Vauld was granted a three month protection from creditors i.e. a moratorium, which was approved on Monday, according to Vauld’s parent company Defi Payments Ltd, will provide it the time to develop a restructuring strategy.

The troubled cryptocurrency lending platform Vauld was granted a brief reprieve from creditors after the Singapore High Court on Monday granted it a three-month moratorium.

According to a Bloomberg article, Justice Aedit Abdullah reportedly rejected Vauld’s parent business Defi Payment Limited’s original zahteva for a six-month embargo on August 1 because of fears that a longer moratorium “won’t obtain enough oversight and monitoring.”

The moratorium would shield Defi Payments from wind-up resolutions, the designation of a receiver or manager, and any legal actions that might be taken against the business, including those that might be brought by its 147,000 creditors.

OGLAS

The moratorium, according to Vauld’s amended website FAQ on Monday, would provide the company the breathing room to develop a restructuring plan for the company and improve the situation for its creditors.

Without a moratorium, Vauld warned, it would be “very conceivable” that creditors would only receive a portion of the value of their account.

Judge Abdullah says he will issue an extension if Vauld is open about their progress in paying off creditors even if the new protection order’s expiration date is November 7.

Additionally, the cryptocurrency platform has been granted two weeks to set up a creditors committee and inform creditors of its cash flow and asset assessment.

The high court judge also suggested looking into the potential of minimum withdrawals for their remaining clients.

OGLAS

Načrt prestrukturiranja

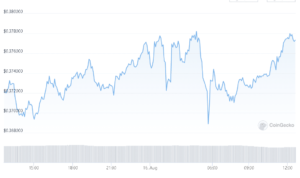

Withdrawals from Vauld’s 800,000 customers were stopped last month due to poor market circumstances and an unprecedented $200 million in withdrawals in only two weeks.

Vauld aims to create a restructuring strategy and research opportunities to resurrect the company while the moratorium is in effect.

The company intends to provide creditors with a thorough Explanatory Statement containing an estimate of recoveries and repayment arrangements that will be made available to creditors as part of its restructuring proposal.

There is no specific date as of yet for Defi Payments to call a meeting of creditors and conduct a vote on whether to approve any potential restructuring.

Nexo’s purchase offer

Darshan Bathija, a co-founder of Vauld, tweeted on July 5 that cryptocurrency lender Nexo has signed an indicative term sheet with a view to potentially acquiring Vauld and its assets while conducting due diligence over a period of 2 months.

Oglejte si zadnje novice o kripto.

- Bitcoin

- blockchain

- skladnost z verigo blokov

- konferenca blockchain

- coinbase

- coingenius

- Soglasje

- kripto konferenca

- kripto rudarstvo

- cryptocurrency

- DC napovedi

- Decentralizirano

- Defi

- Digitalna sredstva

- ethereum

- strojno učenje

- nezamenljiv žeton

- platon

- platon ai

- Platonova podatkovna inteligenca

- Platoblockchain

- PlatoData

- platogaming

- poligon

- dokazilo o vložku

- Nekategorizirane

- W3

- zefirnet