, is too early in its cycle to price in some of these developments and planned updates.

Ergo, glede na trenutni, "strašljiv" trg je razumljivo, da so podatki v verigi in gibanje na trgu za ETH inertni, četudi razpoloženje skupnosti ni. Bo to vendarle trajalo dolgo? Verjetno se zdi, da je sodba. Navsezadnje ostajajo temelji Ethereuma dokaj trdni. Na tem trgu lahko vedno računate na osnove, da boste sčasoma rešili sredstvo.

Vir: https://ambcrypto.com/ethereums-current-inertia-will-this-be-the-case-for-long/

- 000

- 7

- Ukrep

- vsi

- Altcoin

- Analitik

- aplikacije

- sredstvo

- BEST

- Bitcoin

- blockchain

- Bikovski

- Vzrok

- Charts

- skupnost

- cryptocurrency

- Trenutna

- datum

- Povpraševanje

- Popust

- padla

- Zgodnje

- okolja

- ETH

- ethereum

- Event

- dogodki

- evolucija

- pristojbine

- sreče

- Naprej

- gorivo

- Osnove

- dobro

- Zdravje

- visoka

- HTTPS

- vpliv

- interakcije

- IT

- Stopnja

- light

- Seznam

- Long

- marec

- Tržna

- Meritve

- Denar

- mesecev

- mreža

- Novice

- Ostalo

- Popular

- PoS

- Cena

- Razlogi

- okrevanje

- Prilagodljivost

- sentiment

- brušenje

- Delite s prijatelji, znanci, družino in partnerji :-)

- So

- dobavi

- pogovor

- Tehnologija

- čas

- trgovec

- posodobitve

- pisanje

- youtube